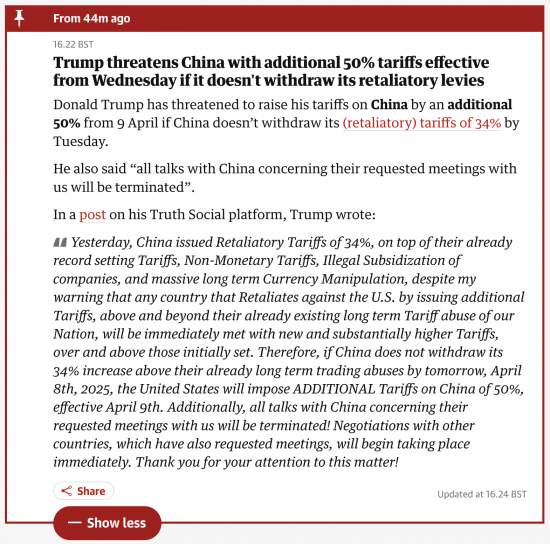

This was posted in The Guardian, yesterday afternoon:

This is what a trade war looks like.

We are deep in trouble, most of all with Andrew Bailey in charge of the supposed financial response.

There are no pretty outcomes from this, unless that is, the world sides against the USA.

It could.

It should.

But will it?

And who might lead the charge?

The only person who looks likely is Mark Carney right now, and he has an election to win first. I am not saying I am a great fan. But he has a lot going for him in this role.

First, he really understands the threat.

Second, he's willing to name the threat.

Third, he knows his way around the world.

Fourth, the world knows him.

Fifth, he's not from an obvious country or power bloc that would usually seek the role.

I might be clutching at straws. I may even be clutching at the wrong straw. But I know we need straws right now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I predict large-scale cold-turkey in USM(ango) due to people unable to obtain adult pacifiers aka iphones (adults & children on the metro/underground – the only differentiator missing wrt infants is dribbling). Anyway, lots of knockon effects.

Best thing China could do is sit back, wait for USM(ango) to implode and offer Taiwan a deal.

You sound like you’re holding out for a hero.

There has to be a better way of looking after the world such as seeking a limited number of good institutions which are accountable and have leaders you can get rid of. That way you’re not so dependent on that dream of the one you need.

What is your way?

This is a war but an economic one.

This is going to get interesting for a number of reasons.

First, I was watching a bit of a commentary on Trump’s concept of secondary tariffs. The idea is to punish the buyers of Iran’s and Venezuela’s oil. This is mainly China. This would bring tariffs well over 100%.

It was pointed out that the US has no consumer electronics manufacturing capability. This also may apply to white goods. This means that US consumers will notice what tariffs mean to them very, very quickly.

The other point is that China is the second largest holder and buyer of US government debt, which could prove interesting.

Expect him to threaten to withhold interest payments

A corollary to the US trade and budget deficits (along with the dollar’s “reserve currency” status, whatever that actually means) is that foreigners hold huge amounts of US Treasury bonds. Japan and China each own about USD 1 trillion (Interestingly, the UK is listed at USD 0.5 trillion – but this reflects London being a global fund management centre rather than the UK having large surpluses).

It is now the old saying… if you owe the bank 1 million they you call your banker “sir”; if you owe the bank 1 billion the banker calls you “sir”.

At first glance, China has the upper hand as any buyers strike or liquidation of USTs would send US interest rates spiralling just as a recession is coming.

On a second look, as you mention, Trump could stop interest payments or freeze the money so does he have the upper hand?

On balance, China is the boss here – any selective default here (and a default is what it would be) would send an earthquake through the US markets and economy that would make 1929, 1987 and 2008 look trivial.

US treasury yields plunged as the stock market dumped… but those gains have been largely given up as traders speculate about a call from China asking “bid for 50bn USTs, please” – just to frighten the horses.

I think we need to be braced for that disruption

I can see this happening

Trump has already said that they are going to reduce the interest paid on existing bonds and convert the term to 100 years.

I am aware

I need to do something on that

Lots of talk about a “Mar a Lago Accord” but very little substance. Also, there is very little understanding of Bond markets (custody arrangements, payment authority, fungibility etc) that are central to any attempt to threaten owners of USTs.

Loose talk by Trump – or, more worryingly if Sec. Bessent joined in – could be VERY damaging to global economic stability.

Agreed

And it will happen

What is the hedge?

The hedge? “Canned food and ammunition” as my old American colleague use to say.

I did that in 2008.

This is four years ago and much can change but it suggests Carney may be able see a bigger picture and beyond the neo-liberal consensus. Let us hope he will go further.

https://www.theguardian.com/books/2021/mar/21/values-by-mark-carney-review-call-for-a-new-kind-of-economics#comments

Meadway was holding forth in the G

https://www.theguardian.com/commentisfree/2025/apr/07/donald-trump-world-economy-shock-us

but misses the bigger picture:

1945 – US imposes Bretton-Woods on world (ex – USSR & satellites)

1972: US de-links $ & gold (cos Bretton-Woods was not working i.e. causing US de-industrialisation)

1980: Volcker pushes interest rates to 13% then 17% (argued this would combat inflation – caused by oil price rises – caused cos US had agree that Saudi oil would be $ priced).

