The government was not meant to make any announcements yesterday so that nothing distracted from the Grenfell Tower anniversary. So HMRC published their latest tax gap data, which has always previously been published in the autumn.

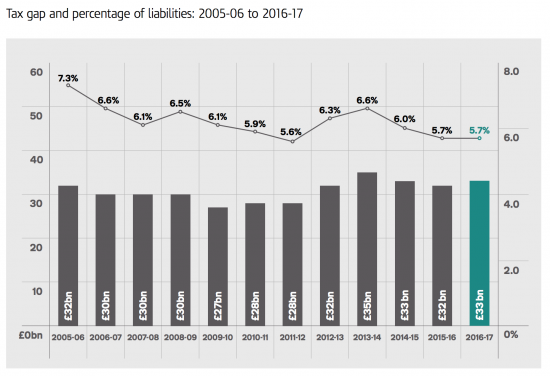

As I mentioned in a blog post last night, the gap is supposedly £33bn. That, however, is hardly surprising. This is the history of this data:

The mean gap is £30.8. Adjust a little for inflation and it was bound to be about £33bn. I hate to say that I think the figures are manipulated, but I believe that they are.

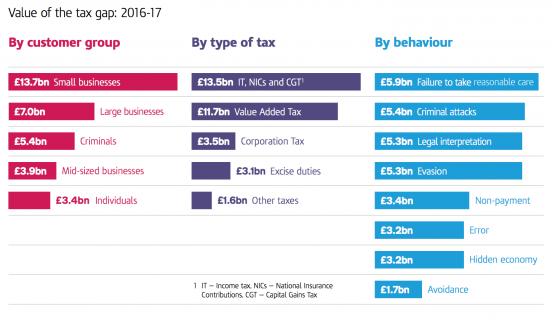

This is the supposed break down of the gap:

Some of these figures are obviously absurd. Tax avoidance only includes losses to schemes disclosed under the Disclosure of Tax Avoidance Schemes rules of 2004 and subsequently. However, we know that the number of disclosures under these arrangements has fallen considerably over the years because most tax avoidance has changed type since these rules were promoted. That does not mean that the avoidance has ended: it just means it takes a different form, but HMRC have chosen not to measure new types of avoidance. As result, and quite absurdly, most of the avoidance that has caught public attention in recent years is not included in these tax gap figures.

One consequence has been the increase in the amount of the tax gap allocated to ' legal interpretation'. HMRC describe this as:

Legal interpretation losses arise where the customer's and HMRC's interpretation of the law and how it applies to the facts in a particular case, result in a different tax outcome. Examples include the correct categorisation of an asset for allowances, the allocation of profits within a group of companies, or VAT liability of a particular supply.

To suggest that the sums in question are lost implies one of two things. Either HMRC's interpretation is wrong or insufficient resources are being supplied to it to make sure that its opinion can win the day. In other words, this loss is voluntarily being accepted by the government. Questions have to be asked as to why that is the case.

Then there are the losses to the shadow economy. These are stated to be £3.2bn. The overall tax rate within the UK economy is about 33.9%. This, then, implies that about £10 billion of economic activity is hidden within the shadow economy. To put this in context, GDP was £1,984bn in 2016-17. The implication is that HMRC think that the UK shadow economy makes up just 0.5% of economic activity. This is absurd: the latest estimate of UK fraud is £190bn a year. And the latest peer-reviewed data for the IMF shows, for the last twenty years the average expected size of the UK shadow economy has been 11.08%. To put this in context the estimated percentage tax gaps are:

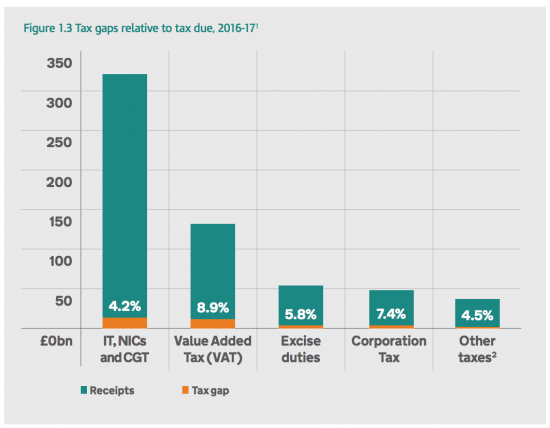

The EU, in contrast, estimates the UK's VAT gap at 10.9%, and on a rising trend. I think that considerably more likely. It also happens, and not by coincidence I suggest, to be remarkably similar to the estimated size of the shadow economy, and total fraud.

