David Graeber has an article in the New Statesman this week on the build up of personal debt in the economy. In it he notes:

For almost a decade now, since 2007, we have been living a lie. And that lie is preparing to wreak havoc on our economy. If we do not create some kind of impartial forum to discuss what is actually happening, the results might well prove disastrous.

The lie I am referring to is the idea that the financial crisis of 2008, and subsequent “Great Recession,” were caused by profligate government spending and subsequent public debt. The exact opposite is in fact the case. The crash happened because of dangerously high levels of private debt (a mortgage crisis specifically). And - this is the part we are not supposed to talk about–there is an inverse relation between public and private debt levels.

He illustrates this with this data:

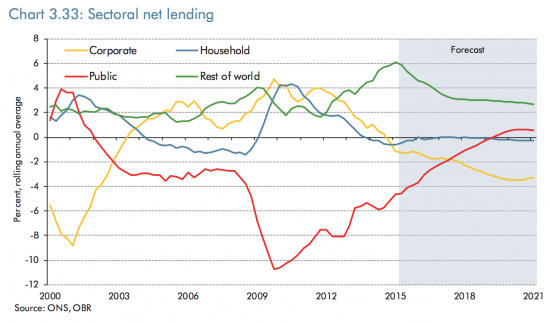

These graphs show the relationship between public and private debt. They are both forecasts from the Office for Budget Responsibility, produced in 2015 and 2017.

This is what the OBR was projecting what would happen around now back in 2015:

This year the OBR completely changed its forecast. This is how it now projects things are likely to turn out:

First, notice how both diagrams are symmetrical. What happens on top (that part of the economy that is in surplus) precisely mirrors what happens in the bottom (that part of the economy that is in deficit). This is called an “accounting identity.”

And he asks:

The OBR observed, austerity and the reduction of government deficits meant private debt levels would have to go up. However, the OBR economists insisted this wouldn't be a problem because the burden would fall not on households but on corporations. Business-friendly Tory policies would, they insisted, inspire a boom in corporate expansion, which would mean frenzied corporate borrowing (that huge red bulge below the line in the first diagram, which was supposed to eventually replace government deficits entirely). Ordinary households would have little or nothing to worry about.

This was total fantasy. No such frenzied boom took place.

David Graeber rightly asks why the OBR got this so wrong.

So could I, but I can say I asked the question in July 2015, saying:

As I have long explained, if the government is to run a surplus within the economy somebody else has to borrow. That's basic double entry book-keeping at play at a national level. It's a fact that cannot be ignored or denied. What that also means is that if the government is to clear a big deficit somebody else has to borrow a lot more. This fact is reflected in the following chart from yesterday's Office for Budget Responsibility forecasts:

The bottom, red line, is government borrowing. The grey area is the forecast. And the requirements for a government deficit are:

1) Households stick with much higher lending then they did from 2009 to 2013

2) The overseas sector borrows much more in the UK (which effectively requires a significant improvement in the balance of trade)

3) Business borrows heavily, which goes against a trend that has been persistent from at least 2001.

Unless those happen as a matter of fact George Osborne will not clear his deficit, which he is assuming he will do.

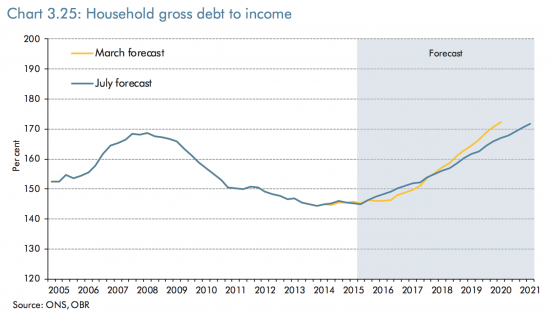

It's important to note that he has missed all his previous forecasts on deficit reduction and I have to say I think he will do so again. To illustrate the point, the apparently innocuous flat line on personal borrowing requires substantial increases in household debt, as this OBR forecast shows:

First, that implies a massive change of behaviour for which there is no evidence right now. Second, the resulting ratios imply dangerous levels of borrowing in the household economy that exceed pre-crash levels. The implications are obvious.

The assumed change in business behaviour is equally dramatic:

To get to required borrowing levels business investment will have to reach real levels substantially higher than anything seen in the Uk for the last 35 years.

Someone is living in cloud cuckoo land if they think that this is going to happen.

And it's only in cloud cuckoo land that Osborne's budget will balance as a result because these assumptions are not just heroic, they are utterly implausible.

I hate to say I was right, but without a shadow of a doubt that was the case.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

As Steve Keen notes in his book ‘Debunking Economics’ the neo-libs are not concerned about where money comes from even money as debt (which is very dangerous) – it’s all the same to them and is yet another example of how their reductionist philosophy works (they over simplify complex issues in order to win arguments).

The $64,000 question has to be: is it ignorance or ideology? Probably both. I don’t suppose Spreadsheet Phil is any wiser. These people commit crimes against the society they’re supposed to protect, without fear of recrimination. In fact they actually get rewarded for failure. Was it ever thus.

Well John, the answer is in the text, The Staggers article and the link/s therein :-

‘90% of our MP’s don’t know where money comes from’ – that’s as good a definition of ‘ignorance’ as I can think of, and pretty…Staggering (sorry!).

