I've said this before, and lots of people say I'm wrong, but I'm going to repeat it anyway. I argue that quantitative easing is actually about writing off government debt whilst the Tories say they have to impose cuts, and that fact has dramatic implications for economic and social policy in this country.

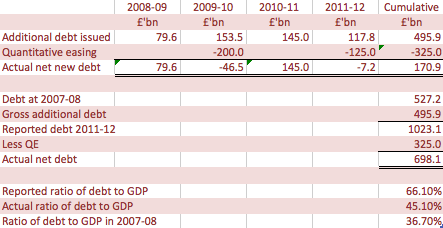

Let me explain this using this table:

Total UK national debt in March 2008 - before Lehman's fell over and the crisis really hit - was £527 billion. To that date for a period of a decade Labour had near enough balanced its books: sure it had borrowed to invest, but current income had very largely equalled current spending over the decade to 2007.

That all changed in 2008. As the table shows (all data being based on Treasury data up to date to 2012 budget) deficits then began to rise, significantly. That's because tax revenues collapsed: spending did not go out of control. The net result was, however, that in four years nominal national debt almost doubled because £495 billion of government borrowing had to be put in place.

That borrowing, amongst other things, brought the Labour government down. The Tories said we had to stop it because it was putting a millstone round the neck of future generations. They have used it as an excuse to cut public services, privatise the NHS, place a debt burden on all students for generations to come by massively increasing student fees and so loans (even though they claim that this is a disaster if applied to the country as a whole) and to slash beenfits and pensions. And the process has only just begun: 80% of the cuts have yet to happen.

They said they had to do this to keep the markets happy. They said interest rates would sky-rocket if they did not cut. They said we'd be like Greece. They said our economy would collapse. Well, we might be in recession but none of those things have happened. Some of us said they wouldn't.

There are a number of reasons for that: one is called quantitative easing. It's an awkward term. Some call it printing money, but that's crude short hand. The reality is that when its using quantitative easing the Bank of England buys in previously issued government debt (called gilts) from banks, pension funds, insurance companies and so on. The aim is to put cash back into the eocnomy and the logic is that since the cash it has used to buy government bonds will, inevitably, end up in banks those banks will then have to lend it on to get the economy going again.

Well, the banks didn't lend as much as expected, that's for sure; but it's also certain that without QE the money supply would have fallen very heavily as lending was so weak (and cash is made by banks through lending) so without QE we'd be in a much bigger mess than we are now: the only debate is how much bigger a mess.

There are three questions to now answer about this process. The first is where does the cash come from that the Bank of England uses to buy the bonds? The answer is "out of thin air". The Bank of England makes it, electronically. That's why QE is euphemistically called printing money. Actually, since about 97% of all money is made in this way there's nothing odd about this. I explain how this happens, day in and day out here so I won't repeat it. People panicked at first at the idea of this: they said inflation would go through the roof. It has, of course, fallen since QE began. So much for the foresight of those who panicked.

Second, the question is what happens to the bonds that the Treasury buys? Well, it simply puts them on its balance sheet - or rather on the balance sheet of the special purpose vehicle it has created for this exercise (because that's the way all deals are done now). The net effect is the same. At March 2012, as I note above, £325 billion had been spent on QE gilt purchases. That did not cancel £325 billion of debt as not all bonds trade at their face value: but near enough we'll say that bonds of about that value were by March 2012 owned by the Bank of England paid for with new cash: it's a fair claim. And the simple fact is that now the Bank of England has these gilts on its balance sheet that is where they will stay. They'll have to. This year we need to sell at least another £120 billion of new debt and it looks like it won't be much less each year for some time to come given the Tories complete failure to stimulate demand. So the bonds that have been bought (now £375 billion, by the way) are not going to be sold back into the market any time soon. In fact, I'll quite confidently predict, they may never be sold back, ever. There just isn't going to be the demand to let them be re-sold at any time for many years to come.

