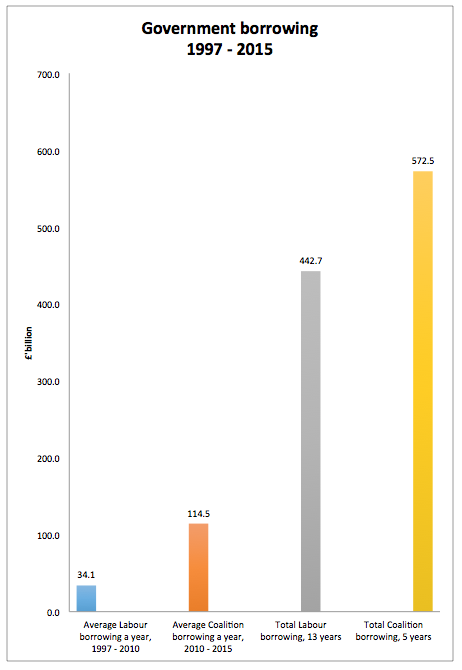

I think this graph tells a story very few seem to know about:

All data is from the HM Treasury Pocket Bank for 30 September. I have extrapolated 2014/15 borrowing form the August data to suggest whole year borrowing of just over £107 billion based on average proportion of total year borrowing to 31 August over the past five years.

The conclusions are stark: the Coalition has borrowed more than four times more a year than 3.3 times a year what Labour did, on average.

In five years the Coalition has borrowed more than Labour did in 13, by a considerable margin.

And there wasn't an unforeseen banking crisis on the Coalition's watch.

So why is the story still told that it is Labour who borrowed too much? Purely objectively that makes no sense and says that there is another entirely different story to be told here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

If we are coming up with narratives to fit the facts, isn’t the obvious one the simplest one. Namely, that as a country (and as individuals) we want a standard of living that is about £100bn pa more than we earn. In the Labour years this was paid for mainly by private sector borrowing, in the coalition years by government borrowing.

Isn’t the real question what we should be doing to come up with a sustainable, affordable future?

Sorry, but this is nonsense

If we had a balance of payment crisis (but we don’t) and a sovereign debt crisis (and we are so far from one it is hard to imagine it happening) then you might be right

But we haven’t got those things. We can afford our standard of living (albeit not in sustainability terms) but what we do not do is tax anough to pay for it

The money is there to be lent. It just has to be paid in tax instead

We currently have tax receipts of 36% of GDP. This is at the top end of the range for the last 50 years (with the exception of the mid 80s when receipts were over 37%).

So although we could theoretically tax more the evidence of the last decades, under a variety of governments, shows that taxing much more than currently is difficult.

Isn’t the actual problem we have that gdp is just too low ?

http://www.theguardian.com/news/datablog/2010/apr/25/tax-receipts-1963

There is no reason why we cannot increase tax as a proprtion of GDP

GDP is at an all time high

There is no reason why we cannot increase tax as a proportion of GDP

GDP is at an all time high

Does Roger not have a point about where the money was raised? Surely if it was off balance sheet like with PFI at high rates of interest, that would be worse than using Government debt at present low rates of interest and adding it to the books, even though it looks worse? Isn’t all of this just smoke and mirrors in how the two main parties manage the debt / deficit, use it for their own political narratives? Are the current government still massively using PFI and similar schemes? It obviously helps the Tories with their narrative on debt enabling them to say to the economically illiterate that we’re broke and can’t afford the NHS, etc.

PFI does not create money

The government can at 0%

This is why the use of PFI is so utterly absurd

Sorry Richard, I don’t understand when you say PFI does not create money! Why are the NHS trusts in debt to various banks through PFI loans, did bankers get bonuses off creating those loans and if they did would they have not spent that money into the economy? Have I been misled somewhere in my understanding of the PFI public debt that has been created. If so please help me to understand. Thank you in advance.

PFI is a loan but not necessarily from a bank so I am not sure how it can create new money

It is debt but I am not sure I follow the rest of your logic

The original post referred to debt creation not money creation, you could argue they are the same thing. After all we are often told that it was “Toxic Debt” that got us into this mess (recession / depression)! The organisation Positive Money talk about the banks creating new money through loans, are they incorrect? Didn’t the government have to bail out the banks because they ‘created’ (loaned out) too much money that was never going to be repaid? How many financial institutions / personnel got rich from this activity?

