The Office for National Statistics has published its first estimate of the UK's national finances for the year to March 2022.

The data is deeply misleading in most cases. Income and receipts and accruals and payments are widely confused in deeply misleading ways. In the web post it is not acknowledged that many of the figures published refer to very different measures of debt, which would leave anyone not knowing that there are about six to choose from deeply confused. As a result the publication could easily be considered misinformation.

I engaged with the ONS extensively on this issue 18 months ago. I now regret not publishing that research because it was deferred thinking it might go to an academic journal, but then all the colleagues I had involved decided that it was unpublishable as the issues were too complex for such journals to handle. I do not think that would have been the case here.

Let me, however, deal with one issue, which I have been asked about. That is the so-called Bank of England contribution to the national debt.

In summary, it is claimed by the ONS that of the supposed (and I use that word advisedly) £2,343.8 billion of public sector net debt excluding public sector banks at the end of March 2022 (96.2% of GDP) £318.7 billion relates to the Bank of England, without whose contribution to the national debt the net debt would be £2,025.1 billion at the end of March 2022 (or around 83.1% of GDP). These claims are wrong.

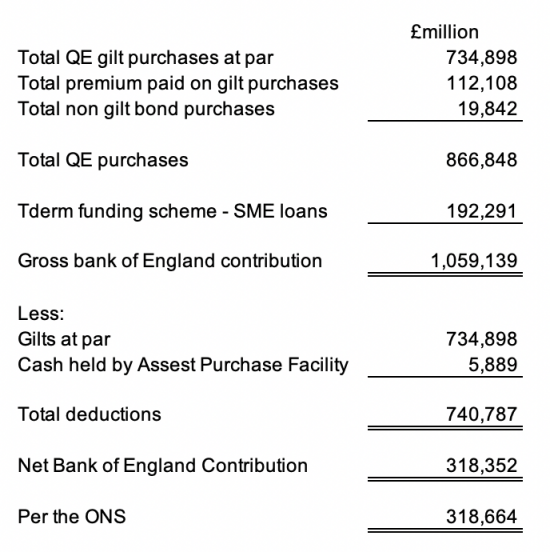

The Bank contribution is calculated in summary (with some estimated data used by the ONS excluded from account) like this:

The data comes from Table PSA9A here. Note that all these figures are deemed to be liabilities.

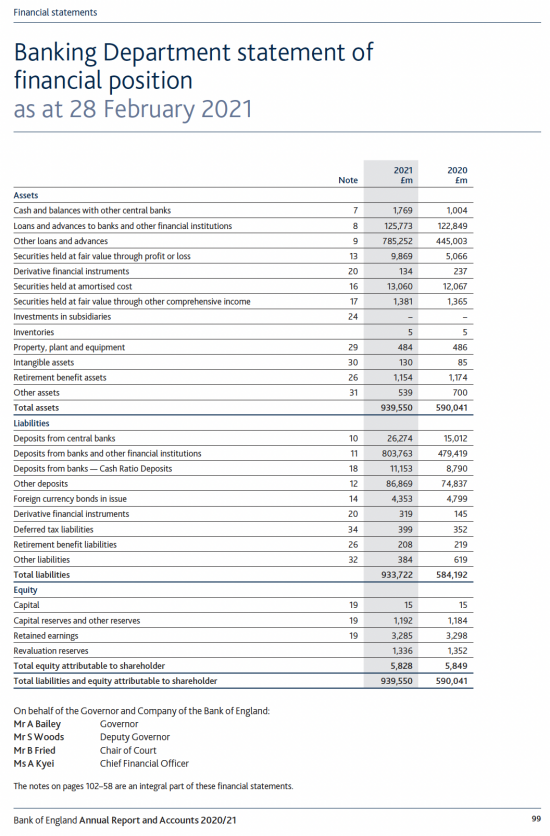

Now note this, which is the last published balance sheet for the Bank of England:

You will note that there is no number remotely like the figure of £318 billion which the ONS refers to as the Bank of England contribution to the national debt.

