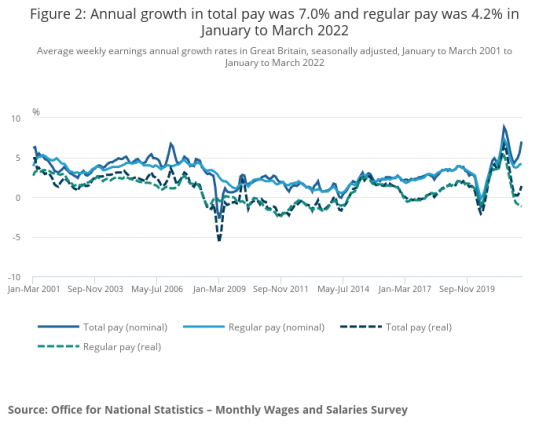

The Office for National Statistics issued its latest survey on average weekly wages this morning. I offer two key charts here:

That looks reassuring. Except, of course for the fact that first of all by no means everyone gets bonuses, so the regular pay data is much more important, and second this is the nominal pay rise, ignoring inflation. Taking inflation into account this is the result:

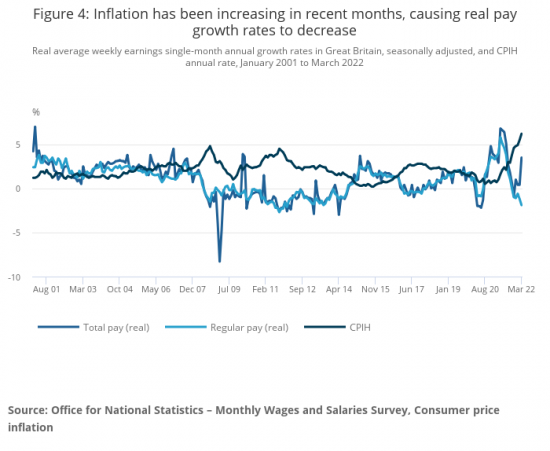

As is now very apparent the regular real pay of people in the UK is now in negative territory when inflation is taken into account, and bonuses are not enough to compensate for that inflation.

Three things follow. First, we are not going to get demand-pull inflation in that case because most people will not have the cash to do that pulling. Only the wealthy have, which is why they should be targeted now with significant tax increases on the returns from wealth and investment.

Second, borrowers are already seeing their real earnings fall before any interest rate rises from the Bank of England.

Third, the Bank of England is deliberately making matters worse for those on lower earnings by seeking to tackle demand-pull inflation with interest rate rises when that demand-pull inflation does not exist and all that can follow from interest rate rises is more misery and more better-off people. They are literally doing the exact opposite of what is required.

When will people read the data and act on it? I wish I could answer that question.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This Government reminds me of what it must have been like at Three Mile Island in the U.S. in 1979 when they nearly lost the reactor.

The supervising team on that fateful morning had never been through a simulation of a problem, and when the emergency signals started they did exactly the wrong thing – they turned off the the cooling system in panic. It was later revealed that this had led to a partial meltdown of the top of the reactor – as what happened at Chernobyl a number of years later where the reactor totally overheated and blew up..

The company who ran the plant did not believe in training to keep a lid on costs.

Cut to No.10 and what we have is a bunch of dogmatic imbeciles who did not run the numbers or simulate what would happen as a result of BREXIT, a pandemic or a war when delivering their austerity and low wage economy policies that they are still intent – like all extremists – to deliver despite whatever.

All they seem to want to do is what John Seddon calls ‘the wrong thing righter’ – which might mean interest rates at + 4%!! I view these as possible given their record. I wouldn’t put it past any of them Richard.

If I was in HM Opposition I’m afraid I’d be calling Johnson and Co every name under the sun – I’d be absolutely livid. I would cross the floor of the House and confront Johnson face face I kid you not in the name of the people being harmed by all this.

Indeed, we are running out of labels for such appalling stupidity. And behind this is also this artifice that the Government can’t do anything.

As you have so ably pointed time and time and time again thus is the biggest and most unforgiveable lie of all by Johnson.

They all beyond redemption in my view. They must be deposed.

Forgive me for commenting on TMI and Chernobyl

The TMI staff were inadequately trained the control ergonomics were poor. A valve line up was incorrect leading to a leak which could not be isolated after a pressure transient in which a relief valve lifted but failed to reseat. Things started to go pear-shaped when a steam bubble formed in the reactor pressure vessel. This caused the water level in the pressuriser (where they expected to measure the water level in the system) to increase. They therefore turned off the Emergency Cooling System of and lost the reactor – 70% of the core melted. The containment building performed its function and retained the radioactivity.

