Thew Counterbalance is a project from my old colleagues John Christensen and Nick Shaxson working with competition lawyer Michelle Meagher. The project tackles the abuse from modern monopolies. This is the latest edition of their newsletter:

An avalanche of trouble seems headed towards Big Tech in the United States, as the Biden administration makes a dramatic break with its Republican and Democrat predecessors and starts to take concentrated corporate power seriously for the first time in decades.

We will discuss this lower down, but this edition focuses on an interview with Jan Eeckhout, economist and author of The Profit Paradox, a major new book addressing one of the biggest questions in the world economy today: why, in a world of plenty and soaring asset prices, is there so much hardship and inequality? A central part of the answer is: mergers, monopolies, and concentrated economic power.

The book is important for several reasons. First, while a hefty pile of new books, many excellent, have been published on monopolies and market power in the last year or two, nearly all focus on the United States. The Balanced Economy Project's focus is explicitly on countries outside the U.S., so we're delighted that this book takes a global view. Second, it pushes back against quite a widespread misconception that monopoly is largely an American problem and that Europeans in particular are protected by strong competition authorities. Third, it is one of those relatively rare books that combines an easy read with deep and rich scholarship from an expert in the field.

The Endnotes look at the bold antitrust moves in the United States, an instructive merger prohibition in South Africa, news on Apple-Google collusion, and plenty more.

The exchange below is the product of two interviews by Balanced Economy's Nicholas Shaxson with Jan Eeckhout.

THE INTERVIEW: JAN EECKHOUT

NS The subtitle to your book is “How thriving firms threaten the future of work.” That already sounds quite paradoxical. What is the Profit Paradox?

JE Look at the stock market: it's through the roof. You may think, ‘if business is doing well, this is good for the economy.' And in general, if you have innovation, and firms making new discoveries, and if they are doing well for that reason, it is a good sign, and that improves standards of living. But if these profits and stock market valuations are driven by the fact that these firms exert their dominance, their market power, if that is the reason then these positive effects for the economy aren't there. It's the opposite. The types of negative effects we see are lower wages, lower business dynamism, fewer startups and so on. That is the main mechanism behind this paradoxical outcome: that high profits may not be good for the economy.

NS Just to understand, how do you measure this dominance?

JE There are different ways of looking at the problem. I will focus here on three, but there are others.

