The next financial crisis is being made right now, by bankers. Although Janet Yellen, chair of the US Federal Reserve, has said in the last month that she does not think we need worry about another Global Financial Crisis "in our lifetime" (a measure about as useful as the length of a piece of string) I do not share her optimism. In fact, I suggest her optimism may be the biggest cause for concern and the surest sign there might be that such an event is now on the cards. Nothing is so risky when it comes to financial crises as a central bank that is complacent to risk. That is most especially true when the primary source of that risk is the central bank. And that, I suggest, is the crisis we're now facing.

The risk in question comes from Janet Yellen's stated desire to unwind US quantitative easing. QE is the process where a central bank buys the debt issued (in the main) by the government that controls that central bank. In the UK there has been £435 billion of QE. The net impact has been to cancel that part of the national debt, or more than 25 per cent of it in all. The unfortunate side effect has been that the new money created has largely created asset bubble pricing and done little to promote real economic activity. As a result it can be argued that the bond market, stock market and property markets (at least where bankers have influence) are now all seriously overpriced in the UK.

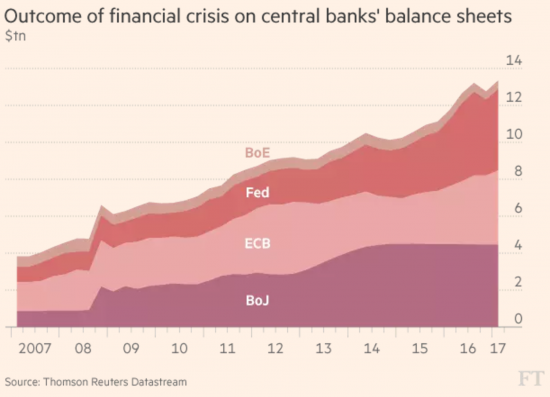

We are, however, but part players in the global game of QE, as this FT chart shows:

The US Fed, European Central Bank and Bank of Japan dominate this field. Indeed apart from the UK, Switzerland and Sweden they are, I think, the only players. Between them these central banks injected around US$1.5 trillion into global financial markets last year as a result of QE purchases of government bonds. This meant tax was not needed to cover that part of government spending; new money creation did it instead because QE replaces money saving with cash in circulation, albeit that much of it is then saved elsewhere.

The trouble is that Janet Yellen, at least, is indicating that this policy may be reversed soon and all central bankers are beginning to talk about the 'normalisation' of monetary policy. This is a process that means three things.

First it seeks to put the world back to its 2007 state, as if that was a utopia (which it was, for bankers). In particular this seeks to restore the power of bond markets over government who could then no longer ignore the restraint they supposedly impose on government because the option of funding government deficits via QE is removed.

Second, it seeks to impose more 'normal' interest rates to provide positive returns to investors and to supposedly provide central bankers with the option of using monetary policy to control the economy again. This they think important because monetary policy, or interest rate variation in more straightforward parlance, is the only tool central bankers have available to them, and they want it back.

Third, it means that instead of money being persistently injected into major economies by central bankers they will, instead, be seeking to draw money out of them. To put it another way, at the same time as governments will still be seeking to sell bonds to fund deficits central banks will also be seeking to sell a whole pile more government bonds, which are those they have held for some time.

The consequences of this, much heralded and now anticipated, change in central bank behaviour will be dramatic, and almost certainly pretty ghastly.

Let's start with the gruesome consequence for many people. The purpose of this policy is to increase interest rates. There is no beating around the bush on this. The desire will be to get back to positive rates (i.e. after allowing for inflation) of two per cent or so. That means an increase in many bank base rates of well over four per cent. Add this onto payments due from many mortgage and personal debt holders and the balance towards insolvency will be tipped for a great many people. The social consequences are dire.

The economic consequence is also obvious. Bankers will suffer from those insolvencies. They will seek to flood the market with repossessed houses and cars as a result, and there may be price crashes. Banks will suffer real costs as a consequence. The delicate balance in many economies will be destabilised as a result: recession is almost inevitable.

