I did some almost accidental research on UK so-called national debt to GDP ratios whilst working on the book I am writing.

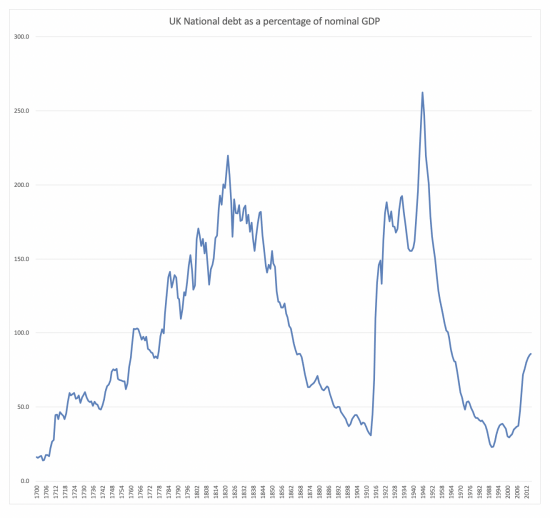

Using the long term macroeconomic data published by the Bank of England I calculated the average so-called national debt to GDP ratio over a 315 year period from 1700 to 2015, the chart for which looks like this:

The average is 98.1 per cent over that 315 year period.

Then I noted this data in the ONS report on the government's finances for February 2022, where this is said:

- Public sector net debt excluding public sector banks (PSND ex) was £2,326.8 billion at the end of February 2022 or around 94.7% of gross domestic product (GDP), maintaining a level not seen since the early 1960s.

- Public sector net debt excluding public sector banks and the Bank of England (PSND ex BoE) was £2,005.3 billion at the end of February 2022 or around 81.6% of GDP.

If the first estimate was adjusted for QE debt of £895 billion the net debt would be £1,431 billion. That is about 58.3% of GDP.

Even if the government's made up figure for the national debt, which is the first noted and which the ONS press release undermines by offering an alternative that eliminates some of the impacts of QE, the current level of so-called national debt is below long term average for the UK, and when properly stated net of the government debt that the government actually owns itself, the figure is at the lower end of the recorded scales of so-called debt over this period. As will be apparent, the number of years when the national debt is less than 58.3% is small, being 104 years in total, but 38 of them are before 1742. Since 1800 just 65 have been.

Three points follow. First, I call this so-called national debt because there is no debt here. These balances are for savings held with the government, which is the safest place of deposit for any saver seeking security for their funds.

Second, to pretend that whatever of the available figures for debt is chosen that this debt is currently out of control is quite simply wrong in that case, most especially when current low costs of interest are taken into account.

Third, if debt is this low what is the reason for not spending £50 billion or so now to prevent the poverty we are now facing. What might the argument for that be?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

And what is the reason for not using more QE to invest in mitigating climate change at home and abroad, something which can both help with immediate and future food and energy security/costs and for which future generations will thank us?

There is no such argument

So how do we fund this? I’m not being difficult, just a) curious and concerned and b) not an expert in financing of public investment

How are we going to fund what?

Sorry, but can you be clearer?

Apologies. You mentioned spending £50 billion to help people with cost of living, e.g., energy costs. My question is how we also spend money to address energy supply in future which would also help with mitigating the impacts of climate change if we invest in renewables

That is the Green New Deal

I have written about this extensively

Se all my ebook Money for nothing and my Tweets for free

Instead they don’t seem at all bothered about whether or not there even are future generations. Maybe they collectively need diagnosis (not just Boris).

The only argument is an ideological one based on a false narrative.

The Tories believe that there is nothing they can do.

Yet hold on? They are literally saving money now for tax breaks for the election.

So the Tory situation needs to be unpicked a bit more.

Even if they really believe that the Government is in debt, it is this holding money back within their intellectual cage for tax break bribes for the 2024 election that is the clincher for me when there are other horrors that this money could be spent on right now.

It is this that marks them out as a particularly nasty bunch of people who have no right to be in office really.

Last night I saw a clip of David Cameron boasting that all his ministers had been charged with removing two regulations for every new one created; I saw Gavin Barwell – a complete numpty – now elevated to the Lords even though Grenfell had occurred.

Those Tories who got in in 2010 were vandals intent upon revenge on the public voting them out in 1997.

This was unfinished business for people who believe that only THEY have the right to govern.

Most of the Tories are not viable human beings to me. They are the worst of us.

I agree. The obsession with “The National Debt” is, at best, silly and at worst, malign. Also, DO keep on about how the APF holdings should be netted off against the gross figure that is published.

I would also add….

First, that the apparent sharp declines in debt after the Napoleonic wars, First Word War (briefly) and Second World war (most dramatically) are a little misleading. At first sight one might assume it was the result of running large budget surpluses to “pay back” the debt. In fact, it was mainly due to strong economic growth associated with the re-tooling of the Nation away from war towards national reconstruction. In no year after WW1 or WW2 was there any significant decline in the par value of the National Debt (just the odd year with a trivial decline). I think this carries strong messages for us as we need to transform our economy in the face of Climate Change and in response to Covid.

Second, the Gold Standard complicates things. It is a fascinating subject but, in short the return to the Gold Standard in 1923 led (in part) to the Great Depression; the maintenance of the Gold Standard after 1815 saw a massive deflation over the following decades that caused untold misery; Bretton Woods combined with the Marshal Plan delivered better results. The “bottom line” is that debt denominated in a commodity that you don’t produce is far more problematic than debt in a fiat currency.

Not a bad summary!

What’s the reason for comparing debt to national GDP in the imperial period?

