This is from the FT this morning:

Spain became the largest eurozone country to impose a windfall tax on banks in a sign of European governments' search for funds to lessen the painful impact of price rises. The move by Socialist prime minister Pedro Sánchez — which the government said was designed to limit banks' gains from rising interest rates — triggered sharp falls in the stocks of Spanish banks.

I wholeheartedly approve.

The reason is straightforward. As we know, the central banks of Europe created billions of pounds and euros worth of additional central bank reserve account balances during the Covid era by using quantitative easing to support government spending. These central bank reserve accounts are the depositories for government-created money. The commercial banks who hold them did nothing to generate the funds: they were simply gifted to them.

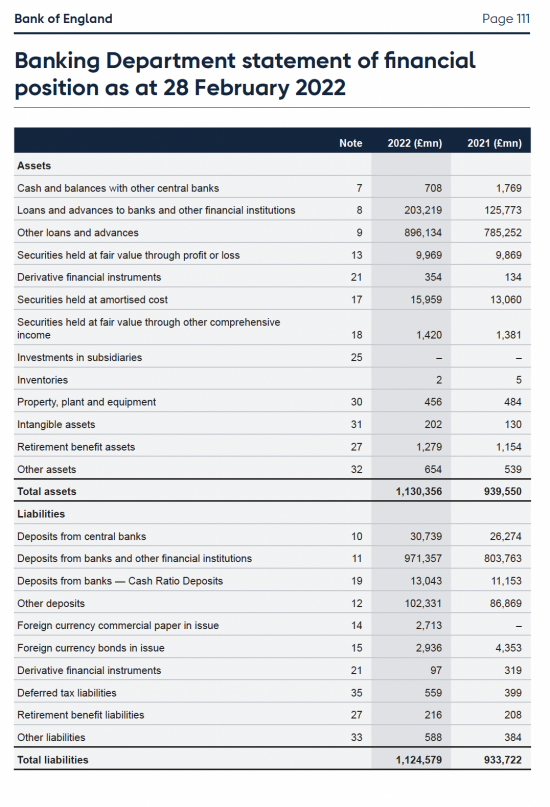

The growth can be seen in the balance sheet of the Bank of England, the most recent of which is here:

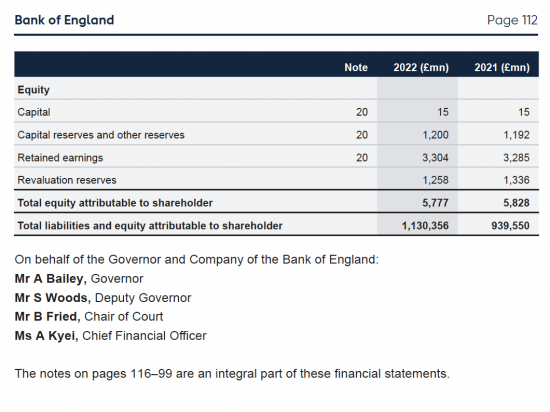

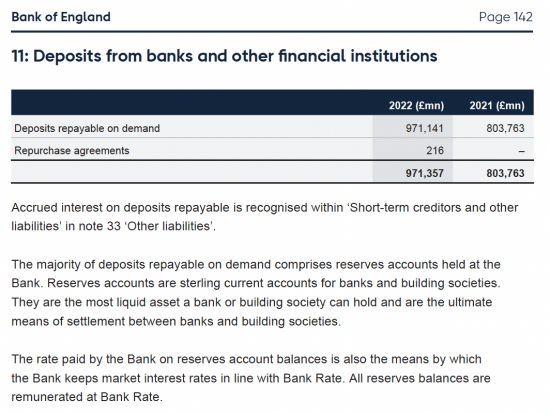

The key figure is that £971,357 million (£971.4 billion) of deposits from banks, which is further explained in Note 11:

This sum is the central bank reserve accounts, almost exclusively. They now come to a bit more than quantitative easing as there are some other funding arrangements that also helped fuel them.

