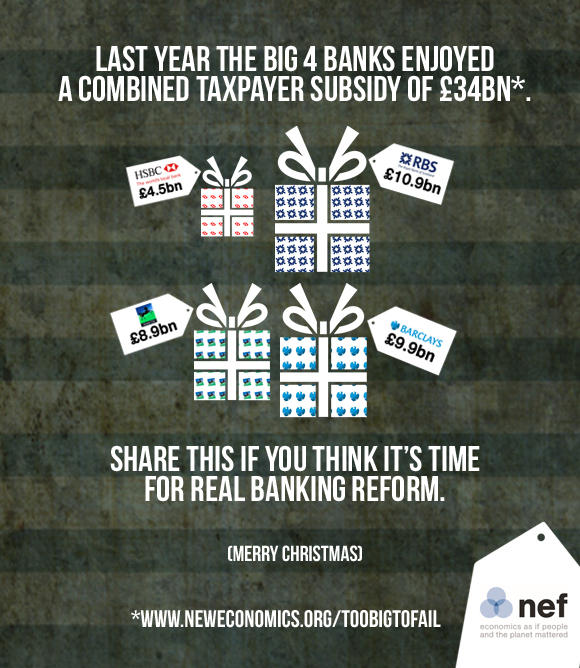

No wonder NEF is calling for banking reform.

Me too.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The problem with the analysis that they use to calculate this subsidy is that that it assumes the implicit guarantee reduces the cost of borrowing, when the case of RBS and Lloyds being explicitly taxpayer showed the exact opposite, i.e. logic said they should fund far more cheaply than Barclays and HSBC given the government guarantee, but in fact they were paying up to twice the spread. The other problem is the assertion that somehow the banks have kept this subsidy and not passed it on, when banks are the one business that prices on return on equity, so lower cost of funding feeds through to pricing and vice versa.

They might as well calculate the implicit subsidy the financial services industry has given to the government through QE reducing gilt rates by over 1%.

Oh dear, another distorter of the truth that they don’t like

[…] Hat tip Richard Murphy […]