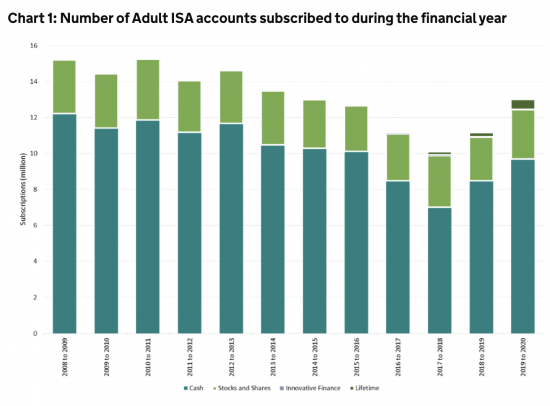

I was intrigued to note the data on ISA savings that has recently been issued by the government. This chart might summarise the trend in the number of savers:

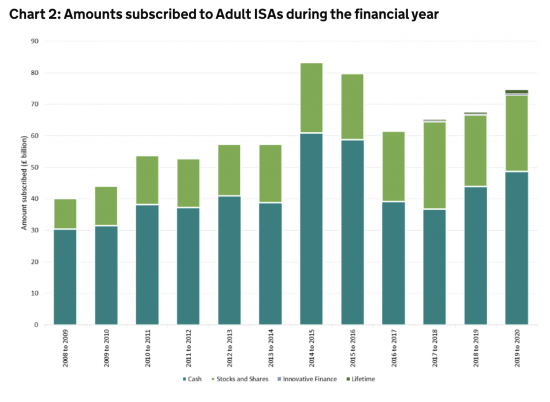

And this chart shows the amounts subscribed:

First, note that it took a long time for people to stop saving after 2008.

Second, note they had been saving again before the current crisis began.

Third, we are aware that savings have now increased dramatically. But note that the baseline is over £70 billion of ISA saving a year (although some, but by no means all of this may be recycled from old accounts). This is still enough though to fund the Green New Deal if placed in hypothecated accounts for this purpose, as I propose.

And fourth, note that cash is very much preferred.

Time and again commentators on here suggest no rational person will save in cash. Time and gain I disagree. Let's summarise why.

First, if rates rise bond prices will fall. Going for cash for security might make sense now.

Second, we do not have the data required to rationally choose ESG investments, and most especially when it comes to environmental issues. So why take the risk when there is so much greenwash rather than hard accounting data round? This will change if and when we have sustainable cost accounting.

Third, markets remain overvalued, largely because of QE funding. This is deliberate.

Fourth, many companies are overvalued because they have been over distributing dividends in proportion to profits.

Fifth, the idea that we are going back to normal is absurd: Covid is changing the economy for good, as will climate change.

So, cash makes sense. But in that case let us put the cash to use by requiring that it be saved in hypothecated Green New Deal accounts. Paying fair (above current market) rates of interest these will lock cash up for several years and let it be used for the green transformation of the economy.

Rationally, this makes sense.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Economists need to think more about how/why real people save in real life. It is important because the pool of money is large and has real potential to impact the economy in good and bad ways.

Excess savings drain spending power from the system. Large pools of cash raise risks of a run on the currency, bubbles in housing or other assets etc…. but equally they can be harnessed for productive investment.

You correctly observe that savings in cash are up even though rates are zero – that is a fact. Economists, commentators and policymakers need to recognise this (and not suggest it is irrational, because it in NOT irrational).

You and others have put the “Green Deal” out there. Labour has put the “Recovery Bond” out there. I see plenty of criticism of both but no alternatives. Those opposing these ideas need to offer a solution…. or step aside and let those with the ideas proceed.

Thanks

There’ll be no ‘stepping aside’ when the intention is to do nothing in the hope that the private sector offers a more expensive alternative.

After all we don’t want to ‘crowd out the private sector ‘ do we – poor dears.

Couple of points of clarification please:

– previously, you’ve argued that ISA tax allowances should be restricted to the ‘Green ISA’ and removed from other ISAs. Is that still the proposal?

