There is one chart, above all others, in those produced by the Office for Budget Responsibility that really reveals the assumptions that have been made by the government when presenting the budget. That is the graph for the sectoral balances.

The sectoral balances are based on an accounting equation. The equation is quite a simple one. It says that for every borrower there must be a lender. That, of course, has to be true.

The equation also says that there are only four sectors in the whole economy. They are the government, the public, companies and overseas i.e., those people who choose to leave their money in the UK even though they themselves are not resident here.

The accounting identity that underpins the sectoral balances is really very simple. As a matter of fact (and double entry accounting does, as a matter of necessity require this) the net borrowing and lending of these sectors must add up to zero.

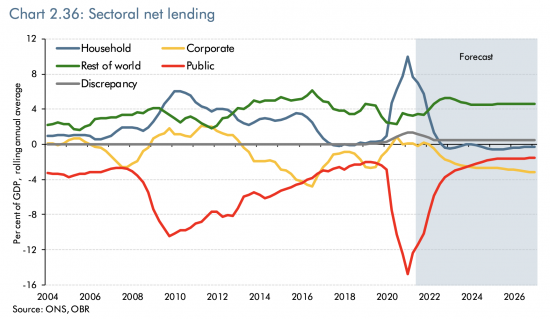

This is the chart of the sectoral balances included in today's publication from the Office for Budget Responsibility:

What it shows is very easy to explain. It says that despite the fact that we have had Brexit, and despite the fact that this threatens the stability of the UK financial system and London as a financial hub, more people from overseas are going to leave money in the UK than they have customarily done to date, looking at long term trends. I have to be honest and say that I think this unlikely.

Then look at the line for households Where the claim is that over the next five years households are going to be net borrowers i.e., we are all going to spend our savings and then overdraw our bank or credit cards to fund our lifestyles. Now, given the poverty that the government is seemingly wishing to impose on the country that may be true, but it also suggests that there is a coming debt crisis in UK households because this really is unsustainable borrowing. Alternatively, and given past patterns of behaviour, it could be entirely reasonably concluded that this is total nonsense.

After that, look at the corporate line. What the government is predicting is persistent, high level, and ongoing levels of corporate borrowing. I am aware that this happened from 2012 to 2016, but the world was very different then. Most UK companies now have record levels of debt already on their balance sheets. Most companies already face difficulty in repaying the debt that they have incurred to keep them going through the covid crisis. Banks are very reluctant to lend at present as a consequence, precisely because companies are already maxed out on their credit. So, what is the likelihood that this is going to happen? I would suggest that it is next to zero.

Finally, we come to the government borrowing line. As you will note the forecast here is that there will be a very rapid improvement in the government's financial situation, with borrowing falling heavily. But note what I have already said in this post. This can only be true if the other 3 sectors behave as the government is forecasting, and as I have noted, each of them would have to act aberrationally, given the facts that we know, for this to be true. The likelihood that anyone of those forecasts is wrong is high. There is a significant chance that they are all hopelessly optimistic. In that case what chance is there that the government will cut debt as this forecast from the Office for Budget Responsibility predicts? I would very strongly suggest that it is close to zero.

The reality is that, as has been the case ever since the Office for Budget Responsibility was created in 2010, its forecasts are wildly optimistic with regard to debt. As a result, the fiscal rule that Rishi Sunak has laid out today has little or no chance of working as he predicts. The government will be in significant debt over this period, and that is without even taking into consideration the similarly wildly optimistic growth forecasts that the Office for Budget Responsibility has also made.

Put simply, at a macroeconomic level, this budget is built on make believe by a Chancellor out of touch with reality.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I totally agree that the budget is make believe and way too optimistic.

But the basis for this is to me is deliberate because the chancellor is in touch with other priorities – such as surviving the consequences of Covid /BREXIT within the confines of the economic belief system he and his fellow Tories adhere to. I think that Sunak & Co are reaching the very upper limits of what they can do within the narrow ideology they impose upon themselves.

I think that the Tories know that they are in for rough time and and are preparing to spend – but as little as they can get away with.

This is to me is a contingent budget based on ”Erm – let’s see what happens’ – which is bad enough believe you me.

All I’m disagreeing ever so slightly with, is motive. That’s all. All I see is something with self-preservation writ all over it. It’s not about us, corporations, public sector or households. It’s about themselves.

There is one thing the Tories have never been out of touch with – the need to be in and retain power, even when they make it so hard for themselves.