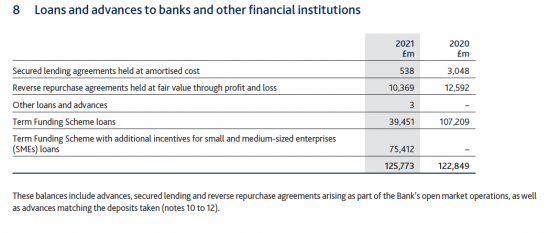

So let's be clear about what there is on that balance sheet. Note 8 shows this:

The term funding scheme is in there. It had just grown a year later.

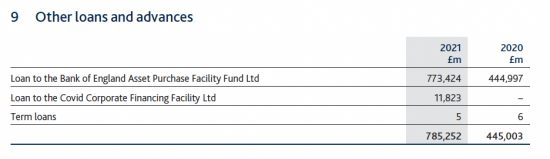

Then there is note 9:

The £773 billion was the loan to the Asset Purchase Facility used to buy the gilts and other bonds acquired using QE: the value of assets held by them is very similar to the loan advanced and had gone up by March 2022.

Now note that these sums I refer to, and which the ONS refers to, are assets. They are not liabilities at all. The Bank of England balance sheet makes that clear. A liability is a sum owing. In contrast, an asset is the value of an investment or in the case of a bank the value of an advance to a customer that they think they might repay. So what is the Office for National Statistics doing describing assets as liabilities when they aren't and including them in debt when there is clearly no debt owing as a result of the matters they describe? There is no reasonable explanation. It's as if they cannot read a balance sheet. What is undoubtedly true is that their presentation is confused, to the point of being wrong.

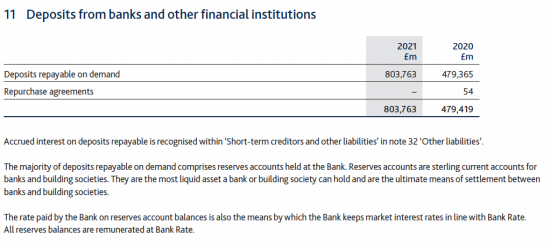

That is confirmed by looking at the rest of Bank of England balance sheet. There are only two serious liabilities there. One is explained by note 11:

These are the central bank reserve accounts held by commercial banks with the Bank of England. Their use is as described in the note: these are the accounts used by commercial banks to make payments to each other and to make payments to and receive funds from the governmment.

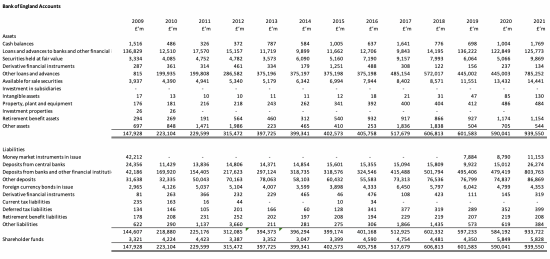

I have summarised the Bank's balance sheets since 2009:

(Click on the image and then do so again to get a larger version)

These central bank reserve account balances grew near enough, although not precisely, in response to rising quantitative easing or other loan fund injections by the government into the economy. My request for further data from the Bank of England to explore this link has been ignored by them despite being made under Freedom of Information rules, and their acknowledging it several times.

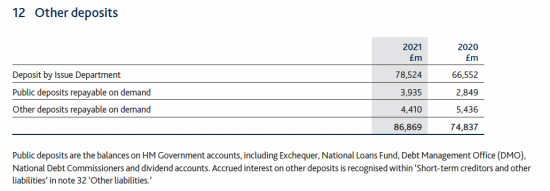

The other deposit balances are explained by note 12:

The £78 billion simply represents banknotes in issue. The rest is inconsequential.

What we have in both these notes 11 and 12 are sums described as liabilities. However, the curious fact about central bank reserve accounts is that commercial banks cannot get rid of them. They can transfer these balances between each other but this 'base money' differs from commercial bank-created money in that it is made by the central bank, and only it or the government can get rid of it by either taxing more or selling more bonds to the market. The balance on these central bank reserve accounts is beyond the commercial banking sector as a whole to control because they are the centrally created base money supply that they must use. So, this liability is not repayable at all in any real sense. And nor, come to that are banknotes. We know they can only be repaid by using another note. So they are not a liability in any real sense either.

