In amongst yesterday's excitement, a new report from the Office for Budget Responsibility was rather overlooked yesterday. As The Guardian said of it:

Britain's public finances are on an “unsustainable” long-term path with a debt burden that could more than treble without further tax rises to cover the mounting cost of an ageing population and falling fuel duties, the Treasury's independent forecaster has warned.

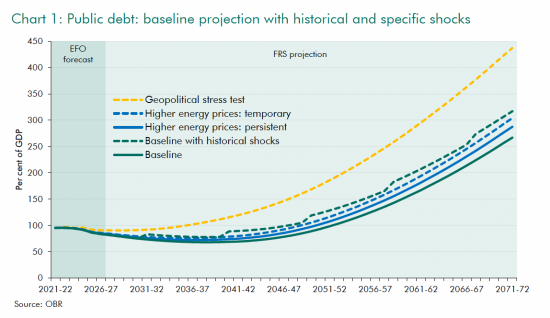

The Office for Budget Responsibility said that if economic shocks continue to hit the public finances, debt is on course to reach almost 320% of annual national income (GDP) in 50 years' time – up from 96% now – unless successive governments raise revenues to offset rising costs.

The favoured chart was this:

The claim by the OBR is that:

[E]mergent geopolitical and energy risks .... need to be managed in the context of a set of longer-term demographic, environmental, and other structural pressures on the public finances. These are the largest, and most certain, threats to long-term fiscal sustainability – with every assessment we have published over the past decade having shown debt on an unsustainable path over the next 50 years as a result of these pressures.

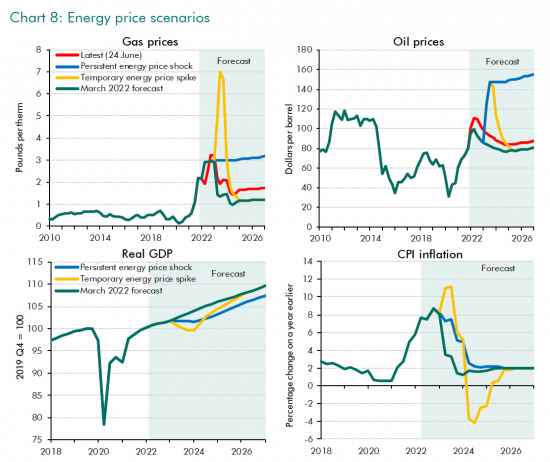

It must be frustrating working at the OBR, when it is apparent that every warning they have given has been ignored. But then, their projections are profoundly uncertain, as a simple comparison of these charts shows:

Even in the short term the OBR has no clue what might happen to inflation, and the possibility that it might disappear quite soon is real, although the Bank of England clearly does not believe that. It is unsurprising that the Office for Budget Responsibility is ignored.

Let me, however, suggest another reason for that. Let me suggest that the reason why the IBR is ignored is that they are wrong. I am not saying that supposed debt of the level noted will not exist: it might well do so. But they are wrong that this is unsustainable.

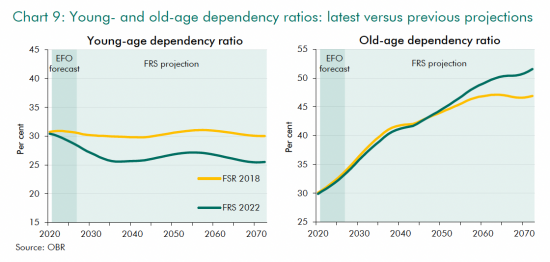

The basis of their claim that debt will rise to unsustainable levels is based on three assumptions. The first is that the population will fall from 2044. The decline will be modest, but real. The second is that fiscal sustainability depends on the age structure of the population. The third is that although people will not live as long, thanks to Covid, the reduction in migration will reduce the number of people to look after an ageing population, and although there will be fewer children the shift in dependency will overall be expensive as the number of elderly people in the population rises:

The OBR thinks that we cannot afford these old people. It most especially thinks we cannot do so when the tax revenue from oil-based taxation is going to fall because of net-zero moves and they see no replacement tax arising.

I think the Office for Budget Responsibility are victims of their own failed dogmatic imaginations. They are suffering from three quite fundamental failings. The first is to assume that tax pays for government spending. It does not. Government money creation does. Second, they believe that what they call government borrowing is funded from surpluses generated in private sector economic activity when it is not: all that happens when the government supposedly borrows is that it provides a safe place of deposit for the funds that the government has already created and spent into the economy to pay for its expenditure in excess of the taxes it has charged. In other words, it simply offers the opportunity for people who are in ultimate receipt of that spending in excess of tax revenues to save it with the government. And third, most savers are elderly.

