The tax affairs of large US companies operating in Europe will attract a lot of attention today. It is expected that the EU will publish a ruling against Amazon. The implications of the ruling, which is technically on a transfer pricing issue, will be clear: Amazon will owe more tax.

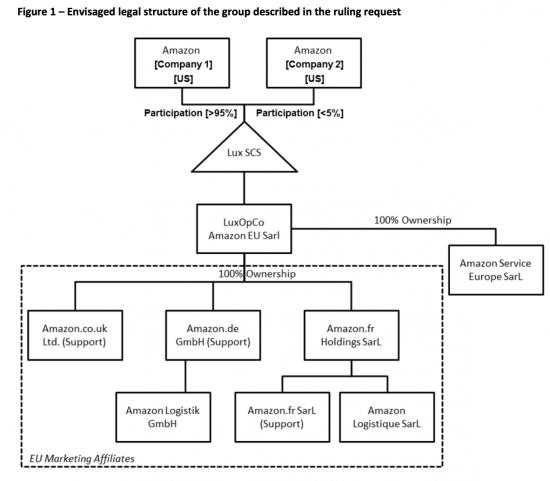

The case against Amazon is summarised here. The argument revolves around this structure:

The US companies own their interests offshore. They in turn own a 'tax transparent' Luxembourg company 'SCS', which owns the rights to the US generated software that drives the Amazon platform. That tax transparency means that SCS is not taxed in Luxembourg but where its members are. Because of the US tax system that has to date, in effect, not taxed overseas earnings not remitted back to the USA, SCS is effectively untaxed.

The rights SCS owns are licensed to a Luxembourg tax resident company, Amazon EU Sarl. Sarl had a transfer pricing agreement with SCS, approved by Luxembourg, that in effect meant that all the profit flowed back to the SCS and so offshore and so became untaxed. The challenge that the EU will consider today is whether that price from Sarl to SCS was fair. And it is thought they will say it was not and as such Sarl has much more profit and so a tax liability. The likelihood is that Luxembourg will object, just as Ireland is objecting to collecting tax from Apple.

That's the technicalities. What are the issues? There are several. First, this is a structure created soon after the turn of the century. To be candid, it's blatant, aggressive and very obviously created with one goal in mind. And back then no one thought anyone would have the temerity to challenge it. Times have changed. I doubt anyone would try a structure quite as blatant as this now. Let's celebrate progress.

Second, let's bear in mind Trump's proposed US corporation tax reforms. These will lock in all Amazon's gains: they have everything to fight for. The evidence is clear that the EU is far ahead in terms of tax justice. International cooperation with the US on this issue still remains a dream. The UK Brexiteers might want to bear this, as well as Bombardier, in mind when negotiating with them.

Third, if there was no transfer pricing arrangement this problem would go away: a unitary tax system that would allocate profits to where sales, people and tangible assets are located would long ago have solved this problem.

Fourth, if country-by-country reporting had existed back then (and the idea was only created in 2003) then the issue would have become apparent a lot sooner: transparency matters in solving tax issues, in other words.

Fifth, the need for cooperation on tax is apparent. In global markets states have to work together to collect tax owing. I am often asked what the merits of the EU are. This is one of them. And I applaud it for it.

Last, the culture that created this has to be rooted out. This is not about competition. Nor is it about free markets. It is not about capitalism. It is about abusing regulation to eliminate competition, establish monopolies, deny responsibilities and eventually suppress market entry. It is the antithesis of what is being lauded by those who say they believe in markets. I do not however expect to hear them condemning it.

And all this matters: it shapes the world we really live in. In the Joy of Tax I said tax systems are the mechanism best able to determine the type of society we have. Beating Amazon on this helps create effective markets and real choice. It's vital that the EU win this case.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

You mentioned about Brexiteers needing to bear in mind US’s lack of cooperation. But post-Brexit is the UK government going to be able to prevent the routing of profits to Luxembourg or Ireland/elsewhere? At the moment this looks increasingly possible because the UK benefits from co-ordinated action at the EU level and EU law on the issue. But presumably that will no longer be the case after, and all we will have to rely on is domestic law (unless something like the current system is encoded in a post brexit deal).

We will have no chance

Mind you, we’ll probably be facilitating it

Johnson has clearly suggested that direction of travel

[…] is, as predicted this morning, facing a tax charge of about €250 million that the European Commission is demanding be imposed […]

Amazon is evil and they have a lot of companies called Sarl, I note you refer to one. Is Sarl the company that licences from or to SCS? What about the other companies called Sarl? How do they fit in?

Sarl is an euivalent of Ltd in Luxembourg: it implies nothing more than a common type of company

SCS is another form – the equivalent of our LLP

Admire your zeal Mr Murphy. Do wonder at the ingenuity of said financiers to find other ways….

In 2014 Nick Hanauer, who was a co-founder of Amazon wrote an article delightfully titled “The Pitchforks Are Coming…For Us Plutocrats”. Here’s a sample:

” And so I have a message for my fellow filthy rich, for all of us who live in our gated bubble worlds: Wake up, people. It won’t last.

If we don’t do something to fix the glaring inequities in this economy, the pitchforks are going to come for us. No society can sustain this kind of rising inequality. In fact, there is no example in human history where wealth accumulated like this and the pitchforks didn’t eventually come out. You show me a highly unequal society, and I will show you a police state. Or an uprising. There are no counterexamples. None. It’s not if, it’s when.

“The most ironic thing about rising inequality is how completely unnecessary and self-defeating it is. If we do something about it, if we adjust our policies in the way that, say, Franklin D. Roosevelt did during the Great Depression–so that we help the 99 percent and preempt the revolutionaries and crazies, the ones with the pitchforks–that will be the best thing possible for us rich folks, too. It’s not just that we’ll escape with our lives; it’s that we’ll most certainly get even richer.”

Oops, link:

http://www.politico.com/magazine/story/2014/06/the-pitchforks-are-coming-for-us-plutocrats-108014?o=0