Trump sought to create three myths.

The first was that he knew what he was doing.

The second was that he could do what he wanted.

The third was that the world would let him do it.

And then there was this:

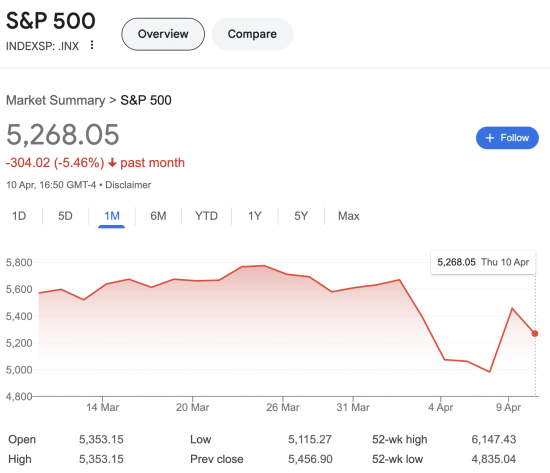

A man who rated his success during his first term in office by the increase in the stock market found that the markets did not like him.

And not only did they not like him once, but when he was forced to give way to the world by relaxing his tariff demands, they did not like him again.

He backtracked under pressure.

There was no grand plan after all.

He was not as resolute as he and his press secretary claimed.

And in the amphitheatre of his choice - the US stock market - he's getting thumbs down.

Trump is not going to be happy. There is good reason for him not to be.

He does not know what he is doing.

He cannot do what he wants.

The world will not let him do so.

I am not for a minute saying that the madness of Trump is over as a result of what has happened. The self-delusional gibberish was still very evident in a press conference last night. But, those around him - even the true believers - may now have their doubts. It looks like Musk has already exited, stage left, hopefully followed by a bear (as a stage instruction from Shakespeare once demanded).

That is significant. Doubt is what we need. Once the myth is shattered, the power evaporates. And the fact is, no one is going to believe Trump again. He has shown himself incapable of delivery. His supposed beliefs can, in fact, be altered to suit the prevailing wind. And his promises to the USA are very obviously meaningless.

If those facts become the narrative - and I think his administration will behave as if it is now, because even those inside his team can have little or no idea what is going on - then the threat he poses can be constrained.

We might have hope, after all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

My Mastodon feed is full of claims that Trump blinked as a result of a Canadian, European and Japanese slow, careful US Treasury bonds attack, co-ordinated by Mark Carney.

Maybe that’s true

I can’t find the article now, but the Guardian had lengthy and detailed piece on the ‘fact’ that it was the bond market that sunk Trump’s tariffs and not fear about the stock marker, which he thought he’d bought off with his promise of massive tax cuts in a few months. No mention of Carney, though.

If such a scenario were true, it would indeed be a masterful geopolitical and financial strategy. Successfully influencing US Treasury bonds in a coordinated manner across multiple countries would require immense foresight, sophisticated knowledge of financial markets, and deep diplomatic skill. It would also be a brilliant move in terms of leveraging global economic interdependence to exert influence over US policy or behavior, potentially causing a shift in decision-making or negotiation stances.

If Trump were “outplayed” in such a manner, it would showcase the vulnerability of relying too heavily on a single asset or approach, especially when international actors are capable of leveraging collective financial power to counterbalance or shift influence.

However, without definitive evidence, this remains an intriguing hypothetical. It underscores the complexity and subtlety of global finance, where power can often be wielded in quiet, unseen ways.

I think it is a hypothetical

you got in first. I’ve seen this on Facebook.

It is also said Carney made this clear to Trump.

It looks now like China is selling too.

I worry, though, that Trump will abandon the broken toy of the global economy to play war with a real army.

Possibly

does he have a real one to play with? Like the one Ukraine has.

The problem with the US military is that the last time it faced a real enemy/pitched combat, was Korea.

(Guerillas don’t count, neither does Iraq 1 and 2).

A lot depends on where it happens and what they are trying to achieve but broadly the answer is yes.

The evidence suggests that Trump knew exactly what he was doing, with some White Housers having made $millions on insider trading over the last week or so.

I don’t think Trump does jokes, so it is concerning that he is bragging about his friends making so much money.

https://x.com/implausibleblog/status/1910285302901440928

To those in his loop, I think he actually announced his intention regarding tariffs on ‘truth central’. In his usual bold capitals he said “IT’S A GREAT TIME TO BUY”

. Two hours later he dropped the tariffs rate.

Richard, wholly agree with your 3 myths. Sadly, I’m less optimistic than you. It is fairly evident that the markets are being manipulated (more wealth going to the wealthy, insider trading, etc.), the Trump-supporting budget has just (literally) been passed and he continues to flood the media – particularly in the US – with his narrative that the tariffs were a brilliant display of the ‘art of the deal’ strategy…it is not, of course, and he has been first to blink.

I can only hope that this is a wake-up call for Europe (I still like to think of the UK being a part of Europe) and that they really do come together as a ‘coalition of the willing’ to extricate ourselves from US dominance / self-interest, e.g., Bancor, European defence (using European technology), maintaining / strengthening EU rules on tech giants, etc.

