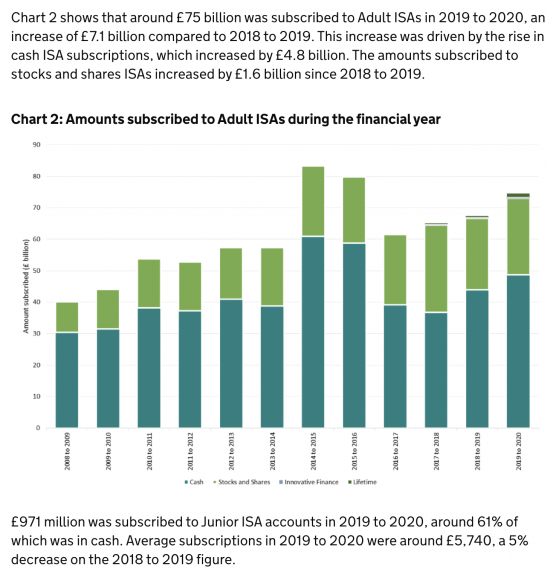

The government has published new savings statistics this week, including this chart and accompanying notes:

Note that the data is already considerably dated. But even so, there are some important things to note.

First, note that subsidising ISA's costs £3.7 billion a year in tax foregone.

Second, based on advances in our understanding of banking over the last decade – starting with the Bank of England's admission in 2014 that banks do not lend out the money deposited with them but do instead always create new money every time they lend – we now know that cash savings serve no useful macroeconomic purpose in the economy. They are simply temporarily redundant money, stored out of use.

Third, what we also now know is that many of the companies quoted on stock exchanges rarely if ever issue new shares now to fund investment. They are instead in a great many cases paying out dividends and buying back their own shares in greater amount than they have earned as profits. In that case the tax reliefs provided for investment in these shares, whether via ISAs or pensions funds, also appears to be wasted government subsidy because there is no payback to society as a result in the form of new investment or job creation as a result of saving via the ownership of shares in these companies.

So, the question is, why are we subsidising ISAs? And wouldn't this money be much better used funding the Green New Deal, as my colleague Colin Hines and I have proposed by requiring that all ISA funds be saved in high interest-paying Green New Deal bonds?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

ISAs encourage people to save for old age..that is a good thing.

Why do we need to have tax subsidies for that which produce no gain for the economy?

they do help the economy as it helps people to smooth out their lifetime earnings and fund their lifestyle in late life instead of relying entirely on the State. That is a good thing as evidenced by the Hugh numbers of people who take out ISAs including the young. They are not the preserve of the rich.

The data contradicts you

Stop talking nonsense to defend the indefensible

“The data contradicts you”…what data you haven’t shown any

“Stop talking nonsense to defend the indefensible”..so deny access to the working person a long term opportunity to provide for themselves in later life..spoken like a true commie

I am about as far from a “commie” as you can get in a sane world that excludes the far right

With respect, you prove yourself a fool

Rich people will always save with or without tax incentives. Incentives DO direct WHERE they save but not whether they save. Poor people cannot save with or without tax incentives. There may be a few, very few, right at the margin where this makes a difference but most of the tax break is just going straight to rich people.

Also, when ISAs were first created they had various restrictions on what you could invest in. Those restrictions were there to direct investments towards certain things that the government wanted. So, the idea of placing conditionality on ISAs was there right at their birth. It seem entirely reasonable given the importance of climate change to direct investments in that direction.

Your point about where savings are directed is the one I adopt in my proposals

People will save

So we need only use tax to direct where

They strike me as being a subsidy for banks / building societies as the interest rate is always lower than the basic savings rate outside an ISA. even more reason to question them.

Arguably, there could be a deferred gain of sorts, if ISAs are genuinely used to save for later life/retirement, then those funds will be released back into the economy at a later date when the funds are spent during retirement.

I think it’s a good thing to encourage some saving, but I take the point that the subsidy is far beyond what is required, given the benefit goes largely to higher earners with a greater propensity to save/remove money from the economy.

I think it would be a difficult political sell to completely remove the tax relief, but arguably, capping the tax free amount that could be held at say £500k would be a lot more palatable? £500k may seem like a high figure, but over a working life of for example 40 years that amounts to savings of maybe £9k per year + accrued returns. Anything over £500k in ISAs could then be taxed at the persons IT rate. Compliance could be made relatively easy if banks are forced to provide HMRC with data on all ISAs holding over £500k. There would also be a small windfall for HMT on introduction.

