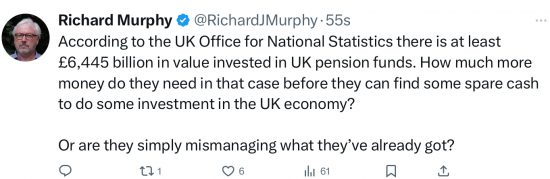

To continue my pension theme of the morning, I just posted this on Twitter:

The question is, I think, appropriate. After all, if the opportunities to invest in the UK economy already exist and you've got £6,445,000,000,000 available to you, don't you think you might already be undertaking all the worthwhile investments already available, with the money you're already got?

And if you aren't, isn't the right question for Rachel Reeves to ask, “Why aren't you doing what is required of you?”, rather than bung some more cash their way?

If pension funds can't invest almost £6.5 trillion for the benefit of the UK economy, what difference is forcing people to pay more to them going to make? Or will it be just more money down the pan whilst the City parties and the rest of the country wonder why they are trusting them with their future well-being?

So, why does Rachel Reeves trust these people when they have so obviously failed to do a good job to date?

I wish I knew the answer to that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

I am left wondering whether Reeves is deluded, stupid or corrupt. Maybe there is some other option but I can’t think what it might be.

You ask the right questions – what are Pension funds doing with the money? Do we need to save more?

Defined Benefit schemes are rarely open to new members these days. They are “mature” and need to invest in safe dull things like gilts and corporate bonds. Regulation requires this…. and it should.

Defined Contribution schemes could, in theory, invest in anything… but what makes sense for an individual does not make sense for society. (Another example where aggregating “good” micro activity delivers a “bad” macro outcome). Individuals are persuaded to invest in various funds for various reasons – some good, some bad. Good reasons are liquidity and price transparency; bad reasons are advisors are driven by fees not clients’ needs.

But, passing round shares in existing companies at ever higher prices is a waste unless these companies invest in productive assets – and the evidence is that they usually don’t. Theory says that if existing asset prices are driven higher then it promotes the creation of new assets – but it does not. Just look at housing – prices have shot up over the last 20 years but do we see the “invisible hand” building more? No, other forces are at work, forces that need government intervention to achieve the desired outcome.

So, what government intervention? It needs government to offer what savers/future pensioners want and deliver infrastructure investment that we need… and take the financial risk that this mismatch of assets and liabilities implies.

What do savers want? Most of us want a secure income in old age. Now, the government already does this to some extent – we pay NI and each year we pay in we get a certain pension entitlement. Why not just expand this and do it a market-ish prices (voluntary NI contribution rates are too low)? Accumulating paper shares and hoping that they will deliver a decent income in old age is a dangerous game.

What investment do we need? Well, it’s water, green power, housing etc. where all efforts over the last 40 years to privatise delivery have led us to here – failure. Government needs to get directly involved.

Do we need to save more? I don’t know. Do we need to invest more? – absolutely yes…. but the two are not the same question as you clearly say.

She’s none of those.

Reeves is ‘connected’ that’s all.

She is representing her hinterland.

What else would someone with her professional background be doing?

And it’s not even corrupt – she is doing this in broad daylight – which given how gullible many of us are – is not a problem.

Welcome back

Hello PSR – nice to see you. Trenchant comments – as per.

Hi Richard.

Would it not be obvious to say that pension funds should be already looking to investment in all areas of UK infrastructure. From health, education, energy etc, surely all these areas are guaranteed a return because there is always someone who needs them. If this is the case, then there is no need to look at private equity at all, to fund the things Government needs.

Regards

I might think that

You might think that

They might not

This has left me puzzled, so I’m hoping for a little education. I decide where my pension investments go, it’s got nothing to do with my provider, and almost nothing to do with any fund manager. So I agree that the idea that increasing the amount I might stash away will induce me to put it to use for some particular societal need seems naive, but that’s my fault, not (say) Fidelity’s or AJ Bell’s. So what is it that these companies should be doing? Making me invest in what they want rather than what I want? Making societally worthwhile investments yield higher returns by fiat? Or is the point that investing money in shares isn’t really investing in the company, or the country, but in a casino that does pay out, mostly, though with great fluctuations?

If you decided precisely on where your pension is allocated you are one of a tiny number who do when the vast majority pick funds, at best.

If you do not appreciate that the rest is not worth addressing.

Like (I assume) most people I don’t pick precisely where my pension is allocated, I’m with the vast majority that pick funds. And like a slim majority of the market (depending greatly on how and what you’re measuring) I pick an index fund. That probably explains why I don’t know what the investment companies are supposed to be doing. I could imagine that it hinges on your use of the word ‘worthwhile’, as there are plenty of important investments that I’d be greatly in favour of, but don’t have the returns that most investors are looking for. So, again, should investment companies be putting my money into investments that make less? Or should they make those investments return more, and if so how?

It’s clear from your response that you doubt my sincerity, and if I dealt with as much spam and abuse as you I might well feel the same. But generally speaking I agree with what you write, and have learned much from it. This is just a point that I don’t understand, and hence I feel that I’m missing out on something that would be meaningful to me if I could only understand it. Clearly my lack of understanding isn’t as important as the enlightenment you can bring with a new video, for example, so I entirely understand if you choose not to reply.

Ok, so you do not, as you claimed, know exactly how your funds are invested. You must see why I doubted you. I was right to question your claim.

See this morning’s video and then come back gain, if you want.