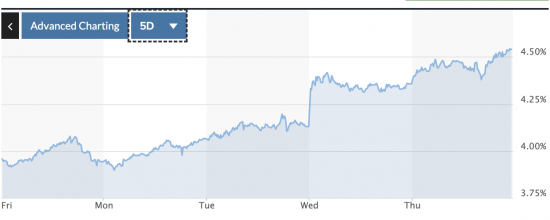

Wednesday's inflation news has provoked a perverse reaction. Although inflation fell considerably, because a bigger fall was expected, financial markets are now speculating that Bank of England interest rates will have to increase again. As a consequence, they have been selling off their holdings of government bonds, which reduces the price of these assets, meaning that the effective rate of interest paid upon them increases.

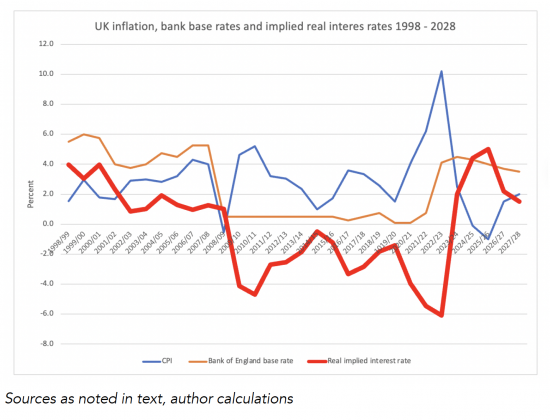

These charts from Market Watch tell the story over the past few days and over the last year:

The interest rate on two-year government bonds has increased by 0.5% in less than a week. This means that interest rates are now approaching those last seen in September 2022 after Kwasi Kwarteng's disastrous outing as Chancellor of the Exchequer.

Reactions have been almost immediate. Mortgage interest rates are now approaching 5%. The dire economic outlook for those who have to refinance their mortgages this year has just worsened. Expectations are that matters will get much worse still: markets are speculating that bank base rates might now reach 5.5% by the end of this year, which will deliver an almost unprecedented (in recent history) positive interest rate as a consequence of the Bank of England base rate exceeding the inflation rate.

I hardly need reiterate my concerns about this. As Danny Blanchflower and I noted in a joint submission that we made to the Treasury Committee of the House of Commons in March 2023, this country cannot afford positive interest rates, which it has not seen since 2008:

The UK economy has stagnated despite having negative interest rates since 2009. The chance that it might flourish with positive interest rates is close to zero. Businesses will not invest. Household incomes will be depressed. Consumer spending will fall. Inquality will rise. And sustained positive real interest rates, which are now anticipated, will, of course, have no impact upon inflation, which everyone still expects to have been curtailed by the end of 2024.

In that case, what we are actually saying is a dogmatic increase in rates, fuelled by market expectations of Bank of England reaction to inflation not falling as fast as the Bank might desire. That Bank of England reaction is driven by their desire to increase the rate of return to financial capital in this country at cost to the population at large. The consequence is what might be described as a central banker-imposed death spiral for the economy as a whole.

That is, of course, a way out of which, but that would require that politicians intervene, and as Ed Conway has reported for Sky this morning:

I think we can all be quite sure that Rachel Reese will be standing right behind Jeremy Hunt.

The consequence is that the two leading political parties in this country, acting in cahoots with the Bank of England, are choosing to impose a recession on this country with the sole goal that the wealthiest might get wealthier. We have seen anything like this since the days of Thatcher, but then North Sea oil saved us from destitution and nothing will now.

I worry, a great deal about the economy, but my sense of despair is now growing by the day.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It seems the chancellor is happy to force recession upon the UK. I mean what the very **** kind of ideology drives such a statement?

There is something innately evil at work here.

There seems to be no morality here at all except that someone seems to think that it is OK for people to suffer in order to ‘correct the markets’. This requirement of suffering has a religiosity about it that is disturbing.

It just so happens that those thinking that this is acceptable are very well off group indeed.

The big lies about money always need more lies and unnecessary things doing to prop them up and look legitimate – that is the truth of the matter to me.

We just have not come very far at all really have we over the years?

We have regressed significantly in the past 20 years IMHO.

Funnily enough, the past 20 years have been dominated by a certain political-economic movement.

“There is something innately evil at work here.”

Follow the money. This is a neo-liberal agenda to break public services and privatise them. The amount of money to be made (by the few) is billions, as evidenced by, for example, the £250 billion siphoned off from the NHS through PPI. This is the tip of the iceberg.