At Chernobyl Reactor 4 in 1986 they performed a coast down test on the cooling pumps with the reactor power at 10%. The reactor design was unstable below 25%. The reactor had a ‘super-prompt criticality’ and went to 1,000 times full power in under a second, hence the explosion which disrupted the reactor core and blew 1,000 tonnes of concrete of the top of the bioshield. The ensuing cloud of radioactive material did a grand tour of Europe.

There’s nothing to forgive Mr Dalton.

Whichever way you look at it, poor planning and training of key staff caused Three Mile Island. Your account is a result of the investigation AFTER the partial meltdown – this was not known at the time of the incident, where panic meant that helpful and even back up systems were unfortunately switched off. They had no idea what was happening. There weren’t even any video cameras so that the core could be seen.

And even though the containment building stopped the radiation, what is little known is radiation was still having to be vented out in steam and gas because a pressure bubble of flammable hydrogen had built up in the building and could have exploded itself and taken the core with it and could have led to a Chernobyl-like incident. The local population of Three Mile Island certainly came to know about that and remain hostile to nuclear power to this day.

My understanding of the core was that it had melted from the top down and until they sent a camera into it a while later, they had no idea how close they had come.

I only mentioned Chernobyl because that was what Three Mile Island came close to being that fateful morning – not because there are similar causalities. You summation of that incident seems correct to me.

If we are not going to get demand pull inflation, why do you need to target any one sector of the population with tax rises ?

The inflation rate is largely dependent upon ‘essentials’ spending rather than discretionary. If ‘most’ people (you words) do not have the cash to do that pulling, taxing the ‘wealthy’ isn’t going to have the effect you think it will.

Someone is paying £30,000 + for second hand cars and it’s not the hard up, is it?

So shall we stop being silly here?

I see the Ex Pro Boxers Union is at it again!

I am not a boxer….

But I rumble them eventually

Everybody is in negative territory regarding wage increases except for those in the (parasitic) “financial sector” – 10%+. Nice little earnings if you can get there from Oxbridge and the big banks.

And what about these useless oafs – 2.7%:

https://www.theguardian.com/business/2022/mar/01/mps-to-get-2200-pay-rise-next-month

So……….

In the 70’s and 80’s when wages were a higher percentage of GDP & more evenly distributed a more unionised and male dominated work force were able to get pay rises that at least kept pace with inflation, and which in turn fed into it.

In the 2020’s a non unionised workforce with many sectors dominated by women, with a smaller percentage of GDP going to wages which are increasingly unevenly distributed are finding their earnings not keeping pace with inflation, which is mostly caused by external factors, or ones within the control of the UK Government, unlike the 70’s and 80’s.

The suggestion is to apply the same medicine and reduce peoples spending power still further and at the same time not butter up The Police like Thatcher did.

The work of genius……….

I think you might find some of your answers in Brian Klass’s book ‘Corruptible’ – https://www.waterstones.com/book/corruptible/dr-brian-klaas/9781529338089

Yesterday I was in a working group where we had talks by Joseph Rowntree and Institute for Government. Main focus was on the massively increased levels of poverty and whilst benefits were of course a big issue, so was the low pay, low hours and insecurity experienced by so many people supposedly ’employed’. Then we had Truss on the radio this morning trotting out the standard line about the low levels of unemployment, of course ignoring the fact that so much of that employment is a big part of the problem.

We know the answers and they would include increasing and enforcing the minimum wage, tackling the abusive section of the gig economy and rebuilding unions. The opposition parties seem to be very quiet on these topics, perhaps fearing that they will be seen as anti business. The kinds of businesses that engage in these practices are the low wage, low productivity businesses that are a big part of the UKs low productivity economy. Time for the opposition to come up with some serious policies for encouraging the kind of economy and businesses that we need. That is not the financialised, low tax, low wage, low productivity economy that the Tories only understand.

On the wage front, worth looking at Resolution Foundation data on average vs median income. Big, big differences in places like London where average incomes are misleadingly high compared to the median, driven up by concentrations of extreme wealth. Explains why London has such high levels of poverty, even though average wages seem (to people outside London…) to be relatively high. True for other major cities too

Thanks

Indeed – the average alone rarely tells you much unless you also know the distribution.

For example, here is an ONS graph of the “UK equivalised household disposable income of individuals”: https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/yearending2018

Graphs like that show that income is more or less a Poisson distribution, with a very long upper tail. In 2018. the median of UK equivalised household disposable income was £28,400, between the fifth and sixth decile. But the mean was £34,200, well into the seventh decile.