That means these bonds - and those that will be repurchased by the Bank of England in the next year or so when I confidently expect there will be another £125 billion or so of QE purchases - are going to remain in the ownership of the Bank of England. And what that means is that at least one third, and over the next year in all likelihood rather more, of the government's debt is going to be owned by the Bank of England which is in turn wholly owned by the government (don't believe those who say otherwise). It's a bit like, therefore, a loan being taken by a husband only for his wife to buy his debt back, with them only having a joint bank account. Of course he could now repay her the debt he woes, but the net effect is no cash would move because in reality the debt has, of course, been cancelled in practice, even if not legally.

So, my third point is to ask what is the practical consequence of this absolutely unambiguous reality that QE has now cancelled about a third of our government's debt leaving it at March 2012 at just under £700 billion instead of in excess of £1 trillion, as the government's scare-mongers would have us believe?

Well, I suggest it's this. First of all, all those tales of leaving a debt burden for generations can be ignored: it's not going to happen. Most of the debt has already been repurchased by the government and has effectively been cancelled. All the stories about burdening your children with it are just fairy tales.

Second, since it is very obvious that whilst the government refuses to boost demand the deficit (that's the annual borrowing which will be about £120 billion this year, and not the total debt which is either £700 billion net of QE or just over £1 trillion gross of it in my table above) is going to continue and in that case so will QE. That's necessary because the market probably doesn't want to buy that much UK debt (although it will certainly readily absorb some) but more impoirtantly, it's essential to make sure the debt is not left around for future generations.

Third, since it's now clear that so long as demand is as low as it now is in the economy this QE and the associated money printing can go on without risk of inflation (and as importantly, it stops the risk of deflation that might otherwise occur as they money supply would shrink without QE) then the right question is not whether we do more QE, because we obviously will, but just what we should do with it?

That question has to be asked because the problem with QE to date is that it has been designed to put money in the hands of bankers. Why anyone thought that a good idea after 2008 is hard to imagine, but let's not reflect on who is to blame for too long, just say its Mervyn King (as it is), and then suggest what the alternatives are so that we can stop too much of this cash being used to pay bankers' bonuses ion the next few years (which it has been used for to date).

The alternatives are all designed to cut out the banks as "middle men" to get the cash into the economy. The aim is to boost economic activity so that people get back to work, and life returns to something like normal. All of them are intended to make sure that the maximum benefit of the cash spent is retained in the UK. They're also designed to be sustainable i.e. green and also sustainable in that they generate income to ensure that if interest does ever have to be paid then the resources to do so are available.

So, first, QE should be used to buy debt issued by a new Green Investment Bank which is given newly printed cash in exchange. It would then use this to deliver some "shovel ready" projects that will get people to work and reduce carbon emissions, save fuel and so protect us from fuel imports in the future and in the process protect the value of the pound. That means putting tens of thousands of people to work double glazing, insulating and loft cladding. The payback on this is very high. And then after this they could then move on to making every building a power station - with solar power.

Second, in much the same way QE could be used to provide the capital of a new state investment bank to get business going again. It's been estimated that at least £40 billion is needed for this purpose by IPPR and I tend to agree with them. With QE that is no problem.

Third, and this is a new one: all student loans could be cancelled. The student loan book is now £40 billion, almost all owed to the government. So, just buy it back. Suddenly there would be extra money for people to spend in the economy. People would not become debt slaves for their working lives for trying to get a decent education. And people could be educated again without fear. What better way to boost short term consumption and liberate new enterprise, thinking and creativity?

And what else? Well, let's build the new homes this country needs, now. QE could provide the capital to build the social housing that will give people who currently can't buy the security of the long term tenancy they need to have a stable family life, a secure place to bring up children and the chance to settle into a community which is impossible in most private rented accommodation.

But what about the cuts I hear you say? Well, if all the above happen using QE then people will get back to work, taxes will be paid, government revenues will be restored and we won't need cuts because we'll have the cash to ensure that we can afford our public services, to pay the those who really can't work, to provide for the sick and to ensure all who are old can live in security. So QE does not need to be used to stop the cuts directly: if used wisely it does that indirectly. Right now it's not used wisely so the cuts continue.

I am of course well aware that many economists will say this is wrong. But let me assure you, 99% of the people said they could see the Emperor's clothes. It only took one person to say otherwise to change people's minds.