Would the Bank of England announcing that it didn’t particularly want to raise interest rates further not dampen the run on selling gilts? Not that that is in any way likely to happen. Jeremy Hunt is “comfortable” with recession, so it’s a moot point whether he is going along with Andrew Bailey on the bank’s actions, or is directing them. Clearly though, at the very least, he is signalling to Bailey that he’s happy with what he is doing.

You don’t have to be an economist to realise that inflation at present isn’t demand-led, it’s down to exogenous supply factors, so any attempts to curb demand will not per se reduce inflation. As you say, we the people will simply get poorer.

‘Reactions have been almost immediate. Mortgage interest rates are now approaching 5%’

Real life example. I took a 5y fix 2 years ago. If it was to end today, my mortgage providers latest 5 y fix on offer is x 3.6 my current rate. If you don’t want to commit to a long term fix at those rates, then the standard variable is an eye watering x 5.54.

Now it’s not a big mortgage. Comparatively tiny compared to some folk we know (and I suspect millions of others in the country), but when you add in all the extra tax we’re paying, plus the higher prices everywhere then I feel confident that Jeremy & Andrew will get their recession. Big style – but it won’t really affect them will it?

Bad luck

And no, it will not affect them

Spare a thought for us poor souls stuck with an-ex Northern Rock mortgage sold to bottom feeders like NRAM and Landmark.

We have been here many times before.

Another round of lost businesses, savings used up, investment deferred and lost jobs.

And we know we have a lack of investment which has resulted in lower productivity than our neighbours. The reverse of Hunt’s assurance that the policy is necessary for prosperity and economic growth.

We need to learn from our history.

We are now in a neomythical age where hardly anyone understands the need for a public-private partnership for the sake of the economy. This age is a consequence of voters and politicians being hammered by the greed propaganda of right-wing market fundamentalists. An estimate of the amount of money the US government had to create to rescue its economy from the greed created market fundamentalist GFC of 2007/2008 is in the region of $29 trillion. The UK figure will obviously be less but the majority of voters and politicians both sides of the “pond” are hardly aware this bail-out could or did happen because of the public-private partnership existing within their societies. They’d much rather believe some shallow neomythical lie in the mainstream media the GFC was all the fault of government. Essentially the willingness to believe this puts both these societies back in the Stone Age, makes them neolithic where neomythic belief drove much of what happened in those societies.

“the need for a public-private partnership”

The need for PPI? Private Finance Initiative (PFI) schemes have siphoned £250-billion from public services into private hands. How is that good? Private interests are different from public interests.

We will live in a mixed economy 8n the future, I am sure. The economy is inherently a public private partnership

No not PPI. We live in a neomythic age not really much different than the Neolithic or late Stone Age because despite the evidence of the causes of the 2007/2008 GFC a great many voters still believe the Adam Smith myth that market capitalism is self-equilibrising. As Keynes and Minsky pointed out even to come close to equilibrium requires the state or public sector to be in partnership with market capitalism not merely to adequately regulate it but to make good on its demand and production deficiencies. Put another way there are always individuals in a human society who want to free-ride and don’t care what occurs to others in achieving this hence the GFC.

I agree with the despair and previous comments.

If something is unsustainable it won’t be sustained. Clearly BoE base rate will have to fall, irrespective of the absurd comments from politicians. Sadly, however, rates may only fall once the true scale of the damage becomes apparent. This may precipitate an election, with either Tory or Labour in power. But despair is justified by the damage that will happen before that.

Since interest rates will fall, perhaps it’s a time to go long on bonds.

As an aside, I recall 2008 and following years. I was watching interest rates carefully (due to personal circumstances). There were constant comments that interest rates would rise. And every few months the timing of the rise would be pushed back. Rates never did rise.

Whilst politicians may spout all sort of nonsense the reality is that high rates are not viable and will not be sustained (even if they do way too much avoidable damage until they are corrected)

Andrew Bailey is just a front for the thinkets and doers at the BoE. Never has looked a very good or competent one. The only way a recession will affect him is if he is sacked. Even then he will be looked after. The only way that a recession will affect the government will be when most of the current MP’s lose their seats and then have to work for their money. I Teresa rates will continue to rise until the well of say stop.

As I said capital f;ight is now here with 40 billion wiped off the UK stock Market Headed for real positive gains and the UK looks an uninteresting prospect for Russia China and Saudi AArabia all whilst the USA come in and buy up comanies and extract the wealth too.

What could go wrong?