So, how come the Office for National Statistics claims that the Bank of England contributes £318 billion of liabilities when what they describe as liabilities are assets, whilst they ignore the Bank's actual liabilities altogether?

I have been told two stories to justify this bizarre accounting. The first is that because the loans advanced to clearing banks to fund the SME loan schemes are due for repayment after more than one year the ONS cannot consider them to be assets, and so they must knock them off the net worth of the Bank of England balance sheet, but still leave the matching net central bank reserve account balance that they create as a liability. The bizarre assumption implicit in this is that the entire UK banking system will go bust sometime soon.

The second claim is that the premium paid for the gilts acquired by the Bank of England under quantitative easing is not an asset because only the par value will eventually (probably many years hence) be repaid. This is another nonsense: what the premium paid represents is prepaid interest that needs to be expensed over the remaining life of the assets in question, which is in effect what the market does, assuming no change in rates. But the Bank says it must be written off straight away.

In other words, the Office for National Statistics is, in creating its accounting for the national debt assuming assets have no worth because they will take more than a year to be repaid but all liabilities, whenever due, must be taken into account. To achieve this outcome the Office for National Statistics is effectively saying that the audited Bank of England accounts are not true and fair at all and actually include assets they do not think of any worth, even though it is clear that is not true. They then write those assets off and claim as a result the Bank of England has a deficit of assets which they then call debt.

If that sounds like contorted logic, trust me that it is. The kindest possible interpretation of this is that it is deeply muddled thinking. It is also very obviously wrong: as a matter of fact the assets clearly do exist and as such do not need to be written off. And so the obvious fact is that the national debt does not include this literally made-up figure of £318billion. That means that the national debt cannot exceed £2,025 billion (as noted above).

But there again, that figure is also wrong. At 31 March 2022 the central bank reserve account balance at the Bank of England were £951.8 billion. There were £87 billion of notes in circulation. Thee must be matched by assets, and as noted in the audited accounts these are of value at the accounting values attributed to them and none need writing off - which is why the £318 billion adjustment is wrong. But what is also true is that if the Bank of England has these credit balances on its balance sheet they should not be ignored in national income accounting. However liabilities cannot be counted twice, and what that means is that to include the gilts that the Bank of England owns as liabilities in the ONS data is false accounting (I use the word advisedly, and the Whole of Government Accounts agrees with me, so I am correct in saying so). You cannot owe yourself money. As a result, the country has not got a debt when the government as a matter of fact owns the bonds or gilts it has issued.

So, starting with the figure of £2,025 billion of so-called national debt there are a number of potential adjustments to make. One is to say that the figure for government-issued bonds owned by the Bank of England should be deducted from the national debt. At gross value (and for the reasons noted above, gross value is fair) that is £847 billion. This would reduce the national debt to £1,178 billion.

Alternatively, there is another way to make this adjustment. That is to say that if the gross debt is £2,025 billion (and it cannot be more) then of that sum the balances held on central bank reserve accounts and banknotes should not be treated as debt because they are not debt as such: they are the core money supply that the government makes available to make the country's finances work. They are, in other words, the financial capital of the country.

There is, as it happens, an odd similarity between capital and liabilities on a balance sheet. They are both credit balances, but otherwise they behave very differently. One is repayable and the other is not. The money the government has created is not repayable at the choice of anyone but the government. This is a simple fact. It can be repaid if the government so wishes, but otherwise it cannot be, and until the decision to repay it is made it is not a liability, but capital.

So, in that case the true actual liabilities owing by the government may be the so-called debt due of £2,025 billion less the part that is really cash balances created by the Bank of England of £1,039 billion (£952 billion of central bank reserve account balances and £87 billion of notes) meaning that the national debt is no more than £986 billion.

And if you are wondering what the difference between these two figures is (£1,178 billion and £986 billion) it happens to be £192 billion - which are the assets owned by the Bank in the form of loan balances made available to commercial banks that were injected into the banking system via the central bank reserve accounts for supposed onward lending to SMEs. And, as these are assets unless (as previously noted) the whole banking system collapses, I think the lower figure for liabilities is correct as there are assets to take into account that the Office for National Statistics not only ignores, but actually treat as a liability, so doubling up their error.

