The Bank of England published its accounts to 28 February 2018 yesterday (I have no idea why it uses that date: does anyone know?)

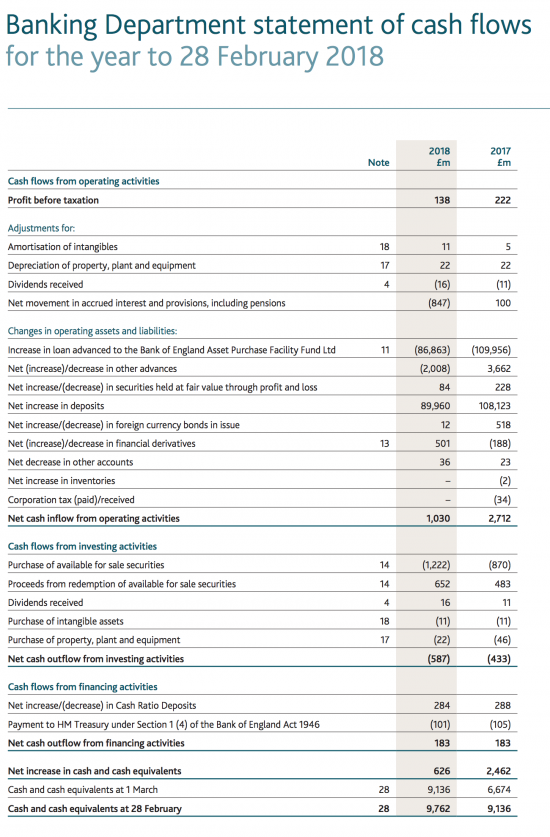

The cash flow statement showed this:

Note the £86.8bn advanced to Bank of England Asset Purchase Facility Fund Limited. That is new quantitative easing by any other name.

And then note the £89.9 billion of additional deposits.

And also note a remarkably similar pattern in behaviour last year, involving slightly larger sums of around a hundred and £108 billion.

What is happening? Quite simply quantitative easing is creating new bank deposits. As modern monetary theory suggests, money advanced creates what are, in effect, new savings, even if in this case they are reserves held by banks with the Bank of England.

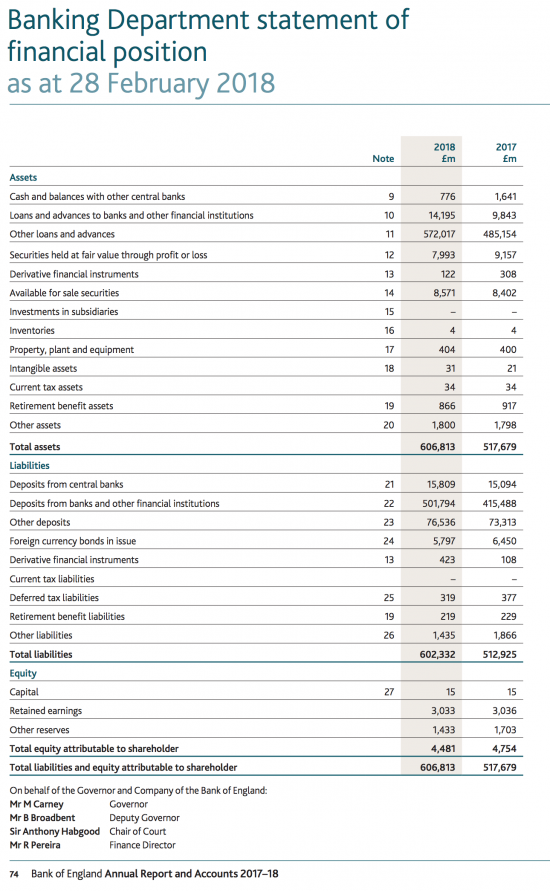

This is confirmed by the balance sheet:

Note 'other loans and advances' of £572 billion. These are made up almost entirely of quantitative easing advances and as is clear, the sums are almost exactly matched by deposits.

I think there can now be no doubt: the government can, and does, create money at will. The only issue left to discuss is how that money should be used.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Can we ask the BOE what other loans are? It all makes the suggested £6 billion for the NHS small fry. Thank you.

They are all for QE purchases i.e. they fund the purchase of government bonds

They’d be bonds which are themselves created by government out of thin air, we should remember. There’s your magic money tree!

Presumably the increase in ‘Other loans and advances’ between 2017 and 2018 of £87bn also demonstrates your point.

‘Other loans and advances’ refers to Note 11 on p96, which explains –

“purchases of assets are financed by the creation of central bank reserves”.

(Hopefully, I’m understanding this)

You are

Why February?

The Bank of England has been reporting details of the notes in circulation at the end of February and the end of August since at least the early 19th century and possibly into the 18th century, and it seems the Court of the Bank decided to “make up the Books to a Ballance”[sic] at the end of February in (!) …. 1685. Wow. So they have been doing that for 333 years. Almost a third of a millennium.

That was just after the Bank decided to hold its General Court twice a year, in March and September, so the accounts would need to be drawn up shortly before.

And since then I guess it has just stuck around.

See page 196 of Elizabeth Hennessy’s “A Domestic History of the Bank of England, 1930-1960”.

Damn. Typo. Should be 1695. “only” 323 years ago.

Thanks

And correction noted

It amuses me that those opposing QE as ‘printing money’ are even more hostile to Peoples’ QE: the former creates loans without the ‘pull factor’ of free-market demand; and the latter creates both loans and assets, with a deliberate policy objective of creating assets of real utility to the general population.

Don’t you know governments aren’t meant to add value? 🙂