What I (and I think Roger) was trying to say is that if the debt (building of hospitals, schools, etc) highlighted in your article was hidden “off balance sheet” by Labour using PFI, but that newer spending is included on the books by the current government then it would make a massive difference to the level of debt we ‘appear’ to have and to the narrative being used by both political parties. At the basic level isn’t this just accounting trickery, which is then used to confuse the general public and used for their own party political propaganda?

How is PFI funded if not by financial institutions? My understanding is that PFI has been used to fund the building of new hospitals by NHS Trusts which are then in ‘hock’ to those financial institutions for high interest payments which damage their ability to afford the level of care required within their cut budgets. This then makes it easy for the Tories to say we can’t afford the current system and the only answer is privatisation! If PFI is also partly funded by the government are those figures included in the debt/deficit calculations above.

“Trusts like Peterborough and Stamford Hospitals NHS Trust, which is locked into making £40m in repayments a year on the PFI it took for Peterborough City Hospital, or Sherwood Forest NHS Trust, which is spending 15 per cent of its annual budget on the annual repayments on a PFI loan it took to expand the King’s Mill Hospital, and so on.” – http://www.newstatesman.com/staggers/2014/07/save-nhs-labour-must-face-ugly-truth-pfi

You said – “PFI is a loan but not necessarily from a bank so I am not sure how it can create new money”.

Going back to money creation – the (institutions) financier(s) that arranged the loan, get rewarded with (interest) high pay or a bonus into their bank accounts, which is then re-invested elsewhere or spent into the economy, is this not creating new money?

You don’t have any Tags in your categories for PFI, so please point me in the right direction if my understanding on these subjects is lacking.

Two points

First this government has continued to use PFI unabated. This is not a party political issue

Second, PFI debt may be new bank money and may not be. All moeny is ultimately but much PFI money will not be at the time injected. Corporate bonds are not necessarily funded by new bank money

So the solution is basically to tax more, and everything will be all rosy in the garden.

To some degree, yes, in the long run when the economy has recovered – but not until

Isn’t that glaringly obvious?

“But what we do not do is tax enough to pay for it”.

So does tax finance gov’t spending or not? Your post from last night seems to make it clear it doesn’t.

We may in the long run not be reclaiming enough of what we spend into the economy

Right now the situation is sustainable

In the long run we need to change that

No we don’t Richard.

There is no long run issue at all and never will be in a Sovereign currency.

Saving is simply voluntary taxation. While there is sufficient saving, there is no need to tax further, nor any need to convert the voluntary taxation into compulsory taxation. The work of ensuring the economy is not overspent has been done.

Of course this also means there is no need to reward people for saving, since they are choosing to do it anyway. So get rid of Gilts and let them leave the money (transitively) at the BoE. Run the government on the Ways and Means Account.

Taxation overall needs to be set, preferably automatically, only to remove excess spending power over and above that voluntarily withdrawn via saving.

Within that is a distribution issue (and I’d prefer that the distribution was more appropriate up front by having a bubble up economy rather than the failed trickle down one we have). But that is a separate debate.

I have to admit you have lost me

But I am very opposed to setting tax rates automatically

Tax is not just a Keynesian interventionist tool

Neal-A few questions:

1) Isn’t the ‘Ways and Means’ for sovereign money creation (debt free issuance)?

2) You equate saving with the removal of currency from circulation? So equivalent to the effect of taxation on the money supply?

3) Are you saying that taxation only has to come into play if saving dips below a certain level?

4) YOu are advocating like Randall-Wray and Richard Werner that bonds are an unnecessary ‘ritual’ which can be replaced by straight savings accounts at the Treasury?

In these discussions it is important not to conflate the economy or the individual with the state. For one, the state does not have to earn its own living, whereas the individual certainly does. The state funds its expenditure many ways but not by entering the market and getting a job. If the state does not have its own currency (see the Eurozone nations) it has to borrow or tax to get the funds it wants to use. If it has its own currency (see the UK) it simply issues currency when it wants to spend. In the latter case, taxation and public borrowing fulfill a different function than in the former case. Taxation becomes a mechanism to dampen demand, nudge people away from bad things and finally it is the chief means be which the currency becomes something people want and in fact have to have. Bond sales are, to quote Warren Mosler, a reserve draw. Spending that produces deficits come first and then the bond sales follows to prop up the target interest rate. Finally, always good to remember that net public financial liabilities are net private financial assets, and we always want lots of the latter, evenly distributed of course.

