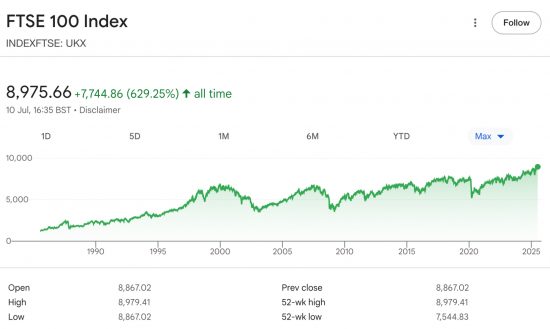

The FTSE 100 reached an all-time record high yesterday:

This either makes no sense at all, because the world is in chaos, Trump is threatening another round of trade war, war itself is prevalent, inequality is rising, populations are fed up with what is happening in politics and so instability is likely, and none of this should favour markets, or this makes total sense.

This either makes no sense at all, because the world is in chaos, Trump is threatening another round of trade war, war itself is prevalent, inequality is rising, populations are fed up with what is happening in politics and so instability is likely, and none of this should favour markets, or this makes total sense.

Could it be that markets think that war is good for defence companies?

And might they believe that instability is good for security companies?

Is there a now view of the building industry that is uniformed by the plan to build mass concentration camps in the USA and, no doubt, elsewhere in due course?

Is Gaza really a growth opportunity, as so many companies seem to think, and as Francesca Albanese has pointed out?

Might it be that the record high of the FTSE 100 is simply a measure of the commercial value of oppression in the eyes of the market?

I cannot offer another explanation for what is happening.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

A disproportionate transfer of money to rentiers?

Yes

I can see an “everything bubble” but I’m no expert.

Should be fun when it bursts, 2008 will look minor by comparison.

It will

Whatever the reason for the current high prices of stocks, investors will now be reluctant to pay those high prices, particularly large corporate investors. Just watch the graph drop over the next week or two as rapidly as it has risen recently.

Why?

All Stock Markets are gambling dens. Why they are used to promote ” financial steroids” is frankly mad.

It’s vulture capitalism isn’t it – the aftermath of chaos is where the money is.

I am old enough to have been in practice as an investment manager in 1987, and in early October that year I took a very small punt on traded put options on my own account in the FTSE 100 index. That worked.

There is a degree of similarity now in the way markets are behaving. All news is good news, prices bubble along, the dog chases its tail.

A minor setback between late July and late August in 1987 was followed by a rally in September. Then markets crashed in October. The proximate cause was twelve computer systems run by NY market makers all deciding to sell at the same time, with no countervailing force, i.e. herd instinct was built into their algorithms (which were rudimentary compared to today).

That crash was a shout for the deaf. Greenspan set out to annul it, by supplying even more credit. Hence we have today’s miserable world where the cost of private sector debt service is slowly destroying societies. It cannot last; something has to give.

I have just sent out a circular to my clients pointing out that Artificial Intelligence is now squaring risk. Lacking training data because everything on the web has been used, a company called Scale AI have been generating artificial data (and Meta have bought the company). Herd instinct is likely to be squared.

The reason that markets chased their tail in 1987 was that central banks were supplying copious credit to the world, which flowed into prices. Much the same has been happening in the USA as the Biden misnamed “Inflation Reduction” Act works its way through the system. In the UK, QT has limited the credit boom.

Equity markets are far too high and there will be a denouement. It is impossible to say when or how it will arrive.

This post represents my personal view. Nothing in this post is an investment recommendation.

You are asking the wrong question, the question should be “who makes profit from this world” also there will not be a repeat of 2008 as the above people will not allow it. The world has changed some 2008, the wealth transfer has tipped over to wealthy people.

As the gap between rich and poor widens the wealth of the rich increase exponentially, this means the poor have less money to spend and the economy shrinks. The rich have more to invest and the markets flourish. Simples.

Nitb that simple.

The richg are saving, and not investing for a start.

They are not the same thing, at all.