There is an excellent article by Paul Greenhalgh of Northumbria University on The Conversation website today. What he offers is a range of maps showing the decline in retailing in England and Wales.

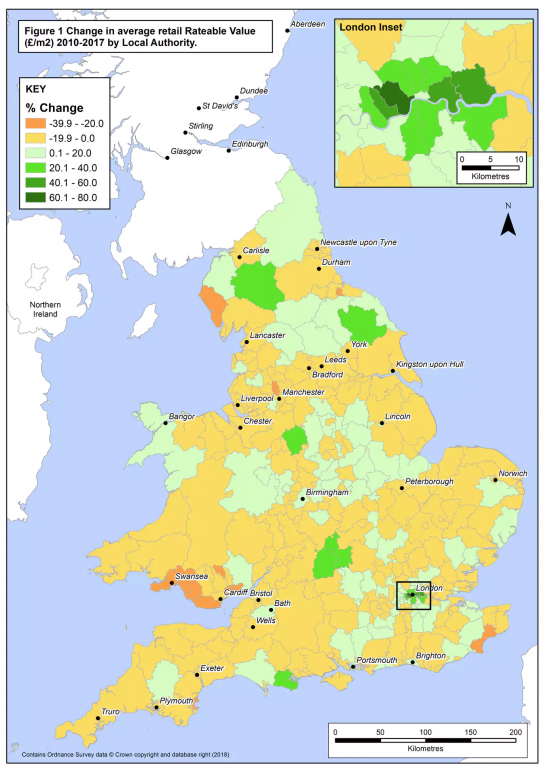

He starts by plotting the change in rateable value, which is broadly related to rents:

The picture is very weak unless you are in one of a few tourist or inner-city areas.

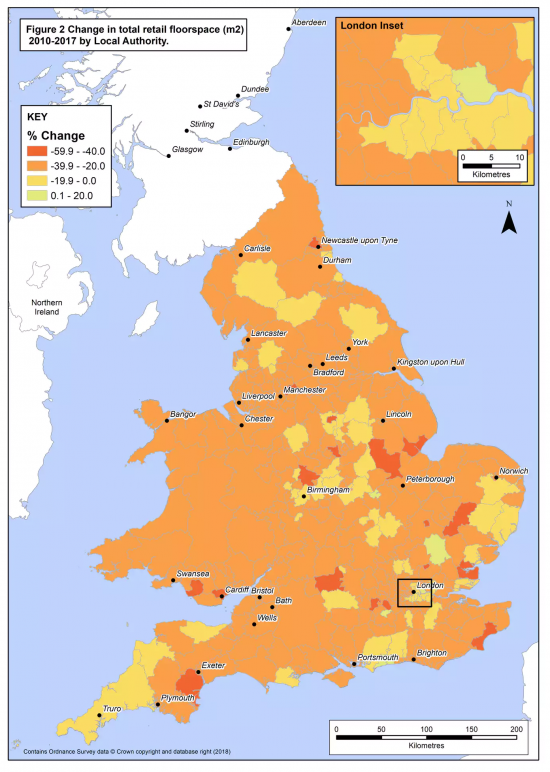

Then he plots the change in total retail floorspace:

The change is almost entirely negative.