A country like the UK is not living beyond its means but below. The evidence is the large amount of unused capacity, especially labour. If the economy was operating at full capacity, which would of course also be at full employment, and the government spent still more, that would be an example of a country trying to living beyond its means.

More and more I find intimations of a recognition of the policy space that follows from possessing a sovereign currency. See the piece by Benjamin Friedman in the latest New York Review of Books, “The Pathology of Europe’s Debt”. Or, in a recent blog by Alex Little he quotes from a speech given by Ed Balls around 2010 where Balls dismisses both the famous treasury view of the 1930s and fears of the possibility of the bond markets rebelling against growing UK deficits. Even a recent blog by Simon Wren Lewis on the Tories promise of tax cuts suggests that that party realizes that deficits are not the real problem for the UK. (And by this I do not mean that inflation or currency depreciation is not something to guard against.) Also I find that in private discussions, individuals will readily admit that possession of one’s own currency means no affordability constraints. What is missing is for a respected public individual or publication to come out and say, the emperor has no clothes. Sadly the think tanks I know seem more bent on enforcing current Labour Party thinking on deficits and debt rather than creating the intellectual space that might assist our elites modulating into a more sensible view of public finances.

Another thought, if full employment is the best answer to the right wing, which I think it is, I am somewhat surprised that simple reasons of state does not cause today’s elites to abandon their financial and monetary orthodoxy and spend until their is full employment. In other words, take a leaf out of Roosevelt’s books and offer publicly financed employment to those willing to work. This would be a great thing too in the trouble Middle East.

Best wishes.

You get it

Thanks

How refreshing to hear it so well put! The real block is not that the broad populace can’t understand this, it is that the vested interests won’t let it happen and politicians of the main three parties won’t rock the boat that brings most of them the catch. The ‘people’ (read also: environment;social purpose;fairness) can go hang as far as they are concerned.

“Taxation becomes a mechanism to dampen demand, nudge people away from bad things”

If we link banker income tax dynamically to unemployment percentage, and the bank-levy dynamically pays whatever the cost of Jobseekers, then this will “nudge”, although I’d say virtually force, banks and bankers to lend to good SMEs at an honest rate. Increasing employment being the major way to reduce their tax bill.

This would return confidence to the whole economy, and make the financial system more stable over time rather than less.

The focus on the deficit is nonsense. Everyone with half a brain knows that if you take care of Growth, deficit & debt take care of themselves. Even if you didn’t know this, if you’ve half a brain, you instantly realise the truth of it.

So we must focus on Growth – and there’s only one idea I’ve heard of which would give “instant” Growth, and that is linking banker & bank taxes to unemployment rate and cost. That is: http://www.bailoutswindle.com

This feedback mechanism can then be adapted to control the banks & other financial extremists, in perpetuity, just choose the linkage.

“Another thought, if full employment is the best answer to the right wing, which I think it is, I am somewhat surprised that simple reasons of state does not cause today’s elites to abandon their financial and monetary orthodoxy and spend until their is full employment. In other words, take a leaf out of Roosevelt’s books and offer publicly financed employment to those willing to work.”

Unemployment, under-employment is a choice made by government leadership. It doesn’t have to be this way.

Wouldn’t it be clearer to label this “debt facts” rather than “deficit facts”? The presentation is all about borrowing, not the deficit.

These are deficit measures

The debt is bigger

2007-08 deficit = £34.5bn includes £25bn bank bailouts (Northern Rock)

2008-09 deficit = £96.1bn includes >£105bn bank bailouts (Bradford and Bingley; RBS, Lloyds; HBOS)

Given Tony_B’s additional information on how much of Labour’s deficit in 2007-2009 relates to bailing out banks and building societies, compared to the massive amount the ConDems have borrowed while they’ve been in power, I wonder where it’s all gone. Not on public services. And PFI mark 2 is alive and well, keeping a good chunk of capital spending off the books. So where?

I admit Tony_B’s data is misleading: that was lending, not spending – and they are not the same thing

I’m not an economist or an accountant. Agreed I was aware I might be misleading – I was raising a number of questions. Is such finance booked against expenditure in a given financial year (the Guardian notes it as contained within the deficit)?; Is it an expenditure? How much has been repaid? How much has been lost or written off? Murky water that is very difficult to read for an amateur like me from Treasury pdfs.