1990s: US starts financial “deregulation” & exports this to UK (big bang & US financial parasites arrive en mass).

2007/8: financial crash caused by USA

2025: the only dominance USA has is financial & implements tariffs to re-assert this dominance (& will probably stop paying interest on those holding T-bills).

The problem is the USA, it always has been & it always will be until the RoW recognises that the dominance over “how the world works” by one country has to finish.

USA, delenda est.

Meadway missing the big picture?

That’s what he as a neoliberal promoting Marxist class war warrior always does.

He did, incidentally, reject MMT becauise it had no implicit theory of class built into it, in his opinion.

There’s a technical desxcription for someone stupid enough to say that….

I am trying to educate myself on MMT and the surrounding themes that come up on your blog; I mostly feel I am floundering.

When you say “neoliberal promoting Marxist class war warrior always does” I think you are implying that you disagree with the Marxist position/analysis? But whether that’s right or not I don’t know/understand enough for that to help me in working out what I think about it. I realise this is poorly worded – it’s a measure of how little I feel I understand these subjects.

Can you suggest where I might learn more about “neoliberal promoti[ion] [of] Marxist class war”? I’ve so far found this to at least be a useful primer: https://challenge-magazine.org/2021/09/06/unpacking-neoliberalism-a-marxist-lesson-to-the-moderate-left/

I am sorry – I try to address comments, but that would take far too long.

Not sure if you’ve had time to read the article by James Meadway in the Guardian https://www.theguardian.com/commentisfree/2025/apr/07/donald-trump-world-economy-shock-us

Interesting that Trump is actually trying to take the US back to the time before the Volcker shocks of 1979-82.

That said, I watched a clip and Howard Lutnick (Trump’s so called Commerce Secretary) being interviewed at the weekend in which he said that once they get the assembly of Smartphone back to the US instead of being ‘made by a million hands screwing screws in Asia’ it’d all be automated anyway. Clearly has absolutely no idea how long it takes to set up such a production facility, or indeed design the machine that will automate such processes, given they’re currently done by hand.

Then again, I seem to recall that in this country we went through similar shocks with the arrival of Thatcher in 1979 and I don’t remember many ordinary working people celebrating that much. And if I’m not mistaken wasn’t Thatcher only saved from electoral defeat by the Falklands War? I doubt it’ll be the Falklands this time, but for Trump it may be history repeating itself.

As usual with Meadway (we have history, I admit) what he was trying to say was hard to discern.

Did he really mean to say that what Trump is doinmg might work?

Why, in that case?

And does he really believe that this might be beneficial, as he implied Volcker’s reforms were in retrosepct, which for a supposed Marxist is hard to underatand.

Meadway remains as confused as he was when John McDonnell’s financial adviser who endorsed the maxed out crdedit card approach.

Following on from you blog yesterday, Richard, Lawrence O’Donnell has an excellent segment on the breakup of the love affair between Trump and Musk. As he points out, given how Trump was with all his CoS in his first administration (remember Rex Tillerson anyone?) everyone thought it’d be Trump falling out with Musk, but it appears it’s the other way round.

https://www.msnbc.com/the-last-word/watch/lawrence-elon-musk-is-the-biggest-loser-in-donald-trump-s-world-war-on-economic-sanity-236779589811

Follow through on that and I wonder what happens to Trump once the tech oligarchs all turn against him. Then again, they have as massive tax cut coming soon so that should keep them quite.

Toys will be thrown

I am confused. Meadway a Marxist? I thought of him as right-facing, like many who were advising/betraying old Labour. Still do. You live and learn.

He claims to be a Marxist

Agree Name it to tame it, key to changing systems because Language is not neutral – language constructs reality. Take the word efficiency for example, and what’s been done in its name, one word used again and again, taken as a truth then created a whole reality.

Noticing and naming are steps to change, deconstructing the problem and then reconstructing preferred futures.

Which is what I like about this space, the deconstruction of a reality constructed for the benefit of established power.

The other route is accommodation of violence, I spend a lot of time with smaller systems who take this route, they are not happy or safe systems.

So, here I am in Costa Rica taking about the impact of Trump’s tariffs on Costa Rican coffee exporters.

They seem pretty relaxed. Trump has imposed a 10% tariff. OK, the USA is (was) Costa Rica’s largest market.

But most of the US coffee comes from Vietnam and Indonesia. These have been hit with a 40% plus tariff.

So, what going to happen? US importers will shift to buying lower tariff imports from Costa Rica, Vietnamese exporters will shift to Europe.

Net result US coffee drinkers pay more for their coffee (it is a pretty price inelastic good).

The rest of the world shift their exports of coffee from US. Coffee exporters from the lower tariff countries sell more coffee to the US. Others sell more coffee to Europe.

And,of course the crazy economists advising Trump say “Don’t worry we can start growing coffee in the US creating new jobs in the new US coffee plantations” (according to their neolibral theories).

If only coffee could grow in the US. Or is that another reason for annexing Panama!