– when you say ‘lock cash up fro several years’ is the proposal for fixed term rather than instant access?

I would suggest on ly Green ISAs get relief in the future – I think all tax reliefs require a social purpose and saving is an insufficient justification as such

And yes I am proposing fixed terms as was implicit in ISAs at the start

One more point please:

The term Cash ISA is used to distinguish between cash & stocks & shares ISAs.

Cash ISAs can be instant access or fixed term.

What is the proposal for stocks & shares ISAs?

There isn’t one at present, but we are working on it.

Hello Richard

What’s your proposed ‘fair’ interest rate?

I invest in mainly smaller companies, spread over a wide range of sectors as I always think it a grave and foolish mistake to be invested in one sector only. Over the last 11 years I have average around 9% p.a. each year (it pays to reinvest dividends!) and so up in total around 150%.

I’d be interested in seeing how that compares with your proposals.

Also, how much do you currently have invested in the ‘green’ sector?

We are suggesting 1%

And you can have your investment choices with all the risks attached

Others don’t want your approach. My suggestion. Is for those who do not want to do what you do

Their choice is as valid as yours. So what point are you making? None, it seems to me, of any use.

Interest rate should cover inflation, else savers lose money. So set rate to the official inflation target of 2%.

Sidebar: The official inflation rate should include a measure of house price inflation, unless this is targeted separately. Rising house prices are used to buy votes, like selling off council houses at half price. So ignoring house price inflation is a political decision.

Why is it the job of government to subsidise those wealthy enough to be able to save?

I asked an investment analysis I know about this and he pointed out that any investment in a new sector, new industries does carry risk.

Cash is going in and is then being invested in industry. It obviously then ceases to be cash. Some investments would inevitably fail, some might take many years before they could return a profit. What would happen when early investors wanted their cash back and there wasn’t any to give them?

To me the answer is obvious as ‘old’ investors wanting their cash back could be repaid from the cash put in by ‘new’ investors who had recently invested.

Read what I have proposed

This is not an investment in the industry

It is hypothecated saving – back by government guarantee as all cash saving is

Why not deal with what I proose and not your mythology?

At the expense of making the same point I have made in earlier threads again…………..

There is, in part as a result of QE, also as a consequence of under taxing the rich an awful lot of money running around looking for an investment opportunity.

This is having some significant ‘real-world’ consequences, the most obvious being the massive hikes in property prices, in particular in places like Wales and Cornwall. There are also issues that Richard understands better than I do in terms of the dividends some companies are paying out and the impact it has on them in the long term.

So given that ‘Taxing’ a lot of this money out of existence isnt possible for various reasons it needs to be ‘cancelled’ in other ways which is where ‘Green New Deal’ savings products come in.

I would advocate a range of products aimed at both individual savers and institutional investors to achieve this. My suggestions might include Index Linked bonds, the opportunity to buy some extra state pension, and possibly a version of ‘Help to Save’ giving everyone the opportunity to put away a limited amount of money with a slightly better than inflation return.

Might I also take a leaf from some of the stuff that has been produced by those looking at ‘Post Independence’ options for Scotland and suggesting that we need to develop and grow ‘financial institutions’ such as Credit Unions and Building Societies that cant ‘Create Money’ as a home for savings?

You get it

“the baseline is over £70 billion of ISA saving a year”

You seem to be labouring under a strange delusion if you think this means you will have £70bn each year to invest in green technologies.

Money is also taken out of ISAs each year. Figures from the report show (for example) that the amount of cash held in ISAs fell between 2015-16 and 2018-19 meaning more cash was being withdrawn than was being put in during those years. Not recycled. Withdrawn.

If something so basic has escaped your notice, it’s worrying.

And my proposal covers that point precisely because of course we took it into account

“And yes I am proposing fixed terms as was implicit in ISAs at the start”

So not cash then. What you are proposing is a bond, with some penalty for early redemption I assume.

People invest in cash ISAs because they are 100% liquid – being cash.

