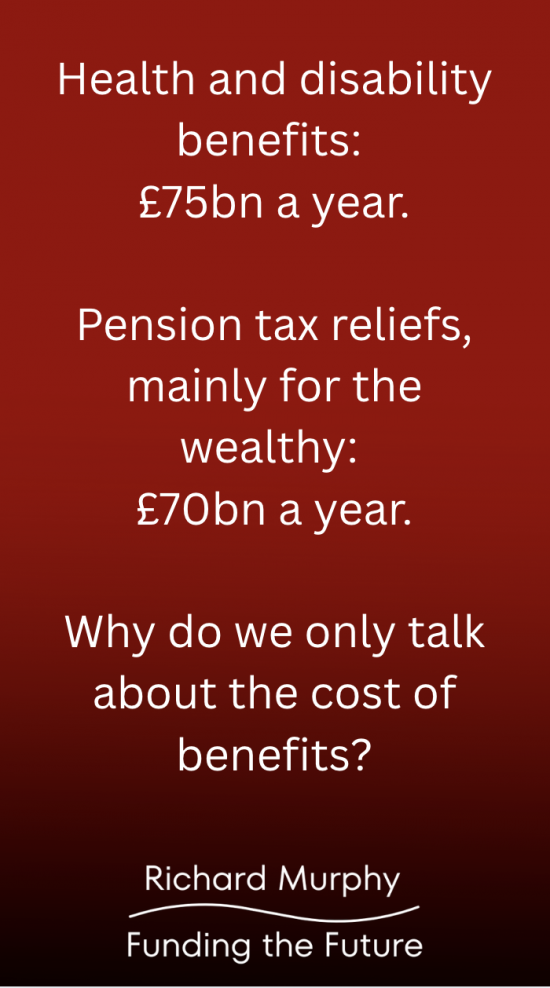

I shared this on social media last night:

Why do we only talk about the costs of benefits for those least well off, and not those for the rich?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Richard, I’m so grateful for your continued focus on this. You’ve enabled the issue to be publicised to a much broader audience.

And thanks, everyone, for the supportive comments on my previous posts.

I believe in justice

Because the poor are weak in wealth and status?

Because those with socio-economic powers are determined on conspicuous socio-economic advantage irrespective of social cohesion and longer term market benefiting transparency and equity and have all too willing communication and political helpers?

Lack of genuine concern about inflation?

“Blessed are the poor for not causing inflation.”?

Perhaps we should change the language.

The wealthy get “pension tax benefits”.

Global companies get “tax benefits”.

etc

Agreed

Then there’s Corporate Welfare, for which up to date data is really hard to find.

https://www.corporate-welfare-watch.org.uk/2018/05/01/report-british-corporate-welfare-state/

https://www.corporate-welfare-watch.org.uk/

I asked DeepSeek about this very subject only last week, expressly corporate welfare in the neo-liberal era (1980 to date). To summarise it returned this: **Total Estimate (1980–2023):**

| Category | Approx. Total (1980–2023) |

| Direct Subsidies & Grants | £645bn

| Corporate Tax Breaks | £645bn

| Loans & Guarantees | £200bn

| Indirect Support | £320bn

| **Total** | **£1.8 trillion**

Now admittedly some of this is invaluable, like R&D for example, but this is a relatively tiny amount.

As always these things come down to political choices and given that the returns on productivity are increasingly being allowed to be captured by capital, at the expense of labour, then it is blatantly obvious who the politicians are running the economy for, either by design or ignorance.

I think such aggregations are meaningless and much of the source data is wrong.

Let’s not forget the hidden costs of NOT helping those least well off.

Why do we never talk about the economic activity that is supported by benefit spending?

People who receive pension tax reliefs by and large bank that cash support as savings which is economically dead or at least sleeping. The money goes nowhere. People who receive universal benefit, or PIP, or other social security benefits by and large spend that cash on goods and services to support themselves. Whether that is groceries or clothing or rent. That is all GDP.

It is the parables of the talents. The first person buries their coins in the ground but the second makes productive use of them.

£70 billion is about 3% of GDP. Won’t benefits cuts reduce GDP directly? So much for growth.

The telling thing is that people in the disabled world have been saying for 15 years (more) that money paid in benefits goes straight back into the economy. One reason is that very few people in those circumstances have any spare money to put aside. Their dilemma is not “I wonder where I might get the best return on the money I’m saving?” – their dilemma is “I wonder if the money will stretch another 4 days?” Most often, it doesn’t.