A fair balance perhaps?

But why do we need to subsidise wealth when one of our biggest problems is wealth inequality in the UK? £500k in ISAs is a staggering sum

“£500k in ISAs is a staggering sum”..yes but a figure of this kind will have been achieved through saving over a long period – they have been going for 35yrs (originally PEPs). So people made the sacrifice and save prudently for the future – good luck to them

But why do you want to subsidise wealth and inequality?

I am not saying people should not save. But why are those who do deserving?

Matt’s figures for saving £500,000 over 35 years mean over £14,000 a year being saved. That sounds to me like huge wealth and no, we shouldn’t be subsidising that wealth.

Everything I have ever really learnt about tax I have learnt from you over the years (and a bit from Jolyon).

To me, ISA ‘s are just another iteration of the the far right anti-tax sentiment based on the pure ignorance of what taxes are for as well as a nice way of handing money to the private sector.

To me, ISAs are perverse – it’s state sponsored tax avoidance when we know what the true value of tax is to a properly managed economy.

In one way they are taking money out of circulation like all savings do and might be able to help cool an economy and that aspect is OK.

But breaking you own tax rules to incentivize people to save is bizarre. It’s just another nail in the coffin that is tax policy.

Agreed

I agree with those here who think it is a legitimate good to incentivise people to have enough savings to provide some resilience to their finances. And that could be dealt with by some sort of maximum personal allowance.

What that should be is a matter for discussion, but I agree that £500K would be over-generous. The fact that the average deposit was £5740 suggests a lower sum would provide an adequate incentive.

I am not sure whether you are being over dramatic in calculating £3.7bn tax foregone. The majority of ISAs (£50bn) were cash, and with savings interest rates at the time being around 1.25% you are talking of not much more than £0.6bn interest so perhaps £0.2bn tax not charged. The lesser amount (around £25bn) of share ISAs might have had an average dividend rate of 3% so £0.75bn income attracting maybe £0.3bn tax. CGT is more difficult, but since it is only charged when shares are sold and it is likely sales were a smallish proportion of the total during the financial year (ISAs are designed for long term saving) with tax only on the gains it is unlikely to be huge.

(I am not questioning your other point that tax incentives should be prioritised for desirable investments like renewable energy, that could create a genuine national benefit).

The £3.7bn is the government’s figure, not mine

My question is simple: why do you want to have the government waste all that subsidising wealth with no net gain to society, especially as those people will save anyway?

I agree, if it is the case that people will save anyway then the incentive isn’t working and shouldn’t be used. I have no idea whether there is evidence on that.

Surely the point being missed by some posters is that the vast majority of people who save with ISA’s would save anyway, so the incentive is pointless.. Those who would not save without an incentive would be unlikely to afford to save very much and would be more likely to remove their savings as soon as possible to cope with a present financial need, leaving the future financial need to look after itself.

Spot on

my suggestion is that there should be some sort of more limited ‘subsidised savings’ aimed at helping build up some sort of ‘financial resilience’

I suggest something like the ‘Help to Save’ but possibly only running over two years, then you can open another. Ditto some sort of ‘additional pension’ scheme.

Why? People don’t save because they don’t have enough money to meet their present needs.

Those who save can afford to save so don’t need help. The help should be targetted at those who cannot afford to live, in the expectation that it will lead to them being able to live and soon being able to afford to save..

Isn’t the £3.7 billion of tax forgone per year part of the government deficit? If so, why are the Tories so worried about the deficit when they are actively promoting it’s increase.

The consequence of this is that when the government says that it must reduce the deficit it is actually saying that it wants to reduce peoples savings.

Pension subsidies cost at least £55 billion a year

So you propose all ISA investors have to invest in your Green Bonds paying 1% when inflation is at 8% ??..are you barking mad?

Maybe 2% now and let me promise you, people would be queuing round the corner

If you don’t understand savers, thankfully I do

Which major savings institutions are you advising, given this vast expertise?

None

I am a researcher

And you, I very strongly suspect, are a troll

You fail to understand the difference between short term cash holdings and long term bond investment, so the £3.bun figure is irrelevant.