In that case, I would venture to suggest that the size of the UK shadow economy is around £200bn and the tax lost on that at the overall 33.9% rate paid in 20916-17 (£672bn tax paid on £1,984 GDP) would be around £68bn, compared to HMRC's estimate of £3.2bn.

I stress that this would include the HMRC estimates for tax evasion, the shadow economy and criminal attacks, totalling £13.9bn. The remaining £19bn or so would still exist on top of that loss, bringing the tax gap to not less than £87bn.

And I stress, that since HMRC do not reflect in their figures what I have suggested in the past to be considerable losses to tax abuse in capital gains, national insurance avoidance, inheritance tax non-declaration and international company profit shifting it is entirely plausible, and very likely, that the tax gap remains at a figure well in excess of £100bn a year.

Three things are clear. The first is that we need more candour from HMRC. The second is that we need an independent appraisal of the tax gap: these estimates are not good enough. The third requirement is for additional resources to be made available to HMRC to tackle this issue. Whatever view of the economy and economics that you take, this failure to collect tax represents gross economic mismanagement that has enormous consequences with regard to inequality, the supply of public services and the overall management of well-being in this country, and it is being ignored. That represents gross negligence and it is time it came to an end.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“a sum between £28bn and £35bn”

That’s more than your tax gap estimates ever varied by and you predicated more than 3x bigger. I note that no-one is using your 120bn estimate any more, even Prem Sikka and TJN, so I guess you’ve given up on that figure.

It relates to 2012

It’s out of date

So of course it is not being widely used

Why do you think no-one gives any credibility to your figures?

I disagree with your suggestion.

My figures have been widely used and have been part of the process of creating alternative anti-austerity narratives, getting Jeremey Corbyn as leader of Labour and creating tax justice movements.

The problem is all yours if you think the figures are not credible: they have been widely used. So the question is, why are you writing nonsense?

I think Labour had disowned your economic work?’’y

You claiming that your work is ‘credible’ doesn’t make it do. There is a constant theme on here where you have to criticise others and boast about your own opinions / work, rather than let others do that for you. – why is that?

Certainly in my business, my expertise sells itself and my new commissions come from word of mouth – I don’t need to belittle others and tell the world how clever I am.

Why has no one commissioned you to re-do this work if it is a) out of date and b) so credible / useful?

The story of my relationship with Labour is well known

John McDonnell has acknowledged my tax expertise from the Dispatch Box. Has he yours?

I am working on new estimates now with EU funding.

And I was appointed a professor.

But if you want to abuse I am sure you will continue to do so.

What did John Mcdonnel say about your economic credibility when they decided not to work with you post Election?

I don’t claim to be an expert in tax. The point is that, unlike you, I don’t need to repeatedly boast about how clever I am (and how wrong everyone else is), my expertise is known within my industry and that’s who’s I get new jobs.

I decided not to work with Labour

He wanted to sign up with George Osborne’s fiscal charter. I could not countenance that. It was easy to move on in that case. McDonnell changed his mind.

And I don’t say how clever I am. Or claim that I am an expert. I just write within the limits of my expertise Others say I am an expert; not me. But I guess that’s why I guess I get a lot of work.

And what I know is you’re unlikely to be Dennis Potter, or be anything but a troll. Which is pretty sad really.

“And I was appointed a professor”

Come come Richard. Professor of Practice is a purely honorary title. No exams were passed or tests taken to get it. I would have thought that your Quaker teachings would have guided you away from the vanity of titles, especially those given rather than earned.

I urge you to examine your soul and be more humble, for your own sake.

Remember Angelina Jolie is a professor. But she wisely does not affect to use the title.

But you may have noted she is not a full time teaching and research professor paid at professorial grade

I don’t claim to be an actor because I am not paid as such

But why let facts get in the way?

Oh, and no professor passes an exam to be a professor. Just in case you weren’t aware of that.

[…] can be little doubt that HMRC's work on the tax gap was prepared in response to the work of Richard Brooks and myself on tax gaps from about 2006 […]

Does the tax gap include any allowance for the tax avoided by companies such as Starbucks, Amazon, Apple, Google, Vodafone, Shell, Tesco and countless others in recent years using complex international schemes? Does it include the tax lost when assets are rented or leased in the UK by companies and subsidiaries registered in tax havens? Does it include all sorts of other creative ways by which tax is legally avoided, often involving secretive overseas jurisdictions and tax havens? Does it include tax avoided by the wealthiest individuals by holding assets in trusts? It seems to me that paying tax in the UK is entirely optional for any individual or business that can afford the best tax advisors and lawyers. On that basis, isn’t the real tax gap £200 billion per year or more?

It does not include those things

The work I am doing is looking at such issues