I have just posted these comments as a twitter thread, which is why they are written in the short form that they are in:

The UK government has just borrowed £62bn in a month, which is more than it planned for the next year. People are sending out panic signals. They're suggesting the gov't has a crisis. But that's not true. That needs explanation.

First, the government is not having a crisis. It's carrying on. And doing a great job. We clap the NHS. It's the private sector that's having a crisis. It's that part of the economy that's lost the money. We need to remember that.

Second, the government is making good the capital lost by the private sector. That's it's role. If it did not do it we'd really have meltdown. We don't want or need meltdown so the government is covering private sector failure.

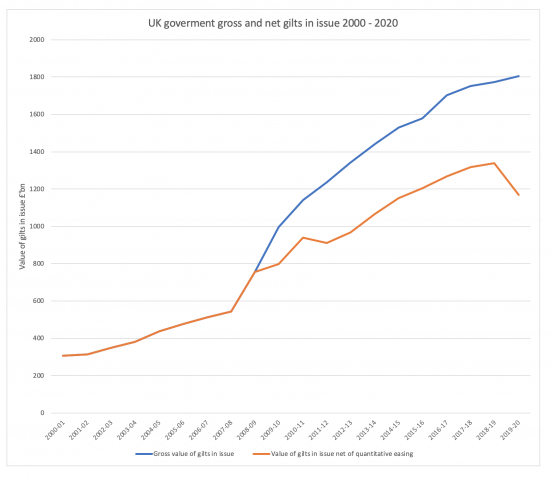

Third, there is no debt crisis. This year the gov't has already bought £200bn of gov't debt back from markets and is expected to do another £100bn soon. That means that right now the government owns at least £575bn of its own debt.

Fourth, if the gov't owns £575bn of its own debt that means it never has to repay it or pay interest on it. What's more it means total debt was actually only £1.23trn in March this year, and not the £1.8trhn the gov't claimed.

Fifth, so gov't debt - the value of gilts in issue - was only 52% of GDP in March 2020 and not 81% as the government said.

Sixth, it will take more than £1 trillion of borrowing on that basis to make the debt 100% of GDP. And that won't happen because there will be more QE before we get anywhere near that.

Seventh, the QE already done also explains how the debt is being bought right now: the gov't has already injected the money into the financial markets to provide the cash so they can buy this debt. So there will be no debt crisis.

Thanks goodness for the good old magic money tree - otherwise called the Bank of England - that can produce money on demand to keep our economy going as best as possible without anyone having to panic.

Keep calm in other words: the chance that this supposed new debt is a matter of any great economic consequence is close to the square root of diddlysquat.

This needs a little explanation though. This chart shows UK government gilts in issue (which some people call the national debt) from 2000 to 2020 having allowed for the fact that the government has repurchased £635bn of these gilts and there is no chance (as has now been admitted by the Bank of England) that any of these will ever be sold back into the market again:

To make it clear: government debt has fallen heavily this year because of QE.

And the money that the government is injecting into the economy via QE is precisely what will now be used to buy government debt.

A game is being played still that makes people think we might have a government funding crisis.

We have no such thing.

Nor has the government done badly.

It's the private sector that's doing badly.

And the government is picking up the bill, because it can afford to do so, precisely because it can do something that no one else can, which is create money, of which there would be a massive shortage right now but for its actions.

We need neither panic or think we're doomed. Leave that to Dad's Army. We'll be just fine so long as no one, anywhere, anytime, thinks that we have to repay that debt. Because in this crisis that is the one thing we will not need.

NB: Amended at 4pm on 22/5/20 because I'd omitted £60bn of QE in 2016 from the data.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

For ages now, when people have been bleating about public debt and the need to repay, I ask them a simple question… “Who exactly do you think the Government is in debt to?” and let them try to work it out for themselves.

I have never posed that question to anyone who knew the answer, which is quite depressing. When I explain that the Govt either owes to itself (which isn’t a debt) or to it’s own citizens (most of whom are pension providers and banks… and we need those to make the world work). I then explain that there’s around a third of it that’s been acquired by foreign interests – mostly governments – and that is a GOOD THING because it reflects how valued Sterling is around the world.