50% of this is cash

And long term bond investments are all marketable

What is it that you do not understand?

“And long term bond investments are all marketable”

Yes long dated are marketable and liquid and (Government Bonds) are down between 20 -40% in recent times. So you fail to understand duration risk. A long dated bond offering 1-2% with inflation at 8% is a truly miserable investment proposition and is guaranteed to lose money in real terms.

Do you understand what a saving bond is?

Long-dated government bonds are in excess of 2%, and are much more liquid.

I don’t think you mean a bond at all, you mean a cash savings product with a fixed rate – which would not provide the long term financing that you claim is needed.

But this is a totally different proposition.

Not only are you a troll, you really do not understand what savers want, or even how short term lending is term into long term investment in the right environment

Is this where ‘pointing out your inaccuracies and poor understanding’ is what you deem to be a troll?

Facts:

Long term risk free rates are above 2%

Inflation (short term) is above 8%, inflation (long term expectations) is above 4%

Why you’d pretend it’s a good idea to lock in a 2% over the long term is beyond me. Is there were your money is invested?

But one of us actually works in financial services and is paid to discuss exactly this type of thing, and one of us purely pontificates on a blog, disagrees with all experts on almost every topic, and is struggling to find paid employment.

Tell me why 50% of ISA subs ate cash

And why NS&I holds about £200 billion of it

Why not look at actual behaviour, or is that too much to ask?

The overall amount of holding tells you nothing about the length of that holding – people invest in cash ISAs (and NS&I) investments precisely because they can get their money back at any time. It is not for long term investment, which is exactly what you are seeking for ‘green investment’.

People are not using cash ISAs for long term investment (or if they are, they are being very stupid).

Are you still suggesting locking in a 2% return is a sensible long-term investment strategy?

The churn in cash is I suspect a lot less than in a managed fund

But you wouldn’t admit that, would you?

I suspect you are an investment adviser as you claim. Not in the whole a profession I have much time for, not least because anything but a fee earning product never seems ri gave much appeal for them.

Now, answer my questions so to why so much is saved in cash, long term,, or be deleted

If you don’t support the concept of ISAs, how are you retirement savings invested, Richard?

Presumably the bulk is in final salary pensions, which benefit from significant tax subsidises plus large contributions by the taxpayer?

That is my affair

But ISAs have never been part of my planning and since I have only had theee years of full time employment since 1984 your other assumption is wildly inaccurate

And just for the record, I have no intention of retiring

If you are as brilliant as you seem to believe, why are you not in more demand, and why do you think you have only had 3 years of full time employment in 40 years?

Because I was self-employed for the vast majority of it as a chartered accountant in partnership and then via an LLP as a campaigner

Really not hard to work out

ISA funds could easily be legislated to invest in things like community projects, solar panels, sustainable transport etc .. all banks and building societies can offer them, investors could even get a vote on which projects the bank or building societies invests in.

As for pensions, they also should have parts invested in infrastructure projects like social housing and transport links.

Precisely

There are all sorts of interesting points being raised. As above, I agree that ISA tax relief is pointless if people are going to save that money anyway. The experience of one person (me) isn’t useful evidence but suggests an ISA is at least encourages you not to use that particular pot of money without careful thought. But is that enough to merit them?

Stuart Clivedon above clearly comes from a professional financial investor background and forgets that ISAs are for saving (the clue is in the name) with most people using them having little understanding of his concept of investment. And he refers to government bonds, which are difficult to access by individuals with small amounts of money, though if they have any sense those with share ISAs may well buy mutual funds which include those bonds. For the rest of us “bond” refers to building society savings products with fixed terms.

Complaining about the tax subsidies on pensions is different. That is an area where incentivisation definitely seems to me needed. There are already far too many who don’t make enough financial provision for their old age, relying on a state pension which they then find a challenge to survive on. I suspect the vast majority of the population would have put too little in without occupational schemes depending on the tax status, With a different politics we might have a higher state pension which would take away the problem – but that might cost similar to a tax subsidy.

Surely to the low income saver, it’s the 25% so-called bonus on up to £4k in a LISA , rather than the tax relief which is attractive?.

It seems more profitable and less risky than inexperienced investing with relatively small sums.

If it were a Green 25% that would be great.

I am not saying saving is wring fir the individual

I am saying the government needs a return for society for the subsidy provided