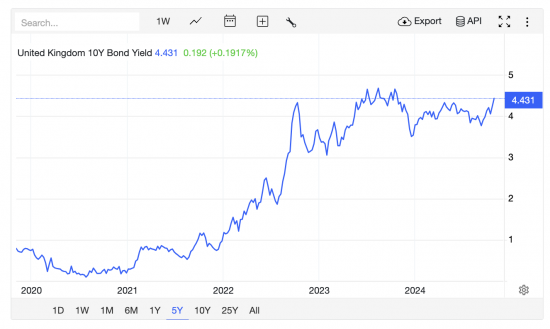

UK interest rates are, apparently, under threat because rates are rising after the budget.

This is the chart on 10-year UK bonds from Trading Economics:

But let me also note this on US 10-year rates:

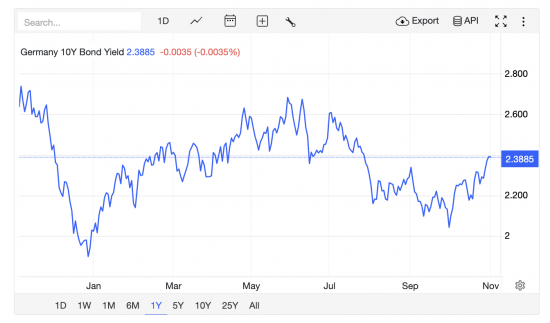

And then note this on German 10-year bond rates:

Have you noticed the trend?

They're all increasing right now.

The U increase is part of a global trend, so it can have nothing to do with Rachel Reeves (who, for once, I am defending). Instead, there must be another factor. What might that be? Try:

- Trump

- Trump's threat of global trade war

- Trump's threat of US isolation

- Middle East stress

- Stress elsewhere

- Germany moving towards resession

Take your pick, or offer another reason, but this is not a reaction to the Budget.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Effectivley the market is no longer treating Governments as AAA rated and demanding a risk premium?

Which is absurd

The commentators seem determined to force more austerity on us.

https://www.theguardian.com/politics/2024/oct/31/ifs-says-extra-9bn-of-tax-rises-may-be-needed-to-avoid-uk-public-service-cuts

They are spinning like tops.

Always hard to attribute reasons for market moves. In practice, the market moves and pundits then have to assign a “reason” for the move…. but the truth is markets move for all sorts of reasons and none.

I would just observe that all the measures announced had been long trailed ahead of the speech – there were no substantive surprises. Indeed, there was relief in some quarters that some mooted changes did not happen or only partially.

During the speech itself gilt prices actually rose… until inflation data in Germany and the US was released. It was, in my view, these data that triggered the modest decline in prices across all markets that afternoon. If the move in gilts was larger during this time it is more likely a reflection of a lack of liquidity in gilts as most participants digested the budget rather than traded.

I offered lots of reasons precisely fir the reason you note – no one really knows

The rest, I agree with

But r4Today this morning kept on pushing the ‘is this another Truss moment?’ —- saying ‘the markets are betting against you aren’t they’ – even after one expert had said very clearly the movements are trivial etc etc..

The narrative they are trying to embed is that ‘the markets’ are in charge, so dont you dare try rebuilding public services..

That is journalist stupidity for you…..

As I understand it it is a policy decision to balance the books every day. Fundamentally we don’t need to “borrow”. Why not just offer bonds at a cheaper rate and if nobody wants them so what. It’s a bit daft selling bonds when interest rates are high. It’s similar to using PFI when as a currency issuer we can just contract stuff ourselves without having to lock into ongoing rake offs for the duration.

You have been reading MMT

I agree, and I think the rake offs are the policy.

Someone somewhere is controlling a bad narrative, setting up the scenery and the back drop.

It’s quite evil really.

Last night Cathy Newman on C4 News told Reeves to explain her ‘largess’!! I’m no fan of the ‘Reeves-cividist’, aping Gordon Brown’s cap doffing to the Tory PSBR in 1997, but that was a complete pile of crap from a ‘journalist’ who should have know better. Disgraceful.

I note an angry letter this morning in the Guardian – so-called because it too protects Neo-liberals lies – about its reporting of ‘the return of tax and spend’ concerning the budget

Ford is apparently dropping one of its most successful smaller cars – the Focus – in order to concentrate on the SUV market.

So there you have it – people are solving the future problems with the environment by purchasing more robust vehicles that make them feel safer!!!! Well, if that’s the case, you might want to have a look at what has just happened in Spain

Amongst absurdity like this, I am reminded of Frank Zappa’s observation that hydrogen is not the most plentiful element in the universe – it is stupidity.

It’s almost as if what our ‘sovereign’ governments do, makes no difference right? Or is it a case that our governments are just doing what they’re told?

The more cynical element of me believes whatever happens in the USA, happens to the rest of the west/world, due to America’s soft imperialism of the west where we all live under neoliberalism (America’s way) and American lifestyle anyway (e.g., American diet infiltrating the western world)