Jermey Hunt supports the Bank of England interest rate policy as a way of ensuring economic growth and prosperity. What is he hanging his faith on, precisely? This, from andre Bailey only a few days ago: “I think there is a genuine debate with food for instance, not so much about the shock itself … but actually about the longevity of the pass through of food prices and what we learned about that, so I think we have a lot to learn about operating monetary policy in a world of big shocks.” (Interview recorded/reported on Sky News, 23rd May 2023).

His faith in the BoE hangs on the acknowledgement by the BoE that it does not adequately understand the problem, or what it is doing.

That will abruptly fail the test of QED formalism; but no dount it will prove good enough for the Daily Mail and Daily Telegraph.

Another rate rise will not reduce inflation short term, it will only exacerbate

further wage and salary increases . This becomes a spiral. Fiscal drag is

overlooked . The brave and in my opinion sensible move would be to have

no increase in the base rate , indeed point to a 0.25 % reduction in the next

six months. Give it a try , everything else has failed us !!

I would cut rates by 1% immediately

George Brown’s policy of allowing the Bank of England independence to set base rate was the equivalent of putting a fox in charge of the hen house. You could obviously expect corrupt Tory politicians to do this but the Labour Party!!! This alone should tell you that the Labour Party a quarter of a century ago become a con, a hollowed out phoney institution on the side of the few not the many!!!

Blame Ed Balls

It was his idea

Gordon Brown I think.

George passed away 1985

To be fair I have made the same slip myself

And I didn’t notice …..

Yes Gordon Brown indeed! PFI was initially launched in 1992 by Prime Minister John Major, and expanded considerably by the Blair government.

https://en.wikipedia.org/wiki/Private_finance_initiative

All based on the Thatcher myth the UK government has no money creation powers of its own!

I feel so angry about the way our future and that of my children is headed. I am not eloquent enough to argue with economists, but I see the fundamental flaw in an economy that is not circular, but that constantly flows to the wealthy.

Perhaps it’s a pre election ploy to please retirees who have paid off their mortgages and have money in the bank and want a return on their savings and to hell with the real economy where the rest of us need to make a living. I guess these people would turn to those losing their house or livelihood and tell them they should have been more careful – conveniently ignoring the benign circumstances that led to their current comfortable position.

“choosing to impose a recession….. with the sole goal that the wealthiest might get wealthier”

But Hunt and Bailey, surely don’t stop to think what this is doing to the economy and to real people -” its just an unfortunate necessity – to get the ship back on course – but at least we are all in it together”.

The docility of the body politic -in the face of this unthinking callousness is pretty astounding – with millions more in debt, and poverty , and the top 10% getting richer.

Could there be some kind of automatic ‘fairness stabiliser’ which kicks in at the same time as the interest hikes, and starts to tax addtional interest income at 90% and/or subsidises income of those faced with increased interest/rent payments That might give pause for thought in that ‘we’ would then be ‘all in it together’.

Is that just silly?

Is there any kind of ‘interest compensat

Nice idea

But not fair they would say

Richard,

The markets focused on core inflation and potential wage inflation not the headline number. Everyone understand how base effects will affect the headline number. So while the result may not be “to taste”, equally it is not perverse in this context.

Markets now expects another 100bp of rate rises here, bringing the base rate well into the zone where the BoEs own analysis (June 2022j suggested serious stress in the HH sector….

So, tell me how that increase will reduce inflation when more than half the population are already facing poverty and destitution because of unnecessary cost of living increases imposed on them by

No generalities here: tell me precisely how this will transmit to produce the desired outcome and over what time scales?

Please compare your answer to mean post inflation spike behaviour.

I make no comment on the policy choices here, Richard, just my observations on why markets reacted in the way that they did. They focus here (and in the US) on core inflation (or PCE in US) as yesterdays moves in the US also indicate.

I believe that the BoE and other central banks have very limited tools and ability to control inflation behind managing inflation expectations (they are doing a slightly better job there), like you (I think) I believe that fiscal policy or at least a combination of both fiscal and monetary policy is required.

“As a consequence, they have been selling off their holdings of government bonds, which reduces the price of these assets, meaning that the effective rate of interest paid upon them increases.”

Presumably this is through the APF process, and does not entail increasing the Bank Rate. Trying to work that through I speculate will create a divergence of formal treatment of interest rates for different kinds of risk-free savers with other types of Government schemes, from Gilts; for example NS&I (whom I assume would not see an increase in the interest rate because bank rate has not increased)?