Trump's tax reforms - designed to enrich Apple by at least $47 billion - will see large corporate America have its tax rate cut form 35% to 20%; ordinary Americans see their personal income tax increase from 10% to 12% and those living in Democrat states always see their taxes rise (because that's implicit in the design). Trump says this will be a 'big, beautiful tax cut'. But the real question is, will it work?

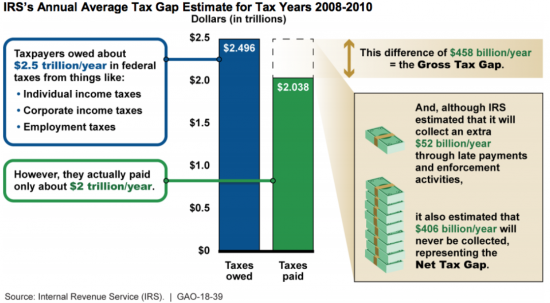

That is a reasonable question to ask. That's because this whole plan is premised on the idea that if rates are reduced then business will invest more, jobs will be created, and growth will follow. There is, however, implicit in that assumption another, even more implicit, assumption, which is that Americans pay the tax that they owe already. And the fact is that they don't. The US General Accounting Office (GAO) has just issued a new report on the performance of the US Internal Revenue Service (IRS) in addressing their tax gap. It's pretty damning stuff. Admittedly the data is somewhat out of date, because they have nothing available beyond 2008, but for that year the tax gap looked like this:

As they note, in the US just 81.7% of the taxes that are owed are actually paid. Admittedly not every tax is considered, but all the important ones are. The research covers individual income, corporation income, employment, estate, and excise taxes.

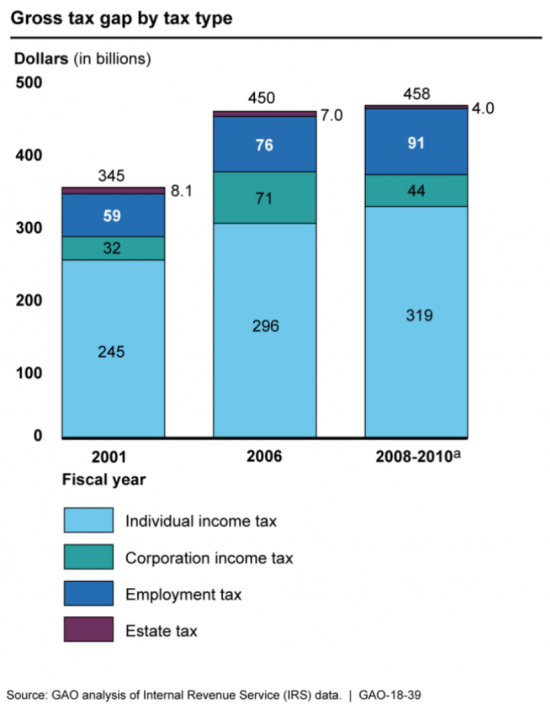

The amounts lost are staggering:

Clearly the losses have increased by now.

The losses are not consistent across all taxes:

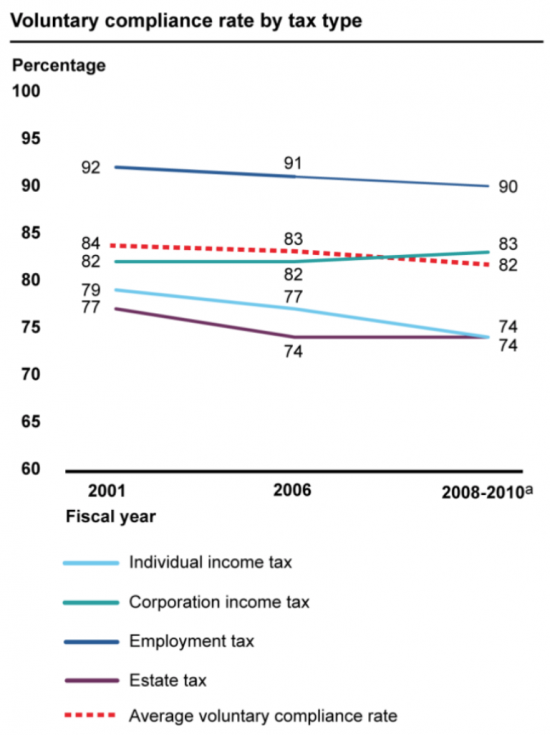

The compliance rate with regard to employment taxes is, very obviously, higher than in the case of other taxes simply because the tax is deducted at source before an employee is ever given the option to evade it. But what is very clear is that if an American is given the option to evade then a lot take it. As this data shows that is not in total in most cases:

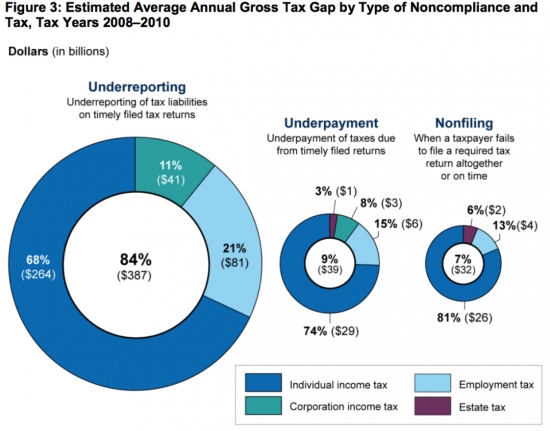

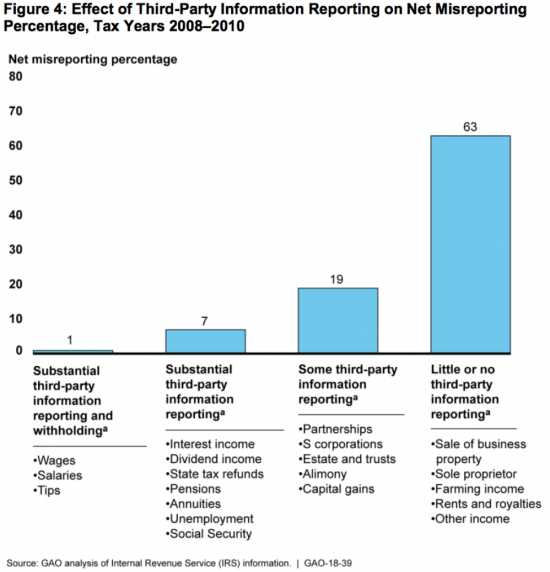

Choosing to pay some of the taxes that are owed is, broadly speaking, ten times more common than evading tax altogether. Which taxes are evaded does, however, depend very heavily upon the chance of being found out:

As is apparent, wages are very largely reported, as is most income where reporting from a bank is commonplace. It is income from trade that is most commonly underreported. And that happens most often when there is no third party involved. The report does in fact suggest that 76% of all self-employed income in the USA was misreported, although in fairness it should be pointed out that 13% of the errors were over, and not under, reporting. The average under declaration of income was just in excess of $4000.

What does this mean? First, this data, which is undertaken on a much larger sample based on that used by the UK's HMRC, reports a much larger tax gap than that which is suggested to arise in the UK.

Second, as I have long suggested, the biggest issue in the tax gap is not tax avoidance by large multinational companies, however significant this is with regard to behaviour and agenda setting. Instead, tax evasion by small businesses is by far the biggest issue of concern.

Third, what is apparent is that the business owners, who are meant to be incentivised by Trump's tax plan, will actually be indifferent to it: those who do not like the existing tax regime are already taking whatever tax cuts they like, as they choose, and as often as they wish.

Fourth, this then implies that Trump's tax plan has almost no chance of delivering the economic growth that he suggests might arise from it because the cut that is planned has already been taken.

Fifth, and in conclusion, what is clear is that if tax is to play a fundamental part in macroeconomic policy agenda setting then there has to be a rigorous, and enforced, tax regime where most taxes are paid and business operates on a level playing field. In the US that level playing field exists, but solely because tax non-compliance is almost endemic right across the business spectrum. However, what that means is that tax incentives aimed at the business community to induce investment are bound to fail. And that, we can be sure, is exactly what will happen with Trump's tax plan.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The only positive thing to come out of this may be that sooner or later the American public will stop drinking the neo-lib cool aid that is trickle down.

Maybe this ‘win’ for Trump may actually work against him in the long run.

But what is also needed in America is a fully functioning Democrat Party with its own republican tendencies kicked firmly into the long grass – with a certain Mr Sanders in charge perhaps – to make the most of the opportunity.

I don’t think so, the Republican party will simply blame the poor, welfare queens, unwed mothers and anybody to their left of their position for the

failure of tax cuts to produce jobs and wealth and of course the Republicans will continue to engage in gerrymandering, voter suppression and will continue to obtain seats and power.

And if not Bernie what about Elizabeth Warren? And of course there are others.

Given his tendency to ignore truth, and not live in the real world, any failure is, if not a success, someone else’s fault.

Heads he wins.

Tails you lose.

John M,

All you are saying is that he is in a constant state of denial. I am not sure if that constitutes an advantage. His failures and losses remain failures and loses whether recognises them or not.

Trump lives in own cartoon reality in his narcissistic mind and his supporters are happy to join him in his bizarre world.

Well done Richard. Most people would be hampered by there being no actual evidence of what happened after 2010 but they lack your omniscience so you can state, with certainty that ‘clearly’ the gap has increased since then, because, well. You said so. Who needs evidence?

I hope you insist on such rigourous academic standards from your students. If they still let you near students? I’ve heard not?

But you see, that’s not what you’ve heard at all

Because I do indeed teach

So you’re just a purveyor of crass stupidity

And that’s why you’re heading for the banned list

I do not know much about the US economy and corporation tax but in the UK there is no correlation between reducing tax rates and increasing revenue from increased business activity nor in the average of Gross fixed capital Formation inflation adjusted between 2000-2015 when were rates were steadily reduced from 30% to 20%. It does not work here so why would it work in the USA. Corporations merely get richer but then so will Trump’s