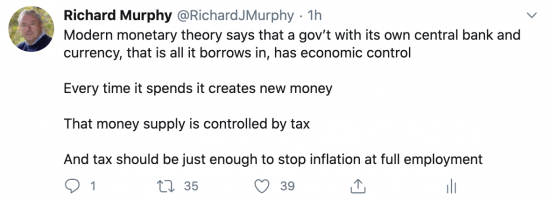

I tried to summarise modern monetary theory in a Tweet this morning:

It loses some nuance. And the job guarantee is only hinted at with full employment.

But here's the challenge: can you do better? Remember just 280 characters can be used.

The alternative is to summarise it in no more than, say, five tweets that can be posted as a thread.

Ideas will be very welcome. We need to communicate this, time and again, so variations are good.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Please please keep sharing your message and educate people (inc. me) on these matters. We’re always told indirectly that we’re not able to understand this and that’s nothing but a wall to stop us asking difficult questions.

I can’t offer any improvement on this, but ask that perhaps this is one of a series of simple messages that shine a light on how the economy really works. Somethings like ‘when I take out a loan where does the money come from?’ or ‘who exactly does the government owe money to?’, or, ‘when gov invests in infrastructure, how much do they get back through tax of companies/individuals involved in the construction etc.?’ – understanding these things would help perforate the shield of ignorance many in power depend upon.

Noted

Thanks

Government can create as much money as is needed within the productive capacity of the economy, as long as there is unemployment. The main role of tax is to contain inflation when the economy is at full stretch and unemployment is minimal.

Thanks

think I get it;

MMT says:

A sovereign* gov’t with its own central bank & currency (which it only borrows in*) has full economic control

When it spends/(pays for stuff) it creates new money

That new money supply is inflation controlled, by real resources limits, full employment & tax*

(267)

* Devolved/local/state gov’ts cannot issue money, only borrow & tax

* borrowing one’s own currency is allowing the nation the safest saving haven for pensions, insurances etc.

* gov’t can requisition/buy any domestic stuff available

gov’t can employ all available unemployed people,

tax validates a currency, helps control demand,

OK, I like the way that’s going

What audience are you trying to reach?

Twitter politics

Sorry to be a bit dim but I don’t know what that means.

Would that be an expert audience, or an intermediate or beginner audience?

Let’s assume curious and likely to be reasonably educated but not necessarily in economics – so we are addressing stereotypes long ingrained

My effort:

Government spends in order to get stuff done to make all our lives better.

Governments never tax and spend but always spend and tax as, unless it is first spent into society, there is no currency to pay tax with.

Government collects tax in order to prevent inflation.

Thanks

Money is a concept, created when banks make loans and governments spend or borrow, and destroyed by taxation. We need to keep a balance with available resources in order to avoid inflation. Real wealth is creativity and physical resources. Air, water, plants, minerals. Work.

Thanks

A collection of these is good

I don’t do Tweeting; but if I did, I would Tweet:

Modern Monetary Theory gives government the power to govern in the everybody’s interest.

When it spends money, it enables jobs to be created. When it adjusts taxes on incomes it controls inflation.

MMT allows full employment and inflation to be balanced, making a fairer society.

That’s 280 characters including spaces and punctuation. Richard I hope you like it, but don’t castigate me if I’ve got it wrong.

Well I’m very tempted to tweet it…

You have my approval if you wish to use it.

Thanks!

The power to impose redemption on money drives money. This means both banks and government can create money. Careful targetting of these creative powers along with fair-minded regulation of global trading increase a nation’s chances of economic well-being.

MMT says that a govt with its own central bank and currency can never run out of money, in the same way a football game can’t run out of goals.

Physical resources and the lack of political will – not the lack of money – are our economy’s main constraint right now.

The need to reduce the deficit, and the human suffering born as a result, is a man-made construct and therefore a political choice, not a natural consequence to some natural law.

(Distilled from reading your blog for many years)

It’s been worthwhile!

Gov stimulates output thru money creation

Gov controls over stimulation thru tax

Where there is un/under employment there is spare capacity

Gov can spend to use that capacity

Deficits are not what your children must pay

But beware not to create bubbles so your friends can make hay

Almost poetic…

How about a Haiku competition – or limericks?

Not that I am volunteering, but I may think about it, now that I have thought about it 🙂

How about adding :-

High inflation only happens when there is a shortage of resources such as labour or oil.

MMT says:

The gov sets the value of its currency.

The gov sets how many people are unemployed:

The gov sets how many people live in poverty.

The gov sets when you see a doctor.

The gov sets how many people live with unimaginable wealth.

The gov is fooling you.

https://twitter.com/tonywestonuk/status/1301562347987832834

That just got a retweet!

Well, as I’m sure you know the private banking sector also creates money by creating loans. IIRC before COVID private sector banking was responsible for like 4/5th of all money created. And tax won’t be affecting that, though regulation could. And also your tweet kind of implies that the quantity theory of money is responsible for inflation, which I know you don’t agree with. And while tax is certainly one tool with which to control inflation it isn’t the only one and may not even be the most appropriate. As I’m sure you’ve seen one of the main criticisms of MMT is that that relying on legislative bodies to hike taxes to curb inflation is dubious, especially since the kind of taxes that would be effective would also be regressive. And the downside of having an automatic trigger, like CPI >2.5% = payroll tax hike of 1% (besides being wildly unpopular during inflation) is that the inflation might have little to do with too much spending power and instead be some oligopolized industry hiking prices, or a supply shortage of a raw material like oil.