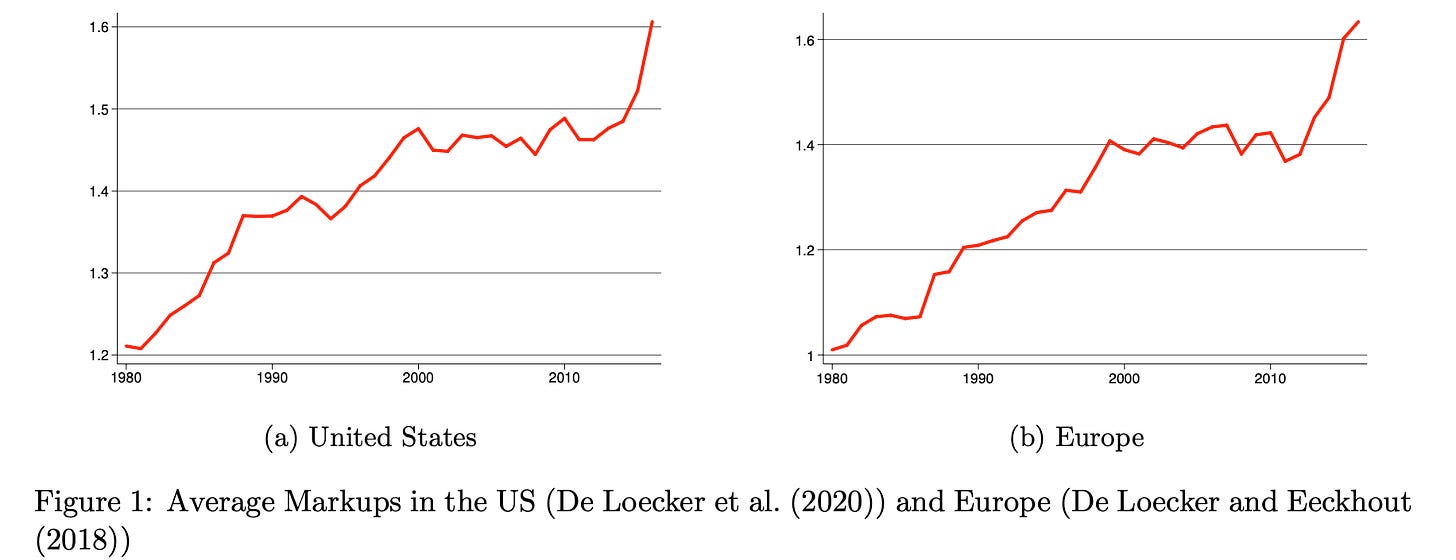

The simplest way is to look at what we call the markup, or the margin. [JE picks up a pen, on the Zoom call.] If I want to sell this pen, there is plastic in it, some metal, there were some machines I needed to produce them, and labour. That is my cost to produce, the marginal cost for each additional unit, to produce this pen. The markup is basically the ratio of price at which I sell it, versus this cost. That markup has gone from 1.2, or 20 percent above costs, to 60 percent above costs in recent years.

That is the first measure. Now you might say this measure doesn't take into account research and development, or marketing, or advertising, or executive salaries i.e. overhead costs. Maybe firms have increased their markup because they have higher overhead costs? So for our second measure, we look at profits or profit rates. And here, it turns out that even if these overhead costs have gone up, the markups have more than compensated for the increase. The profit rate, which is profits as share of sales, has risen from 1-2 percent in the 1980s to 7-8 percent now.

Then there is a third measure, at least for publicly traded firms. This is the market valuation on a stock market. The share price of a firm tells you not just about its profits today, but it is an even broader measure because it tells us about the profits we expect in future. If you look there, at the market valuation as a share of sales, we see that this has risen on average from around 50 percent in the 1980s, to 150 percent today. This has risen by a factor of three. This measure of profits is also consistent with those other two measures.

But we have to be careful: markups, profits rates and market valuations go up enormously for a few firms, but for most firms they stay the same. For the median firm — not the average firm but the 50th percentile firm — there has hardly been any change at all.

NS You have painted quite a stark picture of rising market power at a global level. But if you break it down geographically, patterns emerge. Thomas Philippon's 2019 book The Great Reversal: How America Gave up on Free Markets argued that while market concentration has increased dramatically in the United States, it had not in Europe. This message doesn't ring true for us at the Balanced Economy Project, given that European antitrust authorities have almost never blocked a merger, and giant firms now dominate pretty much every sector here.

In your recent review of The Great Reversal I found a neat explanation for your difference in opinion about the US versus Europe. For Europe, Philippon used Orbis data from 2000-2014, which coincided roughly with the “China shock” after China entered the WTO in 2001, when its cheap exports pushed down prices (and markups). This flattened the graph for that particular period, giving an impression that Europe has been doing OK. For the US, older data was available, showing a longer trend of rising market power. But there is another dataset from Worldscope which now allows us to look further back in Europe, too, and this changes the picture:

JE Well, as I said in that review, Thomas' book is a remarkable piece of research and I agree with 99 percent of it.

But you can see that from about 2000-2010, there is a flatness on the [above] graphs, with a sharp increase in markups before and after that time, for both Europe and the United States. We cannot conclude from this that there is a difference between the United States and Europe.

We also have some differences in emphasis, in terms of what has driven these changes. Thomas emphasises lax antitrust as the dominant explanation, whereas I think that technological change has also been important, in addition to lax antitrust. The shift of economic activity towards high markup, ‘superstar' firms is driven by both factors, in my opinion. Globalisation is also part of that.

NS Some people find it hard to see how big dominant firms push down wages. Google, Facebook, HSBC or Bayer & Monsanto pay employees huge salaries. How can that lower wages? And if someone builds monopoly power in, say, the beer industry and pays workers too little, why can't they go and work somewhere else, where the pay is better?

The mechanism is subtle. It's not that these big firms are paying their workers too little. It's more like an economy-wide effect. This is also happening beyond tech: in textiles, in the beer industry, in publishing, retail, wholesale, anything: you name it, it is dominated by some of these large firms. All these firms set their prices too high relative to costs, so all these firms sell less than what they could in a competitive market, and all these firms are producing less, and demanding less labour. That is where the drop in wages comes from.

Can market power in the beer industry affect the entire labour market? No, because beer is just a small share of people's consumption. But we see behemoth firms dominating all markets. And there is ample evidence that firms with higher market power spend less on labour.

And this might explain one of the great puzzles in economics of recent years: the decline of what we call the “labour share.” That is the share of income or GDP that goes to workers.

Decades ago, economists including Nicholas Kaldor and Arthur Bowley argued that there were certain so-called “stylised facts,” which in physics we would call universal laws. One of these was that the labour share remained constant, at about two thirds of GDP, with capital and profits taking up one third. This had remained remarkably constant even despite huge changes in the labour force, for example as workers left agriculture over the past century and moved to manufacturing and other jobs. It was as if this had been constant forever.

