There is a fascinating article in the FT this morning on quantitative tightening this morning. Trust me: this is not just geekery on my part.

In it, the author, Tomasz Wieladek, who is chief European economist at T Rowe Price and a CEPR Research Fellow, argues three things.

The first is that the Bank of England has underestimated the impact of quantitative tightening on keeping interest rates high. They say it is likely that the impact of the programmes is less than 0.25% when rates are being considered. I also doubt this, or I can see no policy reason why quantitative tightening has been done. Their words and their actions do not match, in my opinion, and their actions matter to me. Wieladek obviously shares that opinion.

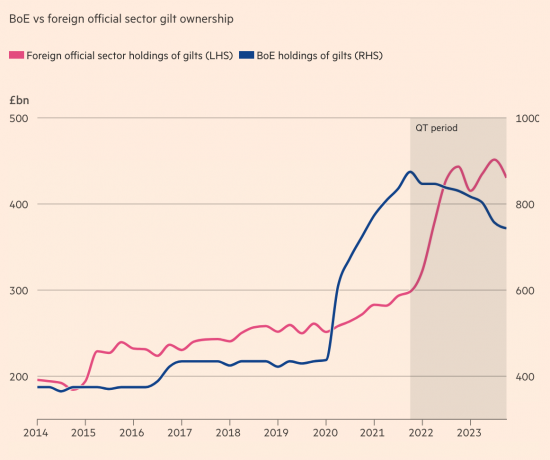

Then, he argues that the quantitative tightening programme has only worked because there have been foreign buyers for the gilts that the Bank of England has been supposedly selling back into the market (although I prefer to think of them as new gilt sales at ridiculous prices). This chart reveals that:

The sale of gilts by the Bank of England has been almost entirely absorbed by foreign buyers. Tomasz Wieladek suggests that their desire to make further such purchases looks to have ended. In that case, the end of the line for quantitative tightening is in sight.

Third, therefore, he suggests that it is time for the Bank of England to urgently reappraise the desirability of further quantitative tightening sales of bonds because further attempts to dump more on markets might well have significant and undesirable impacts on interest rates. These, I think, will seriously harm the UK economy. The author seems to also be of that view.

In other words, the Bank of England might just have got away with quantitative tightening to date, but the chance that it will continue to do so is low. Better stop now, then.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

It’s the Q that is the problem whether QE or QT. Fixing the quantity to sell (QT) or buy (QE) regardless of price is a very bad idea.

Far better to say we will buy or sell gilts in open market operations in order to keep gilt yields consistent with our policy objectives.

The fabled yield curve control or yield optimisation then? Are we turning Japanese? Probably a good idea, seems to work for them.

Open market operations have, for donkey’s years been conducted by asking ” how much cash do I need to borrow or lend to keep market rates close to policy rates.

All I am saying that trying to control Long Term rates should be conducted the same way.

I suspect they will not stop and blame it on something else.

After all, they are ‘the experts’.

I also note the chart says foreign official sector gilt holdings, so that means foreign central banks. Quite possibly the 45 central banks that have reserve accounts at the BoE. I would have a look at their reserve balances. They can swap those into gilts at the current low prices, then get repaid down the road with a nice profit as a gift from HMT. Is subsidising foreign states now official BoE policy?

It would seem so

They give up 5% on their reserves to get 4% on (say) 5 year gilt. Who wins? Depends on the path of Base Rates.

If rates fall as they are expected to do, then there will be a capital gain. If they are being sold below par there will be a gain even if held to redemption. I don’t know for certain that Base Rate is paid on those 45 foreign accounts, but it probably is.

The yield curve “prices in” expected base rate moves. Currently, 3.7% on a 5 year gilt says the market expects base rate to average 3.7% over 5 years…. Ie. Falling from 5 to 3% or lower.

As I say, time will tell who “wins”….. But there is no free money on offer.

But it’s not really ‘Quantitative Tightening’ is it? Because it’s borrowing money (by selling bonds) rather than reversing QE, which would mean doing something like increasing taxes/reducing spending and then destroying the money which has been raised/saved.

I’m obviously not advocating this, it’s just that (to give a facile example) if the Government had a printed money (say £1m) which it then spent, it wouldn’t be reversing the process by then borrowing £1m, eventually paying back the principal (with interest).

What I’m (clumsily) trying to say is that ‘Quantitative Tightening’ is a misnomer used to imply that it is reversing the QE programme. Which is isn’t.

You are right

They could exist wholly independently of each other

Indeed, I think they do

The claim that QT sells existing binds back to the market is an incredibly expensive falsehood.

Sale of existing bonds or issuance of new bonds makes no economic difference…. It’s all effectively lending at the prevailing yield.

QE was lending at the prevailing yield.

Lend at 2%, borrow at 4% and you lose money.

Sorry, but let me disagree again

Selling new or old bonds to reduce the money supply is the problem

But I also think reselling old bonds is not the same as issuing new bonds for current conditions

My comment does pass judgement on the wisdom of QT. I merely observe that QE is lending cash to the market, QT is borrowing cash from the market. The market doesn’t care where the bonds come from – new from DMO or old from BoE….. And the market doesn’t care much what the coupon is, just (to first order) the yield.

As it happens, the lending was done at 2% and the borrowing at 4% so this is a loss. It’s either reflected in a price difference or in an ongoing coupon difference but the economics are the same.

But the loss matters

And QT is realising it

First, my comment missed a “not” wrt passing judgement on QT. Sorry.

Yes, the losses matter. How they are taken- up front by selling allow coupon bond below par or issuing a new bond at par, continue to get the low coupon and pay the high.

Really, it doesn’t matter.

It does, when the media discuss it as if it is real and instantaneous

Can’t help how the media reports…

QE should have been halted when long gilt yield hit 2%- below that did nothing for the real economy. QT should be halted if it pushes gilt yields above “target”…. But we both know that the BoE has the wrong target.

But sometimes it’s hard to separate getting the operational techniques right while the blunder of high rates continues.

My point is made by an article in City AM tonight on claimed losses.

Might a contributory factor in the apparently consistent unsatisfactory performance of central banks result from their being run by people with a rather restricted set.of concepts and attitudes concerning the everyday uses of money?

Thank you for this information, Richard. It, and the discussion that there has been makes me wonder even more about the current status of the BoE. Who is benefiting from its actions? It doesn’t seem that we are. In which direction is it really going?

So I have to wonder, yet again, about the independence of the BoE; I suggest that there is an urgent need for Starmer-Reeves to consider very carefully if that independence is justified. My personal view is that the BoE should revert to being a department of the Treasury, thus making the Chancellor directly accountable to Parliament for the decisions made through the BoE offices. I see no political accountability at the moment, a situation that is no longer tenable.