Now let's imagine that come 2035 and afterwards, as the age dependency ratio rises, the population as a whole will not be willing to take their grandparents outside and shoot them, or leave them shivering at home to die, en masse, which is what is implied by the OBR term that the debt is unsustainable and so must be cut, which would not be possible without culling those who are getting older at the time. Instead, let's imagine that people do care: it's really not hard to do. And then let's assume that to care for the elderly there will be incentives provided for people to make provision for them - including better pay and work conditions for those doing so instead of the shoddy terms offered now. Or maybe, heaven forbid, we might become more enlightened about migration. But in either case let's assume that the maxim that we can afford whatever we can do, and that we will as a matter of fact look after the elderly as something we can do, and in that case let's assume that the OBR is wrong and instead note that the only impediment to achieving these care goals is their assumption that the only way to fund government spending is from taxation, which is utter nonsense.

They assume G = T, where G is government spending and T is tax revenue.

This is. not true. In reality, G = T + ∆B + ∆M where B is borrowing and ∆ is the change in it in a period and M is the amount of government-created money in circulation and ∆, again, is the change in M in a period. In other words, government spending is funded by government-created money, tax and the amount of government-created money that is returned to the government to be placed on deposit during the course of a period, to get the sequencing right since government money creation always starts this process, as a matter of fact.

Now let's notice two things. The first is that the elderly save, and an ageing population will have a much higher savings ratio than at present. And second, let's notice that by then the elderly will have realised that existing savings mechanisms are useless for their purposes, with the stock exchange, in particular, having fallen out of fashion as net-zero shows how incompetent business is at managing real risk. In that case the much increased resulting savings ratios will result in considerably increased demand for government-based savings accounts. That fact and the increased level of government money creation that tending for an elderly population will require will create a virtuous circle. The supposed government borrowing requirement will have to exist to simply meet the need for a place for the elderly to save what is being spent on them. And the elderly will, in fact, fund themselves as a result, precisely because they will not consume all that is spent on them.

The supposedly unsustainable borrowing that the OBR forecasts is not unsustainable at all. When viewed as a deposit-taking activity (which is what it is) the increase in supposed borrowing matches the changing demographic that will demand that such a borrowing (or deposit-taking) facility exists. And the cost of supporting the elderly is entirely sustainable as a result.

The Office for Budget Responsibility fails because it is constrained by its own dogmatic thinking. It is time it did better.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

In many ways thinking about money and debt complicates things.

Old people will need younger people to spend more time caring for them in old age. To allow this to happen we (who are getting old) need to do today the things we can that will relieve future youngsters of the need to do it later. We have to invest in the stuff that lasts…. infrastructure (green and other). Thinking that saving money will help us is a delusion…. and that is the error that the OBR and others make.

Agreed

The answer to the population problem, and the care problem, and the food production problem (all not money-credit–shuffling problems) is that which cannot speak its name: Brexit. The British won’t wear admitting they are wrong? Fine.

Scotland wasn’t wrong. It knows survival and decent living standards will require membership of the EU. We have to run as fast as we can from this British plague of utter, vacant stupidity.

How does Japan manage, where already 28 out of every 100 people people are aged 65 or older? In the UK it is 19.

QE

Money creation

Indeed. They can afford it. So can we.

Oh yes, Japan – it’s been doing money creation for decades now.

When I heard about this on the Wake Up To Money radio show this morning, my immediate thought was what did the equivalent report 50 years ago predict for today? I’m guessing it doesn’t match our current reality, so huge pinch of salt here.

Incidentally it is 50 years since the Club of Rome published The Limits to Growth. I think that has more value than anything the OBR produces.

There were no such reports that I know of

There was a study in the 1920s I think, though could have been before 1914. Anyway it was about the carrying capacity in terms of population for the countries that make uo the UK. If I remember they said England could not support more than 33 million. Usual elite proposals about shipping the excess to the colonies and the like. Could have been a Royal Commission. Not something I have looked at since a Geography student so sorry I can’t remember more. Engalnd is now almost 60 million, so maybe Malthus lurks just arround the corner …

Or not……

I’d be wary of population estimates from the 1920s, unless the plan is to abandon 100 years of innovation and development.

In grains and meats we are largely self-sufficient – although some UK production is exported, and some overseas production is imported – but today, about half our vegetables and about 85% of our fruit is imported. Not just bananas and oranges, but also potatoes and apples.

The proportion of UK production was even higher 30 or 40 years ago, but that is globalisation for you. While the UK is far from self-sufficient in terms of food now, things were much worse before the Second World War.

Is it the OBR that needs to change its models? Surely their predictions are based on government continuing to run public finances in the way they are doing. It’s the government that needs to change its models and we have little expectation of that whichever party wins the next GE.

It seems almost political – the stark warning that ‘this is unsustainable’. And as you say Richard – such a simplistic model G=T. The zero curiosity about whether there might be other ways – and that the declining use of fossil fuel and tax take from it , might not be such a disaster.

