The FT had an article yesterday in which it referred to what it called the great wealth transfer. As it noted:

Over the next 20 years, as baby boomers pass on assets to younger generations, we will see the largest wealth transfer in history. In the UK, £1tn is expected to change hands in the 2020s alone.

But for families, transferring wealth between generations is often a tricky task. There are many hurdles to negotiate, including tax and estate planning, while younger people receiving large amounts of money will need to make decisions about investing and saving that they have never had to make before.

The context in which it was discussing this enormous, upcoming transfer of wealth between generations was apparent from that second paragraph. What it wants to know from its wealthy readers is how they propose to plan this transfer of wealth and what steps, amongst other things, they are taking to mitigate their tax liabilities that might arise as a consequence.

I am well aware that there is a substantial business activity undertaken in the UK advising on how to mitigate inheritance tax liabilities. My own pension advisor, who knows my opinion on these things, still thinks it necessary to point out to my wife and me that we should plan our wills with care to ensure that those liabilities are mitigated. I suspect that we are not the most receptive audience.

That said, the fact that so much wealth is now changing hands is something that should be considered by a responsible government, and so far, we have heard nothing at all from Labour on this issue.

Inheritance tax statistics published by HM Revenue & Customs were recently updated to cover the year 2021/22 (yes, they are that far behind). As they noted:

- 4.39% of UK deaths resulted in an Inheritance Tax (Tax">IHT) charge, increasing by 0.66 percentage points since the tax year 2020 to 2021.

- The total number of UK deaths that resulted in an IHT charge has increased. In the tax year 2021 to 2022, there were 27,800 taxpaying IHT estates, an increase of 800 (3%) since the previous tax year, 2020 to 2021. Fewer than half of all deaths in any given year require interaction with HMRC to establish whether there is a liability to be paid.

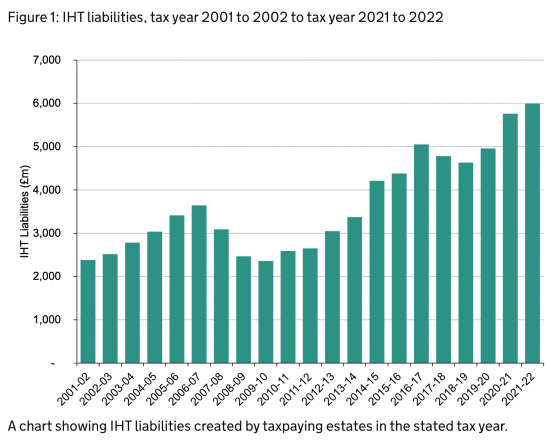

- IHT liabilities created in respect of the tax year 2021 to 2022 were £5.99 billion. This was a rise of £0.23 billion (4%) compared to the previous year.

The long-term data is:

Much of the financial media was shocked to note that total inheritance tax liabilities paid in that year reached an all-time record of near enough £6 billion. Their obvious fear is that could increase substantially if, on average, £100 billion of wealth is to be transferred annually between generations over the next decade.

I have mentioned ways in which revenues from these transfers could be increased in the Taxing Wealth Report 2024. In particular, I have suggested that the current extraordinarily generous treatment of sums in pension funds not expended at the time that a person dies should be brought to a close. The fact that these funds can, in some circumstances, be transferred without an inheritance tax liability arising, and in others can be transferred in a way that defers any potential tax liability for many years, or even decades, is absurd and should be brought to a close.

In addition, most tax relief for agricultural property now needs to end. There is absolutely no evidence at all that these provide any real benefit to the agricultural industry, which is what runs food production in this country now. There is, however, evidence that this relief is being abused by the wealthy who buy up large tracts of farmland as a mechanism to transfer wealth without inheritance tax liabilities arising.