And let me also assure you, all this can be done: it just needs us to open our eyes to what is actually happening. Right now, instead, politicians relying on economists who face blackboards rather than the real world are saying other things should be happening and we must behave as if the economy is working in accordance with neoliberal theory rather than in accordance with the reality we can observe. I've described what's happening, and how it can be turned to benefit. All we need is the courage to do it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard

It would be interesting to see further breakdowns of debt movements, by corporates (financial institutions and others), personal sector (by income) and external/foreign debt – I can guess what they will reveal about the true nature of this government. Perhaps it needs to be remembered that everyone’s debt is someone elses asset.

I partly agree with this, but I have some concerns with the nature of Quantitative Easing. First of all before I get to that, I should point out another reason that Government Debt is not, or at least should not be, as big a problem as is made out to be and that is that while the Government did borrow rather a lot of money, it borrowed it at fairly low interest rates meaning the debt servicing costs are not that great compared to many other countries. If we had a moderate level of economic growth, then it would be fairly easy to meet this cost and gradually reduce the debt. Of course thanks to austerity we do not have any economic growth.

This means that the Tories have effectively made debt into a much bigger problem than it was and while one should not be too keen to ascribe to malice what could as easily be explained by stupidity, it is not too much of a stretch to think that they may have done so deliberately.

Onto your proposal. My problem is that the primary purpose of QE, which was to create demand by allowing more lending has failed because it was based on a false understanding of credit generation. Credit creation is actually led by demand, so banks having more cash to lend with will not do much good as it will not change demand. That is not to say that QE should not have happened but it should have taken a different form.

I favour Steve Keen’s proposal of QE for the public in order to write down private debt as it is private debt deleveraging that is the source of a lot of our problems. I would amend his proposal so that those with little debt who would be receiving a pretty large cash payment under the scheme should be required to spend part of it on special bonds to fund the Green New Deal. This would also have the advantage of making sure that these payments do not cause inflation.

The disadvantage of this policy compared to yours is that it would not reduce government debt as it would focus on private debt instead. However as it would provide the stimulus necessary for growth it would allow for this debt to be reduced in the long run anyway/

“I favour Steve Keen’s proposal”

I very much second that Iain. Steve Keen is also edging toward agreement with the Modern Monetary Theory (MMT) crowd and, from this post, I would say that Richard, though he may not be aware of it?, is too.

More power to all their elbows

I am aware

And am inclining

Are you sure that there is so little inflation around? The price of food seems to have risen very sharply and is forecast to go through the roof in the next 12 months (you no doubt know that pork for summer 2013 delivery is up 31% due to expected shortages as farmers slaughter pigs now because of the price rises in agricultural feed). Electricity, gas, transport are all rising well above the official inflation rate. Perhaps TVs and new cars are not, but life’s essentials seem to be rising sharply in cost.

Do you not think that the inflation rate is simply misleading and is being used to suppress wage demands but does not reflect the real economy?

Also, based on your argument, why issue gilts at all? Why does the BoE not simply “print” the money itself if the effect is not inflationary?

I’m not disputing your view, but the people I speak to are assuming inflation will become an increasing problem and for that reason are buying gold, because the value of money is being systematically destroyed in a race to the bottom.

If there is going to be inflation it is because of market factors e.g. poor harvests, not QE

That was my point

The QE money created needs to be spent directly into the economy, to negate some of the bad debt write offs/destruction. I also prefer Steve Keens approach, its inclusive and will get buyin as all will potentially gain and suffer from the advantages and disadvantages.(ref currency exchange rate changes and effect on imports)

I agree that the QE has reduced the threat of overall deflation (bank debt deflation) of the money supply by virtue of having used sovereign powers to create it

However the banks should be moved to full reserve banking and only the state allowed to create money , subject to some controls around purchasing power parity and blatant party controlled short term manipulation of elections.

Price changes both up and down effect different things differently, and are not representative on individual outcomes.