This inevitably leads to “Well, why did we have 10 years of austerity then?” – which I happen to think is an equally good and powerful question, but the answer is mired in political ideology so I leave that one alone.

The basic lack of understanding on this subject is staggering. Praps if more people had a basic grasp of double-entry bookkeeping the world might be a happier place (if a d@mn sight more dull 😉 ).

Don’t knock the joys of double entry bookkeeping! I remember the days before electronic calculators, never mind desktop, laptop or tablet computers, when accounting worksheets were compiled by hand. The joy and relief of being able to square a large trial balance was very real!

Oh yes….16 column analysis paper…..

The problem is economists saying double things, ie taxes are destroyed on payment and taxes are used to pay for stuff ie govt debt, this confuses the hell out of the population and politicians. So it leaves the door open for right wingers/authoritarians to exploit to the full. No decent politician will defend the fact the govt can produce any cash it wants, because the likes of Andrew Neil will crucify them and so will the public at the polls. I wish economists would keep on message and not conflaguate the message, but they do not.

The above is not known by the majority of the population or the MSM who do not care to look further than their noses. If you do not believe me look at Laura Kungsberg twitter feeds on govt excuses for Cummings joyride and you will get the point. Until economists get their act together and not obfuscate the issue of money creation most members of the public will not get it or understand it.

Pens. Nibs. Ink ….rulers. Double underlines …… the smell of time passing very….very….slowly. Staying awake.

The nostalgic joys of times past. It didn’t seem joy at the time.

The only problem then is the limitations Sunak imposes on himself such as ‘We can’t help everyone’.

Which I think is still the case. It will be Government choices that mess it all up.

Just watched this on the BBC website.

Seems like the BBC hasn’t got the message yet!

Nice shot of a crying baby in a cot at the end for good effect!

https://www.bbc.co.uk/news/av/business-52761890/how-will-we-pay-for-the-coronavirus-damage

No one asked me to repay WW1 loans and I did not suffer for them

This is so absurd

The scary bit is that it’s our national broadcaster spouting this nonsense!!!!

How can we get you on a TV debate about this rubbish Richard.

Petition to get you on Question Time or something?

You up for it?

I’d be very happy

But the closest they ever got me was as a reserve…

Richard – Here’s your chance ☺, they are looking for an audience of 12.

Join Question Time virtually

Question Time will be having a virtual audience during the Coronavirus emergency. If you would like to take part in next week’s programme from the safety of your own home, please fill out the form below.

https://www.bbc.co.uk/send/u39697902

Applied

Does Dharshini David have a Twitter account that you could post on to educate her?

Probably, but not tonight

As if by magic, here wrong on cue are the BBC, doing the usual wringing of hands about the deficit and debts having to be paid by grandchildren etc

https://www.bbc.co.uk/news/business-52766487

Lamentably the lovely Dharshini appears never to have heard of the BofE, let alone its role in reducing govt debt, making, to my amateur eye, complete nonsense of almost all of her broadcast.

See other responses…

This is deeply economically illiterate

It is hard to say anything kinder

The BBC…………….

……..the enema of the people.

Will the new fiscal rules introduced in this years budget have any impact?

https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/developmentofpublicsectorfinancestatistics/april2020

New fiscal rules introduced in Budget 2020

In the Budget 2020 report, the government introduced three new fiscal rules:

to have the current budget at least in balance by the third year of the rolling five-year forecast period

to ensure that public sector net investment does not exceed 3% of gross domestic product (GDP) on average over the rolling five-year forecast period

if the debt interest to revenue ratio is forecast to remain over 6% for a sustained period, the government will take action to ensure the debt-to-GDP ratio is falling

I think we can safely say that is now something for the history books….

Here’s the IFS with what looks like more of the same

https://www.ifs.org.uk/publications/14857

This line intrigues me: “Just two months ago, at the March 2020 Budget, the government forecast borrowing (again on this measure) of £25 billion over the course of the whole financial year (with at the time this measure of borrowing being flattered by a forecast £43 billion of receipts from financial transactions by the Bank of England), whereas it has now borrowed more than three times that in a single month.”

