This video asks a simple question. Is the AI-fuelled stock-market mania echoing the dot.com crash?

I compare FTSE 100 and S&P 500 crashes, highlight that the S&P is now trading at price-to-book levels above 2000, and show how mega-cap tech stocks now represent nearly a third of the index.

Recovery after 2000 took years, cushioned by government intervention—especially in the UK. But will that happen again, or will neoliberal ideology prevail, letting zombie firms and market excess implode?

If we care about economic justice, public accountability and avoiding speculative disaster, this is urgent. A crisis could be coming.

This is the audio version:

This is the transcript:

We are living in an AI stock bubble.

I've been saying this for a while.

I admit I've made videos on the subject before; again, I confess to that, but now I'm not alone in saying this.

The New York Times is running articles saying that they fear we are living in an era before a crash, and so is the Financial Times.

The world is aligning with me. I'm no longer trying to make it do so. It has happened.

And my fear is that we are in effect going to face the dot.com crash that hit the world in the beginning of 2000 all over again.

And I lived through that and knew what it was all about, partly because I was involved in dot.com companies in the 1990s, and this, therefore, as far as I'm concerned, is something that is about lived experience.

The S&P 500 crashed then, and so did the FTSE 100. And now things are much worse in underlying terms than they were in 2000 because the tech giants are now much more dominant in terms of stock market valuation, particularly in the USA, than they were back then, so the risk is that we could have another crash on the scale of 2000, or worse.

In December 1999, just before the millennium, there was a stock market peak in the UK when the FTSE 100 hit 6,930 points, an unprecedented level before then, after which it plunged by nearly 50% by 2003. It took five years after that to recover, before 2008 dragged it down again.

If we look at the States, the S&P 500 peaked at 1,553 points in March 2000, and by October 2002 had lost, near enough, 50% of its value. Again, the recovery took years, until 2008, when, of course, in effect, it all happened once more.

The lesson is this: markets can be irrational , and the fact is that right now markets are deeply irrational.

After 2000, following the dot.com crash, investor and pension plan pain was severe and prolonged, and it's a fact that crashes hurt whole economies and not just speculators.

Now, I want to stress that the links aren't absolute, and in some ways, they are less defined than they were earlier this century because there are so many fewer links between companies and their pension fund these days. But the truth is that unless governments act, the crisis of confidence that a stock market crash represents does drag down the economy as a whole, and so what I'm talking about is significant because if markets fall, we're going to be in deep trouble.

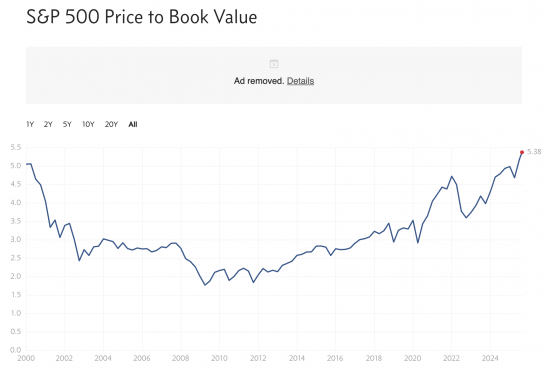

Just look at this chart. What it shows is the price-to-book ratio of the value of the S&P 500 as a whole at present, and compares that with the entire trajectory of this century.

Right now, the price-to-book ratio, which is an indication of the difference between the price that people are willing to pay for shares and the underlying asset values associated with those shares, is 5.3. In other words, people are paying 5.3 times the underlying asset value of the shares that they are buying. And the last time we saw a ratio like that was in 2000, when it was 5.1. And look at what has happened in between. It fell heavily.

The indication, as a consequence, that we are seeing a bubble is incredibly strong.

AI is in effect the new dot.com in earnings terms. People are claiming that AI is going to deliver massive profits, and those are being valued so that stock market valuations compared to underlying asset values are enormous.

The fact is, investor psychology is driving valuations, and fundamentals are not. That is the classic driving force of a bubble.

And this time it's even worse than it was in 2000 because back then the companies that were overvalued were diversified in their nature, and now they're very concentrated. Now we are looking at about seven companies dominating the US stock markets in particular and dragging the rest of the world behind them in terms of market valuations.

Microsoft, Apple, Nvidia, Amazon, Alphabet, which owns Google, Meta, which owns Facebook, and Tesla are around one third of the value of the S&P 500 between them.