I am of much of the same opinion which regard to business property relief. Whilst I would most definitely allow extended periods for the settlement of inheritance tax liabilities arising on the transfer of ownership of businesses on the death of an owner with a majority stake in a private company to prevent disruption arising, the need to totally cancel all such liabilities appears to be without merit. The idea that the ability to run a company is eugenically passed from one generation to the next is very largely unproven. Just watch Succession, and the antics of the Murdoch family on which it is believed to be based, and then observe the same thing happening time again in the economy and understand that planned transfers of ownership after the death of the founder of a company are usually in the best interests of that company, its employees and the next generation of the families involved. As such, this relief should also go.

In addition, serious questions have to be raised as to why many couples can now pass funds of up to million pounds to their heirs without tax being paid. I am not, in any way, opposed to the wish of parents to benefit the next generations of their families, but to do so in ways that can only reinforce inequality within the UK, which is deeply economically and socially destructive, makes no sense at all. This level of relief does that.

As a consequence, my response to the Financial Times is, 'Bring the taxation on'. We need to tax these transfers more because the needs of younger people in this country must be met, and that can only be done by the redistribution of wealth, which tax is capable of delivering. It's time for radical reform.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

For some reason people seem to get very emotional about inheritance tax, even those who have no likelihood of paying it. Any change is likely to create losers who will make a lot of noise, but the year or two after winning an election is when a government can make this sort of change.

I’d suggest that a lot of the heat could be taken out of the issue by not only abolishing the ridiculous exemption for pensions, and restricting APR and BPR (perhaps £1m each to protect small businesses) but also reducing the 40% rate to say 25%%, and increasing the nil rate band to say £1 million. All very broad brush and you could quibble withy the amounts and the revenue implications but the shape of the regime would be much more rationale.

The IFS has published some work on the numbers in the last year or so. Eg. https://ifs.org.uk/publications/reforming-inheritance-tax

I’d cut the nil band to a lower figure, start at 10% and be quite progressive. Normalise the charge in other words.

And apr and bpr are just not needed. No one can show why they are, albeit deferred payment makes sense.

I’ve said before on this blog …. Any tapering to correct an error, simply sustains the error. If the logic means that there is an unjustified benefit, there is no need to prolong it.

I don’t think making farmers or other small businesses pay IHT is appropriate. How will the next generation carry on farming? Farmers are asset rich and income poor.

We need limits on land ownership levels instead and any IHT paid by the person who inherits. So if they already have a high level of assets they pay more.

I am not sure I follow your logic

There is many a political Party Treasurer going to choke on their muesli reading this!

Which I approve of, of course!

Jeremy Clarkson admitted on Clarksons Farm that he had bought the farm to reduce his IHT liability.

What is clear is that UK Agricultural land prices are way above what can be justified by the proceeds from farming

Precisely

Is the provision of a spouse’s pension on death a ‘absurd tax avoidance measure’?

No

I have never said so

And you do pay for it

So what you are saying is that, those people with public sector final salary pensions (vastly subsidised at taxpayer expense) should be allowed to pass on a spouse’s pension on death (without any IHT).

But put private sector workers, who have mainly paid for their own pensions (in additional to subsidising public sector) cannot be allowed to pass on any of the value of their pensions to their spouses?

Should we also note that you fall into the first category – is that purely coincidence?

Read what I said

I did not say that

All spouse pensions are paid for, whoever they come from

And my USS pension is pretty small, for the record, and not payable as yet. So, yet again, you are taking total nonsense.

Richard as you have pointed out before there are many reasons for taxation. (There are six reasons why we need taxes Posted on May 7 2024 https://www.taxresearch.org.uk/Blog/2024/05/07/there-are-six-reasons-why-we-need-taxes/) What strikes me are things related to several on your list and which amount to allocating land labour and capital for productive purposes and essential needs – as why we need to reform this tax.