The interest rate paid on these less than a year ago was o.1%pa. It is now expected to exceed 3% sometime in the coming months if the Bank of England gets its way, as is likely. So, the cost will increase from £less than 1 billion a year to something in excess of £30 billion a year. That is pure unearned profit gifted to the banks from the public coffers.

Of course we also need a tax to recover this sum - and I would suggest at a rate in excess of 90%, payable solely on profits arising from the central bank reserve accounts.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“The commercial banks who hold them did nothing to generate the funds: they were simply gifted to them.”

That’s not true though, is it?

Banks weren’t simply **given** money, were they?

They got the money in exchange for selling government bonds they already owned.

Government bonds which pay interest, at higher rates than cash.

That is completely untrue

The money was created first

The bonds were mere fiver

And in case the banks did not own the bonds sold

Are you seriously trying to claim that banks were given hundreds of billions of cash for nothing?

“And in case the banks did not own the bonds sold”

So what? Or are you trying to now tell us that the institutions that did sell their bonds got nothing for them, and the banks kept all the money?

“That is completely untrue”

What, like claiming that banks were gifted the money from QE? Which is totally and completely untrue, for example.

The Bank of England creates central bank reserves

That is money creation

It then used that money it created – of its own free will to buy bonds

The commercial banks were – as I have shown here – intermediary beneficiaries of the payment made

They did nothing to acquire the funds they have supposedly deposited with the Bank of England – the Bank of England created those deposits – gifting them to the commercial banks as a result to inject new funds into the economy which is what QE provided cover for

So yes, I am 100% right and you are 100% wrong

Your argument is quite simply the most ridiculous thing I have ever heard. The extension of this quite crazy argument is that because the BoE at some point created all sterling, all sterling belongs to the BoE/government. Which is simply nuts.

“The Bank of England creates central bank reserves”

So what.

“It then used that money it created – of its own free will to buy bonds”

Bonds that other people already owned, and most importantly, had already paid for with their own money.

“The commercial banks were – as I have shown here – intermediary beneficiaries of the payment made”

Again, so what if they are intermediaries, unless you are claiming they get to keep the money as intermediaries.

“They did nothing to acquire the funds they have supposedly deposited with the Bank of England – the Bank of England created those deposits – gifting them to the commercial banks as a result to inject new funds into the economy which is what QE provided cover for”

They sold bonds which they already owned and had paid for. No money was “gifted” to the banks.

“So yes, I am 100% right and you are 100% wrong”

You must live in a topsy turvy world. You are 100% wrong here, and I really cannot understand how you are making your claim with a straight face. It is totally ignorant.

You can check this. Have banks market capitalization increased by the same amount as QE? If your claim was true, this would be the case as their assets would have increased by the amount of QE.

I’ll give you a clue. They haven’t.

You ask the wrong question, of course

Has cash in bank balance sheets increased massively since 2008? Yes

Has that massively increased their effective capital? Yes

Has it reduced their chance of failure considerably? Yes

Where did that cash come from? The government. No one else

Where they charged for that solvency lifeline? No

Do they, Quixote amazingly, expect to charge the government for it? Yes

I rest my case

And you need to learn how to properly read a set of accounts and what they mean

“You ask the wrong question, of course”

I was asking if you were actually claiming that banks were gifted £895bn. Which of course they weren’t. Now you seem to be trying to change the argument, but even then you get it wrong.

“Has cash in bank balance sheets increased massively since 2008? Yes”

True, at the cost of having less Gilts.

“Has that massively increased their effective capital? Yes”

Not true. Both cash and Gilts are tier 1 capital. At best, it has marginally increased short term liquidity (as cash is more liquid than repo).

“Has it reduced their chance of failure considerably? Yes”

Has made little or no difference to this. Tier 1/Capital adequacy ratios have not changed because bonds were swapped for cash.

“Where they charged for that solvency lifeline? No”

Yes they were, in effect. having sold higher yielding bonds for lower yielding cash.

“Do they, Quixote amazingly, expect to charge the government for it? Yes”

Only in so far as they get paid an interest rate on deposits, instead of getting paid interest on the bonds they held pre-QE. See above.

“I rest my case”

Good luck with that. You’ll need it with a case as obviously wrong as yours.

