Accounting consultations are coming thick and fast right now. First, we had one on sustainability reporting from the International Financial Reporting Standards Foundation. Then we had one on the future of Companies House and UK accounts reporting. At the end of last week the filing deadline for another past. This was from the Financial Reporting Council on the future of corporate reporting.

You could have been forgiven for missing this last consultation. The FRC did not even list it on their own open consultations page as it was ongoing. However, my colleague Adam Leaver and I did notice it, and got a long (33 page) submission in, which will be the subject of a number of blog posts because of the significance of the issues it raised.

We raised objection to most of the proposals that the FRC made, all of which they claimed were intended to address the need for stakeholder reporting in the future, so expanding the range of financial reporting. Or so they claimed.

But there were real problems with their proposal. The first was that they proposed retaining the existing accounts of a company as the core report within their new framework. When the whole problem is that those accounts are not delivering that was not a good opening gambit. As Adam and I said in our submission:

At the heart of [your] proposed new reporting framework are the existing financial statements of the Public Interest Entity (PIE) as prepared under IFRS without seeking to reform the required disclosures within them in any apparent way. These financial statements are not produced to meet existing shareholder needs, as we have shown in this submission. Nor do they meet the needs of almost any other stakeholder. To do so substantial reform of their content would be required. As such at the heart of the proposal is a failed mechanism of accounting and that means that the proposed reporting will fail to deliver what is required by the stakeholders of PIEs.

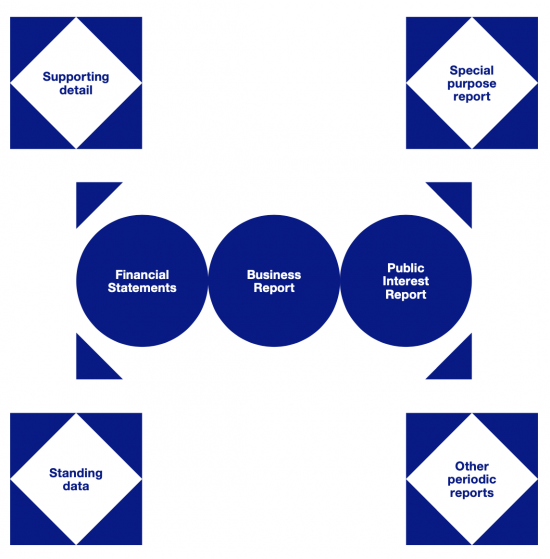

Second they proposed additional reporting, using this schematic:

The problem is threefold. That's partly because they do not say if these additional reports will be audited. In that case who knows what value they might have?

Then they make clear that in effect these are additional reports. They commit the sin described in the recent Dasgupta report for HM Treasury, in which it is made clear that the core problem in tackling our climate and biodiversity crises is the continuing assumption that nature is external to our economy, and even accounting, when actually it is integral to it. The concept of the public interest report, which might address sustainability issues but from outside the accounts, is simply wrong for this reason.

And on top of these failings, they claim that these reports will be 'stakeholder neutral'.

This claim of stakeholder neutrality is the core failing in the FRC report. They say:

We propose a network of interconnected reports to unbundle existing reporting. The reporting network would be centred around a stakeholder-neutral Business Report designed to facilitate better communication with a range of users.

But then they add (elsewhere in the report, and almost as an afterthought):

In our view, it is for the company to determine its key stakeholders.

As Adam and I said in our submission:

Because it is suggested that the entities creating the new reports that are proposed might define their own stakeholders, and might pursue their own view of those stakeholder's needs, the essential discipline that is required to ensure that stakeholder needs are met in future corporate reporting are absent from the proposals made.

We think that this should be obvious. Senior management of an organisation are, of course, stakeholders of it, with a decided vested interest in its activities. To assume that they might be stakeholder neutral is naive, at best. They are not. In that case it is impossible that they could produce stakeholder neutral reporting without an external agency ensuring that they have achieved this goal to set standards.

Our proposal to address this was that the FRC should:

- Define stakeholders as part of the standard-setting process;

- Define basic stakeholder need that must be met as part of that same process;

- Require that auditors provide the information that stakeholders require from a PIE if the entity will not do so itself, and that they use their judgement to determine what that need is if they consider it extends beyond the minimum required by standards;

- Incorporate all this data into a single audited report;

- Require that the PIE's reporting embrace the external risks that it creates to those with whom it might have a liability in tort as well as in contract law;

- Reframe the reporting requirements of PIEs to reflect their status as entities of macroeconomic, rather than microeconomic significance;

- Require that the PIE report on the activities of all its subsidiaries in full, free of charge and on pubic record;

- Require that the PIE produce full country-by-country reporting;

- Require that the PIE account for climate change on its balance sheet rather than off-balance sheet.

If this as done we might get decent financial reporting for all the stakeholders of a company, which is what the Corporate Accountability Network wants. But we are a very long way from that as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I went to the Corporate Accountability Network’s website to look at the new form of accounting it proposes, and saw this:

“Its first accounts are expected to be for the year to 31 March 2020 and we will publish them in full in using the standards we propose that others adopt after that date.”

But I can’t find the CAN publishing it’s accounts. They exist on Companies House register but in a regular format with nothing new.

Has CAN published it’s accounts in the manner it has claimed it would do?

Yes, because we made disclosure way beyond that required by law

What disclosure would this be that exceeds what is exceeds that required by law exactly?

From the accounts I can see on companies house, they are just a very basic set of accounts, and do not include any of the climate accounting CAN wants.

I also cannot find any accounts on the CAN website itself.

So as far as I can see, CAN has just made normal accounts, as every other company would, with no differences.

You may have noted that CAN only calls for climate accoiut8ing by large companies because that is where the problem lies

The fact that you can see the whole accounts and the disclosures we make is us going far beyond the requirements of the law

So what you are saying is that you are using a loophole you created to avoid publishing climate accounting details?

I would have thought that an organization pushing for very stringent climate accounting would want to set an example and publish accounts in the manner it wants other companies to abide by. It would also show an example of how this new form of climate accounting works in practice – which I don’t see anywhere else on the CAN website either. Does such a worked example exist anywhere we can see?

“The fact that you can see the whole accounts and the disclosures we make is us going far beyond the requirements of the law”

No. You have met the basic requirements of the law by submitting accounts, but that is it. The disclosures made are not significant, and the accounts (as is normal for a company this size) are unaudited. So you have met the requirements set by law but no more. To claim that you go “far beyond” is a claim also “far beyond”.

We could have filed vastly less data

We published our full accounts

That puts us in a tiny minority who do so

So you are wrong

I have tended think of all this accountancy stuff as a bit dull and tedious in the past but reading your blog has persuaded me otherwise – particularly over the last year – and I have made an effort to respond to the consultations you have flagged up lately. As you will recall I proposed that the way to deal with financial instability in future (and to reconcile stability and adaptability) is to establish a state backed credit risk insurance fund (CRIF). In addition to providing credit insurance an institution like this would also have a vital role in regulating corporate accounting to ensure that credit risks can be properly assessed and understood. These accounting issues are an essential element in designing a functional state credit risk institution….start of a new learning curve for me then!

Thanks Jim