Price increases, i am aware of , gas,electricity,food,oil, air,rail/bus fees and taxation having risen, i am not aware of which prices which have fallen? Why have house prices/rent not fallen in price? (I suspect this is to come- famous Thomas Jefferson quote comes to mind)

“If the American people ever allow private banks

to control the issue of their money,

first by inflation and then by deflation,

the banks and corporations that will

grow up around them (around the banks),

will deprive the people of their property

until their children will wake up homeless

on the continent their fathers conquered.”.

http://quotes.liberty-tree.ca/quote_blog/Thomas.Jefferson.Quote.CA94

I think we underestimate the future potential dangers of inflation/deflation unless the banks are fundamentally restructured and the state controls the money supply directly.

Fiat currency are just that, unless they have a productive economy behind them.

Not sure if we should write off non uk citizen student debt,, unless we deduct it from EU subscriptons etc

I agree with the general thrust.

You say “I am of course well aware that many economists will say this is wrong”. These would be the same economists who failed to predict the financial crisis because they don’t include debt money in their models, or believed that QE would cause increased interest rates, or believe that bank lending depends on reserves so QE would actually affect the real economy, or a hundred other dogma-based stupidities – why do people listen to these idiots?

It’s obvious that the whole deficit/debt reduction madness is simply a pseudo-justification for neo-liberal (Tory) destruction of the welfare state. We’ve had much larger so-called ‘debt’ in the past and the economy (and social equality) has done very well.

Richard, you and I have exchanged views on BoE’s operations before and purely from an accounting point of view, I am sure that your interpretation of QE is correct and you are right to challenge our Government’s apparent misunderstanding of the application of debt.

The operations of BoE are shielded by its Royal Charter status and various aspects of the Official Secrets Act but we should bear in mind that Mervyn King is heavily influenced by the senior international bankers with whom he must co-ordinate at the Bank for International Settlements, Basel.

How does QE offset or supress deflation? The money created exists only as bank reserves at the BofE (as I understand it) so it ever affect the amount in circulation. I know technically there’s more money in existence but there’s money and there’s money, isn’t there? The supply of the jangle-in-your-pocket variety continues to shrink due to Osborne’s cuts and banks calling in old ‘loans’ (we’ll pause to chortle at the word ‘loans’ there) and not making any new ones so I’d think a deflationary period was still well on the cards. Given that some items are going up in price due to external influences (speculation and the droughts) we won’t be seeing universal deflation but some items seem bound to go down in price as a) there’s less money about and b) what little there is is inreasinngly gobbled up by necessities.

There may be an upside to this last however. If there’s no cheap and cheerful way of feeding pigs, cattle etc and the cost of ‘normal’ meat’s going up it’ll make more sense soon to pay what will by then be just a little extra and get the decent organic stuff. I’m sure this will pay dividends and we’ll see an improvement in the nation’s overall health as a consequence. Om nom nom nom!

Cash is creating by lending

The BoE is turning lending into cash

Without that cash flow there would be a shortage of money supply as banks are not lending

The result would be deflation

QE doesn’t create cash, though, does it? Mervyn doesn’t go round the banks with bags of crisp tenners. Rather he plunks away at a keyboard somewhere deep in the bowels of the BofE and the commercial banks’ reserves grow and the amount of gilts attributed to them shrinks. That”s how I’ve understood it. No cash involved I can see so how does it improve cash flow? I know the theory is that expanding the commercial banks’ reserves encourages them to, ahem, lend so that should encourage them to put more money into circulation but in practice as we all know that’s a myth.

No, this is cash

Cheques issued

Money paid

So gilts were bought back from the likes of pension companies then? Is there a reference where we can see what proportion of the recent QEs went to where?

Unfortunately not that I know of

Hi,

1. Is it fair to say that as money is not tied to anything physical, i.e. the debt is mainly just a number only, that we can get past the debt by effectively resetting those numbers via QE without causing significant disruption to the system?

2. I thought the lower inflation was because prices are being cut in shops to get the sales, but these can’t be sustained much longer and inflation is going to shoot up?

Thanks

All money is debt in the UK. But if debt ran down we’d have a cash flow crisis. QE rebalances that

Inflation is too complex to summarise as you have: the best reason why prices will rise soon is that we had a lousy summer worldwide and that will result in food shortages

See Robert Shiller ‘The Narrative Structure of Global Weakening’ at Project Syndicate posted yesterday for the impact the story of ‘Greece as all of us bubble’ is having. It was what I was wondering about yesterday.

http://www.project-syndicate.org/commentary/the-narrative-structure-of-global-weakening-by-robert-j–shiller

Narrative?

