The Treasury Committee has published a new report on savings, pensions and related issues. There is much to take issue with in it at a theoretical level. But there is much sobering analysis as well. Take this for example:

While estimates vary, it appears that millions of UK households do not have [£1,000] of savings, or any savings at all. StepChange estimates that over 7 million households (25 per cent) have savings below £1,000. Meanwhile, the Open University Centre for Public Understanding of Finance (PUFin) cited data showing that a third of households have no savings at all. StepChange's research indicates that low incomes, living in rented accommodation, having dependent children and being younger, were are all risk factors for having a low level of precautionary savings.

This is the world the Tories cannot imagine. But is is very real.

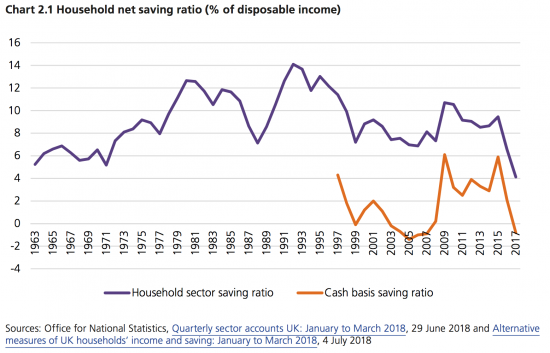

As is the movement in the savings ratio, repeated in the report:

The cash data is significant: people are already not making ends meet.

This is an economy in trouble.

This is a nation in trouble.

And it can only get worse right now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

So where do we go from here?

We need a Green New Deal

Instead we’re getting approvals for fracking. The mind fracking boggles.

Something to bear in mind when thinking about a green new deal is the shambolic rollout of smart meters, also the previous green deals of the recent decade.

All this does is turn a lot of people against energy saving and renewables.

As for savings, quite a high number of over 65’s have savings of over £5k just sitting there not being spent, and unlikely to be spent. Why, “well, it’s nice to have” or “you never know”

Any suggestions?

That’s because the private sector was allowed to do it for all the wrong reasons

well down the tube i thought,the plebs have been put to the sword,min wages/zero hour contracts/zero interest rates/public services cuts,there is no end to it! folk should have proper jobs with proper wages.

Good data, thanks for pointing it out.

Household debt, the other side of the coin: https://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/articles/makingendsmeetarehouseholdslivingbeyondtheirmeans/2018-07-26

It is

“This is the world the Tories cannot imagine. But is is very real.”

This is a huge problem. The angriest i’ve been in a long time was watching the Universal Credit debate and seeing one thick Tory blowhard after another displaying that they have no idea about the lives of low income people in the UK.

Well, we’ve broken into ours and may have to reduce what we are saving. We’d rather not but our experience seems consistent with the post. And we are not big spenders by any stretch of the imagination.

There is no such thing as Trickle down, but what we are seeing now is the rising damp of poverty creeping into the middle class.

The fabric is crumbling. The wallpaper peels first, then the plaster rots and then the dry rot takes hold.

The constituency of the comfortable becomes numerically smaller by the day.

Something about this doesn’t look right: https://www.bbc.co.uk/news/business-44979607

Tax cuts encourage spending and help US growth, don’t think it will last.

The argument is it is a fiscal stimulus

“The argument is it is a fiscal stimulus”

Not convincing though is it ?…if the stimulus is to beat the falling of the tariff barrier. After which, what next ? And the blip will encourage the FED with its interest rate rises….and then we shall see what we shall see.

What’s the betting it won’t be pretty ?

“Economists say that figure, which contributed more than 1% to the GDP gains, was inflated in part by farmers seeking to get ahead of new trade tariffs on items such as soybeans.”

Worry not, The Donald is going to devise a way that US farmers can sell their soybeans again next quarter. Even if he has to send the marines to steal them all back again.

What could possibly go wrong…..?