The top 10 companies in the USA represent 38% of the value of the S&P 500, and Nvidia by itself represents 8.1%, although it has seen a fall in its value in the few days before we recorded this video.

A stumble in any one of these can move the entire index. If they all move together - and that is what I'm suggesting might happen - and we're heading for a crash scenario.

And in 2000, people said that it couldn't happen because the internet was going to deliver untold riches. Today, we are told the market can't crash because AI is going to deliver untold and almost immediate riches as a consequence of the hundreds of billions that these companies are throwing at it.

And the fact is that the internet really did transform business completely and utterly. We all know that. Our lives are totally different from what they were 25 years ago as a consequence of that invention. But it didn't happen overnight. Nor did it entirely eliminate old-style business either, and that's going to be true of AI as well, I suspect.

Of course, it is going to change things. Let's not pretend otherwise. That would be absurd. It obviously is new technology, which is going to change the way that we work. But to presume that massive flows of profit will arise as a consequence for the companies that are investing now is quite absurd.

Let's put that in context. If that confidence, which is underpinning current stock market valuations, disappears, because it becomes apparent that there isn't going to be the stream of profits that people are currently expecting, indices could fall. They fell by 40% to 50% in the era from 2000 to 2002. In other words, values just about halved in many cases. It was that dramatic. The FTSE fell to a little over 3,000 from a peak of nearly 7,000.

Pension funds, savers, and jobs were all exposed as a consequence, and people lost jobs as a result. Let's be clear about it. And this time, the global fallout as a consequence of the concentrated tech valuations could be even worse, and the result could be something much more significant.

In 2000-2003, the UK government and others spent a lot to prevent market meltdowns. Gordon Brown, to his credit, rose to the challenge, and most people in the UK would not have realised we suffered the consequences of a stock market meltdown in this country in the period in question, 2000-2003, because he compensated for what was going on by increasing government spending to make sure we did not suffer.

But suppose that in this new world we now live in, where we have politicians like Rachel Reeves saying, "We must balance the books and nothing else matters", this crash could have a massive social impact.

If the government decides not to help this time, and the neoliberal dogma, which is that zombies must fail, and not just companies, but also governments potentially, then we are going to see a disaster as a consequence of the crash that I believe is coming our way as stock markets begin to fail.

AI's optimism is simply unjustified. I've been here before.

In 1999, I warned my co-directors in a company that if we did not sell out within months, we would not see the same valuation ever offered for the company ever again. It turned out I was right. When the company was eventually sold, long after I left, the figure that we got for it was about 20% of what we were offered in 1999, which my colleagues turned down. It's that sort of feeling that I get now.

We are facing that sort of potential reevaluation of AI.

Without action by governments now to actually put in place the steps that are necessary to ensure we have a soft landing when the AI bubble bursts, as burst it will, we are going to be in real trouble.

Governments have to have a contingency plan for this, and that contingency plan is about government spending to keep economies going when those who have brought it to its knees by overvaluing stock markets will have long taken their losses and fled the scene, leaving governments to pick up the pieces.

So, what do you think is going to happen?

Do you think that AI is overvalued?

Do you think that we could face a stock market crisis?

Do you think that the government is ready for it?

Do you think that we might all suffer as a consequence?

These are the sort of questions to which we want answers.

There's a poll down below. Let us know what you think, and thank you for telling us.

Poll

Why do you think about the AI stock market mania?

- The bubble is going to burst (57%, 194 Votes)

- This will end in tears for us all (27%, 93 Votes)

- I don't know (13%, 46 Votes)

- These companies are worth their valuations (2%, 8 Votes)

Total Voters: 341

Taking further action

If you want to write a letter to your MP on the issues raised in this blog post, there is a ChatGPT prompt to assist you in doing so, with full instructions, here.

One word of warning, though: please ensure you have the correct MP. ChatGPT can get it wrong.

Comments

When commenting, please take note of this blog's comment policy, which is available here. Contravening this policy will result in comments being deleted before or after initial publication at the editor's sole discretion and without explanation being required or offered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

There’s an estimated $35billion invested in unicorn businesses that essentially do nothing and produce nothing. That sounds risky to me, and I know very little about the stock market.

Stock markets are gambling dens. The US Dow is dominated by the big tech companies where the share price just keeps going up without any realistic justification other than the fear of missing out.

What goes up has a tendency to go down with a bang.

Agreed the signs of impending collapse are coming into focus.

As you say the collapse will hit everyone.