So, the true national debt right now is £986 billion, or near enough 40% of GDP.

Shall we, in that case, stop obsessing about the national debt, welcome the fact that there is national capital of £1,039 billion, which is represented by our money supply, and that the government has the capacity it needs right now to assist all those who require help in the economic crisis to come? I think we should.

But what we should also do is demand that the Office for National Statistics stop accounting for assets as liabilities and demand that they treat the money supply as what it actually is, and stop pretending - utterly falsely - that there are debts in issue that do not exist.

We are used to having a Prime Minister who does not tell the truth. We expect the Office for National Statistics to be honest, but they aren't being so in their national debt accounting, at cost to us all. And that is unacceptable right now when it means that necessary services are not being supplied by the government.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I fear that the detail in your blog may beyond many (including me) – but it is correct. What I really admire is your persistence in pointing out the nonsense – keep it up.

As you clearly say –

The BoE is owned by the government (us); gilts owned by the BoE is money owed to “us” by “us”… it is obviously NOT a debt, merely an accounting choice.

If I wander in to the BoE with a £20 note and ask to “pay the bearer” (me) then they will….. with a crisp new £20 note. Now, it may well be the case that, at some point, there is too much money in circulation. If there is it can be drained as a matter of policy CHOICE (by sale of gilts or taxation) not necessity.

And as if that is not enough I heard Simon Clarke (Junior Treasury Minister) on TV last night quote interest payments at £83bn! It was enough to make me go for a lie down!!

As we know, the £83 billion figure is a lie

Isn’t there some kind of international standard for these national balance sheets so they can be compared on a consistent basis? Do other countries mix up liabilities and assets in the same way as ONS?

It seems absolutely appalling that the ONS itself should be ‘fiddling the books’ in a way that just happens to suit the governments ideology about public spending and debt repayment.

I used to look at national ‘input/output tables’ but being not really familiar with all the arcane definitions makes it difficult to follow all the details in your argument but will keep trying

The standard was created in 2008 pre QE and is open to wide abuse on how QE is handled as a result

You make a very good point about International standards.

Thirty years ago I had to teach a course on international business and one day looking up unemployment statistics I was amazed by how differently various countries counted their unemployment.

At the time unemployment was a political hot topic and most of our better newspapers printed articles that included international comparisons. I do not remember anyone of them understanding that they were comparing apples with oranges.

This is still true

But this area is supposedly subject to standards – however they are not consistently applied

I’d like to associate myself with Clive Parry’s recognition of your persistence.

But has it ever occurred to you that this sort of gross distortion promulgated by the ONS is because of people like you and others who came nailing home the truth of the matter? Maybe they are rightly becoming unnerved?

I wouldn’t put it past any of them – ONS, Treasury, Tory Labour Lib Dem and even (unfortunately maybe) the Greens – they’re all in on the Big Lie.

And then to make out that the interest payments are a problem!!! To whom? To whom do we owe this interest? Who is banging on the door of the Government for its money with interest?

If the Government has packaged some of its investment as bonds whatever to sell to willing buyers in the market at a rate interest growth – then fine. And even that can be paid by just printing it.

People should realise that it is their Government that is Sovereign – not the Bank of England. And the BoE is owned by the Government. Even the interest – if it exists – cannot be surely levied on the Government on itself – although it could choose to I suppose.

The way it is portrayed is as the other way around – that the the Government is in hock to this bogeyman called BoE.

It’s nonsense. But effective nonsense.

This is al, fuel for my book

“I wouldn’t put it past any of them – ONS, Treasury, Tory Labour Lib Dem and even (unfortunately maybe) the Greens – they’re all in on the Big Lie.”

ONS, Treasury and the Tory Government, absolutely all in on the big lie. However, I fear the lie is so big and complicated (like others my head is spinning trying to get around it all), that the opposition fear to question it as being wrong, especially as when an election comes the accusation of where the money is coming from, tax and spend, etc will be thrown at them. Are the opposition even questioning it, or do they simply accept that the ONS and BoE must know what they are talking about? Do they ever talk to someone like Richard? Heads in the sand most of them.