Most of this was loans and so not spending

Only recognised as cost when not repaid / asset sold

Thanks. The Guardian’s graphic on “Budget 2010: visualising the deficit mountain” is at the following link, click the graphic for more text. It states “What the deficit is? This is what the govt has to borrow each year to cover spending.” and “including £XXbn bailout of YY bank”. http://www.theguardian.com/news/datablog/2010/mar/25/budget-2010-deficit-visualisation#_

If the Guardian had been right Labour would have run a surplus in 2008-09 and that was definitely not true

The choices are actually 3-fold not 2-fold as the tax and spend crowd like the argue. As far as I am concerned, taxation and borrowing are the same. It diverts resources from savers and investors and sends them over to consumption. This is a short term solution but creates a long term problem. Capital is diverted and not dedicated to the creation of the next generation of earnings. So, eventually, the model of taxing and spending or borrowing and spending fails. The 3rd way is for government to actually live within its means and despite this being a mysterious concept to many in government it is something that will definitely happen. So either we choose to live within our means or markets will force us to live within our means.

Please read the Bank of England on money – published April this year

As they agree, investing is unrelated to saving and is related solely to credit

The idea that there is a zero sum game at play is now recognised by the Bank as wrong – and that people arguing it is the case, as you do, are also wrong

As for the market forcing us to live within our means – it is the market forcing bank borrowing rates down. You are simply wrong again

WHy peddle untruths? What is your reason for ignoring real world evidence?

central banks using central planning methods are forcing rates down.

And for five years markets have acquiesced?

No, markets have agreed because it’s appropriate to do so

Link to that paper?

Just Google it

It’s amazing that we are STILL hearing the ‘crowding-out’ argument, even after it has long since been discredited, and in spite of the fact of its tarnished source – Matt Ridley, he of Northern Rock!

We keep getting told that Governments mustn’t spend too much, or they will stop investors from investing in productive capital, and hence jobs; and mustn’t tax too much, or they will discourage people from working hard, and being innovative and entrepreneurial. But we look at the Scandinavian countries, and at the high levels of both Government spending and taxation there, and the greater levels of income and wealth equality those countries enjoy as a result of their histories of social democratic rule, and we find that they have higher economic growth rates and higher GDPs per capita than this country. So we are being told fairy stories by those on the Right, for their own selfish purposes. Quelle surprise!

The sad thing is – the _very_ sad thing is – that we no longer have a social democratic party in this country, and that _every_ political party, with the sole exception of the Greens, offering itself to the Electorate in England at the next General Election, will be fully signed up to the neoliberal austerity agenda, committed to ‘reducing the deficit’ and cutting public expenditure. Labour has sold the pass, and betrayed the working people of this country. I cannot forgive them for that. They wanted victory so badly, back in 1994, that they made Tony Blair their Leader. He gave them victory – three victories in a row – but at the price of their soul. It was a pact with the Devil. Now they will pay.

I agree with you on social democracy

Labour has forgotten what it means. When they are described as Centre Left I often want to laugh

Yet, you do not want to ask of the UK to become Scandinavian. This would be to ask the impossible. Becoming a social democracy is very path dependent. Focus what is within our grasp. I suggest this is over all a Job Guarantee payed for by UK’s sovereign currency. If such a thing were to happen (don’t hold your breath) it would be a powerful object lesson in the capacity of the state to solve the country’s problems.

I never know whether to laugh or cry. Sometimes I end up doing both.

I’m always interested when people site Scandinavian countries as an example of tax and spend success. Sweden suffered from very low growth from 1970 – 89 as the size of the state ballooned to 65% plus of GDP. This was followed by a banking crisis in 1991-93 and budget deficits of 11%.

What was the response of the Swedish Government? They cut taxes, deregulated huge swathes of the economy and slashed public spending. Even when the social democrats came back into power they continued to cut the size of the state. The Swedish economy has since this point been one of the best performers in Europe and they have consistently delivered Government surpluses and a balance of payments surplus as well.

The Swedish government has removed pretty much all wealth taxes including inheritance tax. The top marginal income tax rate is still over 50% but there is considerable pressure to reduce it to 50% and Corporation tax which is now 26% will probably be reduced to 20% in the near future.

All of this shows how misguided people still are about the Scandinavian model.

Richard, you mention in your initial post that the banking crisis was unforeseen. This is simply not true. Many people, including myself, saw it coming. It was obvious if you were looking at the right metrics. The fact that Ben Bernanke and others (including the Bank of England) did not, says more about their models and their thinking than anything else. In fact, having so spectacularly failed to see the crisis coming, why should we trust their models and thinking in the future?

