Everyone but the government seems to agree that young people need a proper education in finance before leaving school, and there is a pot of money available to pay for it.

This is the audio version:

This is the transcript:

Every young person in the UK needs financial education as part of their school curriculum. It is quite absurd that although there is now a legal requirement that young people have financial education before they leave school, there's actually nobody checking that they get it. And those schools that provide it do it, let's be honest, pretty perfunctorily. As a result, we have young people at the age of 18 who are coming out into the workplace who have almost no understanding of money.

I'm not talking here about money in a macroeconomic sense, I'm simply talking about money in a microeconomic sense, and how it impacts them.

They don't know sufficient about how to run a bank account.

They don't know what a credit card is.

Most of them can't work out how to save if they need to, and what the benefits of saving might be.

And they most certainly don't understand interest rates on savings, nor do they understand interest charges on borrowing.

They don't know the difference between a debit card and a credit card.

They don't know what tax is.

They don't know why they will be taxed.

They don't know why they will also be asked to sign up for a pension scheme and what the consequences might be.

They most certainly aren't prepared for things like credit deals, which, however, they might be asked to sign if they want to buy their first car or to take out a loan to do something else.

And they aren't prepared for things like renting a property or, in the longer term, buying a house and all the consequences of such arrangements.

Nor do they know how to avoid fraud. They're exposed to risk and are innocent in the face of it.

And all of this is a complete failure to provide a proper education for things that people really do need to know.

I will question whether it is worthwhile dropping some other parts of the curriculum to have these included. We might drop compulsory maths in the way that it is taught to a great many people so that we could include budgeting and taxation and accounting and we might want to talk about how we change some of the civics curriculum to cover other parts of this. But whatever is the case, is we need decent materials to do this.

Now, I am aware that Martin Lewis had a go at this a while ago, and he did produce a lot of copies of his book, and they appear to have disappeared into thin air.

I've also had a look at some of the videos he produced, and they've got tiny numbers of views, which is not encouraging.

In other words, there's clear indication that we are not getting the backing for education for young people in these areas because the resources that have been produced so far are not being used.

This is something that has troubled me for some time. One of the things that I feel increasingly as I get older is that people are so underprepared for the world around them that they are literally being taken for a ride in almost everything that they do, and I hate that idea. I want people to be able to manage the real world in which they live, and money is an essential part of that.

Knowing this, a couple of years or so ago, I noticed that the Institute for Chartered Accountants in England and Wales, of which I was a member for over 40 years, had picked up well over £100 million in fines from its own members for their failure to undertake proper work on behalf of their audit clients.

More of those fines were paid by the very large audit firm KPMG than anyone else, but frankly, almost every single one of those fines was paid by one of the big four firms of accountants or the firms very slightly below them in the pecking order by size of UK firms of accountants. And every single one of them had failed in an audit task or some other form of assurance activity.

They'd let the public down, in other words, and they'd been fined for it. And the Institute of Chartered Accountants, instead of using that money, put it on its balance sheet, has earned a great deal of interest, given some discounts to its members against their membership fees, and has done nothing with the money for the public good.

I went to see the then chief executive of the Institute of Chartered Accountants, who I knew quite well at the time and sat down and said I wanted this money used for public purpose. “After all,” I said, “you were not meant to be enriched because your members failed. You, too, failed if your members failed; you, too, should be making good for the failures for which you are responsible. And you should be doing that by undertaking education on finance for people in the communities in which they live, and most especially for young people.”

And given that the fines at the time were nearly £150 million, I suggested that £100m of that should be put aside by the Institute of Chartered Accountants in England and Wales into a fund to pay for this education programme for young people in schools, to create the materials, to pay for the teachers who could go round and deliver these lessons on a peripatetic basis so that specialists were delivering it, not just ordinary class teachers who had themselves to prepare the materials the night before, meaning that they were not really on top of the subject.

I thought that that was the way in which accountancy could be made to look relevant to society, and accountants could plug themselves in the process, I thought.

I was told no one was interested.

And yet, time and again, I see that they are.