My blood pressure was at severe risk while listening to so much nonsense talked about growth and taxpayers money, from both sides – and zilch about climate change from the Chancellor. So it’s great to see some sense here.

One question about the OBR plot of sectoral balances – what does the Discrepancy plotted on the chart mean? It seems to have arisen during the pandemic, and persists thereafter. Are they just admitting that their sums don’t add up, or is there something behind it?

They say:

“In practice, ONS estimates of sectoral net lending do not sum precisely to zero, reflecting differences between the income and expenditure measures of GDP (the ‘statistical discrepancy’). Our standard practice is to assume that this difference remains flat over the forecast period from the most recent data.”

This is odd as the ONS reconcile this monthly….I have not gone into the detailed workings to explore the issue

You are making a large number of very significant mistakes in your article. You also make a very large number of claims and assertions which have no evidence to back them up.

Firstly, sectoral balances simply do not mean that much. It is true that for every borrower there must be a lender, but that does not in itself mean anything. Added value is what drives economies and GDP growth.

You make an unevidenced claim that overseas inflows have to increase past customary levels. The chart shows inflows returning to a not unprecedented level of 4% – which is approximately the long term trend.

Regarding households, you misunderstand the graph and again make claims which do not reflect reality. You say that households are going to be large net borrowers, when the chart shows that households are expected be neither borrowing or saving to any significant extent. You also miss that the chart is a rolling annual average, which means the years after such a surge in savings you are likely to see the savings rate tail off. You then claim there is a coming debt crisis, even though the chart tells you nothing of the sort because borrowing is unsustainable – even though the chart is showing no real net borrowing among households.

I also find it slightly odd that you seem to think that household borrowing will be unsustainable when government borrowing – which will continue and at a much larger scale – will not be in other articles you have posted. In fact, you go as far as to say there should be more of it.

Given that the sectoral balance accounting identity must hold, if the government is to borrow even more, who is to be the saver?

Regarding corporates, you make another totally unevidenced claim that debt levels are at record levels and are finding it difficult to repay. There is simply no evidence for this. Corporate debt to GBP levels have been trending down since 2010 and credit spreads (representing the cost of borrowing and the likelihood of repayment to an investor) are at all time lows.

As for the government line – I refer to the question posed above. You are saying here though that government debt is a problem. I find this strange as in almost every other post I have read of yours you advocate for a lot more of it and saying the government is not limited in any manner by the amount of debt it can raise or amount it can borrow.

Clearly you cannot be on both side of the argument and be correct both times.

First, I deal with the growth issue in another blog. It’s the one after this one: mot hard to find then.

Second, I said there was no reason why overseas balances should stay at that level. You missed the point. Maybe you have not noticed what is going on in the world.

Re households, I am right: the assumption is that the savings ratio will crash. Other data in the OBR report confirms it.

And no, this is not a rolling average: it is a statement of balances. Do you know what you are talking about?

In addition, I guess you know government borrowing is always sustainable because governments create money and so in a situation like that of the UK cannot default? Households can. It’s a pretty basic error that you make.

As for household debt – the forecast is increased debt: the figures show so

On corporates – you have obviously not heard of Covid loans

And on government – I am saying there will be much more government debt. I am relaxed about this. I am saying Sunak is wrong. That is all.

You are on every one of your claims. Worse than him on that score.

I don’t know if this is relevant here. And I would fully understand not including it. Your main post i completely agree with.

On corporate loans. We had a Covid one because we could. Haven’t spent a penny of it. Have a lot of spending to do. We will. And use that. We won’t need to borrow much more. Once Covid is over. And we can find anyone available to do it. Because of BrexShit.

I am sure you are right that the forward projections are make believe. But I am trying to decide whether that is good news or bad.

In the fairytale world where consumers are boosting the economy by spending their savings, companies are investing to increase production and the rest of the world is putting money in – there is no need to impose more austerity* and government spending can be increased. While the justifications are wrong, that isn’t a bad thing even if more could be done.

By the way, were others as nonplussed as I was by the Conservatives making a big deal of finally putting money in education – with the aim of returning to the real terms funding they inherited from their predecessors? Clearly Sunak doesn’t do irony.

[*Other than the tax rise and UC cut he cleverly announced separately from the budget].

Well it’s a very pretty and colourful graph, but I’m inclined to share your scepticism that it is likely to be predictive.

GDP growth would need to be phenomenal for it even to be a possibility wouldn’t it?

……and I don’t believe these ‘V’ shaped reverses. They appear fantastical.

Great piece richard with which i totally agree. But your headline only goes to show how slavishly he is following our pm.