The following is reproduced from the Tax Justice Network blog, because of the importance of the findings to which it refers:

One of the most obvious failures of the OECD's BEPS (Base Erosion and Profit Shifting) Action Plan relates to action 11. Here the intention was to draw together existing data to create a baseline for the scale of BEPS, in order both to understand the nature of the problem and to be able to track progress over time.

No such baseline has been delivered: despite some committed work by the staff involved, major OECD members resisted even the minimal transparency of allowing companies' country-by-country reporting to be centrally collated and analysed.

The need for new research

As a result, new research on the scale of base erosion and profit shifting (BEPS) by multinationals is sorely needed. UNCTAD's World Investment Report 2015 found that one form of profit-shifting alone cost developing countries around $100 billion a year in lost revenues. Researchers at the International Monetary Fund put the overall revenue loss for developing countries at about twice that, and the global total nearer $600 billion a year.

None of these studies, as published, have provided a breakdown that would identify the winners and losers. An earlier attempt (Cobham & Loretz, 2014) using the major database of corporate balance sheets revealed mainly that the coverage was simply too poor — especially of developing countries. For the available sample however, it was clear that countries with lower per capita incomes suffered the most extreme profit-shifting.

Now, using a relatively under-exploited dataset covering all multinationals headquartered in the United States, we have been able to establish country-level findings that broaden the analysis.

Main findings

Three main findings stand out.

First, BEPS is a problem of first-order importance in terms of the world economy. The preferred spot estimate for shifted profit in 2012 uses the European Commission's proposed formula for economic activity, and amounts to $660bn, 27% of US multinationals' gross profit or approximately 0.9% of world GDP. Depending on the relative scale of profit-shifting among non-US multinationals, it is feasible that the issue reaches the accounting materiality threshold of 5% in respect of global economic accounts.

Second, countries at all incomes levels are losing out to profit-shifting — while the majority of ‘missing' profit ends up in just a few jurisdictions with near-zero effective tax rates — of which Netherlands, Ireland, Bermuda and Luxembourg are the most important by far, and with Singapore and Switzerland account for almost the entirety of profit-shifting that can be allocated to individual jurisdictions.

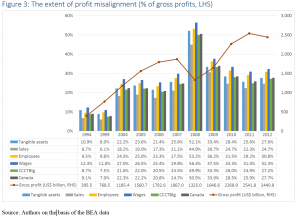

Third, profit-shifting by US multinationals has grown sharply over the last two decades. The bars in Figure 3 show, for various measures of economic activity, the extent of profit shifting as a proportional of total gross profits. The level in the immediate post-crisis period stands at around 25-30% of total profits, notably higher than that which prevailed pre-crisis in the early 2000s — which was in turn sharply higher than the mere 5-10% of the 1990s. So the current scale of BEPS is a relatively new phenomenon, and this is despite a substantial narrowing of the effective tax rate differential between missing profit and excess jurisdictions — suggesting that the race to the bottom among major economies like the UK has simply given away corporate tax revenues.

various measures of economic activity, the extent of profit shifting as a proportional of total gross profits. The level in the immediate post-crisis period stands at around 25-30% of total profits, notably higher than that which prevailed pre-crisis in the early 2000s — which was in turn sharply higher than the mere 5-10% of the 1990s. So the current scale of BEPS is a relatively new phenomenon, and this is despite a substantial narrowing of the effective tax rate differential between missing profit and excess jurisdictions — suggesting that the race to the bottom among major economies like the UK has simply given away corporate tax revenues.

Finally, this confirmation of the scale of misalignment, and the extent to which most countries are losing out to a handful of jurisdictions, should focus minds on the importance of better data to track BEPS and to ensure progress is made. Individual jurisdictions and economic blocs should seriously consider making country-by-country reporting public. At the global level, there should be an urgent revisiting of the decision not to establish a repository which would allow analysis by trusted researchers, and the publication of aggregate data annually.

Full paper and data annex

The full paper will be published shortly in the peer-reviewed working paper series of the International Centre for Tax and Development — the leading international and interdisciplinary academic centre in its field, funded by the UK and Norwegian governments.

A preliminary version is available now.

Download the full paper: Cobham Jansky 11Nov15

Download the data annex: Cobham Jansky 2015 — Data annexes

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Sony

Built its first UK TV factory in 1972, expanded that in 1980. I obtained Sony UK’s 1989 accounts which showed a UK T/O of £400m and zero profit (& apparently none since 1972). So Sony was running a charitable operation in the Uk 1972 – 1989? Nope, because they did transfer pricing. On my budget (I worked for Sony as the factory servicec engineer) I had a Japanese “consultant” priced in at around £6k per month – there were perhaps 20 or 30 Japanese guys in the factory – all on consultancy rates. We were often told that the factory was unprofitable – after having done an MBA (& specialised in applied deviousness aka International taxation) I understood what was happening. Every company does it. I don’t blame Sony – I do blame a supine HMRC.

At last – some direct community action to poke a finger in the eye of the UK government and fire a shot across the bows of what could be in store if they don’t deal with the real tax dodgers.

It highlights once again the ludicrous nature of our current corporate tax system (and the threat that it poses to national wealth and security!).

It will be interesting to see if other communities threaten to take the same action and start off a real tax revolution!!

http://www.independent.co.uk/news/uk/crickhowell-welsh-town-moves-offshore-to-avoid-tax-on-local-business-a6728971.html

I was asked to be involved in this stunt

I refused: demanding the lowest common denominator is not a solution to any problem

This is a TV trick from which I see no benefit arising