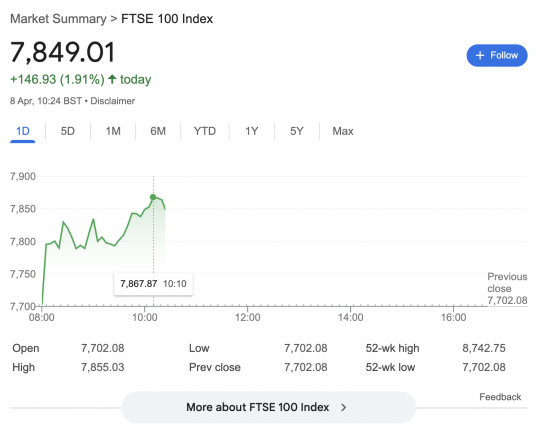

The FTSE is, this morning, rebounding in the way I suggested was inevitable only early yesterday morning. This is the way that markets always work. They react like headless chickens, and then rethinking the harm they have already created, if there is an opportunity to profit from doing so.

But let's not pretend this does not matter.

As a Ponzi scheme, what the market says valuations are is a little inconsequential: as I have already noted this morning, the most they can do is value hope, and that is as amorphous as love, hope and joy, and as often as painful as anguish, loss and grief.

What really matters is the real world. And the problem is that we never see crashes like this without a recession following. We can pretend it is different this time, but it will not be.

And still, Wes Streeting was out this morning saying that, come what may, the fiscal rules will apply.

I despair.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Wes Streeting and other ministers may say that fiscal rules will apply come what may.

But he clearly hasn’t heard of King Canute. He clearly does not know, or recall, that George Osborne, the king of austerity, eventually had to relax his fiscal rules.

The sadness is the damage and the pain that the Labour party will inflict before they are eventually forced to bow to reality. 🙁

Much to agree with

I despair, too.

Even the deficit headbangers that crafted the Maastricht Treaty (on budget deficits) always included “exceptional circumstances” into their rules as a “get out”.

If today’s situation is not exceptional then I would like Starmer/Streeting to tell me what is

We should share our despair sometime

I share my dejection on this blog – and believe me, it helps.

“Even the deficit headbangers that crafted the Maastricht Treaty ” –

steady on old chap – I knew/know one of those headbangers – the problem with Masstricht/EMU/Euro is that it was half-arsed – & the Euro has no political control (deliberately) etc etc. I did a paper back in 2018 (circa 10 – 15 pages) on Europe and funding industry – passed it to my friend who promptly went bonkers – his mark ups show that he did not understand the points I was making (& he did not like me quoting Draghi’s comments about having enough resource to meet any eventuality).

Anyway, EU will have to sort out how it funds all the things it wants to do – & the ECB standing on the sidelines sucking its teeth ain’t an option.

Meanwhile, back in Blighty I see Reeves is not supporting a “Buy British” move – bless.

I spent many days in Brussels between 1995 and 1997 discussing lots of technical stuff with ESCB (forerunner of the ECB) and policy stuff with the secretaries to the Monetary Committee and Ecofin. Sure, this was post-Maastricht (1992) but the people in the room included several drafters of that Treaty… and one or two were real deficit hawks. But even they recognised that sovereign nations still had to have wiggle room in extreme situations.

FWIW Lots of very smart people and they listened in a way that HMT never did. I think they got a huge amount right with regards to market infrastructure. However, we were all aware that this was a political project and it would live/die Berlin/Paris/Rome – not Brussels. And, so far, with quite a bit of stretching (QE etc.) it is still going.

Time to revisit the classic paper on the real problems of the Maastricht Treaty Wynne-Godley [1992] Maastricht-and-all-that : https://www.lrb.co.uk/v14/n19/wynne-godley/maastricht-and-all-that

At least I can come here to understand what is being said and what is not being said.

‘ Fiscal Rules Apply’ is a mass mind control, say it enough times and it becomes the dominant reality.

Language constructs reality, and language can de-construct reality which is what Funding the Future provides, thank goodness.

I read a Substack by Robert Reich this morning, on why we’ll have a recession. I wondered if you would be interested in it? Of course he’s American, so it may be different for us, but I thought it was interesting.

Why we’ll have a recession

Trump wants to get it over early in his term, so he and his fellow billionaires can buy up everything cheap and then enjoy the ride upward

https://robertreich.substack.com/p/why-trump-and-his-billionaires-welcome

I read it and agree with him, pretty much.

Is Andrew Bailey in the same game of acting to invite a recession by holding interest rates so high and selling off bonds?

Reich is one of the ones to read to find out what is really happening in the USA, along with Heather Cox Richardson, Krugman, Snyder and Applebaum – depending on how much time you’ve got! They are consistently well ahead of what we hear in the usual media. However paranoid they might sound, they turn out to be right.

It’s telling that Snyder has announced he is moving to Toronto. This is someone who has written and knows more about tyranny than just about anyone else.

I think he might need to move.

That’s pretty much what I suspect. Create market mayhem and short the indexes as they drop and then choose best value shares to buy once in recession

Richard, I bought “The Joy Of Tax” several years ago. I have just watched your video regarding tax havens. Is it possible to get a copy of the report you did on this matter in 2010 as well as a copy of the “Taxing Wealth” report you did more recently? Very happy to pay whatever they cost. Kindest regards, Stuart Valentine.

The TWR is here

https://taxingwealth.uk/

What 2010 publication are you refering to? If it is the book, I think it is still on sale. I do not have spare copies.

If the publication in question is: Ronen Palan, Richard Murphy and Christian Chavagneux, *Tax Havens: How Globalization Really Works* (Cornell University Press, 2010), it’s available to read on The Internet Archive:

https://archive.org/details/taxhavenshowglob0000pala

I was not aware of that

Thank you for your reply. Will try to find the book about tax havens. Best wishes.

And I gather Rachel from the office said the same about the fiscal rules. This government is totally clueless and out of its depth. Labour will wreck the UK economy and society.

What I would like to know is WHY!? WHY are Reeves and Starmer intransigent on these fiscal rules which will cause misery and suppression for many? What is it they know we dont? Because from a common sense/common good point of view, there lack of flexibility on these issues is borderline madness.

It is madness

I prefer stupidity or callousness. They aren’t interesting enough to be mad. They either believe “cast iron fiscal rules” are important for the future of the UK (stupid) or know it’s nonsense and killing people, but pretend for political reasons or in a vain attempt to preserve their reputations (callous).

Stock Markets…

I was looking at the graphs of many different stocks from different sectors on Monday ( in Canada) and I find it interesting that the majority follow the same curves pattern by the seconds, independant of the sectors. They all went up and down at the same time, with a sudden rally from – 1200 to + 700 in about an hour to back down to – 900. Let’s be honest, Humans are not fast enough for this. We are no longer in control of the Markets.

So, as far as I am concerned, the Stock Markets are not a good economic indicator of what’s next because they seem to rely on algorithms that react more to what is in the medias, irrelevant if it is true or false, in order to maximize profit.

But, they do affect people’s sentiments. And that is important. A lot of people will lose money out of fear, and a few will make a fortune.

A recession is coming, that is certain. Expect job losses, the cost of local goods to increase just as much as imported ones. (They will provide bogus reasons for it too). Less money to purchase goods, slow down of the economy. Yeah, the next couple of years are going to be interesting.

Thanks