But then in 1980, around the world, the labour share began to decline, from 65-66 percent of GDP, to about 58-59 percent today. That is a big deal.

In addition, our research shows that GDP now is 9-10 percent lower compared to what it would have been if we had had the competitiveness of 1980.

NS The World Bank currently estimates global GDP at about US$ 87 trilion. So 9-10 percent of GDP is worth eight trillion dollars or so. And the seven percentage point decline in the labour share that you describe would be worth about six trillion. Workers would have six trillion more in their pockets, globally, each year, if the labour share of GDP was what it was back then! The declining labour share distributes the pie more unequally, but the GDP loss shrinks the total pie too. It seems from your work that lax antitrust is a key part of the explanation in both cases.

In my earlier work I am familiar with global estimates of corporate tax avoidance of the order of $5-600 billion in annual global revenue losses. But $6-8 trillion is an order of magnitude bigger. Tax is important, but it amazes me that so little attention is being paid to antitrust outside the United States and outside narrow technocratic circles. Is my back-of-the-envelope calculation a reasonable one?

JE Yes. This is another way of looking at the Profit Paradox. If profits go up as a share of the economy, it must come from somewhere. It means less is spent on labour. More profits, workers are worse off. But also remember: in my opinion lax antitrust is only part of the story. Technological change plays a big role too. So does globalisation.

NS As an economist, how do you untangle market power from technological change, or globalisation in terms of impacts. Can you say it was ‘this factor more than this factor?' Google is clearly an example of all these factors.

JE It is a very hard problem. Market power in retail is totally different to market power in social networks, or in the biomedical industry where they produce vaccines. And Inditex [the fashion firm that owns Zara and other brands] is as much a technology company as Amazon is, in many ways.

You must study each market, being very specific about each one, and this can only be done by dedicating many more resources to it. And you also have to recognise that these changes have economy-wide consequences, going through the macro economy — whether it is declining start-up rates, declining wage rates, or increases in inequality. These effects are driven by everything going on, in many different ways specific to each market.

Disentangling all this from a policy perspective, you have to look at it on a case by case basis.

NS In our last newsletter about dominant supermarkets and their submissive suppliers, we described a kind of ‘gravitational pull' effect where the dominant firms take the lion's share of the rewards, leaving the suppliers (and their employees) dependent on the dominant firms to fight for the scraps. Is this a big part of the story?

JE This is one of several effects. Amazon is a master in doing that. It is not a matter of all businesses doing well, but some doing well and everyone else gets squeezed. Suppliers and workers are getting screwed one way or another — directly like this, but also through this general macro effect on the economy.

NS What does your research tell us in terms of solutions?

JE We have to be careful to understand how firms grew dominant. If they grew dominant because they were so efficient — technology being the hero -- then that is different than if they grew through mergers and acquisitions (M&A). Technology is a villain at the same time as it allows firms to become dominant because they are so productive. Being productive is great, but maybe they don't pass that on to consumers. You don't want to throw out the hero part: you want to address the villain part.

So if we are talking about splitting firms that have grown through M&A, I can definitely see that, we should split Facebook from Instagram and Whatsapp. But splitting Amazon is different. You could be throwing away some of the good parts, like digging up railway lines. You may have to find cleverer policies. I am not saying that will be easy. But it's different from just saying “let's split it up.”

And let me make a clarification here. What we call antitrust at the moment is anything that helps address issues of market power — whether the dominance is due to technological change, or due to M&A. I completely agree that antitrust policy is the solution, using a broad definition of antitrust. We have to deploy antitrust that addresses not just M&A but also the consequences of fast technological change. I believe there is a consensus about this, even if there is no consensus about how to do it.

END

ENDNOTES

Biden's stunning appointment

The top worldwide antitrust story — it's stunning news — is the appointment of 32 year old Lina Khan, a leader of the radical new antitrust movement there, to chair the Federal Trade Commission (FTC,) one of the two main agencies (alongside the Department of Justice) that enforces antitrust law. This is a bit like appointing Greta Thunberg to, say, the top environmental post in the EU. Khan is widely respected, fierce, intensely knowledgeable, and courageous. Crucially, her appointment received wide bipartisan support in the Senate, suggesting that the FTC may be allowed to grow real teeth. Listen to this BBC interview with the lawyerly Khan, here.

