Just before I joined the meeting of the Tax Coop in Montreal last night to talk about tax ethics I was sent the Association of Accounting Technicians (AAT) submission to Parliament on Tax and Coronavirus. I should stress, they sent it themselves: this could not come from a disgruntled member.

It was a stark reminder of a point I made in my talk last night, when I said:

It really is time that we understood the real role of tax within the macroeconomy of the countries of which we are a part, so that we can truly understand the way in which tax systems might have to adapt to the crisis we face so that the most vulnerable, in particular, in our societies can be supported. I suggest that every professional institute should now be providing teaching on this issue and that it should be on every professional syllabus for examination study.

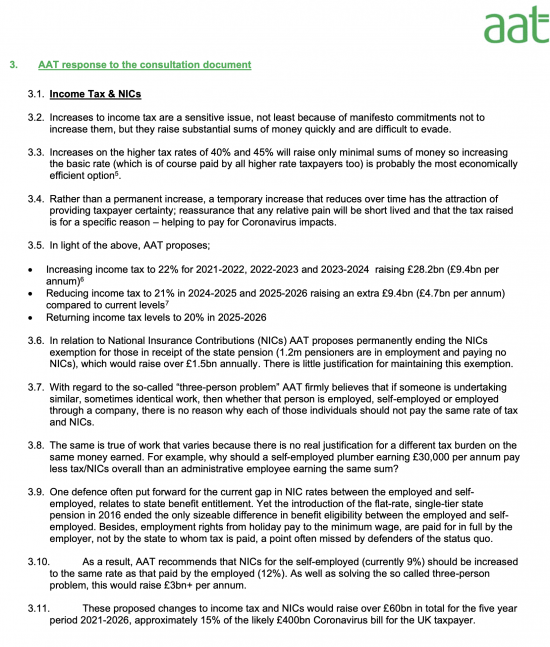

That is because the AAT recommended this:

In other words, in the face of a massive potential economic crisis that will be created, above all else, by a shortage of demand, the AAT is suggesting that people have their capacity to spend reduced.

What is more, they are demanding that this reduction in the capacity to spend be imposed right across the board, including on pensioners, so that those with the highest marginal propensity to consume and so have the greatest chance of ensuring that demand continues, are impacted, if anything, the most. In Keynesian macroeconomic terms, the AAT is, then, demanding a policy of austerity at the time when this is bound to increase the rate of corporate failures and increase unemployment. It is hard to imagine anything more destructive for the interests of their members, or society at large, that the AAT could demand.

I rest my case that it really is time that the professional tax and accounting institutes should begin to learn about tax in a macroeconomic environment. It is very clear that they do not understand it at present.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Even taken on its own terms the briefing is mostly nonsense. For example, para 3.3 says that “increases in the higher tax rates of 40% and 45% will raise only minimal sums of money”. In fact the HMRC ready reckoner says that increasing the 40% rate by 1% raises £1.4bn per year by 2022-23 and increasing the 45% rate raises £210m per year. So a 5% increase in both would raise about £8bn, and in a much more progressive manner than raising the basic rate (and I think the true figure would be greater than that because HMRC overstates Laffer curve effects when modelling changes to the 45% rate).

Of course I agree that there is no macro case for increasing taxes in the current economic situation anyway, but their failure to understand basic maths suggests that they don’t understand tax in a microeconomic environment, let alone macro!

Agreed Howard

What they say is technically absolutely correct: (1) increasing the higher and additional rates of income tax do not raise much money: you get much more from increasing the basic rate, if revenue is your primary concern; (2) there has long been a recognition that the NIC exemption for pensioners in employment is not justifiable (given demographic changes, and changes in employment patterns); and (3) the tax and NICs differentials between various forms of working (employment, self-employment, PSC) is a persistent problem that need addressing, and a levelling up of tax and NICS to employment rates is much more likely than a levelling down.

Whether now is the right time to do any of them is another question. If the political decision is to raise taxes, then perhaps the opportunity can be taken to address inconsistencies (such as (2) and (3)) at the same time. You could add taxing capital gains at income tax rates, and restricting and abolishing some tax reliefs. Increasing the basic rate is a very blunt tool, but it would bring in a lot of revenue.

You missed the whole point of what I said

Why?

You want accounting technicians to learn more about macroeconomics? OK, fine: I am sure everyone needs more of that, MPs and government minsters especially.

As it happens, I also think they are mistaken about there being any “need” to increase the basic rate of income tax. But that is framed by their acceptance of the ONS calculation that national debt exceeds 100% of GDP, and thus a “need” for higher taxes or lower spending to bring “borrowing” under control. They could do with someone explaining why that is wrong-headed and likely to be counterproductive.

Just for context, this is one of a large number of submissions that have been made to the Treasury Select Committee, for its inquiry into “tax after coronavirus”. https://committees.parliament.uk/work/465/tax-after-coronavirus/publications/

Among their main suggestions are:

* a temporary increase in the basic rate of income tax

* reform of capital gains tax

* simplification of inheritance tax (but not a new wealth tax)

* abolishing VAT exemptions and lower rates, and reducing the registration threshold to zero (like Sweden and Spain)

* abolishing the pensions triple lock in favour of CPI indexation

* reform of the legal regime for late payments between businesses

* regulation of the accountancy and tax professions

* a new “data assets tax” (but not windfall taxes)

Quite a lot I would have expected you to support there (along with a few items I expect you won’t).

I support 2 and maybe 3

It’s not a good list

And right now I only support them if linked to tax cust for the lowest paid

Think you’re being a bit harsh here Richard, having read that page it’s clear they are only talking about a temporary fixed term increase, not immediate but from next year and at a very modest level.

Modest proposals like this need to be considered by the left rather than dismissed out of hand if we ever to restore our economic credentials. Voters realise that the pandemic has got to be paid for somehow – the politics and the economics need to be considered together not in isolation.

That’s even worse!

Read what the INF is saying

Read what I am saying

It’s crass in the extreme to impose austerity on an already crushed economy and that is what the AAT and you want

What’s your goal? Economic armageddon created by your indifference to learning?

Methinks they are demonstrating the difference between accounting technicians and professional accountants (see recent thread): answering the question, rather than saying it’s a stupid question, whose basis is fundamentally wrong, and we should be doing something else entirely.

(Their next job, though they don’t know it yet: deck chair arranger on the Titanic)

Tax rises aren’t the right medicine right now, but how they can defend raising the basic rate whilst not changing higher rate is beyond me.

The one thing I think they are right to highlight is the NICs issue. It is a thorny one that has persisted too long and needs resolving sooner rather than later…