By characterising the purchase of Treasury (part of govt) bonds by the BofE (part of govt) using money created from nowhere for the occasion as ‘receipts from financial transactions’ the IFS appear to be deliberately obfuscating reality. In that reality, perhaps, in fact very probably, the BofE is likely to be flattering the suggested borrowing measures by a few hundred billion more, making something of a nonsense, perhaps, of all the other calculations in the piece.

Precisely

“We’ll be just fine so long as no one, anywhere, anytime, thinks that we have to repay that debt.”

Dharshini David, Economics Editor, BBC, thinks we have to repay this debt. In fact in a video I’ve just watched on the BBC website, she claimed our grandchildren will have to foot the bill.

The government has three choices now, according to this video

1. Cut spending

2. Increase taxes

3. Borrow in the financial markets, (if the financial markets aren’t scared that the government might default)

Quantitative Easing isn’t mentioned at all. Only tax payers money, and borrowing.

At the mention of deficit, a klaxon sounded and the word was in capitals across the screen.

If this is the view of Dharshini David, then it’s the view of the BBC, otherwise it wouldn’t be aired.

Unfortunately this video will be the message that too many in society will hear. It will reinforce the belief that the government has no money. The BBC needs to do better.

It really was crass

I tweeted this in response to the claim that grandchildren will pay:

I’ve just seen a clip of a BBC correspondent claiming that the government’s current debt will have to be repaid by our grandchildren. What utter nonsense. How do I know? Well, my grandparents’ generation borrowed a fortune to pay for WW1 and I never suffered for paying it back.

This is beyond preposterous. It is misinformation & fear mongering on an industrial scale which necessitates a formal complaint to the BBC. There’s no point in any number of laypersons writing in. It requires an ‘official’ letter from as many academics as possible. While that will be difficult to arrange at short notice, I think it should be sent anyhow even if it arrives a week or so later in order to register the gross inaccuracies on record. It wouldn’t be so serious if it had been an external opinion piece published by the BBC but it wasn’t. As Gordon McKendrick points out, Dharshini David is the BBC’s Senior Economics Editor which means she speaks on behalf of the Corporation.

The Covid-19 crisis is exposing the weaknesses in the quality of government this country has endured for far, far too long. It’s a golden opportunity to set many records straight (viz. the Tories are naturally better managers) and the macro-economic lies of the past 40+ years are surely at the top of the list.

I just noticed that one of the most watched items on the BBC News website was this.

https://www.bbc.co.uk/news/av/business-52761890/how-will-we-pay-for-the-coronavirus-damage

A bigger load of media economics bullshit would be harder to find. Why does the BBC economics correspondent seem to know so little about real world economics?

I wish I knew. I said this on Twitter

I’ve just seen a clip of a BBC correspondent claiming that the government’s current debt will have to be repaid by our grandchildren. What utter nonsense. How do I know? Well, my grandparents’ generation borrowed a fortune to pay for WW1 and I never suffered for paying it back.

Patrick Collinson in the Guardian today telling us all how they’ll have to scrap the triple lock on state pensions to pay off the debt. There was a time – I think there was, anyway – when I used to learn things by reading the Guardian. I start reading articles now and two paragraphs in I find myself thinking – this guy is an idiot. Richard writes his blog, Bill Mitchell writes his blog, Stephanie Kelton, Warren Mosler and a few others write their books and no one hears. The TV, Radio and print media are stone deaf. The House of Commons is full of flat earthers. It really is tragic that there is hardly a figure in or near government that you can look up to.

The Guardian has a blind spot when it comes to MMT.

I have challenged them on this, even mentioning this blog, but I get no response. And I bring it up nicely and politely too. I want to see Bill Keegan speak up for DMF/MMT and Larry Elliott – both whom I’ve got a lot of time for (Nils Pratley can be interesting too at times).

So much for their supposed ‘independent journalism’ and ‘editorial freedom’.