The average person isn’t going to understand these balance sheets. They understand tax and spend fears and basic fears of where is the money come from to pay for things. That’s the Tories ace card which at election time they always play.

I do discuss these issues

Nothing much happens

Thanks, Richard. I could not make head or tail of this yesterday, apart from realising that something looked deeply wrong. It is deeply depressing that the ONS publishes information like this that is trumpeted by the press and politicians without them understanding the underlying position and why it is misleading at best.

I keep asking the question, is this deliberate?

The answer keeps coming back ‘yes’

I agree. It’s produced to scare people and create the narrative that the debt has to be repaid.

Craig

In other words, we are watching an exercise, as it were, in fraudulent accounting in real time?

Yes

“…. all the colleagues I had involved decided that it was unpublishable as the issues were too complex for such journals to handle.” Now it is my turn to go and lie down in a darkened room. If the journals cannot handle the debate – where does one go?

I can think of one answer. Avoid the economists. Flee! In my opinion, the only theoretical, academic monetary economist who adequately understands the centrality of money, and the crucial relationship between monetary economics and accounting is Perry Mehrling. Have you thought of approaching him to discuss the issues, Richard? In the mess we are in it is crucial to build networks. His position is what he terms ‘The Money View’ (he is the only monetary economist I know who puts money at the centre of economic theory – think about that!); he is not explicitly ‘MMT’, but I think he is not unsympathetic. His starting point is always observation of how money actually works: facts only, and double-entry.

I advise everyone – everyone! – to read Mehring’s ‘The New Lombard Street: How the Fed became the Dealer of Last Resort’ (2011). Short, trenchant and illuminating.

That includes you, Mr Parry!

But that still won’t get a journal paper published…

Journals only like theorising and dotting i’s and crossing t’s

No, I had conceded that point. Networking is valuable. How did Hayekian Neoliberalism become the conventional wisdom in the US, outside academia? By thinking about networking. The Mont Pelerin Society targeted the elite legal faculties in the US universities, and influenced a whole generation of leading lawyers in the US with neoliberal economic theory. I make the point to focus on the importance of networking. The power of archaic thinking among neoliberal economists to control the narrative is paralysing. Connections need to be made among those who are actually addressing the real issues.

Their influence also critically depended on those they influenced not knowing anything about how the national economic system actually worked during the interwar years and post-Bretton Woods. And that included many economists who either couldn’t unthink what they had previously been thinking about how things worked or had vested interests in continuing to think the way they had been. Even 2008 didn’t have the influence one might have thought it should have. Neoliberalism seems almost like an endemic virus with no, seemingly acceptable, antidote available. In fact, there is an antidote, but hardly anyone seems to want to take it, so high is the resistance to any, more realistic, alternative. Why this is I do not know.

John Warren

Help us out here about Mehrling please.

I scanned it yesterday but not read it deeply as yet ( I do my best as a working stiff to keep up). It is very dry writing talking about very high level concepts in central banking. High level concepts that need I think explaining to the general public (and me!)

It is not clear to me why you mention it. What are you getting at? BTW this is not a threat or disagreement or anything, its genuine sense making. What is your understanding of the situation?

Are you suggesting:

1) That the central bank needs to interfere on both sides of the banking/money operation during crises – the debt and asset side (the lender AND dealer of last resort as Mehrling observes). And that this is a more effective way for a central bank to run the financial system to stopping it ‘falling off the rails’ other than just interest rates?

2) And, if we accept this role of central banks ( as defined by the U.S. Fed) then it is normal and desirable for the central bank to interfere in this way?

So, then, back in the UK now, when we consider the inaction by this Tory Government, in comparison to the behaviour of the U.S. Fed in 2007/8, the inaction of Sunak and Co cannot really be justified in any way.

So although Mehrling thinks that a genuine role for central banks has been asserted by the Fed’s behaviour in 2007/08 , and that the tools are there to deal with the cost of living crises (COLC), Covid, BREXIT even, the Bank of England has them but has chosen not to use them because it has been directed by the Chancellor not to do so?