And as Andrew says, why not glance at Japan for clues as to a way out? Its as though they don’t want to find any other way other that spending cuts or culling the old.

It so maddens me that neither the OBR, the Government, nor the usual ‘economics’ pundits like Faisal Islam on the BBC get this at all! Why can’t they grasp it?

It does not pay them to do so

More Fascist fear-mongering.

More division, less listening and understanding.

Another enemy is declared; another impending non-disaster (any baby boom will mean a pensioner boom – duh!!).

Shocking. What a thing to come out and say.

If there is a demographic problem in the UK – and I don’t accept there is: we just need to rearrange allocation and distribution – it is nothing like the problem coming down the line in China.

Scotland has a more critical population and birth rate problem, even than the UK; our health and care sectors, our farm production (especially soft fruits), fish processing, West Coast fishing sector, and on and on all require a return to the EU, whatever the UK wants or thinks it needs. Scotland’s necessity is indisputable, and Brexit is an unmitigated catastrophe for Scotland, and everybody knows it.

I entirely agree with you

I’m interested to know how pensioners with no earned income are net savers?

I’m also interested to know how printing and spending ever increasing amounts of money is going to increase demand for that money (and thus savings and bonds), when all evidence would point that the opposite is true.

Several people in the comments as well as Richard Murphy have also mentioned Japan. It is not money printing which has enabled the country to support an aging population.

It is a fully funded public sector pension scheme. Which means that as older people retire, the pension savings they have are real and available for their retirement.

This is totally unlike the UK’s which is funded from current and general taxation, and is therefore unfunded. There are no

Even then Japan is staring down the barrel of a demographic nightmare.

Pensioners have income

They tend not to spend it all

And they are owners of most wealth

So they are savers

Is it really hard to work this out? Why?

Japan has a “fully funded public sector pension scheme.” Really? Now, it has been a while since i dealt with these pension funds but they certainly were not fully funded then…. and I really doubt things have changed.

The point is that to prove the assertion “printing money creates inflation” false one merely needs a counter example

.. and Japan is that counter example. Of course, Japan is not the UK but we need to look more deeply at what drives UK inflation rather than make unfounded assertion

True

People save in their younger years and general use up those savings in retirement. The elderly (as a group) are not net savers. That’s just wrong^3.

Secondly why do you continue with this nonsense that money printing is the answer to all of our problems, as if there are no adverse consequences?

Weird that the elderly own the vast proportion of wealth then.

Why not check your facts?

“Now let’s notice two things. The first is that the elderly save, and an ageing population will have a much higher savings ratio than at present.”

No, they don’t. People save in expectation of becoming elderly and having in income when they do. They then spend down those savings when elderly. So quite the reverse.

So, the elderly save then

And very few dissave completely if they have saved

More typically the elderly accumulate wealth from ‘savings’, but predominantly savings of a special – often tax incentivised – or special kind; the “spending” rarely disspitates wealth, still less eliminates the wealth accumulation of the elderly. Wealth accumulation becomes a habit. In many cases the wealth of the elderly comes from property (people typically no longer rely on work to generate wealth; they buy a house, the deposit probably funded by the elderly – it is an implicit property speculation). The initial property investment is typically based not on savings, but a mortgage: borrowing. The equity increase comes as a passive side-effect of living in the house and doing nothing. There is no acitvity involved.

You are beset by special pleading ideologues and trolls Richard.

True

There appears to be a problem amongst some commentators here who do not seem to understand that if you are over 45 you are in the elderly half of the population. Maybe they’d like to think a little harder before commenting.

Sweet Jesus. Thank you for that home truth, Richard, although to be frank the grey hairs were a clue.

I wonder how many of your readers and commentators are in their 30s or younger. We can’t all be children of the 50s to the 80s, surely?

The trolls seemed to find this beyond their imagination

They are being deleted in their drves

So, the median age in the UK is about 40.4. It is higher in Wales and Scotland (about 42) and lower in NI (about 39) and London (about 36). By local authority, the lowest median ages are Oxford, Nottingham, Manchester, and Cambridge, all under 30.

https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2020

Nice map in the 2019 release, here: https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2019estimates

Nationally, about 13% of people (9 million) are aged over 70, but there are some areas – principally around the coasts, but also parts of Wales, and some rural areas – where 20% or more of the people are aged over 70, and the median age (half the people!) is 50 or more. In parts of London it is below 6% and below 32.

Thanks

Would perhaps ‘older half of the population’

be more palatable (and perhaps more accurate) than elderly?

Yes

See all the comments about OBR predictions being wrong. Unfortunately the impact off aging on the fiscal position has already hit. The percentage of GDP spending for social care and pensions and health care has been rising for decades. The tax level is the highest for decades as we are meeting this expanding cost. And other parts of the budget are being squeezed. The Tories are wrong to claim the state is expanding it is just impact of aging. There is of course no serious debate about what is happening.