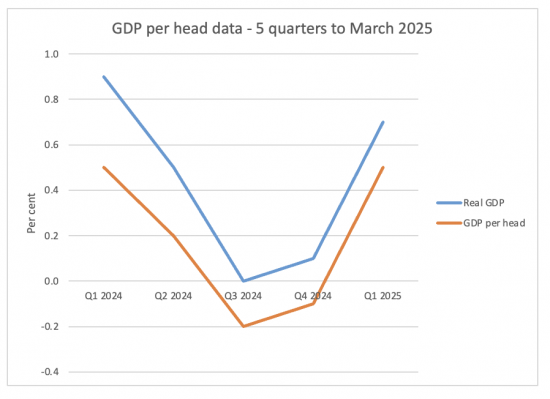

According to the Office for National Statistics, GDP growth was 0.7% in the first quarter of this year, but on a GDP per head basis, that was restated to 0.5%.

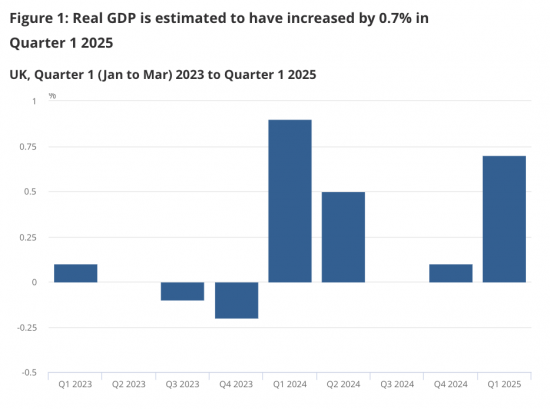

Their chart on real GDP looks like this:

Labour will like that. It looks as though there are no negatives on their watch.

GDP per head looks different (my chart from their data for the last five quarters):

Per head, Labour has seen two negative quarters, with the impact only just reversing in the last quarter, and then only for people who got above-inflation pay rises.

Good luck to Rachel Reeves trying to persuade anyone that this is good news on growth. It isn't. It remains hard to spot, variable, and inconsequential.

Reeves needs to find another economic goal very soon, or quit, because she's failing to deliver this one.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

At the moment a huge amount of money is going into housing costs despite building costs having risen roughly in line with inflation since 1945.

I suggest that tackling that and interest rates could leave individuals with more money in their pockets without anyone earning a penny more

That’s what’s been so frustrating about her tax policy, actually.

She didn’t even equalise CGT with income tax. CGT should be way higher than income tax.

Just rebalancing the existing tax take to take more from the rich and big companies would allow labour to actually cut things like VAT, which are the most regressive taxes.

Alternatively, could increase funding for councils and strongly recommend cuts to council tax.

etc etc.

So many ways to put more money in people’s pockets without waiting for the growth tree to bloom.

Also, her fiscal rules allow her to borrow to invest but she’s not rolling out a plan for mass investment in council housing or anything like that. Utter stupidity.

Couldn’t agree more, and also lower business costs, who spend a fortune on rents, sure help businesses grow…

Meanwhile swathes of houses and land being bought up by vulture funds, turning us into renting serfs.

An interesting figure has been kicking around for the last few weeks on the internet.

It seems that road traffic collisions cost us about 2% of GDP

Now I’d be hard put to argue that its a good thing, I dont even think that a Tufton Street Think Tank could manage that.

Secondly a lot of the actions needed to reduce the number of Road Traffic Collisions would have other benefits. A nicer urban environment for one.

Its a win win so long as you can take on the Mr Toads

Except, don’t RTAs contribute to GDP? Repairing or replacing vehicles, repairing the roadway, all those things are positive for the ridiculous figure we call GDP.

Which is why, as Richard has pointed out multiple times, just saying you want GDP growth with no qualifiers is insanity. The only thing that grows endlessly in nature is cancer. Believing in the Market to deliver optimal outcomes (defined as whatever the Market decides on) is tautological.

None of that impedes the Right Honourable Ms. ‘From Accounts’ MP, of course.

OTOH, Reeves is delivering for Labour’s funders.

Everyday Labour does nothing about the mess the Tories left, someone in the top 5 benefits.

OTOH, Reeves is delivering for Labour’s funders.

Everyday Labour does nothing about the mess the Tories left, someone in the top 5% benefits.

Never fear! Mr Nick Williams has his hand on the tiller.

https://www.theguardian.com/politics/live/2025/may/15/keir-starmer-rachel-reeves-economy-nhs-kemi-badenoch-uk-politics-live-news-updates

When will this government wake up and start creating those green-collar jobs? And regulate banks and City properly, and make things better for small business, rather than being over-generous to big business? Reform our tax system? I know, none of it is visible from inside their blinkers. On trips to the supermarket, I see what is in some people’s baskets and am starkly reminded this is just getting worse and worse. We need the right sort of growth, and we need it soon. Keep writing and making videos!

I’d be interested in Richard’s take on what has become a 5-year bear market in bonds. The UK 10-year gilt yield is now around 4.9%, the 30-year 5.4%. In the USA, household debt rose by $167bn in Q1 2025. Now $18.2tn. $12.8tn is mortgage debt. The US 30-year Note yield in back to 5% and mortgage rates in the US to 7%.

the only happy people I’m working with at the moment are those buying annuities!

Something might well give.

I need to think about how to tackle that…

Maybe I should think about an annuity

I’d rather work though…

Buying an annuity doesn’t stop you working! Many clients who have bought them just work at a (slightly) reduced pace.

I don’t seem to be slwoing down.

In fact, I think I might need another assistant.

GDP Raw Loss adjusted Positive and Income caused by sales to beat Trump Tariffs

https://youtu.be/bZaGhzYLsO4?si=CtCZIzm537Rc5TiW

ONS adjustments