The people who yell out “The money in benefits goes straight back into the economy” are simply not heard. How could they be? The rhetoric about “benefit scroungers” has been swirling around for decades. It was raised to its current heights by Irritable Duncan Syndrome, and no one with a voice challenged it. Now it’s embedded in many parts of our society.

I sometimes feel as though I’ve been fighting against this kind of thing all my life. I’m tired of it. I’m tired of having to prove I’m unwell every few years.

I’m just very, very tired.

I’m so sorry.

And your tiredness fuels my anger.

People who have a disability or are unwell in some way, need financial support (OK, there will be some exceptions).

Wealthy people do not even need tax relief – on pensions or anything else. They should pay their full share.

With their big cars and multiple houses, they – much more than the rest of us – are bringing on the catastrophic climate and other environmental crises that governments are not tackling [For a start, to reduce carbon dioxide emissions, make roads safer and quieter and inhibit habits of making long and unnecessary journeys, there could be legislation for a nationwide maximum speed of 50 mph enacted within a week.]

They dominate our conurbations with their vehicles and demand for (increasingly large) parking spaces. They have necessitated motorways and claim ever-expanding airports to accommodate their ‘requirement’ for speed and almost incessant travel.

Wealth should be taxed more heavily just to even things up a bit. Then they should pay more, first to restrict their unnecessary extravagance, second, because our country – and the world – needs good education and social services. They can afford to pay. Everyone would (will?) benefit – including them.

And government gives all this attention to restricting cash for the poorest! How is this tolerated?

The poor don’t have big mouths (or time), rich pensioners do (& the time to indulge in whining), bolt on the oligarch press (vile old men using megaphones/protitutes pretending to be jounrnalists) & you have what you have – a narrative which demonises the poor/ill/needy.

Because the rich are seen as productive when in fact the truth is they are only productive for themselves?

You can get away with this if you have an education system and media the produce barbarous ignorance in the population so that they join in and condemn those who need benefits.

The situation is supported by the conceit that too many think that needing help will never happen to them.

It is psychological use of language. The poor are ‘on benefits’ or, more recently ‘on welfare’. The rich have tax reliefs and argue that is legitimate tax avoidance and never tax evasion.

In a recent blog you suggested we should stop using the words ‘welfare’ and ‘benefits’, and only use the original term – social security. I agree entirely with that. Perhaps we should stop talking about tax reliefs and properly refer to them as state subsidies for the wealthy, or a better term that describes what they are?

To paraphrase that well known saying

Who then are thy welfare scroungers?

Back in 2015 Citizens UK came up with a figure of £11 billion pa claimed by supermarket workers due to low pay

Even the Daily Mail covered the story – with a helpful table showing tax paid V benefits claimed

https://www.dailymail.co.uk/news/article-3036200/Supermarkets-fire-11bn-benefits-subsidise-low-wages-Critics-say-figures-companies-rely-taxpayers-ensure-staff-food-table.html

Now why cant we have a Job Coach going into the boards of these companies to demand they pay more and block the payment of managers bonus’s until they do?

“Community support”

“Community share”

“Community payout”

“Fair share payout ”

“Financial first aid”

“Healthy living payment”

“Secure living supplement”

And for those regressive tax breaks…

“Parasite pension tax breaks”

“Community theft”

“Trickle-up tax benefits”

“Inequality enhancement payment”

“Wealth wheeze”

“Community impoverishment relief”

Sorry, not v inspired today.

I m very tired…..

What the professionals call “in-work benefits” basically are a subsidy to employers paying low wages. Why should the Treasury indirectly subsidise low wage employers who always seem to manage to find money for their own bonuses and dividends? Then gov’t complain that the system is “broken”?

Of course it’s broken but it isn’t young sick people that broke it.

What a way to run an economy.

But to actually discuss that area, exposes a politically charged cesspit, exploited by all the worst people in politics, so I tend not to mention it.

Brilliant post as usual Richard

We do need a cap on all these things that you list. There is no moral or economic case for allowing tax relief on pensions beyond a certain point, for example.

I do think we need better systems to help prevent criminals making multiple false benefit claims. Much of this is about cross checking between agencies. Some will be checks to ensure claimants are real people.

Much of this work is ongoing now, but it could be revised and constantly renewed. It helps defuse attacks on the system itself.

In short, leave claimants alone as much as possible, but it would show society cared if they were physically visited as an additional personal safety check from time to time, something which would reassure all.

These posters/memes or whatjacallums are great and very useful (and no sarcasm is intendedI). Keep ’em coming.

Thanks

ill do, when the right moment and inspiration arises.