I admit I do not agree in tax

I accept the issue with language

That’s why I asked!

I am a one of the ‘economics illiterati’ but I am learning by means of this blog for which I thank you Mr Murphy.

The biggest stumbling block in my mind to shifting my (now as I know) ignorance of the the way things really worked was the base assumption that it was only the banks that created money and that therefore, Govt. had no option but to borrow money from them and as result became indebted to them. I think that’s the way most people think too. Once I’d dispelled that base assumption the rest started to become clear. For me (as representative of the majority!!), it would be good to make it clear at the outset, and with much repetition thereafter, that Govt can create its own money and then spend it where and how it chooses.

Noted! Thanks

Private savings = Govt debt.

MMT describes what already happens.

Governments create money and spends into the economy, NHS, Schools, etc,

Repeated private sector spending is taxed which cancels most of the government spend.

Remaining untaxed spend is private saving which equals public/national debt.

Repeat.

Too complicated, I fear…

Version 2:-

It’s the power to enforce money’s return, to redeem it through repayment or taxes, that drives its acceptance and this means “both” banks and government are able to create it. Careful and equitable targetting of this power along with fair-minded regulation of global trading will improve economic well-being.

Thanks

How about as a Haiku:

Gov’ment spend creates

but watch out for inflation

tax might be needed

Amused…

* Society’s surpluses are government fiscal deficits and vice versa (meaning all non-government surpluses). It is the simple maths of accounting identity.

* Balance the Economy instead of focusing on the spreadsheet. Until you have full employment (including hidden unemployment) the economy is running under-capacity and lives are being damaged.

* It is hard if not impossible to find a case of serious inflation caused in pursuit of full employment. (iirc)

Whereas govts running surpluses (society’s deficits) have almost always produced full-blown Depressions.

* Only near full-employment is the inflation risk more elevated. Govt spending proposals should be assessed for their potential effect on productivity, social well-being and inflation risk.

Thanks

MMT means perpetual digital money printing to pay for government expansion until inflation takes off. At that point taxes are increased to curtail private spending. Over time government grows, private enterprise shrinks and taxes go up.

Your final sentence need not be true. Both can grow

Both government and private sector can’t grow together under MMT if government is meant to grow when the economy is in recession and the private sector is taxed more (to stem inflation) when the economy is booming.

MMT involves government getting funded by money printing in bad times and by taxes in good times. The private sector surrenders jobs to government in a bust and transfers income to government in a boom. This is a recipe for transferring resources from private to public purposes over a full economic cycle.

Keynesians by contrast favour governments running surpluses in good times to fund their deficits in bad times.

My own view is that money printing to support inordinate government deficits in a once in a century depression like now is warranted to avoid excess public debt/GDP in future and to offset the contraction in money supply from private sector precautionary deleveraging.

But perpetual money printing to replace taxation (except when inflation spikes) is a recipe for ratchetting up the size of the government sector relative to the business sector.

If that’s what you want, it’s a perfect recipe. But over time it would mean lower private production and more public supply. In other words more free public goods (paid for by money printing) and fewer priced private good (paid for from personal income).

Because taxes would regularly climb to stave off inflation, private consumption and investment would fall to accommodate increased government welfare (free or highly subsidised services).

The bottom line is that MMT is a national socialist fantasy that would make an economy behave like Argentina, going through perpetual booms and busts without living standards improving.

You are wholly misrepresenting MMT, which is commonplace

No one who really supports MMT suggests “perpetual money printing to replace taxation (except when inflation spikes)” so why make such silly claims?

This might help provide a more informed basis for any statement about what MMT is or isn’t. For £0.99p in the UK Amazon are currently offering the Kindle version of Stephanie Kelton’s bestselling book The Deficit Myth – Modern Monetary Theory and How to Build a Better Economy. There are free Kindle apps for iOS and Android.

https://www.amazon.co.uk/gp/product/B081JVRT57

Getting my head around MMT, and wondered about the job guarantee scheme and localism? If a country is in full employment how do we support the voluntary sector, volunteerism, localism, and the work they do? Are all the above replaced by government in a recession, then dumped when full employment is achieved?

If a government turns the tap on and off depending on whether the economy is running at near to full capacity, and that measure is UK wide, how do we deal with the London effect? London could be a full tilt and the UK figures skewed because of it, but Scotland or for that matter Cornwall might be in a very different place economically. So how do you measure the state of the economy to allow for regional variation?

Remember, full employment is about choice and so too us use of the JG, no one is compelled to work

This might be useful. Pavlina recently wrote a book on the Job Guarantee. An excellent companion to Stephanie’s blockbuster

https://pavlina-tcherneva.net/job-guarantee-faq/

how about a slightly different starting point?