Then there is the consequence for bond markets. The reality is that whilst the market for debt is big, massively increasing the supply of debt will flood it. You can't move from US$1.5 trillion being withdrawn from the market each year by QE to there being net inflows of new money over and above the levels dictated by government deficits without there being massive market disruption. At best bond prices will fall dramatically. At worst, there will be major runs on the bond funds that many investors use to access this market. This will create a liquidity crisis for them: the likelihood of major insolvencies in this sector as a result because cash will not be available to meet the demand of bond sellers will be very high indeed. It is almost always liquidity that brings financial institutions down, and the makings of such a crisis can be easily foreseen here.

And that will have spillover effects for property and stock markets.

And like it or not, that will also have spillover effects in the real economy as cash becomes the product in shortest supply.

And I stress, this shortage of cash will not be by chance: the whole point of the QE programme was to inject cash into the economy. The point of reversing the QE programme is to take that cash out again, to force interest rates up and to increase the cost of borrowing. Removing money from use in this way has wholly predictable consequences in the real economy. One is to dampen demand, which will collapse. The other is to dampen investment, of which there is already far too little. The third, incidentally, is to reduce the role of government by reducing its tax revenues and increasing its cost of borrowing to provide alternative funding.

Try as I might then I cannot find a single upside in what is proposed. I can only find two things. One is downside risk. The other is dogma. I've described the risk. Let me deal briefly with the dogma.

The dogma is based in three ideas. The first is that savings matter. The logic is that savings fund investment and so we need savings. The trouble is that we now know that this is not true. Savings are just money withdrawn from the economy. They do not fund investment. Bank credit does that, and as we now know, bank credit is created costlessly without direct reference to the amount deposited in a bank. Increasing the rate paid to investors is, then, a wholly destructive economic act from which there is no upside but plenty of downside as cash is transferred to those who already have wealth from those who haven't got enough of it.

Second, the dogma is that monetary policy is needed. We now know it isn't. It is fiscal policy that has to be used to manage the real economy. The era of the dominant central banker is over. The trouble is that they yearn for the 1990s when they thought they ruled the universe. Now they don't but dogmatically they do not want to let go.

And third, it is still thought that government must be constrained by bond markets to live within its means, which was a myth QE shattered but which frightens bankers enormously because in the hands of a socially motivated government QE could be used, as I have long suggested, to fund investment by a government in the real economy to transform the way it works for the benefit of ordinary people, with the conventional suppliers of capital being sidelined in the process. The battle over QE is, then, a battle fir the future of more than money, debt and the public finances; it is battle over who has control within the economy. Is that to be government and people, or bankers?

Bankers have no doubt who they think should be in control. To seek to re-establish their claim they are willing to act recklessly by unwinding QE. There is no known practical or economic justification for doing this. There are only dogmatic ones. But bankers have their hands on some power and it looks like they are intent on using it for their own dogmatic purposes. If they do they will trigger the next global financial crisis, and well within our lifetimes. This is the battle to come. And it is the surest sign that the lessons of the last crisis have yet to be learned. Irresponsible bankers caused that crisis. It looks like irresponsible bankers are now engineering the next one as well.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Frightening stuff.

Only hope is that the Bank of Japan has not so far felt inclined to unwind its much earlier established QE and that the BoE will feel inclined to follow their example – rather than the example of the US which is likely to crash the car.

Richard Werner also makes a good case for the fact that Central Bank interest rates follow the economy up and down rather than encouraging it in the other direction or even stabilising it.

I am afraid I do not agree with Richard on this

While I can agree with much of this, esp vis a vis bankers and government and the neoliberal dogma, it does sound like savers are to blame and borrowers are the saints. So I should go out and spend that money I’ve put away for the rainy day or to pay for care if/when I need it and get myself up to the eye balls in debt, perhaps buy a bigger house than I need or a Mclaren super car, or maybe a yacht or a hacienda in Mallorca. Then I’ll really be helping the economy rather than having dosh mouldering away in the Building Society earning an insultingly low rate of return. In fact, I should be paying them for keeping it safe for me and they should give that to those in debt.

If “savings are just money withdrawn from the economy” then what is the point? We need a better theory of savings than that.

And it is?

I have offered it, e.g. in using local authority bonds to direct fund investment

What is yours?

Sorry, I’m not an economist, but I would think as you say Gov/Dev Admin/LA bonds would work. As a socialist I’m against most private investment in social utilities.