If it wasn’t a primary aim of Trump’s inner team, the insider trading of buying out the dip was in my opinion. Trump even boasted so of billions being made. Marjorie Taylor is even claimed to be buying the dip – its all about timing and having funds at the ready – thanks DJT.

I don’t think his team are so stupid. They’re working to a rough and brutal economic plan.

Last night on C4 news a rep from the Chinese government basically said that China will take it all in its stride – it has room for growth internally (although its housing markets is in a bit of a mess) to raise GDP per head and then there is the rest of the world to make friends with, post Trump.

The Chinese gent said that China could not care less about Trump’s posturing, and pointed out that China had been around for 5000 years. He saw the U.S. democracy has the key to ending Trumps run. When ‘our Cathy’ chided him on the one party system in China I reflected on the wonderful choice of political parties we have in the West …………….most of which believe in the same bullshit and are also getting a taste for suppressing dissent.

What I find so irksome about all of this is that its race to the bottom rich capitalists in search of huge gains in the U.S. that exported U.S. jobs to China. China did not invade and nick all the plant and it take back to Peking. To hear Trump speak, you’d think that’s what happened. Bullshit.

And then to top it all, you get a jerk like Mike Johnson, the current Reprehensi-publican speaker of the HoR and whose best part of his personality ended up being flushed down the loo on a tissue just after he been conceived, crowing about the tax cuts he and his fellow criminals have just approved for the same people who handed over- voluntarily – all their manufacturing capability to a competitor!!!!

Tell me now – has anything been as fucked up as this? It’s lunacy.

I saw that interview

And I agree with your conclusion

The midterm in elections in 2026 will tell how the voting public really feels about Trump.

I think Trump will have a rude awakening.

However, many MAGAts are still driven by the by the ‘Cultural War” and “anti-woke”. I know as I live among these people in “Anti-Woke Central” aka Southwest Florida.

A good exert from HuffPost:

“I’ve voted GOP since 1984, my first time voting. I stopped in 2020. The last straw? Trump’s misogyny. His racism. National security advisers and generals and chiefs of staff told us, ‘Don’t vote for this guy, don’t support this guy’ — one of whom, Mark Milley, a Marine and a man’s man, has said Trump is the most dangerous person he’s ever met. Mad Dog Mattis said pretty much the same thing. Rex Tillerson, Mark Esper … this goes on and on.

Then there’s his grifting. What kind of president sells bibles, gold shoes and a $100,000 watch (that will likely never be on the market or delivered), but you can buy it through Bitcoin? That means you’re making a $100,000 donation to Trump that can’t be traced. That is the ultimate grift. His daughter and son-in-law received billions from the Saudis. His convictions, his indictments, January 6 — he encouraged a rabid insurrection and then, in real time, refused to do anything to stop it, and told us he would pardon those who did it. What kind of world is this?

My wife teaches middle school math and she says that Donald Trump could not get a job at her school, not as a teacher, or a substitute or the person serving food in the cafeteria line. And yet, almost half of our country still supports him. They’re willing to have a lower standard for the president than they would have for their own elementary or middle school staff. He’s a horrible influence. Why did I turn away from Trump? Why would anybody stick with him?” ― Danny, a 62-year-old from Texas

Need more be said?????

No….

Mr TampaBay, maybe a bit more needs to be said. Simply, how come so many US voters still back him?

We can all see that Dementia Don is a disaster. Why can’t they?

@sickoftaxdodgers

The remining people who still support Trump are very-very loud vocally, watch FOX news, do not understand economics and are really just interested in the cultural war. Their is another group of people, who turned against Trump, who are not speaking out against Trump because they are afraid of him and what he has the potential to do to them.

The people who were always against Trump and the people who have turned against him really do not know how to fight him except at the ballot box. I am in this category.

Footnote: It is Ms. BayTampaBay but HRH BayTampaBay will work! LOL! LOL!

There are various indicators that strongly suggest foreign selling of USTs. First, that the Cross currency basis swap did not get stressed as one usually sees in a panic suggests no demand for dollars among foreign banks; second, swap spreads went sharply negative (UST yields above swaps) suggesting sudden supply of USTs with insufficient capacity for dealers and hedge funds to absorb c) Superficially “good” UST auctions giving no bounce to the bond market.

Now, a coordinated strategy? I think it unlikely…. but it could be.

Looking at the stock market I think we now see stock market traders reviving the idea of the “Trump put” – ie. if bonds get too ugly then he will step in with a policy response to save the day (for stocks).

The problem is that even if he reverses on tariffs against China, bond yields will keep rising and that will be bad news for the US economy and stock market.

Once the damage has been done to credibility, trust and competence it is hard to go back.

I think your conclusion is right.

