Having been talking in an OECD conference during the dayI moved on to talk to the Ely Cathedral Business Group (of which I was a founding member a long time ago) yesterday evening. This group has reached out to many hundreds during its recent meetings over Zoom and Facebook.

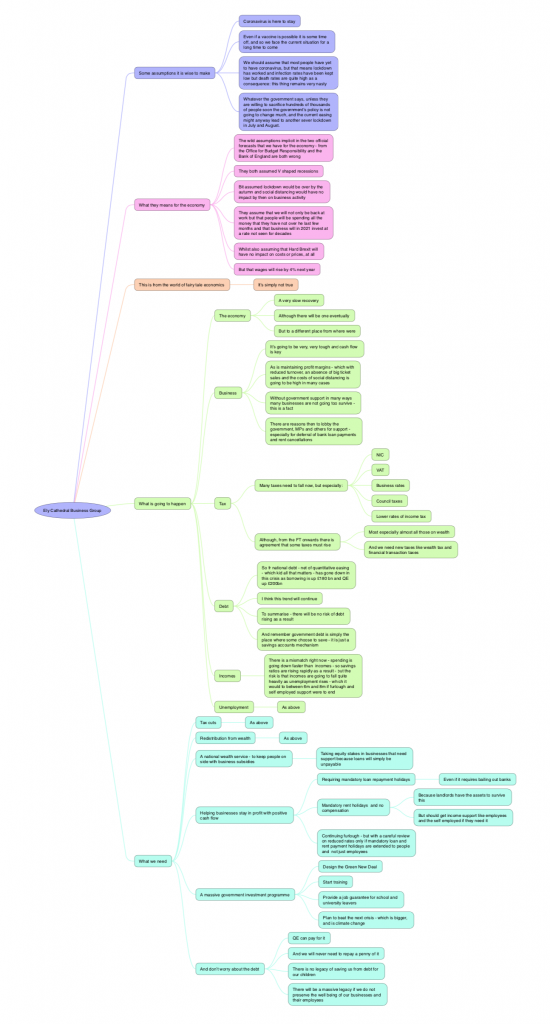

I spoke about my view of the coming economy and associated risks. These were my speaking notes, also reproduced more conventionally below:

- Some assumptions it is wise to make

- Coronavirus is here to stay

- Even if a vaccine is possible it is some time off, and so we face the current situation for a long time to come

- We should assume that most people have yet to have coronavirus, but that means lockdown has worked and infection rates have been kept low but death rates are quite high as a consequence: this thing remains very nasty

- Whatever the government says, unless they are willing to sacrifice hundreds of thousands of people soon the government's policy is not going to change much, and the current easing might anyway lead to another sever lockdown in July and August.

- What they means for the economy

- The wild assumptions implicit in the two official forecasts that we have for the economy - from the Office for Budget Responsibility and the Bank of England are both wrong

- They both assumed V shaped recessions

- Bit assumed lockdown would be over by the autumn and social distancing would have no impact by then on business activity

- They assume that we will not only be back at work but that people will be spending all the money that they have not over he last few months and that business will in 2021 invest at a rate not seen for decades

- Whilst also assuming that Hard Brexit will have no impact on costs or prices, at all

- But that wages will rise by 4% next year

- This is from the world of fairy tale economics

- It's simply not true

- What is going to happen

- The economy

- A very slow recovery

- Although there will be one eventually

- But to a different place from where were

- Business

- It's going to be very, very tough and cash flow is key

- As is maintaining profit margins - which with reduced turnover, an absence of big-ticket sales and the costs of social distancing is going to be high in many cases

- Without government support in many ways many businesses are not going to survive - this is a fact

- There are reasons then to lobby the government, MPs and others for support - especially for deferral of bank loan payments and rent cancellations

- Tax

- Many taxes need to fall now, but especially:

- NIC

- VAT

- Business rates

- Council taxes

- Lower rates of income tax

- Although, from the FT onwards there is agreement that some taxes must rise

- Most especially almost all those on wealth

- And we need new taxes like wealth tax and financial transaction taxes

- Debt

- So far national debt - net of quantitative easing - which is all that matters - has gone down in this crisis as borrowing is up £180 bn and QE up £200bn

- I think this trend will continue

- To summarise - there will be no risk of debt rising as a result

- And remember government debt is simply the place where some choose to save - it is just a savings accounts mechanism

- Incomes

- There is a mismatch right now - spending is going down faster than incomes - so savings ratios are rising rapidly as a result - but the risk is that incomes are going to fall quite heavily as unemployment rises - which it would to between 6m and 8m if furlough and self employed support were to end

- Unemployment

- As above

- What we need

- Tax cuts

- As above

- Redistribution from wealth

- As above

- A national wealth service - to keep people on side with business subsidies

- Taking equity stakes in businesses that need support because loans will simply be unpayable

- Helping businesses stay in profit with positive cash flow

- Requiring mandatory loan repayment holidays

- Even if it requires bailing out banks

- Mandatory rent holidays and no compensation

- Because landlords have the assets to survive this

- But should get income support like employees and the self employed if they need it

- Continuing furlough - but with a careful review on reduced rates only if mandatory loan and rent payment holidays are extended to people and not just employees

- Requiring mandatory loan repayment holidays

- A massive government investment programme

- Design the Green New Deal

- Start training

- Provide a job guarantee for school and university leavers

- Plan to beat the next crisis - which is bigger, and is climate change

- And don't worry about the debt

- QE can pay for it

- And we will never need to repay a penny of it

- There is no legacy of saving us from debt for our children

- There will be a massive legacy if we do not preserve the well being of our businesses and their employees

- Tax cuts

- Many taxes need to fall now, but especially:

- The economy

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hi Richard, interesting notes. I would have liked a bit more context about the effect of debt and deficit because it seems the latter is again going to be the driver for the UK economy. Like many, I am not an economist or a tax specialist and there seems to be many all hallowed myths around these two words. The big one may be that they work the same for a household or business as they do for a country – how can they be made to work for instead of us for them ie austerity?

On another matter, we need plain speaking radical economists on the mainstream as all the same stuff is being talked about and I can see that in 10 years time, my sons will be in a worse state than now. Have you seen the GMB Twitter feed this morning?

The charts are to small to read also when you post Tweets, the graphic is blank.

Thank you for trying to educate the masses every day. I really hope we can debunk the myths for Workington man and someone out there can mobilise with a radically more positive vision

Can you see the blog this morning on the deficit?

I plan a recording on the household myth

Richard the opposition should adopt all of these sensible proposals. Each point succinctly made without evasion or waffle. If only we had a decent opposition, not just whishey washey.

Richard,

To what extent are you concerned about inflation in the economy? The QE liquidity is going to end up somewhere – property/assets/bonds? Those with wealth are well protected with property (rents linked to inflation) and assets (shares with growing revenue lines). By contrast those in the public sector are punished by a return to wage friezes to fund the tax cuts and have few assets to compensate.

Correspondingly, where do you see interest rates in your scenarios? Mark Carney memorably described the British economy being dependent on “the kindness of strangers”. That kindness is going to come at a higher price in future and the weakness of sterling points the way to a low growth high inflation economy.

No-one chose this position so this is not a political point but what is the way out of this trap please? The economic exit strategy will be highly political and I hope many of us will remember the lessons of 2008-2012.

Donald

I’ll stick with this for now

https://www.taxresearch.org.uk/Blog/2020/03/30/tackling-the-post-coronavirus-economic-myths-runaway-inflation-and-tax-increases-are-not-around-the-corner/