I will muse on that

Richard The financial times had a prominent economist support another tax strategy which is highly related to your post:

https://www.ft.com/content/a3ee952d-ff42-47c8-9b34-ee1eed66da3b

Opinion Tax

Reeves has the best chance since Lloyd George of reforming property tax

Once the challenge of transitioning to a tax on land value is overcome, other issues become much easier

Charles Goodhart

I disagree with Goodhart

LVT is impossible to undertsand

The tax base is estimated and wholly open to dispute

You hgave to find an owner to pay

The charge will always be passed on in rent – and it’s naive to retend otherwise

And the admin would be enormous – and it wouldd very likely be deeply reghressive – precisely because it would be passed on

It is terrible idea

I should make a video on that

Richard there is a lot of evidence, a lot of successes. The problem has always been that the vested interests get it shut down.

Pennsylvania in America was quite successful. Vancouver was successful many decades ago. I can provide links.

I would point out two things about implementation.

1. When it has been done the same assessment people are involved, only land becomes a bigger part of the equation.

2. Inheritance taxes would also be collecting some unearned income from land appreciation.

These two different interesting links are one short one

https://www.wsj.com/video/series/wsj-explains/the-invisible-role-taxes-play-in-americas-housing-shortage/3B6959A8-71A5-4943-94C6-DE52E3AB8DD0?mod=Searchresults_pos2&page=1

and another more detailed about one of the most business friendly centres in the world

https://www.abc.net.au/news/2024-08-18/singapore-homeownership-sock-yong-phang-henry-george/104237980

We will have to disagree on this one

I have never been much of a fan and the more I think about them the less I like them

Richard much of what you would propose would capture unearned income and reduce land price factor in unaffordable housing – particularly capital gains changes and inheritance taxes.

So the thinking is the same – capture the unearned income, capture the monopoly position of land owners. Your monetary position is similar. The monetary and economic policy changes you would make would capture the unearned income of the monopoly on money by banking practises which extract wealth from everyone, including government now with interest on reserves.

Like Keynes – you would euthanize the rentier.

In the case of expensive city property, the value of the land is a result of public investments – subways, sewers, fire stations, sidewalks, roads, schools, hospitals, universities, museums, police, garbage collection, libraries etc etc. That is the land owner gets the appreciation resulting from public investments.

Conversely a cottage appreciates beside a public lake, where as the city home or cottage placed in the middle of the forest would be worth … far far less.

I have made a video on this

LVT is just not a practical tax – and I like practical taxes

Richard Even the Wall Street Journal supports this strategy

https://www.wsj.com/video/series/wsj-explains/the-invisible-role-taxes-play-in-americas-housing-shortage/3B6959A8-71A5-4943-94C6-DE52E3AB8DD0?mod=Searchresults_pos2&page=1 …. and I think it is very practical. It is a property tax with a change to the weighting of assessment. More on the land, less on the improvements – the buildings.

Taxing improvements discourages improvements. Taxing the land more discourages hoarding the land. It works much like a carbon tax, or sin tax.

It is a good application of Pigouvian tax strategies.

I spoke to an employee of a developer – he said they were the largest private parking lot holder in the city. The lots are low revenue improvements so they are taxed less until the developer is ready to take advantage of a tight pricey market. Raise the land tax and they developer can’t hoard and monopolize.

I remain unconvinced

I believe Land Value Tax or some other metric based on the opportunity cost is an important part of us of land in the UK.

I understand the practical problems of LVT that RM has in general. However, applying the opportunity cosy of unused assets (eg the deliberate neglect of heritage buildings as featured in Private Eye) needs to be addressed. Currently, abusing key assets, irrespective of the externality impact, is too often to the benefit of bad owners.

But there are better ways to deal with that, like regulation

Absolutely!

In absence of a proposed better alternative use, by a named owner, a regulatory price/cost should be based on the land value of the highest value use of that potential asset. That should avoid managed neglect.

Richard I loved Meatloaf’s song Two out of Three Ain’t Bad. In your case I agree with about 28 out of 30 key positions – that ain’t bad!!

🙂

I think we can live with that