How radical!

How right

You are missing two important points.

1. Cash (in the form of bank reserves) is a liability of BoE and hence the government to the banking system. Merely shifting gilts into reserves shifts one government liability into another government liability and does absolutely nothing to the government debt numbers. You often point out how the government sector is the opposite of the private sector, so in order for the government to have £325bn less debt, the private sector would have £325bn less assets.

2. The BoE manages inflation (in a normal economy which we should hopefully return to at some point) by setting base rate and controlling the amount of reserves that banks have. Currently there are massive excess reserves which are not causing a credit bubble given weak demand in the economy. But when demand comes back, and the BoE needs to get market interest rates up, it will need to push base rate up and bring reserves down. And it brings reserves down through the sales of gilts. So it will sell them back into the market and cancel the reserves.

You really don’t get it, do you?

Money is “printed”. It’s new, it’s as real as money ever is, and it’s a liability that is never repaid. And it’s not a claim on the private sector, it’s a claim on the Treasury: an equal and opposite claim of no consequence

And re (2) – you assume there will be no gilts to sell at the time? Pull the other one….

[…] the rest here: The real potential of QE: how we could turn our economy round now … Related […]

Richard Murphy et al,

Let me tell you v simply why you are all wrong. You believe that QE can cancel debt. If that were true, Zimbabwe would be the richest country on Earth, and yet it’s in economic ruin.

Based on your arguments, the UK govt should run up £infinity of debt overnight, buy the whole world (nay the whole Universe), then print £infinity of QE to “balance the books” and all would be well. This would be a nice scenario as UK taxpayers would own everything and never need to do an honest day’s work again.

Oh wait – it wouldn’t work, because everyone else would print infinite money, thus making it all worthless. I put it to you that it your type of naive thinking, and the fact that hardly anyone does an honest day’s work in the UK these days that is why we’re in sh*t creek.

Interested to hear your rebuttal…

Bob

Simple rebuttal – I’ve never said it could do it forever

Why do you people always extrapolate to extremes

When full employment returns of course we could not QE

Now stop being very silly

I think we could if we wanted to. If we assume it to be backed by the wealth of the nation we could increase the wealth of the nation in proportion with any credit or note issue. By wealth of the nation I mean infrastructure, hospitals, training surgeons, funding the arts. Others may differ in their views of what constitutes wealth. Should we fund philosophers? I don’t know. It’s a grey area. The ultimate arbiter of disputes would be users of foreign currencies when it came to setting exchange rates. If we funded a lot of philosophers recently as opposed to creating useful infrastructure, perhaps the value of the pound would diminish. Then again, perhaps not. If there’s one thing Schacht established with the Rentenmark, it’s that currency value is in the eye of the beholder. What would others think of what we create with our currency? It’s an important consideration as their perception will affect the value. Perhaps then we could create money for an unending stream of public relations, it’s only end product to be the convincing of other nations of the value of our currency. Would it work? I don’t know. I do know though it’s really not easy trying to decide a way forward 🙂

Richard,

That’s the point – full employment (or anything near it) won’t ever return and here’s why:

– technology (progress?) is making more and more jobs obsolete (across agriculture, mining/extraction, manufacturing, services, finance and even the ‘knowledge economy’). I’ve seen this first hand as my job involves automating IT systems (to replace people).

– in the UK education standards are so low that the jobs that are being created struggle to find talent (again, I know because I struggle to recruit people who can string a sentence together, let along deal with clients and be literate in IT)

– the benefits system in the UK, whilst great in theory and for the very needy, destroys the incentive for low waged people to work (e.g. a friend of mine is a working, single mum who’d be better of on benefits)

So back to QE – we have a structural broken economy (and thus society) in the UK. Politicians of all parties are loathe to implement real fixes, and prefer to run up debt so we can pretend our standard of living will remain roughly constant. The easiest way to do this is via QE.

Sure, this buys us a year or so, but in the long run just makes the problem worse.

Would be genuinely interested to hear your views on any/all of the above.

Neoliberalism has broken society, I agree

Read the Courageous State for my views