MMT is not a theory. It deals in FACTS——-

& then make the same points the earlier posts have made empathising that MMT IS STATING WHAT REALLY HAPPENS in the economy & not what we are constantly being told in the mainstream

Be careful in the use of language! The Jobs Guarantee is claimed to be an integral part of MMT, but does not happen in any economy at the moment. It is only part of MMT that is descriptive, part is prescriptive.

Job Guarantee is the only conceivable part that could be construed as prescriptive. But the reason it is core to the framework is that it acts as a far better automatic stabiliser than discredited neoliberal alternatives such as NAIRU. So 100% of MMT is descriptive once you understand how the stabilising mechanism works.

MMT is an extensive body of theory that describes the actual constraints and potential consequences available to governments in our modern money system. Not necessarily a journalistic commentary of the errors they are making. Don’t confuse an analytical framework with narrative description.

Thought I’d have a go. My first sentence is a point the person in the street knows but usually doesn’t think about. A different way to grab attention maybe, but the cost with just 280 characters is reference to full employment. I have never tweeted, but for what it’s worth in 280 characters I’ve gone for:

MMT explains neither we nor the firms that pay us can legally create money

Money is bank credit or created by gov’t spending

Sovereign gov’ts that make money can’t run out

Taxes remove money so help reduce demand and inflation

The gov’t deficit is money still invested in the economy

I like it

Thanks

Richard, you say I am misrepresenting MMT by saying it advocates perpetual money printing in place of taxation unless inflation spikes at which stage taxes are raised. If I am wrong at what point does money printing to expand government spending on not-for-profit employment stop?

MMT does not say money printing takes the place of taxation

Nor does it refer to perpetual money printing

Or even printing at all, come to that

And nor does it say that government spending must be on not-for-profit activity

Your claims are falsely premised

When you’ve read some MMT please come back

Richard, further to my least comment here is the evidence that MMT does not see taxation as necessary other than as a tool to make people accept a fiat currency and to control inflation when it gets out of control:

“Taxes are not needed to “pay for” government spending…Some who hear this for the first time jump to the question: “Well, why not just eliminate taxes altogether?” There are several reasons. First–as we said last time—it is the tax that “drives” the currency. If we eliminated the tax, people probably would not immediately abandon use of the currency, but the main driver for its use would be gone. Further, the second reason to have taxes is to reduce aggregate demand.” Source: https://neweconomicperspectives.org/2014/05/taxes-mmt-approach.html

Since taxation is not needed for government spending and government spending increases in line with or faster than nominal GDP its funding needs perpetual money printing under MMT unless higher taxes are needed to stem runaway price inflation.

So my question remains – other than on such occasions, when is the digital money printing press turned off by the government’s Treasury department?

And what makes one think that politicians who can deliver popular promises without raising taxes, will be willing to raise taxes once inflation takes off?

The lesson of Argentina is that that politicians that rely on money creation to meet their extravagant promises don’t have the discipline to increase taxes when inflation takes off. Argentina had to tie its currency to the US dollar to restore public confidence in it and subdue inflation. Simply having some taxation did not stop citizens abandoning the local currency and insisting on being paid in US dollars before that became the anchor currency.

You make an entirely false leap that because tax is not needed for government spending then tax is not needed

But MMT does not say money printing takes the place of taxation – that is not its claim. Nor is it true

Nor does it refer to perpetual money printing

Or even printing at all, come to that

And nor does it say that government spending must be on not-for-profit activity

Your claims are falsely premised

When you’ve read some MMT please come back

Richard, read Professor Bill Mitchell’s writings. He is one of the founders of MMT whom I debated in Australia on this topic.

If you disagree with Bill please tell me if money is not created by a government digitally printing it how is it generated? In order to spend government must draw down cash balances which if not obtained from taxes, borrowings, asset or service sales needs to be generated by money creation . MMT wants to abolish central banks and have money created by government finance/treasury departments for spending by the state. It also wants to end the fractional banking system so than banks hold 100 percent of their client deposits as reserves leaving only the state to add to bank deposits (i.e. money supply). Under MMT taxes play only a secondary role in forcing people to use money created by a government finance/treasury department as legal tender for meeting tax obligations and for manipulating aggregate demand when needed. Under MMT taxes are not used for funding increased public spending as my earlier quote from an MMT brief made clear. Indeed there is no limit to the extent that governments can create money for spending on worthy causes except a takeoff in price inflation at which point governments will increase taxes to rein in private spending even though it was not the cause of the problem. My question to you and other MMT followers is what level of inflation would you tolerate before tax hikes would be applied to stamp it out. And what makes you think populist politicians who have found that increasing spending without matching tax increases would be prepared to hike taxes when their profligacy ignited higher inflation? In truth MMT has no definitive agreed position on anything (other than the job guarantee) which makes it very difficult to pin down what it actually stands for. I have used Bill Mitchell as my basis for understanding it since he was one of its founders.

Of course I know that MMT says all government spending is funded by money creation

But nothing it says that this means that this happens in perpetuity without tax

Or even at all without tax

Because something is true does not mean that all else you claim is true

And it isn’t

Your extrapolations are false

Read The Deficit Myth

Stephanie Kelton is a million times clearer than Bill