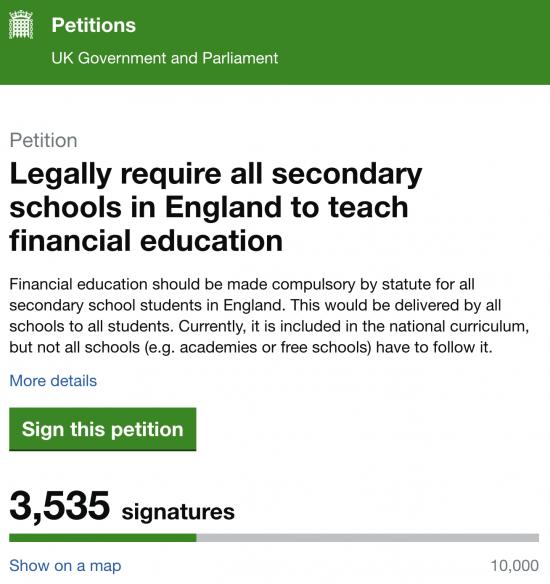

I recently saw a petition put up on the government petition website about this.

And this is it. You can sign it. Only three and a half thousand people or so have done at present. But you could indicate your concern. This was created by a member of the Youth Parliament. And I like the idea. An article about it was printed in Investor's Chronicle. And the Financial Times has talked about the need for this type of education as well.

People know that we are missing a trick here. But all the time the point is made, there's no money for this. But there is. The Institute of Chartered Accountants has the money because it's sitting on the fines that it got as a result of the failure of its members.

Ethically, I believe it has a duty to act with that money for the public good. But it says legal impediments exist, and my answer is then change your rulebook because I know that is possible, because almost every year, they do make changes to that rulebook, and they are approved by the Privy Council, as is required.

So in other words, any objection that they put up that they can't legally do this is nonsense. They can, they could, they should. And young people in this country should have the entitlement to that education which they need and deserve to protect them from the abuse that they might otherwise suffer from the financial services sector in the UK.

Why is it that the Institute of Childhood Accountants in England and Wales is not interested in protecting people from that abuse when they could? I wish I knew the answer to that question.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I’ve signed

It might be an excellent opportunity for the accountancy profession to ‘sell’ itself both by providing the materials and perhaps going into schools to teach it

And at the expense of making the point again we need to particularly look at those in FE Colleges, apprenticeships etc who are studying courses that may lead to self employment and include not only how top deal with their tax but Companies, partnerships, business rates, leases, payroll, employers liability etc all the things they will need to know if they become self employed or set up a business

Agreed

Excellent Richard. Have just signed.

Thanks

Might it be that the “Deep State” wants children and young people to be brought up/“educated” to be sufficiently ignorant, naive and ignorant so that they can be more easily exploited and defrauded by that cartel/group to their selfish material and ego advantage/indulgence?

Yes

Thatcher vs Bernanke on money supply:

since Andrew Bailey et al from the Bank of England have said much the same as Bernanke, we can assume that Thatcher’s understanding of money supply was indeed hopelessly and dangerously flawed. It would be worrying that any politician had so little understanding, but for the First Lord of the Treasury to be so ignorant and for Thatcher’s ignorance to be passed down, first through successive Tory PMs and now to Starmer, it is profoundly depressing. And the fact that the media is resolutely opposed to any meaningful discussion of this profound ignorance suggests that the truth will never come out. The money markets alone are now influential enough to ensure that.

How can any people who think themselves smart leave out macroeconomic education when it’s so fundamental to the intertwined matters of economics and democracy?

Here’s the governor of the US government’s central bank Ben Bernanke who rescued the world from another Great Depression explaining how the government undertook this rescue:-

“To lend to a bank we simply use the computer to mark up the size of the account.”

https://www.youtube.com/watch?v=hiCs_YHlKSI

But here’s Margaret Thatcher saying the opposite:-

“Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more. It is no good thinking that someone else will pay—that “someone else” is you. There is no such thing as public money; there is only taxpayers’ money.”

https://www.margaretthatcher.org/document/105454

What price democracy when most voters are completely unaware that only one of these individuals can be correct and the immense implications that flow from this? How useless or rather biased is the mainstream media in failing to address this fundamental question of fact! Did Ben Bernanke immediately cause huge hyperinflation by creating and injecting money into the American and some other countries financial system? Obviously he didn’t because it took several years for countries to get out of a recessionary condition!

I presume that is a swipe at me.

Why leave out macro? Because that is not the education I am talking about.

It is a different subject – as I made clear.