If the inaction in the face of the facts cannot be justified then what is the mens rea for inaction and lack of central bank intervention by the Tories?

It can only be that creating money to deal with the COLC and Covid undermines the intent by the Tories to underfund public services because by helping it shows the public that the Government DOES have the money to fund public services if it wants to. By helping it would let the cat out of the bag.

It does not want fund them because its aim is to privatise public sector services and turn them into investments for private money. So it is pleading poverty and debt as a means to make (for example) the NHS so bad that it manufactures consent in society to privatise the whole lot.

Mehrling’s assertion about central bank potential brings home just how callous the Tories are to me and just how weak Labour and the Lib-dems / Greens and SNP are on these fundamental issues.

Once again it is this denial of any state apparatus to be of any use to society except to the objectives of the very rich. It is typically Neo-liberal.

We are indeed going backwards.

I began reading, and fell asleep, I will be honest, so thank you

I am slightly shocked at the lack of interest.

Allow me to focus on one single proposition. Fed funds, Eurodollars and Repo are important money market instruments “but not everyone has equal access to them” (Mehrling). The position that developed up to 2007 was of monetary management generally being limited to manipulation of the federal funds rate by the Fed. Other than that, the Fed intervened in the market for treasury Repo (to stabilise the rate at some target), and other Repo and Eurodollar rates functioned through market arbitrage by private dealers, and the money market provided funding liquidity for two-way dealer operations that were the source of market liquidity (Ch.6). The dealers had a key role, but dealing with an exclusive set of principals with special access.

The central banking system, in a crisis, historically acted as ‘lender of last resort’, (funding liquidity) but with the shift from a traditional banking model to a capital-market-based system (with dealers playing a critical role) this is not enough to ensure the necessary liquidity: “in a really severe crisis, market liquidity is no longer a matter of the funding liquidity of private dealers but rather of shiftability to the Fed” (see Ch.5, p.106-7). This requires the central bank to act as ‘dealer of last resort’ (market liquidity), which de facto is what happened in the financial crash (but note, economic theory still lags behind).

I focus narrowly on this because in exploring the nature of the relationship between the banks, central banks and the dealers in the system (and in a crisis) it strikes me that Mehrling’s reference to “not everyone has equal access to them” is both obviously true, and very revealing. Fixing the crisis, reconstructing the banking system and reformulating the theory may all work, but it works in a closed system; a system of insiders. The general public’s needs are not directly addressed, or fixed. This obviously has consequences.

Mehrling, remember he was writing here in 2011, refers near the close of the book to TALF (Ch.6), and its limitations; with the Fed stepping in as dealer of last resort to acquire “directly” $1Trillion of mortgage-backed securities, effectively extending its role beyond the credit insurance market directly to the capital market. The idea was sound. How was it actually working for the people on Main Street grappling with these mortgage-backed securities in everyday life? Not well!

If we look now at Neil Barofsky’s ‘Bail Out’ (2012), much more at the ‘coal-face’ of everyday life of mortgage-backed securities crises for Joe Public, we can see that Barofsky as Special Inspector General of TARP was struggling with the real life Main Street problems with mortgage-backed securities created by the Treasury, banks and TARP working in a closed system of insiders. Barofsky was particularly concerned by the Treasury’s egregious focus on the banks’ wants (Ch.10, p.175); or even of TALF creating “extremely difficult to detect fraud: collusion between the bond’s buyer and seller” (Ch.5, p.89). The deep scars left on Main Street by both the Crash and the Banking fix I suspect had a big impact on the political divisions in the US today; which Barofsky neatly condensed as his sub-title: ‘How Washington abandoned Main Street while rescuing Wall Street’. It seems to me it is this separation, or detachment; but in fact represents Mahrling’s complete inequality of access (at least to solutions), of a banking system focused solely on insiders (the institutions, reputations, politics, and above all the market and the system of insiders); even in crisis, and excluding the requirement to address directly the economic needs of vast numbers of ordinary people it is scarcely surprising that such a solution will fail the public test and the people; but probably not fail the ‘system’ the Treasury and Central Bank wish to protect.