But low rates of interest drive ordinary citizens to the Stock Market. That must be “money withdrawn” as well, but at least you can get dividends, possibly capital gains and favourable tax rates. You can also lose all your money, hence the premium. But whether the stock market is good for society is another matter.

Could this be a classic “bait and switch” play by the Neocons?

Objective could be to squeeze out minor players who used cheap money to acquire assets, a “crash” would wipe these players out and allow the “top” players to acquire at knock down prices.

This has worked over and over again at national levels ( Argentina, Thailand, Greece…)

It may well be

I go with Richard on this one, as soon as the Fed starts saying crap like, ” in the last month that the Fed(A rep from) does not think we need worry about another Global Financial Crisis “in our lifetime” ” I know its time to start planting veggies and buy another freezer.

I have seen too many of these events in 65+ years and its always the same.

This time the banks should just be allowed to go tits up, get rid of them altogether and start anew with a world currency (Something I believe Rothschilds and Rockefeller types have been advocating for a very long time) Can it be any worse for the vast majority?

Yes it can

If banks fail the global food supply chain fails in three days

Then what are you going to do?

When Yellen gave her talk last month Hamish McRae reported that “she did not expect there to be another serious financial crisis in our lifetimes” — so not that there wouldn’t be another crisis, but there wouldn’t be another “serious” one — I took this to mean we might get another crisis/recession with the next downturn in the cycle, but we would be unlikely to see another crisis/recession of the same severity of the 1930s or 2007/08.

The McRae article says “This was largely because reforms in the US banking system after the last one would make the system safer … The first point makes a lot of sense, because huge financial crises are indeed rare creatures and the memory of the most recent one will keep bankers and their regulators on guard for a generation at least.” He says that Yellen’s view is “the next potential financial crash will be better managed than the last one”.

http://www.independent.co.uk/voices/uk-economy-us-janet-yellan-bank-of-england-europe-mark-carney-resilience-a7812941.html

Richard, you have said you can see a recession on the horizon, but what do you think are the chances that we will see not just a recession but a crisis on the level of the 1930s or 2007/08 within the next few years?

With QE unwinding, Brexit and Trump, very high chance of another GFC in my opinion

Those plus debt levels back at peak and obviously over-heated markets provide all the obvious ingredients

– “Try as I might then I cannot find a single upside in what is proposed”

Some people think there are practical (as opposed to ideological) upsides to unwinding QE – this is what someone called Tim Worstall says — it’s currently making our insurance premiums and pensions too expensive.

https://capx.co/quantitative-easing-has-outstayed-its-welcome/

From reading assorted blogs I gather that people like him would want to see a return to monetary control of the economy, and this needs interest rates to rise above the “lower bound”, never mind any collateral damage. They might also want, as you say, to re-empower the bond markets to constrain governments – I assume this is what The Economist referred to recently in an article criticizing Corbyn when it said “…drastically increased public spending would … risk capital flight”. But I think you assured me in a recent blog that the myth of the “Bond Vigilantes” has been destroyed by QE itself and capital can fly if it wants to. Do the Monetarists and The Economist not accept that this is the case?

You take anything Tim Worstall says seriously?

Really?

This man is the evidence, if ever it were needed, of the contempt of the economist for humanity at large (and in particular in many cases, it would seem).

Is it just me who’s confused by these type of charts? I suspect it is (-:

So, so the various coloured bands represent the delta, or does the BoE have a bigger balance sheet than the Fed?

They’re stacked

The band width is that for each bank, stacked to show a total

Richard, sorry to take you back 2 days but even though I’m addicted to reading your blog there are other things need doing in life as well! I think I understand your irritation with me quoting Mr Worstall – his utterances are framed by the agenda of the ASI funders – but if as erudite a publication as The Economist magazine says that “…drastically increased public spending would … risk capital flight” (by which I take it they mean selling of government bonds?) shouldn’t I take note?

When I advocate increased public spending this is always thrown back at me, after the inevitable “it’ll lead to inflation”.

Your “Laffer Curve” blog is just the thing people need to refute false arguments, one on “Capital Flight” would be very welcome.

And back to Mr Worstall – I think it’s always worth knowing what the other side is saying!

The other side does not include Worstall

I agree with listening to the other side, but not wasting time

And re capital flight because of inflation, I have dealt with it many times of late. I doubt I have time to do again right now. But it reminds me of why a wiki will be of use.

Good analysis.