Debt to national GDP is supposedly interesting because the second is a measure of the potential tax base, or perhaps 45-60% of that, whatever the current taxable limit is.

But when that tax base was the empire then the ratio needs to be redone to have the same meaning over time.

Imv oranges from the 18th century are being broadly compared to apples from the reign of QEII in this interesting piece.

Please supply the data

Adjust it for slavery

Submit your workings

Alternatively, accept this is a useful approximation

Your points still stand… but it is an interesting issue Janice raises – even if not in the way she thinks.

From the BoE data site that you reference, prices halved (!!!) between 1813 and 1851. It caused revolutions in continental Europe (1848 in particular) but I wonder whether plunder from empire prevented the grip of deflation causing revolution in England?

We only just avoided it….

And we had a financial crisis that year (the railway mania ended)

For your approximation to be useful you’d need to show the ratio of Debt to GIP (Gross Imperial Product).

But those were different times – you can only accumulate debt if there are willing lenders – and if you have a Navy, and the resources that the British Empire did then you are likely to attract willing lenders, because they think they have a reasonable expectation of being paid the coupon and getting the money back. The British Empire had the military might.

Different times. Incorporating the benefits of slavery into your analysis to say the debt ratio was higher back then, and *should* be meaningfully compared to now, and that wasn’t a major problem does your argument no favours.

You should start your time series from when there was no empire for practical purposes.

Debt to GDP please, when GDP didn’t include the benefits of slavery or empire.

So, you are not rising to the challenge

I thought not

I think your trolling here is over, not least because it looks like you have multiple identities – the sure sigh of a troll

Most of the taxes raised in the Empire were spent locally.

A lot of private wealth was brought to Britain.

But I am curious as to how you would separate trade income from the Empire and from trade with the rest of the world? After the mid 19th century we had free trade in most areas.

What do we all think is the predominant underlying reason, or driver, for this mad, cruel, imposition of austerity MkII at the worst possible time? PSR, above, suggests ideological obsession based on a false narrative. And a mad attempt to “save up” for a tax cut pre-election? Mad, because Sunak must know that with a fiat currency, the UK cannot actually save up money, or is it a case of making the figures look good?I s it driven by Sunak himself, or the godforsaken Treasury? Is it a desperate attempt to defend the increasingly shaky “tax-funds-spending/balance the books” narrative? Is Sunak a slave to mega Banks-his former employers- who are looking to assist vulture funds to buy up assets cheap when the crash comes? Is it a power-struggle between Sunak and Johnson? It’s certainly affected by the current weakness of the PM, who is well known to be a “wonky trolley” anyway, and cannot really dominate the Treasury/Sunak, even if he could make up his mind to do so. Is it just a hatred and contempt for the “peasants”, of whom they know little or nothing, and care much less? Or something else? Thoughts, please.

https://www.theguardian.com/politics/2022/apr/06/national-insurance-increase-is-right-and-fair-says-sajid-javid

“When we spend money on public services, whether it’s NHS or anything else, for that matter, the money can only come from two sources. You raise it directly for people today, that’s through taxes, or you borrow it, which essentially you are asking the next generation to pay for it”

Javid happily wheeled out again to justify regressive taxes with his fallacious reasoning.

We deserve better than this.

Thye usual drivel from these people

Could the national debt the government owes itself simply be deleted? To bring the value down to 58% of GDP? How could that be done mechanically? If it is possible, would it be worth a petition? If nothing else, this would raise awareness of the situtation, and is something that could spread rapidly across the wider public.

It could be

But they won’t do it

Richard. You asked “Why?”

I’ve been reading comments from 2012 when our current ministers were new MPs.

The following comments are from an article by John Cruddas in the Guardian that September.

“Britannia Unchained, the short tract written by a group of young, right-wing Tory MPs that is considered a route map to political renewal. Forget the small beer, shallow-end stuff of the news cycle: real unity is to be secured through rallying to the ideas in this book, and its generation of Tory “stars” putting a spark into their party and securing outright victory in 2015. That is quite a task for the MP authors Kwasi Kwarteng, Priti Patel, Dominic Raab, Chris Skidmore and Elizabeth Truss, yet they appear up for it.

Scratch off the veneer and all is revealed: a destructive economic liberalism that threatens the foundations of modern conservatism. The state is assumed always to be malign, and it’s taken for granted that the labour market is not flexible enough (is it ever?). For reform read marketisation and intensified commodification. In this world, safety nets stifle a “can-do” culture, weakening our work ethic and muscular individuality. Banking crises are simply part of the natural order of things; Britons are working fewer hours because they can’t be bothered or are wilfully avoiding work.

For these authors – all members of the party’s right-leaning Free Enterprise Group – it is a binary world, where everything is forward or back, progress or decline, sink or swim, good or bad. They do not appear to see the world as a complex place. The choice is between regulation and dynamism: their ideal worker is one prepared to work long hours, commute long distances and expect no employment protection and low pay. Their solution to the problem of childcare is unregulated, “informal and cheap childminders”. We need dramatic cuts in public expenditure, they argue, to be matched by equivalent tax cuts. The demonisation of the welfare recipient continues apace; a broad dystopian worldview dominates the future. The bottom line for these Tory radicals is that the notion of community, society or indeed country is always trumped by textbook economic liberalism.

. . . the authors of Britannia Unchained represent a project that is extreme and destructive, and which threatens the essential character of our nation.”

And now, ten years later, they have the power. They are our government.

Indeed

So scary that they won power

And still have it

What is it that these supposed conservatives actually wish to conserve, bar their own privilege? Not much.