What has this to do with Britain? Mehrling’s book title is an acknowledgment of Bagehot’s earlier work; a reference to the importance of Britain’s deep, historic role in the development of the international banking system. More relevant, a similar disconnect between the money system and the economic needs and interests of the public may be seen in the mess we are in.

Thanks

I have made no progress because to be honest I have not been feeling at all well for two days

But it is an identified bug and will go…

A further explanation of why I focus on Mehrling; while acknowledging it is best if he is read – it is a short book and has beautifully reduced complex issues to their minimum essentials. I cannot speak for it I hasten to add, or do it justice. Read the book.

Allow me to approach this from a different perspective, which of course includes my idiosyncratic interpretation. Mehrling focuses his work on observation and description of how the monetary system actually works. The principle the money system relies on to work is double-entry. Every debit requires a credit. If you eliminate the debt, there are no assets. This gives the lie to the “magic money tree” sneer. The whole system is “magic”. It requires an act of imagination simply to exist.

The problem of democracy is actually a problem of money and economics. If our democratic system seems to be rapidly decaying, it is merely following the changes to the money system over the last forty years. The rise of the ‘free market’ on the back of changes to the money and banking system are at the root of the democratic failure. Governments still exercise control and management over ordinary people through public spend or controls (public services, energy caps or whatever), and more critically through direct taxes (PAYE, NHI, VAT etc). The other side of the equation before the neoliberal triumph was indirectly through the banking system, but in order to reach the whole population, the issue of currency (notes and coin) was essential, money that left the banking system and freely (note the word) spent most of its active life circulating in the hands of the whole population. The modern, pre-and-post crash (and Covid) capital-market oriented banking operation has moved away at accelerating speed from a ‘free circulating’ cash system serving all the people, to a banking-dealer-controlled system, with a hierarchy of money; but also a powerful hierarchy of access to the money system, which is becoming almost exclusively an ‘insider’ system. Cash counts much less, which slowly removes significant parts of the population (with little or no interaction with banks) from influence, and crucially from the capacity of government to balance the penalty of its taxes, with the benefits of the circulation of money, free of the interests and gatekeeping proclivities of the banks.

Mehrling (who does not emphasise my focus here on popular access), uses a powerful American image to contrast the old banking system with the modern capital market system. The old system he terms the ‘Jimmy Stewart banking’ system (Ch.6, pp.116-123), which Mehrling emphasises was mythic, but powerful; this was Main Street banking, with basic solvency and liquidity risks backstopped by deposit insurance, or through the discount window at the Fed (presumably Mehrling is using ‘Its a Wonderful Life’, notably dated – 1946). This was how America Main Street expected banking to work – for them. It doesn’t work for them now, and they know it – Washington sold-out Main Street for Wall Street; the public are now incidental to the operation.

Government it seems to me (I make no claims Mehrling believes this) has detached itself, and effectively is detaching people from direct access to money, save through electronic mechanisms controlled exclusively by banks and serving first interests deemed entitled to special access to the digital money system.

Sorry to hear that, Richard. Get well soon.

This particular issue hits me every two or three years

Thankfully, my GP reacted quickly so I can be confident it will go

Always enjoy your insight…. and I will read it. Thank you

You don’t have to buy the book – you can download it as a fee pdf Clive:

http://www.academia.edu/7952295/THE_NEW_LOMBARD_STREET_How_the_Fed_Became_the_Dealer_of_Last_Resort

Thanks

Couldn’t you just do an article for a journal just explaining that the £83 billion in interest payments cited by the ONS for the government is grossly inflated as it is obvious that the Tories will be hell-bent on drumming this figure into peoples’ heads in order to justify their malicious austerity cuts and continuance of below inflation levels of pay and benefits?

That’s just not how journals work in economics

I would suggest your presenting this is hugely important, but not for the obvious reason that it might achieve an improvement in the figure, but because it highlights the absurdity of worrying too much about the national debt. All measures of the debt are absurdly large numbers, the average reader of this numbers can’t do anything useful with the numbers.

