A speech by Andy Haldane, the chief economist of the Bank of England, was published this morning.

I have to admit that I have not understood Haldane's views throughout this current economic crisis, and this speech leaves me as confused as ever I was. But then, at least he has the decency to admit that he too is confused, although the blames what he clearly thinks to be the irrational behaviour of the public for his confusion.

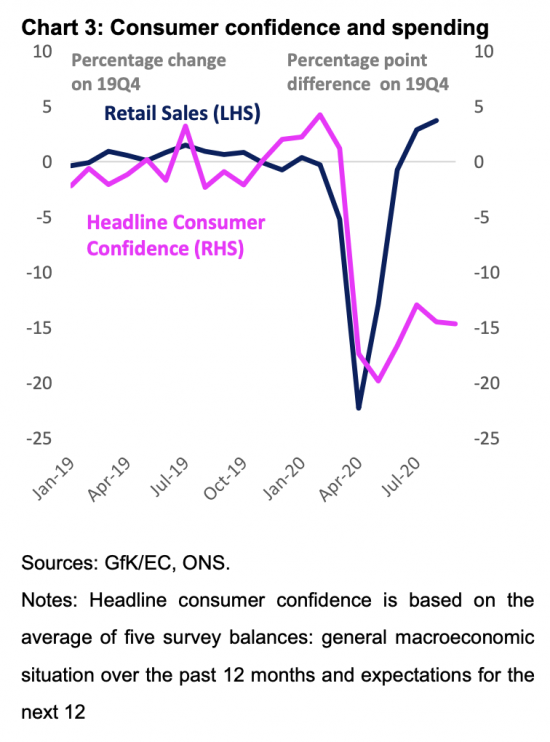

One of the things that he is confused about is implicit within this chart:

As he puts it:

The failure of consumer confidence to recover is particularly striking, given the complete recovery in consumption by households over the same period. Put differently, the historical correlation between consumer confidence and spending appears to have broken down (Chart 3). A wedge has emerged between peoples' expectations and their spending, between their risk perceptions and economic reality. The same is true, to a somewhat lesser extent, among businesses.

His explanation is that Chinese whispers amongst the population at large are exaggerating the systemic risk that we face a present when things are actually going quite well. As evidence of things going well he offers increasing share prices and Riosh Sunak's new job retention scheme. As far as I can see, however, share prices are continuing a downward trend:

And, as I have already made clear in comments, which it is clear that many people agree with, Sunak's scheme has a perverse incentive to sack people built into it. If Haldane can take courage from bad news, and thinks others should, he clearly has a problem reading the runes.

What is more, as ever, Haldane appears unable to see beyond the immediate future. As I have suggested many times, this crisis will evolve as the cash flow pressures implicit within it begin to hit employers, particularly with regard to the demand that they settle back taxes, pay rent arrears and begin repayment of new loans.

I would, then, suggest two things to Andy Haldane. The first is that his chart 3 simply reveals that pent-up demand was released when lockdown ended, but that did not change long-term consumer expectation, which remained deeply negative. The second is that consumers have got this right: they can see that if there are at least 3 million people still on the furlough scheme now and that scheme comes to an end in October, with the replacement scheme encouraging employers to make people redundant, then the chance that unemployment will skyrocket is extremely high, and in that case, of course, they remain exceptionally wary. All the baffles me is that Haldane cannot see that. I suggest his ability to forecast almost anything has gone absent during this crisis.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Perhaps Haldane should listen to More or Less on radio 4 – might help him understand numbers a little more.

Decent scientists posit a theory and then try to disprove it. Many economists seem to use sandbags to shore up a losing argument.

Doom and Gloom!!

“This will also have unsettled the Bank of England.

Net consumer credit borrowing remained positive in August at £0.3 billion. This was a little weaker than borrowing of £1.1 billion in July, which was in line with the average net flow in the 18 months to February 2020. These increases followed net repayments of £3.9 billion per month, on average, between March and June. The annual growth rate fell slightly to -3.9%, down from -3.7% in July: this was a new series low since it began in 1994.

I mean with borrowing of this sort so low how will the banks make a profit! More seriously there is a hint of consumers battening down the hatches; from the repayment numbers”

https://notayesmanseconomics.wordpress.com/2020/09/29/the-bank-of-england-will-be-very-worried-about-the-weakness-in-consumer-credit/

Indeed

Are you sure that its not Andy ‘Hasbeen’?

Especially since 2008.

I suppose one answer to Andy Haldane’s conundrum is that with the possibility of being locked down at very short notice many people are wisely stocking-up against the deprivations which might come in the short term and in the longer term with likely Brexit supply disruptions(?).

I’m not surprised at the low level of consumer confidence, but a little surprised at the reported retail sales figures.

@ Andy Crow

It would be good to know how much of the retail spend was concerned with the home, D-I-Y, replacement of appliances, carpet, furniture, kitchens, bathrooms, etc. Since spending on holidays, eating and drinking out is likely to have dropped plus travel to work costs if you’re working at home this releases cash to be spent on the first items I list.

Agreed

Spending on pets and DIY soars… but sales of clothing plummet

https://www.thisismoney.co.uk/money/markets/article-8769951/Spending-pets-DIY-soars-sales-clothing-plummet.html

Very tough to read the data – I think it is reasonable to be confused by it. However, I would make the following points.

(1) Just because the sky has not fallen in yet doesn’t mean that it won’t in the future. Most folk get on with their lives without poring over economic data. They might have an uneasy feeling but they still need to feed, clothe and house the family….. and they will do this until they lose their jobs and they can’t do it any more. The time of maximum peril lies ahead and spending data will not fully capture this.

(2) Sales data is prone to stocking/de-stocking “noise” – the deep decline and bounce are so large as to make underlying trends difficult to discern. I have stopped looking.

(3) Credit data is good AND bad. Good in the sense that personal debt levels are too high and that a reduction is a good thing but bad because (without compensatory moves from government) it means declining demand. Any attempt at fiscal restraint now will be a disaster.

(4) Housing is likely to be where the problems emerge in a BIG way. Forced liquidations of property might be small in number but it is the marginal trade that sets the price…. and there is nothing like falling house prices to unsettle the comfortable middle classes…. and the banks. BUT this is unlikely to be in 2020 – more like 2021.

In summary, things develop more slowly than we expect and day-to-day data mean little. Unusually for me, I would trust survey data over hard, real time data that is excessively polluted by noise. Even better, get out (if allowed) and talk to friends, neighbours and family – see what they are doing and what they plan to do. That is the best data!!

1) Agreed

2) Definitely right – clearly happening

3) Agreed

4) Absolutely right

And I am doing a lot of talking right now, to all sorts of people