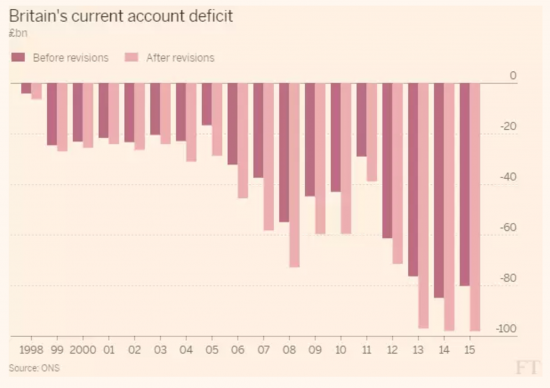

As the FT has reported the Office for National Statistics is revising a number of features of UK national income reporting from this month. One thing that will change as a result is the way that the UK current account deficit with the rest of the world is recorded (it's always been a deficit in the chart that follows, so I only give it one sign in my description). This is what it will look like before and after revision:

Now, let's ask a simple question? Who has delivered the biggest run on the pound? I think the answer is obvious.

And who is the only party likely to form a government planning to deal with it? That would seem to be Labour.

Some of those suffering from hysteria this morning at John McDonnell's comments should take note of a few facts.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Markets of course don’t , despite their protestations , deal in facts. They deal in ‘sentiment’.

McDonnell does well to spell out in advance that the market will display a fit of ‘teenage hysterics’ (following the lead of the major manipulators) if there were to be a Labour election victory.

Moody’s downrating of UK credit rating to Aa2 from Aa1 scarcely made the news, after an original downgrade under Osbourne. I’m sure if this had happened under Labour the BBC and news papers would have reacted hysterically.

The statistics do not support your claim – there is no a direct read across from the current account to ‘run on the pound’.

The correct answer is Labour, under Gordon Brown.

If you ignore the data you could be right

But only if you do

Wasn’t it Gordon Brown in 2008? The effective e change rate index fell from 105 to 73.5.

John Major’s ERM fiasco moved the index from 90 to 73.6.

Brexit moved it from 94 to 73.4.

You are correct. But I doubt Richard will acknowledge that!

The other two resulted from policy errors

2008 did not

Maybe you can’t tell the difference

Some of us can

“2008 did not”

So you don’t think deregulating the financial sector was a policy error?

And Brexit can hardly be described as a “policy error”, given that it was the result of the referendum (not the calling for it, nor the holding of it) which led to the fall in the exchange rate index.

I think deregulating the financial sector was a hegemonic mistake that Labour partook in, but where they resisted the trend and demands of the markets and Conservatjve Party for much greater relaxation.

I am not saying they got it right. But I am also saying that it was deregulation in the US flowing from Glass Stegall that led to that crisis. It was not a consequence of a UK policy failure decided on by a UK political party unlike the other two.

You may do simplistic analysis if you wish but in the real world you’ll find it does not help.

Graeme,

I was just musing on Bruce’s suggestion that there is no “direct” relation between exchange rate and current account when I noticed your comment.

Given the point that R. Murphy just made about about 2008 (a global event), you’ve just supported the overall point he is making with additional facts. Which is quite amusing.

Could someone please send this to the BBC?

I’d like to but I’m so angry with them at the moment I don’t trust myself.

There’s a line in a Crocodile Dundee film:

“You call that a knife? Nahhhh… THIS is a knife!”

The single most surprising thing about our current acount deficit is that it is so small.

Given the likely future of our trade balance, and the known facts in the present about the exchange rate, I think that we are due for an unpleasant surprise about how big such a problem can get.

I would urge all my fellow armchair economists to take a day off and re-watch the Crocodile Dundee movies: it does us all good to see so many visual gags about false assumptions, and the running joke of punctured overconfidence as the sequel replays “That’s a knife?” in lots of subtle little ways.

Sorry, Richard I know this is not a social media chat line, but Nile makes an important/interesting point about the role of film in popular culture.

Following Nile’s recommendation I’ll perhaps revisit Crocodile Dundee (charity shops’ stock is hit and miss at best)

I watched (for the first time) Erin Brockovich the other evening and was awed by the persistence and sheer effort required to challenge the powerful. There are honest people who can be recruited, sometimes reluctantly, to join the struggle and do the right thing. I found it quite an uplifting story.

@marco, Gordon Brown seems to have accepted he made policy errors

Apart from trying to offer utterly pointless political pedantry what is the purpose of your comment?