Instead, we can point at the figures and say, those numbers are just wrong _but that doesn’t matter_. What matters is other things that have nothing to do with these arbitrary figures.

The ONS appears to be presenting an extract from an unconsolidated account. Clearly, if the accounting standards mean anything, the result must be misleading. Who audits the ONS?

No one

The ONS accounts do not – I stress – use double entry

Otherwise they could not call assets liabilities

In other words the ONS accounts are as unreliable as GERS.

Yes

The point I was making was that the BoE account cannot be read in isolation of the Government account. If a proper consolidation takes place then the inter group transactions are cancelled out and the assets and liabilities restated.

It would appear that the ONS is selecting data from two sets of interdependent accounts and in the process confusing assets and liabilities.

The point about the ONS audit is that the provision of information is the primary, sole purpose of the ONS and their output shoud fall within the remit of the NAO. This takes us back to the Whole of Government Account consolidation process. There needs to be a separate Net Debt/BoE consolidation statement, at the moment we are wholly dependent upon you to make sense of these criitical numbers.

You are right

I agree that the assets held by the BoE are real. I notice that the BoE balance sheet actually balances, at least to the nearest pound, in all the years you’ve referenced. So no net debts are held by the Bank of England.

However, if the Bank’s financial assets are real, doesn’t this also imply that those issued by the Treasury have to be matched by a liability held by the Treasury? So the trillion or so of ‘extra debt’ can’t be ignored in the way you’d like.

Of course this doesn’t mean that the debt needs ever to be repaid! It can stay on the books for as long as anyone in government thinks necessary.

Did you read the bit about credits also being capable of being capital?

Alternatively, we could step back and look at the way you have constructed your proposition, and ask: in what way is a debt that never need be repaid, be described as – a debt?

This way of arguing you propose reminds me of Rishi Sunak describing an energy loan made to the public by Government that is to be repaid in specified staged repayments over time, by insisting it is not a loan. George Orwell would have been dazzled by the sheer impertinence, not only because it beyond argument a loan (that isn’t a loan only in in ‘Sunak Newspeak’). In fact Sunak has invented a dangerous new Government power in the process: the compulsory loan. The principle of the compulsory loan which has now been set is far beyond usury (whether or not interest is charged), because we have established a new principle not attempted even by loan-sharks: compulsory loans, backed by the force of law. What a precedent of both Government distortion and folly is there.

We are reduced to discussions like this, then wonder why we live in a world of fake news conjured (with careless and lazy disregard even for disguise) by media and politicians. That should remind us not just of the low regard of the public for media and politicians; but that disregard and indiffrence is not nearly as low as the opinion that media and politicians obviously have – for the public.

Isn’t this the line of the Positive Money group? That issued money isn’t debt but, and as you would put it “National Capital”. Whereas MMT advocates would argue that all money is an IOU, and therefore debt.

It’s curious that the money supply isn’t counted as part of the National Debt. I once asked Warren Mosler about this and his answer was that it’s a hangover from Gold Standard days when all issued currency was covered by Gold reserves, and so the value of the Gold reserves offset the debt. There are no, or insufficient, gold reserves any longer so it should be included if we are doing our accounting properly, and which the equations, or identities, of the sectoral balances assume.

The government has lots of other assets besides gold so when these are recognised, there is no need to worry about even 2 trillion or so of debt. Its biggest asset, IMO, is the ability to levy taxes and the ability to issue debt, in an accounting sense, without having to ever repay it.

Money is debt: I do not agree with Positive Money, who really do not understand money

But, government-issued debt that is entirely under their control in the sense that its repayment, or not, is entirely at their choice with the rate of return due also determined by them. So how can then be called a debt in any contractually meaningful com[arable way when contrasted with, for example, gilts, where the obligations are quite different?

Calling it capital is not to agree with Positive Money. It is to appraise the facts.

The discussion of the gold standard is inconsequential

Is it worth approaching the National Audit Office about this? They have to sign off the government accounts. Do they also audit the BoE? If so, they should have a view on what the national debt is? And that all accounts assets and liabilities should be consistent.

The Whole of Government Accounts show a more accurate view of debt