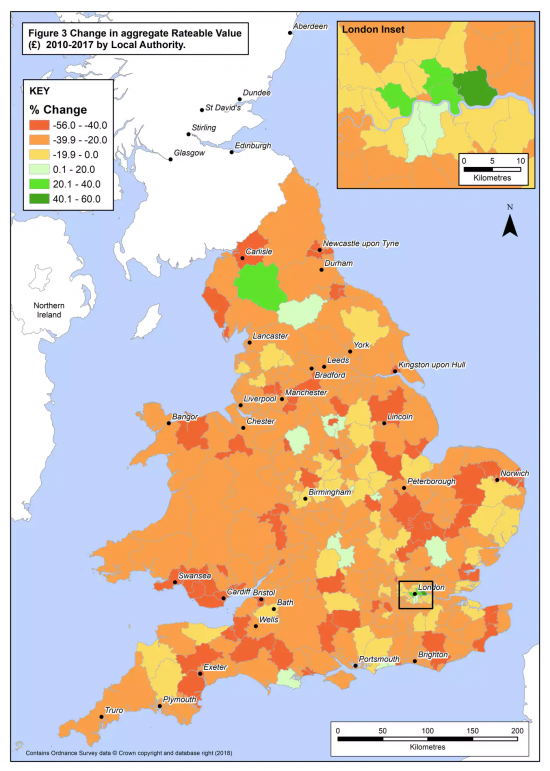

Finally he plots changes in aggregate rateable value, which effectively combines these trends.

Again, a few odd exceptions apart the trend is negative, or deeply so.

Why does this matter? Firstly, and very obviously it has local employment impact.

Second, it removes economic activity from the local economy.

But Third, as Greenhalgh says:

Our analysis delivers a sobering message: across most of England and Wales, the revenue generated from business rates on retail properties has diminished significantly. Local authorities in England and Wales — hit by significant funding cuts during austerity — are increasingly exposed to the vagaries of commercial real estate markets, since they now depend more on income from business rates to pay for local services.

To put it bluntly, this is precisely why hypothecated taxation does not work. When the tax base shrinks - and hypothecated tax bases tend to either because they are already ‘bads' or because they become overtaxed, then th3 yield suffers. And when, As is true of local authorities, yield is the basis for service supply, then hypothecation causes direct harm.

Can we forget it, forever, please?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Well, you can’t say it anymore simply than that.

Already forgotten – easy at my age. I do seem to have memories of hypothecation being to do, at least in the minds of others, as a means of more say on what tax is spent on and transparency through more real-time new-tech accounting. One might then be a no war spending individual and so on. Magic realism or similar, though fiction can make its point.

I come at this research from a different tack, though I accept Richard’s good sense on what is revealed about tax. I’ve never been comfortable with economists blithely talking about “the economy” as though they had a handle on what economies are. Raising any questions generally led to assumptions I couldn’t do their sums. In fact, I wanted some genuine complex systems analysis prepared to include evidence, not exclude it for easy calculation. That the High Street was done for has been obvious for years. Retailing is a very inefficient way to provide what we need in a way that protects everyone from precarity and the planet and other life from humans at their worst. Financial services are even worse. David Graeber’s recent(ish) “bullshit jobs” stuff reminds me of a much earlier “Neurocracy” written before neuro meant ‘vaguely connected with brain research’. Most of our work isn’t necessary and clearly vulnerable to re-organisation approaching elimination. We are stuck at the level of ‘Mary Queen of Shops consultancy’ rather then bringing in a sensible money system with tax as a control. The hard news of 40,000 retail jobs going or under threat is the tip of an iceberg of a crumbling system from which tax is extracted. That hypothecation is akin to magic realism is clear. A new money-tax system is needed and Richard’s is “approximate enough”. Resistance to the good sense, in my view, is based on just how radical such a system is, scaring huge numbers of people and especially politicians who really want to swan about in charge. There is imo no place for sensible, honest policies to be reviewed on merit in this neurocracy. “Retail experience is a great thing” says some dork on television. No thought of some whale eating plastic detritus from the experience, or dorks consuming micro plastic eating a meal costing the month’s universal benefit of a friend up the road.

The hypothecation of tax, in any case, would be subordinate to what are only hypothetical sources of what to levy on, increasingly not ready-to-hand and potentially accounting blackholes.

While we’re discussing attacks on councils in general might be the time to bring this up; “Northamptonshire is to be replaced by two unitary authorities under plans approved by ministers earlier this year after the inspectors’ report concluded that the council’s management and financial problems were so deep-rooted it could not be easily turned around.” Unitary authority – what’s one of them when it’s at home then, eh?

https://www.theguardian.com/society/2018/nov/29/tory-run-northamptonshire-county-council-bailed-out-by-government