I would love to think that this country is heading for good times again. Today's budget is not going to deliver that outcome.

There are three assumptions that reveal that. The first is that Covid is now over. It is as if the government think that coronavirus has signed up to its roadmap. The Health Services Journal noted this morning that the NHS in London is now preparing for a new Covid peak this year. I fear that they are wise to do so. The current policy of this government is to increase R, and to make it well over one. Another Covid crisis is the inevitable outcome. If it does, and anyone with any sense has to recognise the risk, then everything in this budget is going to be very wrong.

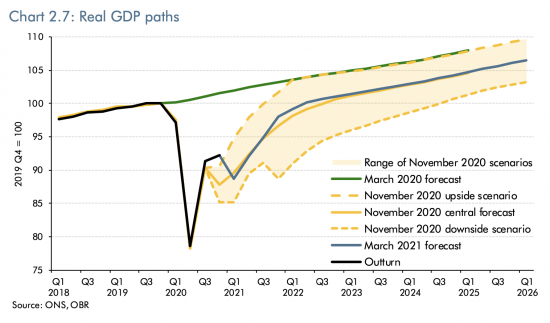

Second, I know the growth forecasts for the next few years (4% this year, 7% next year and less than 2% each year thereafter) are wildly too optimistic. That is not just because they have come from the Office for Budget Responsibility, who always over-predict growth. It is because I can read this chart:

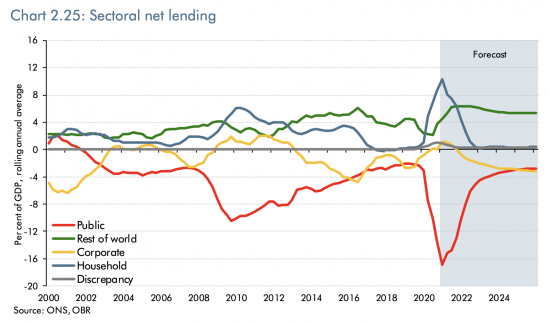

What this chart shows is who is borrowing and who is saving in the economy. The totals above and below the line have to balance: every saver needs a borrower.

What this chart shows is who is borrowing and who is saving in the economy. The totals above and below the line have to balance: every saver needs a borrower.

But look at what is forecast. According to the government business is, despite Brexit and all the crippling burdens of loans on its balance sheet from Covid losses incurred, going to invest very heavily, and borrow enormously over the years to come. In practice that is simply not going to happen. Record business investment will not happen because it requires confidence, good ideas and a belief that people will spend to justify that. But there is no reason at all to believe any of those conditions are going to exist.

And then look at the household line: there are going to be no net savings in a year or so. Households are going to spend, spend, spend. Two things follow. First, private debt will be escalating out of control in that case (as will be business borrowing). But also, that's not going to happen. And all I have to do is look at what happened after 2008. It took seven years after the crisis for that situation to arise. This crisis is much worse, and millions will be in fear of their jobs. They will not be spending. That forecast is ridiculous.

Third, this growth plan is not going to happen then:

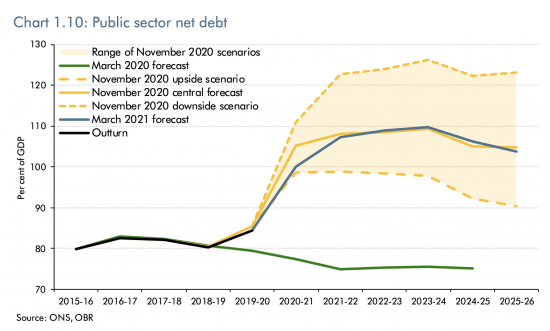

And in that case the deficits will be much bigger than forecast. This is that forecast:

I expect that blue line to move continually upward.

But I also expect considerable QE for a long time to come as well.

The government is going to need to support the UK economy for a long time to come yet. Sunak has read the UK economy wrong. In fact, badly wrong.

The need for a plan to out the economy to work and to deliver a Green New Deal is as strong as ever. Today we did not get that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

You are right to begin with the ‘road map’ plan for R>1 and a late summer wave of infection. Just think of the impact on the other fantasies if the ‘map’ was to suppress infection down to the tens and hundred a day rather than the 8000 or whatever we have today. and held that steady for a couple for months or even decreased further using a proper track, trace and isolate system. Business and households would begin to have the confidence to think about spending and investing.

Sunak was responsible for ‘Black September’ when he rejected the science – circuit breaker – and caused 50,000 unnecessary deaths. He has never grasped the very elementary point that there is no trade off between beating the virus and saving the economy – the one depends on the other. Pity he and Johnson cant be hauled before and inquiry for disregarding expert advice – like in Scotland.

Agreed

R <<1 by the summer. Nearly all adults will be vaccinated by 21 June and vaccination greatly reduces onward transmission. In addition to this, the summer climate is hostile to respiratory virus transmission, as we saw last summer.

As a result, a late summer peak is extremely unlikely. This could happen only if a new variant, substantially unaffected by vaccination, arises. All variants to date ARE substantially affected by vaccination.

So, to state that, "another Covid crisis is inevitable", is an unrealistically pessimistic forecast.

Except many doctors are not convinced

It is not most gave the vaccine. Maybe half will

And the effectiveness is only just enough to be considered a vaccine

[…] Sunak thinks it will. I am not convinced, as I suggested yesterday. […]