The signal was a deeper one. The US changed the world order because it no longer believes it can sustain its hegemony, long term. The signal that confirmed that thought (which I have had since Trump’s victory, but found hard to distinguish it from Main’s Street’s determination for revenge on Washington for deserting it) has been confirmed in this article in the FT: ‘Liquidity worsens in $29tn Treasury market as volatility soars’.

Here is the section that made the point, at least for me:

‘

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/5b436a19-4061-48a8-87fa-94c0c8d83e0e

“There is real pressure across the globe to sell Treasuries and corporate bonds if you are a foreign holder,” said Peter Tchir, head of US macro strategy at Academy Securities. “There is a real global concern that they don’t know where Trump is going.”

Friday’s sell-off, which left Treasuries on course for their worst week since 2019, according to returns on the Bloomberg US Treasury index, was accompanied by a drop in the dollar.

A gauge of the currency’s strength against major peers fell as much as 1.8 per cent on Friday. Sterling, the Japanese yen and the Swiss franc all made significant gains.

“We are concerned because the movements you see point to something else other than a normal sell-off,” said a European bank executive in prime services, a division that facilitates leveraged trading for firms including proprietary traders and hedge funds. “They point to a complete loss of faith in the strongest bond market in the world.”

One of the primary beneficiaries of the sell-off in US assets had been German Bunds, said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott. The 10-year German yield was down 0.04 percentage points to 2.54 per cent’ (FT: 11th April, 2025).

Note in this article the perhaps surprising strengthening of German Bonds, in spite of Merz’s promise to spend €1Trn Euros, to end the tyranny of the fiscal rules, and substantially to increase the German Debt. If you have a purpose, and public investment will do what the private sector can’t or won’t do in a crisis – it may well far more persuasive than the politics of spinelessly repeating what everyone can see is the politics of failure; the politics and economics of Britain. In Roosevelt’s great observation, all we have to fear, is fear itself …… (oh, and the current crop of the living-dead: our British politicians, bankers and economists).

Thanks

King Trump believes that he is a messiah. His believers are spiritual diviners interpreting his utterances and formulating their own reality to justify his fantasy world.

Chaos reigns and the King says he knows what he is doing.

King Trump’s world will collapse in the end. Probably faster than expected.

This is probably a bit off topic, but here goes!

I recently decided my nail scissors (made by CK Tools in Pwllheli, who are still in business since I just googled them, around 20 years ago probably. Bought in the chemist in Abersoch) didn’t seem to be as sharp as they used to be. So decided to order some new curved scissors online from Boots the Chemist.

Now although I’m more or less bed ridden with ME, I still have some elements of vanity, so I like to shape my nails carefully, using a nail file, before (very occasionally) using bright red nail polish. So I ordered a Sapphire Nail File too.

Then I thought I’m sick of my toenails being so difficult to cut (don’t talk to me about toenails!), so I also ordered toenail scissors. In case you’re worrying, I don’t varnish my toenails.

These were all ordered online from Boots the Chemist. They all arrived yesterday.

So I just looked (I have to use a magnifying glass to do that at present) at where they were made. With both pairs of scissors it was very difficult to make out, since the print was in white on very pale blue! There’s an argument to make about that too, of course!

At least the nail file had black print on white, so it was easier to read – could manage with my glasses.

Anyway, my point is that all of these were labelled as being “Made in China”. Does US make their own nail scissors and nail files? I rather suspect not. I suspect they’re Made in China. If so, I think there will be some women up in arms when they can’t get these items when they need to replace them, or purchase for the first time.

You are right!

When Trump talks he addresses two audiences his Maga lot, and the oligarch 3% lot.

It sounded mad and puerile to me but when I listen with those audiences’ ears, it has a whole different meaning.

Agreed

Interesting article on Craig Murray’s blog this morning, https://www.craigmurray.org.uk/archives/2025/04/trump-tariffs-and-trade/ which includes some very interesting comments and replies concerning the US dollar as the global reserve currency plus industrial collapse in the USA.

Murray’s argument appears to be circular.

He seems to be saying the problem for the US is with having the world reserve currency.

Then he says faith is being lost in it – which was largely not true until Trump decided to destroy that faith.

So the problem is not with the reserve currency but with Trump.

He seems to have no solutions – only empgty words – in response. If I might say so, very Craig Murray.

Not sure about faith in the $US only being lost post Trump2. The BRICS countries have been quietly developing alternatives for a few years now, partly stimulated by Venezuela who Trump1 tried to freeze out of oil trading by banning the use of the dollar, which led to Brics countries creating a work round. My reading is that Trump has simply accelerated that trend. As to your comments about Craig Murray, he may not have all the answers, though he has some, particularly regarding Scottish independence. He’s also a very courageous man, having sacrificed his diplomatic career in exposing the UKs complicity in extraordinary rendition and more recently going to prison for his beliefs. Not many of us can say that.

I have a very different view of Craig, I am afraid.

There’s not really any need for a multinational conspiracy to sell US Treasury bonds. Financial professionals are fairly quick to panic when it looks as if they’re going to lose money. All that’s required is the perception that prices will drop and people will start selling. As we saw with Liz Truss’s lettuce premiership.