If the Bank of England have written a report claiming that their is no connection between savings and investment then shame on them. The relationship between savings and investment underpins the very fabric of how capitalism is supposed to work.

Sweden is the most right wing Nordic country, yes

But you are ignoring its benefits system and much else and so are also guilty of considerable selectivity

Richard, you seem to support this conclusion so I would ask in a successful economy, where do you think credit comes from? In my world it comes from savings. The way the system is supposed to work is that savings are used to generate credit and investment. If no-one saves, and the only way banks can issue credit is through government and central bank policy actions, then the whole system will (and should) collapse

What we have is a banking crisis that is being turned into a central banking crisis. The Federal Reserve has 56 odd billion in assets supporting 4.3 trillion in liabilities. In other words a ratio of 77 to 1. How sustainable do you think that is? In 2008 the ratio was 22 to 1. That to me is an enormous red flag.

But you are wrong to think money comes from savings

Money comes from loans

The Bank of England confirmed that in its April quarterly bulletin this year

It is loans that create deposis, not savings

This means your whole analysis is wrong

Swedish voters, having grown tired of the neoliberal model of the Centre-Right Coalition of Fredrik Reinfeldt (PM 2006-14), and the policies so admired and loved by the likes of Michael Gove, voted last month (http://en.wikipedia.org/wiki/Swedish_general_election,_2014) to return a minority Coalition Government to power, consisting of the Social Democrats and the Greens. They have already decided to recognise Palestine as a State – a token of a degree of radicalism in foreign affairs, at least. It is to be expected that they will do a great deal, on the domestic front, to undo the damage that the Reinfeldt years have done to Swedish social democracy, and the egalitarianism of Swedish society. Even in spite of Reinfeldt and his cronies, Sweden still has a very much lower Gini coefficient than this country. There is absolutely no excuse for ours.

I welcome that new government

Incorrect. The majority of money in a fractional reserve banking system comes from loans. The key word here is majority.

Are you really saying that you need zero savings in a fractional reserve banking system?

In principle, yes

There is no need for any savings for a bank to make a loan. Not one penny

Richard Murphy, what you are arguing here is pure nonsense. Fractional reserve banking REQUIRES deposits. If there is 10mm of deposits and RR is 10%, the bank can lend out 9mm. Of course, this comes back as deposits, in the amount of 9mm whereas 8.1mm then can be lent out, etc, etc etc. This is central banking 101. However, it is deposits that create the cascade effect. Conversely, if a bank losses deposits, it HAS to then shrink its balance sheet and the reverse takes place.

However, the “Modern Economy” as the BoE paper argues, (and this is unique view from decades of research and academic works)is that loans and not deposits are the creator of ‘money’ and deposits. It seems as they are arguing that there is some kind of difference between the savings rates of households vs. businesses but national savings comprises of this that we find find in a simple course at the World Bank Institute….

National saving (S)= The portion of output, Y, that is not devoted to

household consumption, C, or government purchases,G.

It always equals investment in a closed economy. A closed economy can save only by building up its capital stock (S = I).

An open economy can save either by building up its capital stock or by acquiring foreign wealth (S = I + CA).

A country’s CA surplus is referred to as its net

foreign investment.

The BoE paper is also misleading since the ‘Modern economy’ that they cite implies that QE, that is by definition temporary, is a replacement for savings. Money creation by lending new money to the government in the return for government bonds that never get paid back? So are they saying that an economy no longer has to save or how about no longer has to invest? Why bother since the central bank can create unlimited amounts of new money that be used to purchase an unlimited number of iPhone 6s. Lets not create anything. Are they also arguing that a central bank can create an unlimited amount of new money for consumption without any kind of other effects? I think that even Keynes would argue that this is fantastically dangerous since the bedrock of his economic philosophy was that governments “save” in good times in order to disburse funds in bad times when consumers and businesses hoard their funds. I do not think that anyone with any common sense would ever agree with such thinking as that.

However, in the Alice in Wonderland of today where we are approaching 6 years after the GFC, central banks are still in a panic mode and pumping extraordinary amounts of liquidity into the banking systems in what I think will prove to be both a vain attempt and even more damaging central planning exercise when it is either withdrawn or when the effects of inflation decimates working people’s standards of living or the excessive debt finally takes its toll creating uncontrollable debt spirals and the collapse of important means of exchange.