There is a video in the morning….

perhaps not the moment for small savers to be shifting their money into the stock market then, and perhaps RR should postpone any loosening of the regulations on the banks introduced in the wake of 2008. Just a thought.

Most definitely agreed.

Does the bubble level of AI stock prices drive up the price of non AI stocks?

Drags up….Yes

If there is an AI stock market crash, I hope it happens before AI takes over the NHS.

I have noticed that Palantir has been sending people into schools to get apprentices to work for them rather than go to college or sixth form. It will put a stop to that, I presume.

“And I lived through that and knew what it was all about, partly because I was involved in dot.com companies in the 1990s, and this, therefore, as far as I’m concerned, is something that is about lived experience”.

I was in London at the time; we were raising money for a small business, at the same time as the dot.com boom. We raised our money, but the environment was completely bizarre. They were throwing millions at 20 year-olds, whom had never run a business, and knew nothing whatsoever about running a business, before or after the crash. It was surreal; as if the City institutions were more frightened of being left out of the mania (even though it seemed obvious to me, fundamentally they simply couldn’t, and didn’t understand what dot.com was, or what they were buying); than making a bad decision (on the grounds the downside is everyone goes over the edge of the abyss together, but being left out of an epoch changing success is even worse? Who knows). One institution asked if we could not give our business (which had nothing whatsoever to with the dot.com experiment), a dot.com twist. It was all quite ludicrous.

It was.

It was ridiculous and surreal. I left.

Stock markets are unpredictable. If you really know what’s going to happen next, you could probably make money betting on the direction of market movements. I don’t know which way they will go, but the downside of a collapse will hurt everybody except speculators who bet on it. It’s an ill wind and all that.

I agree that politicians will have no clue how to deal with a major crash.

Just yesterday MIT research found that “95% of generative AI pilots at companies are failing” – but there’s a history to this tech-hype – remember Zuckerberg’s idea that we’d all be in virtual reality by now – his ‘metaverse’ – even changed the company name – or Musk’s claim that we’d have self-driving cars next year – a claim he makes pretty much every year as far as I can make out.

The difference this time, perhaps is that all the US Big Tech corporations seem to be caught up in the AI hype. Meanwhile, as with electric cars, the Chinese are probably quietly manufacturing real things that actually work…

Forbes headline today: “Elon Musk’s Self-Driving Tesla Lies Are Finally Catching Up To Him” – there are apparently a number of legal cases pending, because his ‘robotaxis’ keep injuring people.

There are also, incidentally, lots of legal copyright cases coming all over the world against Generative AI.

Concerning the MIT article, I don’t have access to it, but it reportedly says how companies adopt AI is crucial, and this is absolutely true. Salient quote: “Purchasing AI tools from specialized vendors and building partnerships succeed about 67% of the time, while internal builds succeed only one-third as often.” The specialized vendors mentioned here include small, middlemen companies which sit between AI provider and client. I suspect this structure has at least two benefits: (1) offloading development expenses and rerouting pricing pressure to the middleman (2) insulating AI companies from the success or failure of any one venture.

As for “hype,” there is definitely a lot of it. Marketing has been big component of tech since the early days, and it has gotten more outlandish over time. You might say that when AI hit the public papers, it was mostly a big marketing push to keep tech (and the U.S. economy) flying high during a period of high interest rates. AI spending generated economic activity. Even if you were hesitant to bet on AI directly, you might bet on the businesses which fed AI (NVIDIA, utilities, real estate for data centers, etc).

As to the truth about AI: In the domain of soft power, it’s much more concerning than is publicly acknowledged; AI having a direct line to the minds of millions through a myriad of devices is not good, to put it mildly. Is it going to kill demand for labor? No. Even in the dystopian fantasy of AI and robotics experiencing a breakthrough (which has yet to materialize), civilization demands the preservation and cultivation of generational knowledge, and for that, it needs people. Will AI put downward pressure on labor in certain sectors? Yes. Enough to justify the price tag? Hmm.

I haven’t subscribed to AI, and I don’t plan to. But timing the market… betting against the geopolitical interests of the U.S… I don’t know. That seems dicey. But no matter your position, hedging risk is probably sound.

It’s 07:56 and I am asking myself ‘Is our host alright?’.

Yes, he is.

A post has just appeared. It took a while to write those 1,200 words this morning, and have breakfast, coffee, a shower and get ready to record a poodcast in an hour or so’s time. Sorry.