“And you need to learn how to properly read a set of accounts and what they mean”

I suppose then that you might need to read some UK bank accounts then, which will show you that banks were not “gifted” any money via QE.

I don’t know why you are persisting with this claim that banks were simply given money for nothing. You know full well it isn’t true, and it makes you look really quite stupid.

Politely, provide true data on the gilts sold by banks

There is not the slightest chance you can support your claim

But what you also might want to explain is that the Bank of England says that the QE process involves the creation of central bank reserves to by bonds

Now, how can it be that this meiny creation does not explain the increase in deposits

I gave evidenced this link

Now you sen me links to all your data, or give up

“Politely, provide true data on the gilts sold by banks”

What on earth are you going on about now? Are you saying the BoE didn’t buy all those bonds?

“But what you also might want to explain is that the Bank of England says that the QE process involves the creation of central bank reserves to by bonds”

Yes. It does. But that is not the same as giving banks free money, which is what you have repeatedly claimed.

The BoE prints new money, and uses that to buy existing bonds from the market – which has already bought and paid for them with their own assets.

No money given to banks. Assets sold by banks for cash.

“Now, how can it be that this meiny creation does not explain the increase in deposits”

Because they have swapped Gilts for cash. Which increases cash deposits, but reduces the amount of Gilts in circulation. Is it really that difficult for you you understand these basic concepts?

“I gave evidenced this link”

What gave evidenced link is that then?

“Now you sen me links to all your data, or give up”

I still can’t believe you are either so stupid that you don’t realise you have made an error or so arrogant and egotistical that you are unwilling to admit it.

Of course the BoE bought bonds

It did not buy them from banks, in the main

It bought them from pension and life assurance funds, overseas holders and more

But very definitely not all from banks

Now answer the questions

And read my posts on the central bank reserve accounts as you clearly do not understand them

OK. Once more you have given a dissembling, rambling, meaningless answer, trying desperately to avoid the point at hand.

I will ask the primary question in a very simple yes/no format so we can all be very clear on where you stand.

Did the BoE “give” money to the commercial banks, leaving those banks with more assets than they started with before QE?

Yes or no.

https://www.taxresearch.org.uk/Blog/2022/06/17/how-are-the-central-bank-reserve-accounts-created/

https://www.taxresearch.org.uk/Blog/2022/06/21/the-double-entry-behind-the-money-creation-in-the-central-bank-reserve-accounts/

Quite apart from getting various things in your other posts wrong, I see you are once again desperately trying to avoid what is a very simple question. I’ll ask it again for the avoidance of any doubt.

You have made the following statement in your post above:

“The commercial banks who hold them did nothing to generate the funds: they were simply gifted to them.”

By saying this are you claiming that through QE were given money as a form of handout?

Yes or no.

Read those papers

Then you have your answer

And stop wasting my time

Rather long 114 pages

but I did read it , some years ago and it might clarify for you.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/quarterly-bulletin-2014-q1.pdf

If I have got this correct then that would be the same £971 billion that has been added to the National Debt, so trebles all round for the Tories and their masters in the City of London.

Possibly I am a bit slow but it took me years of wading through newspaper articles and supposedly expert accounts of quantitative easing that either were simply wrong or deliberately obscurantist before I developed a mostly correct account of the process and since encountering your blog I think I have been able to clear up most of the remaining bits and pieces.

Now that I am there it strikes me even more forcibly that quantitative easing as it has worked for over a decade is the biggest swindle ever foisted on an entirely ignorant British public for the exclusive benefit of the tiny number of private individuals who had caused the Banking crisis rather than its victims.

Unfortunately, rather than trying to explain all this to voters, the opposition parties have given us twelve years of almost total silence.

What is needed is a reader friendly brief summary, perhaps 100 words or less if possible, covering everything from the hubristic boasting of the bankers pre-crash until the present day.

Perhaps this blog and its readers would be the right place for a competition for the best account.

We have Money for Nothing and my Tweets for Free by Richard Murphy.

It is not 100 words but a good account.

I agree with you on this Richard, knowing now how the Central Bank Reserve Account works and what use the banks put that facility to.