Your Labor readers in the UK should be learning from you what the risks of these excessive policy steps are and what they should be looking out for such as the potential for inflation above income growth leading to lower standards of living. Or the potential for collapse of important industries where they are no longer able to compete since long-term wealth creation and value is no longer the goal for a central bank or an economy but some kind of Alice in Wonderland nihilistic dream conjured up by socialist retreads to appease the something for nothing crowd.

As the BoE says, you are wrong:

This article explains how the majority of money in the modern economy is created by commercial banks making loans. Money creation in practice differs from some popular misconceptions – banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits. The amount of money created in the economy ultimately depends on the monetary policy of the central bank. In normal times, this is carried out by setting interest rates. The central bank can also affect the amount of money directly through purchasing assets or ‘quantitative easing’.

http://www.bankofengland.co.uk/publications/Pages/quarterlybulletin/2014/qb14q1.aspx

As they say in their Q1 2014 Quarterly Bulletin, almost all economic textbooks are wrong on this issue.

And so are you

And you hardly help yourself by suggesting printing money automatically results in iphones. Hyperbole is not argument

I suggest you stick to facts – and you are using falsehoods

¨Broad money is made up of bank deposits – which are

essentially IOUs from commercial banks to households and

companies – and currency – mostly IOUs from the central

bank.

Of the two types of broad money, bank deposits

make up the vast majority – 97% of the amount currently in

circulation.

And in the modern economy, those bank

deposits are mostly created by commercial banks

themselves¨

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

Well, it seems to me to the Bank of England is unique in their position here and I argue that this is a position that the central banks now have to take in order to justify and support their behavior. But creating unlimited amounts of money through what is thought of as a costless approach to creating wealth is a dubious endeavor at best and potentially highly destructive at worst. The choices that CBs have taken leave little room for error on a path that has never been explored before.

Philosophically, Gottfied Liebnitz would be very proud of the BoE and your approach but Voltaire would be horrified. But don’t be fooled by my hyperbole since we could both probably agree that unlimited money creation would never be met with unlimited supply.

I see much of the sympathy for unique interventions in markets as we have seen over the past 6 years as being more akin to a prisoner suffering from the Stockholm Syndrome than one where real solid thinking is driving a path towards building a economy based on real wealth creation.

You clearly gave no comprehension of what money is, how it is created or the importance of liquidity

That apart your analysis might be correct

As it is, you’re a million miles out

I know exactly how money is created as I repeated over and over. I am arguing that just because a central bank does it that does not make it the best policy nor even a reasonable policy. You know as well as I do, particularly with the work of the classical economists, that excess monetary creation that is met with demand for that money results in temporary gains in employment and risks inflationary costs. I also argue that CB behavior now, 6 years on from the GFC is a telling sign that they fell compelled to continue with excessive monetary creation to support increasingly flimsy economies.

Just because money is created does not mean that there is demand for that money. If there is no demand for the money, reserves pile up and central bank is ‘pushing on a string.’ And for CBs to lead people to take risk by lowering the cost of money by artificially creating supply and lowering prices, does not mean that investment or productive investment is the result. It incentives risk taking, over-leverage, consumption over saving and destroys the informational value to prices of money and risk.

Furthermore, QE as it is being executed now is a new policy and has a multitude of risks specifically in the withdrawal of that policy. How is the Fed expected to liquidate the $3 trillion or so of excess bonds that they have piled onto their balance sheet. Savings HAVE to be created or exist to support an expanding debt stack and no economy can expect to build an investment environment with reasonable debt/equity ratios on purely debt alone. I remember back in late 90s here in Asia that the price of money was way too low and this lead to a severe mispricing of money and risk that led to a very destructive downturn. Destructive and inevitable.

Short-term centrally planned increases in bank reserves through CB action increases short-term investments that are by nature temporary and speculative. It is no way to build an economy that is driven on real investment that is driven from savings. The Bank of England paper reads as if they are creating excuses and a new paradigm for monetary intervention above and beyond what CBs intended use.

Your logic is that money is king

The reality is that you ignore the fact that there is a massive demand but the real money is all in the worng places

So, there is a need for wage rises

And state investment

And new housing

And training

Etc etc etc

But its sitting in all the wrong places

QE has to some extent exacerbated this hence my demand for Green QE

But you just focus on the money and the absurd suggestion that we need more saving (money in the wrong place, again) and to unwind QE – which will never, ever, happen – that is now cash

So your analysis does wholly miss the real point

And I am bored by reiteration of this sort of nonsense by so many people who seem wholly unable to see the real world and its needs