It’s knowing that you are OK that is important, based on how quickly you are usually out of the traps, but thanks.

I admit that I am tired. I have developed a lot of materials which we will be recording over time. This morning we have recorded our first podcast. That will be out next week. I’ve also been pushing myself on the topics that I am talking about. I might be taking a slowish weekend, including, possibly, some time out tomorrow. The batteries need recharging.

I fear a major crash for several other reasons apart from AI. Climate change is imposing a huge increase in costs – it is destructive and who will end up paying for it? That destruction will continue for years and years. Polarisation between USA and the rest of the western world is adding more and more uncertainty, adding to the surreal nature of our politics and economies. There are several possible triggers into a crash, not just AI. But when it happens, I fear a domino effect will make the crash bigger than any previous ones.

And speaking selfishly, as a soon-to-be-retired adult, should I move my small pension pot from green investments into cash??

I cannot offer investment advice, but I can say that a great deal of my savings are, a present, in cash for precisely the reason, much as I am hesitant to otherwise put them into such a useless savings medium.

Will green investments be affected as much as other investments?

I know it’s not investments, but I have just moved back to Ecotricity for my energy and am saving £40 a month. And my smart meter works properly again after all this time. It was put in by Ecotricity in 2017.

Success!

There are over a Billion users of AI today but only 3% actually pay for using it. With the leading chip giant NVIDIA having a price to Book ratio of over 50 which is 10x the current S&P average, surely the Emperors new cloths will be revealed very soon.

Agreed, and I am one of the 3%.

I too was in the .com world at the time. It feels very similar now. There are people talking in ways that seem completely detached from reality and getting huge amounts of money for it.

The one thing that will make the crunch harder is that it’s not just the stock market but whole economies that are being propped up by the ai bubble. The big tech companies have huge cash reserves which they are spending on AI infrastructure in large enough amounts to make a difference to the US economy. That will dry up pretty fast. Leaving a bigger hole than just a stock market crash

Agreed. The investment will end, overnight.

Trump is going to make damn sure the US global monopolies Richard mentions will not be taxed anywhere or held to account for global disinformation.

We are now all well and truly dependent on them so how that will work out when the crash comes ….daren’t contemplate

They are taxed.

The question is where they are taxed, and at what rate.

This should be interesting, my MP’s Emma Reynolds – Economic Secretary to the Treasury and City Minister!

Shall I keep you posted on what she comes back with – if anything?

Nice GPT prompt!

I admit that her replies are always planned, but this is a new topic, so it might be interesting to see what she has to say. Thanks for doing this.

She just replied – she’s not my MP, seems ChatGPT got it wrong.

I’ve asked for her feedback anyway and will send the letter to the correct MP.

Hence the warning in my footnote on the ChatGPT link. It does sometimes find the wrong MP, and I have no idea why.

https://youtu.be/9bpsukhaV2s

I have just watched this and thought i am not sure what what they are trying to signal but i know a man that does ! excuse my lack of knowledge and you may be talking about this above ?

Thankyou .

This one is easy to explain. Stock markets are at all-time highs. Money has left bond markets to move into stock markets. As a consequence, the price of bonds has fallen. And given that the price of bonds and the interest rate that is declared upon them are inverse to each other, it would appear as if the cost of government borrowing is at a record high level as a consequence. But that is only because stock markets are high and not because the actual cost of government borrowing is excessive at this point of time. The simple fact is, it should just sit out the bond markets at present and not issue anything, wait until stock markets collapse and then there will be so much money trying to find a home with government bonds that the rates on those will fall considerably as their price will have risen enormously.

The government has to issue c. £150+bn to meet the current deficit, it doesn’t have a choice.

The government can run an overdraft with the Bank of England. It has no reason to issue bonds. You are wrong.

Being in the software industry during my career (now retired) I completely agree with you. Just trying to get the courage to tell my financial advisor to get my pension portfolio out of the stock market until the correction occurs. I need a plan to confront him. Perhaps it just by delaying my risk level to be adjusted to very low. Any advice?

Just tell him, straightforwardly, but if the New York Times and the financial times are both saying that the crash is likely, you want out of the market for the time being. That’s it. Nothing more required.

China cautions tech firms over Nvidia H20 AI chip purchases, sources say.

This will probably damage Nvidia, bringing the collapse closer.

https://www.reuters.com/world/china/china-cautions-tech-firms-over-nvidia-h20-ai-chip-purchases-sources-say-2025-08-12/

Agreed