“We are suggesting 1%”

OK, so by investing in this fixed term product, you are locking in a loss thanks to inflation, and lose the liquidity of cash.

If people want liquidity, they’ll chose cash, and if they want a real return, they’ll go for a stocks and shares ISA and take the risk of a loss as opposed to a guaranteed one.

Oh come on, let’s stop being silly here

Term deposits are cash in savers eyes

As Clive Parry has commented – there are strong and wholly rational reasons for saving in cash. The majority of ISA savers do – putting tens of billions into such accounts, Many will be term accounts. And you think you know their situations better than they do.

That’s not just arrogant, it might suggest you are very wrong

Term deposits are otherwise known as fixed rate bonds.

They are not the same as cash in savers eyes, unless those savers are oblivious to the early withdrawal penalties or in some cases inability to withdraw before maturity at all. Whilst there are definitely reasons to hold savings in cash – liquidity being the main one – what you are proposing is not cash. It is a term deposit.

So either your 1% term ISA has a withdrawal penalty, as every other product would.

Or you are in effect raising interest rates to 1% – as banks (and other deposit taking institutions) would then be forced to pay 1% on their deposits to compete for cash. Which would raise interest rates across all other deposit and lending products.

Your call. Which is it?

You are wrong about how savers view these products

Of course there would be ab early withdrawal penalty

And that is what savers expect

But do they think of that as a bond? No. But you can if you wish. It makes no difference

But that’s the problem with all troll comments: they are all about irrelevance.

And yes, you are a troll because I can already tell you know all the usual tricks

You can call it cash, but if it has a fixed term and a withdrawal penalty….it’s a bond. Which investors will be well aware of given you have to disclose all the terms upfront.

Which is not the same as a cash ISA, which you can access with no withdrawal penalty.

At which point, why lock yourself into an investment which only has a 1% return, which after inflation (and the inevitable fees) is guaranteed to mean a loss.

With equities at least you can get a real return (10y mean return on equities is around 4% real, Gilts is 0.2% nominal, so negative in real terms) and with cash you have the liquidity.

To make the point quite clear – the amount invested directly in fixed term products through ISAs is tiny. There are already plenty of fixed rate ISAs out there offering more than 1%, so I’m not sure why you think people will suddenly flock to your Green ISA offering less, with worse investment characteristics than other options.

Twi things. Fixed term ISAs are called cash ISAs, just in case you did not know

And yes you can get more than 1% (just) with someone you have never heard of, and people don’t do that

Now stop trolling

Commentators are wrong if they say no rational person will save in cash, I suspect what they mean is that a person who had wealth they wanted to invest to make money wouldn’t put it in cash. That is completely different, most people save to give themselves a safety net and to fund a significant expense or possibly “treat” in the near future. Something most easily done through cash saving, even if it doesn’t hold its value in real terms.

That means that an attractive interest rate on cash within a “Green ISA” needs only to be a bit higher than rival cash savings rates to generate significant funding for projects. The key thing is that it needs to be available through the retail sources the average saver uses for savings, like building societies.

Such an ISA wouldn’t be intended for those who are investors rather than savers, those who are hoping to build wealth. Like your correspondent “Cautious One” (though his/her strategy doesn’t seem particularly cautious to me) they can invest directly in companies within the green sector which have the potential for much bigger gains, but also failures. Totally different. And I would be surprised if someone hasn’t already introduced a “Green Unit Trust” to do this with the added security of a single purchase spreading the risk between many companies in multiple sectors.

(My only caveat is that I wonder whether there might be other less direct social benefits of incentivising saving and investing via ISAs and SIPPs, and that would need analysis before any decision to limit them to a single fund. Nevertheless for both I suspect the thresholds are not well aligned to any potential social benefit).

I do like the idea of a green ISA but what’s the point with the tories in office, they’ve had two goes at a green deal and after the first effort, well supported by industry, collapsed they never used the phrase “lesson learn’t” once, they just outsourced to the well known green experts the Yanks and screwed up worse the second time.

As for saving in cash in inflationary times ….