I have long argued that the stock market is an almost irrelevant institution in UK corporate funding. Put imply, companies do not use equity share capital to fund investment in the real economy. What share issues there are take place to fund mergers and acquisitions activity.

As research I have done with others shows, share prices are also heavily manipulated by companies by way of excessive dividends and share buy backs, often paid at rates in excess of profits generated over long periods of time. And all of this is done to inflate senior management pay and exploit gullible pension funds who insist on buying equities as if they are a meaningful basis for providing long-term returns to those seeking an income in retirement when. the reality is that they are now merely instruments for speculation, which makes them wholly unsuitable for the use made of them.

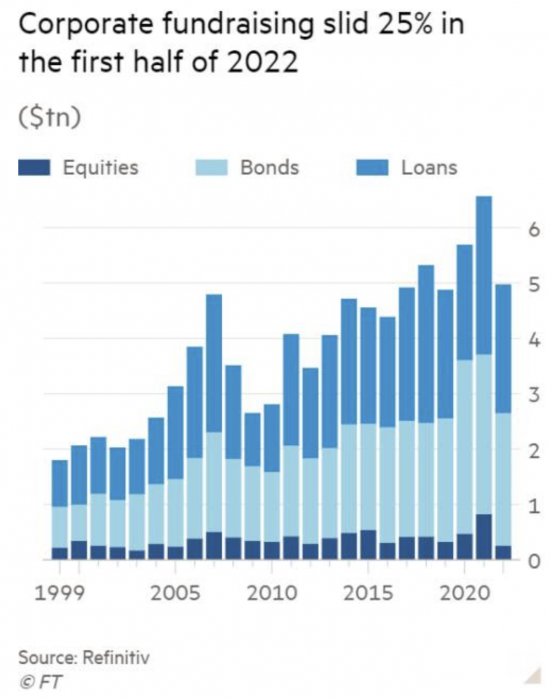

Data in the FT this morning confirms the irrelevance of equity investment to business investment:

The dark blue line at the bottom represents equity funding: it is almost irrelevant.

Four questions follow. First, why in that case the massive emphasis placed on share-related issues by economists, the media and others? Is it all just a giant con-trick on the investor, or are the media and economists conned too?

Second, why do shareholders remain the complete focus of corporate reporting when they are so irrelevant?

Third, why do pensions funds still persist in investing in instruments so unsuited to the needs of those that they represent; which carry such risk because their value is so obviously manipulated; and there is no social or macroeconomic gain from doing so?

Fourth, why do we give tax reliefs for investing in something so useless?

I have long asked these questions. I will be doing so in a more structured way, very soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“share buy banks” should of course be “share buy backs” and that alone renders the stock market useless as a vehicle for price discovery.

Edited. Thanks

“Second, why do shareholders remain the complete focus of corporate reporting when they are so irrelevant?”

How can you say that when they are the owners of a Company. It’s the rhetoric of someone prepared to annex Corporations into State Ownership

They are not the owners of a company

They own a share issued by a company

Not the same thing at all

They have absolutely no claim on the company at all

You are wrong

Ben

The thing is that shareholders can behave as if they own the company and even seek to become the majority shareholder -and too many times for malign reasons such as short term profit hikes. Pension funds will lean on companies to cut jobs and use savings to maintain pension fund values. Big investors call for companies to carry out share buybacks to boost returns, leaving the companies with more debt.

But as Richard said, with the appalling state of company accounting standards – how can shareholding be a secure way of investing anyway? What we seem to have is a really cynical system where no-one trusts each other anymore, so all sides just want to screw each other in some way to get the most out of it as quickly as possible. My concern is what this does to companies themselves and to working people.

That undermines the whole basis of investment which is supposed to be a long term beneficial arrangement based on good research, solid facts and data and trust! It makes concepts like ‘fiduciary duty’ and the “imprimatur” (endorsement as a vehicle fit for investment) by investment bodies totally invalid.

Richard is right to call it out. It all needs a complete overhaul.

“They are not the owners of a company”

“They own a share issued by a company”

They are the same thing. Shareholders appoint directors who manage the business. They can be removed by shareholders at any point. Shareholders collectively need to agree to any change in the capital structure. To take the limit they could force directors to sell the business and distribute the proceeds to themselves. This happens frequently in listed closed end funds and in traditional equities when they can vote through a takeover, Of course shareholders own a company. If they don’t who the hell does????

With respect, they are not the same thing at all

And it is almost unknown for shareholders to get appointed to boards in quoted companies – which is the discussion point

You are promoting your fantasy, not reality

“And it is almost unknown for shareholders to get appointed to boards in quoted companies – which is the discussion point”

With respect it is not the discussion point at all it is ownership not management… you said “shareholders do not own the company”…they do!!! but they don’t manage it day to day of course..again i say directors come and go and their tenure is ultimately determined by shareholders. Shareholders control the voting rights. I will say again at any time they collectively decide to sell the company and distribute the proceeds to themselves they can. Directors rum the business day to day they do not own it unless of course they own shares.

Tell me how shareholders own a company when they have no right of access to any of its property, at all and no legal claim over any of it except in a winding up where the current experience in the group of companies of concern here is that they will get nothing?