But there's even more to celebrate in the U.S., following last year's Department of Justice landmark lawsuit against Google in October; a groundbreaking House antitrust report the same month; the FTC's heavyweight lawsuit in December against Facebook, lawsuits against Facebook and Google supported by nearly all state attorneys-general, and Attorney-General Karl Racine's suit against Amazon in March for anticompetitive practices. As if that wasn't enough heat on Big Tech, the House antitrust subcommittee introduced five new bills in June, again with bipartisan support, each taking aim at a different aspect of Big Tech. They include David Ciciline's bill targeting platforms like Amazon that self-preference their own products over their competitors (a problem that we described in a previous newsletter); Hakeem Jeffries' bill putting the burden of proof on platforms to show that acquisitions do not harm competition; and Pramila Jayapal's bill to eliminate platforms' conflicts of interests where they both host other providers and also compete with them — and calls for breakup if they violate this. Another, proposed by Mary Gay Scanlon, requires inter-operability with other platforms, so users can easily escape one and migrate to another; while a fifth authorises more money for the Department of Justice's Antitrust Division and the FTC, and makes filing fees for mergers more expensive too. There is also a new antitrust bill in New York inspired by EU competition law (in particular, lowering the market share threshold for monopoly from 70-90% towards the European level of 40%). See more here.

Smug Europeans who felt their antitrust system was better than that in the United States are being left in the dust. The U.S. antitrust movement is gaining serious traction at last. Read more here.

Apple and Google in cahoots

In the UK, the Competition and Markets Authority has launched a market study into Apple's and Google's “effective duopoly” over mobile ecosystems. For more details on this duopoly, and especially on the close and multi-faceted collusion between the two tech giants, see this, from Marketers for an Open Web. This has wide global ramifications, though we also worry about media coverage for such arrangements because of things like this.

South Africa blocks Burger King merger on public interest grounds

On June 1 South Africa's Competition Commission prohibited a merger for the first time on public interest grounds. The acquisition of Burger King South Africa and Grand Foods by ECP Africa (and its associated funds) was blocked on an argument that it would reduce the shareholdings of historically disadvantaged individuals (HDPs). Public interest continues to be a core value of the South African Competition Act, as reflected in a series of amendments in 2018. The minister for Trade, Industry and Competition said the bill “will enable competition law to support our efforts to greater economic inclusion and injecting more dynamism in the economy. It is a critical tool for the state to strengthen its ability to act against companies who abuse their dominance in the market and to protect and advance the interests of SMEs and township entrepreneurs."

Breakups in Germany

Allies of ours in Germany have published a statement, reported in the Süddeutsche Zeitung, pushing for the creation of a breakup law as a necessary tool in any country's anti-monopoly arsenal.

Other US antitrust news

Access to Marketsis a brilliant new initiative by Denise Hearn (co-author of The Myth of Capitalism) and the American Economic Liberties Project. They warn that those, especially on the Right, concerned with government bureaucracy should pay attention to the byzantine rules and taxes imposed by private governments in the form of monopolistic gatekeepers: The Other Red Tape. (See also Denise's remarks on monopoly and political freedom at a recent Canadian Competition Bureau conference.)

Big Tech and tax

The Fair Tax Foundation revealed that the six biggest global tech companies have managed to avoid $100bn in tax over the last decade. Separately, Actionaid calculated that the biggest five tech firms are escaping over $32 billion in tax each year, enough to pay for a two-dose vaccination for every human on earth. A third study by Taxwatch found that eight large tech firms escaped £1.5 billion, nearly US$ 2 billion, in the UK alone in 2019. (And watch out for a forthcoming article on the G7 tax deal from Balanced Economy Co-founder Nicholas Shaxson, in Foreign Affairs.)

Euro-moves

The EU has excluded 10 of the biggest banks including JPMorgan, Citigroup, Bank of America and Barclays from running lucrative bond sales as part of its €800bn recovery fund, over historic breaches of antitrust rules.

The European Commission said it will investigate whether Facebook misuses a trove of data gathered from advertisers to compete against them in classified ads. It will also check if the company unfairly ties its Marketplace small ad service to the social network.

Our news

Our co-founder Michelle wrote a piece for the Guardian warning of the threat that instant grocery apps and the finance that is weighing behind them pose to your local highstreet, and she's talking about this on the BBC World Service's Food Chain programme on June 23. Michelle will also be on a panel with Lina Khan, Tommaso Valletti, Stacy Mitchell and others at the Oxford Antitrust Enforcement Symposium on 25th June and will be participating in a conference on the Penrose Review of UK Competition Policy on the 8th July 2021. (We'll be publishing our view of the Penrose Review on the newsletter shortly.) We also gave a teach-in to the Competition and Markets Authority of the UK on the role of private equity in children's social care, and we will publish more on this soon. (See our first submission here.)