John Crace has been brilliant as well Steve Bell and the other cartoonists. They still have some good writing in terms of analysis of the problems.

But what about going forward, what’s the next big idea, from the Left or progressives? Frankly , they haven’t got a clue. And as you point out, it’s not as if there aren’t any ideas.

However, they are not as bad as the BBC. I used to rate Faisal Islam as open minded when he was on Channel 4 but now he’s seems to have turned into a corporate numpty – and he does not seem comfortable with that either. I wonder if the BBC economics/political correspondents are being told to shut up by the office bullies?

I can’t help feeling that it might help if there were a bit more coordination between those who are sending out the same message through blogs, books, columns, podcasts etc, in order to create (in addition to anything they might do individually through blogs, Twitter etc) a regular video presentation/discussion that gets such points over and might attract more sustained attention of the likes of MSM correspondents. I know this may be tough to do in practice, but without something that can be seen as representative of more than an individual, I feel that MMT and allied views may pass MSM by or be seen as too maverick (at least until years have passed and the damage is done).

U am planning a Youtube channel…

Lets turn to the Bank of England’s own interpretation of QE (click on link below). I’m sure you will agree that there is not much to argue with. Even the short clip is easy to understand and digest.

Quantitative easing is a tool that central banks, like us, can use to inject money directly into the economy.

Money is either physical, like banknotes, or digital, like the money in your bank account. Quantitative easing involves us creating digital money. We then use it to buy things like government debt in the form of bonds. You may also hear it called ‘QE’ or ‘asset purchase’ — these are the same thing.

The aim of QE is simple: by creating this ‘new’ money, we aim to boost spending and investment in the economy.

https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

I suggeest someone sends this link to all their media contacts around the world.

At least some in the media get it:

Anyone who says “how do you pay for it” in the midst of once-in-a-century crises like the Crash of ’08 or the pandemic of ’20 should be ignored forever. They have zero credibility.

https://twitter.com/mehdirhasan/status/1262892912716722177

I agree with Mehdi – with whom I have not spoken for ages

Bluntly with a majority of voters not understanding how the country’s monetary system works turns the nation into Self-Destruct Land! It’s been like this for over seven decades now and this ignorance one of the major causes for the country’s economic decline.

I’ll be writing more on how to tackle this over the weekend

It may be worth pointing out that when debt was “paid down” to great fanfare in year 2000 (the £22bn from the sale of 3G licences) that repayment was totally blown out of the water by the financial crisis that followed a few years later. It was a criminal waste of money.

Austerity was a similarly futile perversion of priorities. The Tories literally coasted on the crest of investment put in by Labour while crushing the poor by robbing them of income and services. That infrastructure has long since frayed for wont of maintenance but the coronavirus crisis has finally exposed the Tories’ decade-long dereliction of duty.

People need to understand that governments straining sinews to “pay down debt” is a key contributor to all this massive volatility and the insecurity they feel.

Indeed….

“It’s the private sector that’s doing badly.”

It’s a bit harsh to criticise the private sector when the government has effectively forced them to close down.

“Nor has the government done badly.”

Wow. Which country are you in?

The U.K., where the hollowing our of private enterprise in pursuit of shareholder reward maximisation had left business utterly hollowed out and without the capital to deal with the crisis

The fundamental working principle of neoliberalism (forget the high-falutin’ ideology, we are talking ‘real world’ neoliberal realpolitik), is to make the minimum conceivable equity maintained in the business produce the largest possible shareholder return in either dividend or share price (in a public company).

The model, now deeply established is cheap debt, just-in-time, contracting out everything, use the self-employed, zero-hour contracts for labour, move everything on-line and off-shore, including production; and overpay a very small number of executives (under the pressure of a balance sheet squeezed till the pips squeak) to keep everything from falling over; and if its does; walk away fast – there is another corporate carcase (mug) to feed vulture capitalism, just around the corner.

The future? Surveillance capitalism; now the vultures can feed directly off the carcase of the consumer, with virtually no overheads at all.

the debt is being bought right now: the gov’t has already injected the money into the financial markets to provide the cash so they can buy this debt. So there will be no debt crisis.