The major institutional shareholders have very little interest in the ‘nuts and bolts’ of the company they ‘own’. Institutional holders back management (which is why their self-indulgence in matters of pay is larley ignored, save egregious, publicly embarrassing failure); and if they don’t, they are not interested in hanging around to fuss over ownershipmatters. They sell their shares on the market. Their effective ownership is solely in instantly transactable paper. It is nothing like owning property, or running a small business with assets, employees and no corporate “owners”.

I think de facto (and in reality, on the very edge of ‘de jure’) we mean something quite different when we use the term in a corporate context, to ‘ownership’ as understood in ordinary language. There is a portamento, meaning intruded into the matter by coprorat, institutional ownership, and ambiguity in the substantive meaning of the term.

The reality is that of all the relationships a PLC has the most easily severable is that with its shareholders, whose relationship with it is literally purely transactional, and revocable at any moment without any consequence for the entity at all since the shareholder has no claim over any of its assets, and the sale of a share it has no resulting accounting or transactional consequence for it. Hence my suggestion that the shareholder has no ownership stake in the entity as such, but merely owns a financial instrument issued by it.

Yes, I think you have better articulated (than me); the essential ‘de facto’ reality.

If I’m correct the graph shows new fundraising in the period

Equity is permanent capital.

Bonds and loans have a fixed term and need to be refinanced periodically so in most periods will be much higher than equity as it’s the same funding being rolled over.

A more accurate comparison to support (or not) your argument would be the balance sheet, not the funding flows. I believe that most (certainly not all eg. apple) corporates have very high debt to equity ratios

On a 2nd point, if not quality equities what can I invest in that is highly liquid and has real value

3 What are the tax breaks for investing in equities vs. debt, property, commodities etc

Have you read the Hollow Firms report?

Come back when you have

Like other examples you have mentioned Richard, these are privileges granted by law not because they provide private profit but because they are supposed to provide public goods such as employment, more affordable goods/services and taxes.

Unfortunately, after years of systematic abuse, like their near cousin, limited liability, they have mostly become a means of committing crimes against the law-abiding population and the country that there are not yet laws against.

The follow up question, as someone who really does want to invest in helping to mitigate climate change, what should we be investing in?

Sorry – I cannot offer what looks to be specific investment advice

Henry – perhaps the best way is to do some research yourself and by-pass the established markets own ‘data’.

Talk to the companies yourself – not a third party. Meet them face to face. Or go through some of the more ethical intermediaries – they are out there – there is a market – take a look and take your time.

It’s less about specific investment advice, and more about understanding what mechanism one has to invest in ethical investments. There are loads of options for “ethical investments”, but they still all feel like speculation mechanisms that have little impact on the investee companies. What platforms (in the broadest sense) offer a means to actually invest beneficially for the investee? Or is it a case of finding the investment opportunities one-at-a-time?

I fear the latter at present

Really interesting stuff. So what would you suggest is the best alternative for investing a pension fund?

I thi8nk I have made that clear in previous posts

Instead of buying and selling shares, pension funds could be providing new capital for investing in the productive capacity of our economy (and other economies) by acting as equity partners. This would be real long term investing to support the formation,

development and growth of productive, real wealth generating businesses.

Of course investing as equity partners has risks – risks related to the execution of successful business plans. These are different risks than those associated with share ownership as equity partnerships are not liquid financial assets. This means they are not appropriate for small pension funds. They are however possible with large pension funds with the capacity to handle the risks associated with long term committed partnership investments.

A National Pension Fund could do this – as well as provide the means to restore earnings related pensions and make them universally available to all citizens.

“Tell me how shareholders own a company when they have no right of access to any of its property, at all and no legal claim over any of it except in a winding up”

So if a company is bid for who decides the course of action? If a shareholder puts forward a proposal at AGM to dispose of any asset and distribute the cash to shareholders and this is voted in favour by Shareholders what do you think happens?????

Of course shareholders own a company.. this really is a ridiculous dialogue. Who seem to have no idea of corporate law.

The board make a recommendation on bids, which are almost invariably followed

The shareholders cannot propose such resolutions – that is a decision for the directors

I think the problems are all yours

And not one have you shown the slightest comprehension of the argument

I suggest you stop wasting my time

You have missed the point. The observation has already been made, that the word “own” is being used in a very special way in the case of a corporate business. It does not have the same meaning as “owning” a car, or a house. The ‘ownership’ of shares can only be expressed in a very limited number of ways, most of them directed and processed under the stewardship of management. At the same time, since public corporate businesses are overwhelmingly ‘owned’ by large financial institutions like pension funds (which carry the decisive votes), and which have no interest in taking management decisions directly, or even taking a very public stance on management issues, save in very exceptional circumstances; this is a very constrained, rarified form of ‘owning’: if faced with something in the business the shareholder institutions really do not like, they exercise their executive decision by selling the stock.

Shareholder voting rights over ‘rights issues’, or takeovers are exceptions that scarcely change the distinctiveness of this form of ‘ownership’. As Richard described the real nature of the almost pure transactional nature of this form of shareholder ownership: the manjor owning financial institution “merely owns a financial instrument”. This applies, a fortiori to the small shareholder, who has virtually no other leverage (in voting terms, totally insignficant compared to the big institutional shareholders), except to buy or sell the stock.

You get it

Yes you are right about shareholders, they have plenty in voting rights but creditors rule the roost over the balance sheet. Also that chart tells me another thing: how big DCM has become versus ECM. The only thing keeping Barcap in the IB rankings these days