Your question assumes that sex education would be incomplete without an explanation of the mircobiology of reproduction. It isn’t. It has a particular job to do that does not require that the bioloogy of reproduction be understood.

In that case I might ask, how can anyone who thinks themselves so smart so misunderstand what I said? I suggest you take your blinkers off and look at the real world and what is needed.

No not a swipe at you. My reference was to those responsible for the educational system syllabus not being smart. You know as well as I do macroeconomic education is important too otherwise you wouldn’t be writing this blog!

Thanks

Fabulous idea Richard. Given your expertise in finance and education should put yourself forward to write the syllabus.

A course on this is something I am considering – but doubt it is the best use of my time right now.

I once worked with a fantastic gentleman at Nuneaton and Bedworth’s Citizen’s Advice Bureaus on something similar to this about debt advice and money management – is it worth teaming up with these. I can’t remember the chap’s name but he did a lot fact sheets clarifying a lot of the questions in your post.

Might be worth a try? His output was all very useful stuff.

Once was how long ago?

And were the sheets his, or more general?

And that does not stop the need for actually funding the teachng…

Children certainly need to be educated, but so too do many adults. It really would help many to avoid debt or unnecessarily paying exorbitant rates of interest.

Yesterday there was an ‘educational’ programme on BBC Radio 4 at 1.30pm.

“Indebted: The Story Behind National Debt” :

https://www.bbc.co.uk/sounds/play/m0027t6q

Given the credentials of those who took part, I hoped it would be both accurate and educational throughout. By the end, I felt it was sadly lacking.

Thanks

You do not encoruage me to listen

No, don’t waste your time, Richard!

By the end I was in full-on shout-at-radio mode.

Some of the material was factual and perhaps interesting or enlightening in understanding what various institutions do (notably the DMO, which is very rarely mentioned in mainstream commentary, I think). But ultimately it was the same old story of the ‘need to reduce government debt’; gilts as money supply management; no mention of sectoral balances; and Jamaica held up as an example of a government that managed its economy so well, they had a budget surplus of 7% (?) every year and drastically cut their debt… by following IMF adjustment advice (or obligations?)

I doubt most people in Jamaica are excited by the additional tax debt repayment represents.

Signed.

I agree the macro stuff has to be dealt with elsewhere, it’s more “political” because it is contested, so not appropriate for schools.

I see the Guardian is going Keynesian today?

https://www.theguardian.com/commentisfree/2025/feb/09/the-guardian-view-on-interest-rates-the-bank-of-england-on-its-own-wont-revive-growth

I find that mildly encouraging, they want public spending, a larger fiscal deficit, they criticise her hands-off approach on growth.

Maybe they can do another one on where money comes from!

Quite a good editorial

Thank you and well said, Richard.

I will sign.

When working at the banking trade body, 2008 – 12, we were often asked to fund and organise, via branches, schools or the government. The members refused, saying it paid tax for the government to do so and this was a government matter. I disagreed privately.

Speaking of banking, the too big to fail next door and football sponsor, British, but operating largely in the former colonies, has halved its office space over the winter. It’s a mixture of working from home and ramping up activity in Frankfurt. It’s local, i.e. far eastern, rival is returning to the City, around the corner and across the road from St Paul’s, after two dozen years at Canary Wharf, and scaling back from not just the UK, but Europe and the US, too.

Fun facts for readers: Both banks were founded to recycle profits from the opium trade. Their first CEOs, not a term used then, are the ancestors of David Cameron. Cameron also interned with a related and somewhat aristocratic firm. This part explains the / his cosying up to China.

I like ‘The Institute of Childhood Accountants’ (final para) – we had no financial education at all within school, and our sex education (age 18 when we were about to leave – 62 years ago) was twofold ‘beware of elderly men, especially elderly married men’ and ‘no petting or cuddling’. I have signed the petition. I had self employed clients who were utterly clueless regarding any sort of economics – leave it to the Accountant which was sometimes too late. My Father, when around, did talk to me about money matters, both micro and macro economics, and had strong opinions about the importance of education, including practical subjects and their application in everyday life.

Thanks

Agreed and signed.

Related to this is my proposal that a “driving licence” style qualification should be required for directors of limited companies. I have been shocked on multiple occasions to discover how little some directors of SMEs understand of their responsibilities.

Agreed