A reading list

Anyone looking for some summer anti-monopoly reading should look at the syllabus reading list for the Law and Political Economy Anti-Monopoly Summer School compiled by leading thinkers behind the shift in antitrust thinking over the last few years, including (among others) Lina Khan, Sandeep Vaheesan, Sanjukta Paul, Amy Kapczynski, William Novak, Frank Pasquale, Saule Omarova, Zephyr Teachout, K. Sabeel Rahman, Marshall Steinbaum and Suresh Naidu. We would add as essential books to read Barry Lynn's Liberty from All Masters, Matt Stoller's Goliath, David Dayen's Monopolized, and Sally Hubbard's Monopolies Suck. And, of course, Michelle's book Competition is Killing Us.

As mentioned, nearly all these books (apart from Michelle's) focus mainly on the US; it's urgently important to broaden the field internationally.

| 4 |

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I always find cancer a useful model for the market economy. In accordance with good economic principles, the cancer cell is more efficient and has a selective advantage. Sadly, in the end the cancer and the patient both die.

Perhaps this is simplistic, but it seems to me that, in the absence of measures to counteract it, the unconstrained capitalist economy acts as a great sucking machine, providing excess returns on capital and impoverishing those without, and making almost everyone less happy. That also tends towards monopoly as those at the top buy out their competitors.

Among the measures to counteract this tendency are taxes on income and capital and wealth and inheritance and spending, and strong rules for the market with strong regulators, including effective completion regulation. The continued growth of inequality demonstrates that we have not got this right, and it is getting worse.

Having a bad morning. I meant *competition* regulation. I could blame the autocorrect, but it was probably my own fault.

It happens to us all….

Still need more explanation about the Finance role in the grand scheme of M&A – always gaining from both sides of the deals. While always having had control of these ‘Capitalists’ which equates directly to a shadow cartel activity – regardless of how much market share any one capitalist enterprise has aided and abetted by the number wizards, their controlled Auditors. With promiscuous unruly bed hopping to keep them dancing to the same tune.

They are engineering the Inflation they so desire, to launch their centennial harvesting of the pumped up assets and the usual losers – the companies, individual mortagees and their personal pensions. At the behest of these super wizards controllers behind the curtain. The fake cartel invented inflation has nothing to do with wages and cost of Labour as the first part explains. Which is low across the developed global arena over the decade for one reason only it seems – Austerity. Imposed by Political choice and governments – as if they ALL dance to the same tune and string pulling and narrative management. Interest rates have to increase to start the great defaulting wave. It seems obvious to me.

Hence it was nice to see this near the end :

“ The EU has excluded 10 of the biggest banks including JPMorgan, Citigroup, Bank of America and Barclays from running lucrative bond sales as part of its €800bn recovery fund, over historic breaches of antitrust rules.”

In response- it seems like the usual Hollywood, American fairy tale narrative. a fresh faced anti-trust mask has been put on to hide these craggy avaricious old sorcerers evil visages. .

Let’s see if young smart Khan really has a go at dealing with that shit in her own home first or ends up actually defending their rights to dodoo on the RoW’s door steps – how exactly will she react to the EU moves? Full support?

I won’t hold my breath too long.

This is welcome is it is an often overlooked phenomenon.

From what I know of modern markets in the Neo-liberal Age, everything is set up to be pro-monopoly anyway.

New entry into the market has to have a lot of capital up front to sit at the same table as the established ‘big boys’ – usually funded by debt. And then, if you are moderately successful, the big monopolies come along and buy you up through the vagaries of the stock market and absorb you into their operation rather than compete.

As a monopoly – c’mon – what is there not to like? All the start ups and new entrants do your R&D for you don’t they to keep your investors happy.

‘Markets’ eh – the best processor of information? Yes – only if you want to buy out the competition.

The best allocator of resources? Yes – only if you want to diverge much needed money away from R&D and into acquisitions and stuff like Viagra.

The best way to use competition to get better services, products and prices? – Yes – but only if you are a monopoly.

It’s good to see a renewed focus on the governance of capitalism. The US, since the Progressive Era was always good on this – until the dogma of this misnamed neoliberalism secured an ascendancy over the last four decades. Europe’s record has been poor to patchy. The Biden administration is pivoting determinedly away from neoliberalism and getting stuck in to the governance of capitalism. But a flaky majority in the House and none in the Senate means it has its work cut out. There are a handful of sensible Republicans who know that changes are needed, but it’ll be hard to get 10 in the Senate to break the filibuster. And the majority in the House in vulnerable to the antics of the Squad and the Sandersistas who, like so many on the left here and in Europe, believe that capitalism is always and everywhere evil, could scupper things.

This sort of stuff doesn’t get the pulse racing, but its crucial.