I think we could possibly add ‘ideology’ to that, but only if it’s borne of ignorance. In those circumstances at least you have the defence that you genuinely believe the rubbish you’re spouting. But if you know the rubbish you’re spouting is lies – see ‘Labour’s mess’ etc – or just plain wrong (see Paul Krugman et al) then that’s an altogether more serious allegation.

(NB It was of course up to/the role of Her Majesty’s Opposition to point out – day in, day out – that it was lies, but for reasons best known to MiliBalls they chose not to. Those reasons probably flowed from ‘Well if 90% of MP’s don’t understand this, how on earth are we going to explain it to the voter?’! – but the logic of that position, which they also ignored, is that you then have to get into the good ship ‘HMS Dishonest’ and eventually everyone, even some of your crew, recognises that everyone’s rowing in the same direction, that you’ve stopped opposing and started agreeing. Cue Corbyn.

The problem that we have now is that it was, and remains, open to Corbyn to start pointing out that all this was nonsense – which he began to do by reading/adopting/embracing the works of -to pick one at random – Richard Murphy, and to work those up into something he might call ‘Corbynomics’ so everyone could grapple with the arguments. But ‘lo…he wandered in the wilderness and discovered there is no magic money tree.’

Now – was that ignorance or ideology?!

@ Alan

No quibbles with your comments. Agree completely. I’m aware of the appalling ignorance of the majority of MPs and the population at large. The point I wanted to make was specifically regarding Osborne & Hammond. As Chancellors one would like to believe they’re aware of the economic nonsense they promote but then you think …. well, maybe they aren’t. It’s been a puzzle to hetrodox economists for a long time. Prof. Wray only recently stated that he was totally perplexed as why politicians don’t appear even to listen. My conclusion is that it’s probably mainly ideological (and therefore, as you say, a lot more serious) but aso maybe fear, i.e. they prefer to stick with what they know doesn’t work, rather than to move publicly into what they would consider risky unknown territory, albeit there’s incontravertible epistomological evidence to suggest otherwise. Not unlike Copernicus’ conflict with the established Church of Rome.

I’m afraid it’s going to be a long, tough political struggle to get Graebner/Murphy radical change. Probably not in muy life-time. The sociopathic neo-cons are tightening their global grip and won’t surrender power without a fight ot the end, of that I’m pretty certain.

Re. Corbyn, I agree with your observations. But, inspite of his growing popularism, I’ve never rated him either as a natural leader or an innovative thinker, so my expectations of him are quite limited especially when it comes to macro-economics. But what do I know?

@John,

Thanks – I fear I too shall be the wrong side of the turf before this is resolved!

I reckon it has to do with ‘power'(personal/corporate/government) – getting it, holding onto it etc, and ‘fear’ of having to admit that they got it wrong…and that all the evidence (and experts) points to them having got it wrong. It takes b@lls (and Balls! – he has some owning up to do too), and a degree of humility, to do that and neither Osborne nor Cameron had it – indeed with them it was just Oxford Union stuff. You won the argument – the fact that with your rhetorical skills you condemned people to poverty, ill health and miserable lives didn’t matter…and sticks in the craw. And anyway who would vote for a politician or a Party that stood up and said ‘As you were…I got that completely wrong -sorry’? You have to be strong and stable…

They might have got away with it by doing a Roosevelt and seizing power by appealing to whatever the public were prepared to vote for then getting on with doing whatever was necessary. As it was, for reasons which elude me, the voters decided instead to punish the LibDems for restraining them for four years and, thus emboldened, they began to believe their own publicity rather than the evidence…and failed to look up ‘hubris’ in the OED.

Some hope today in Owen Jones’ piece in the Graun about Portugal –

https://www.theguardian.com/commentisfree/2017/aug/24/austerity-lie-deep-cuts-economy-portugal-socialist , contrasted of course with the more depressing stuff- https://www.theguardian.com/business/2017/aug/23/chanel-owners-paid–34bn-dividend-alain-and-gerard-wertheimer

Go well.

This point needs to made over and over. It is so important that I also had a go:

http://www.progressivepulse.org/uncategorized/what-they-did-not-tell-us-austerity-pushes-households-into-the-red/

I am pleased to be in your company

Will tweet now

The Guardian has a piece today cheerleading the fact that The Government has achieved a surplus in July . What chance do we stand .

I suspect we’ll find this was just a timing difference and August will be down

Osborne, I gather wants an HS rail service Liverpool to Hull. I truly wonder how many people from Hull go to Liverpool and vice versa each day; a handful of coach loads? There is this big road. It is called a motorway, M62, that does the job very well. Such an HS line could cost billions and never ever cover loan costs never mind running costs. My 1923 Bradshaw has better ideas than this.

Few go through

But cross country trains take on many personalities along their route

I travel on them, often

I suspect HS2 is merely a convoluted way of Osborne funnelling taxpayers money into his and his mates’ back pockets. That appears to be the only rational justification for it. By the way, I’m hearing the NAO have recently published suggesting all but 5% of the money govt used to bail out the banksters and keep them in business (well, the NAO didn’t put it quite like that, admittedly), anyway, all but 5% of this has now been paid back. Where’s the government’s excuse now for continuing austerity? Why, if we’re almost sorted, is Hammond still talking about continuing austerity till 2027? Is this not a very accessible point of attack, one which even the man painting graffiti on the Clapham omnibus can easily grasp and be excited by?

If the true costs of building and maintaining the M62, including policing, dealing with accidents, snow clearance etc were all added up, I doubt that the railway would be much more expensive to run – also a greener option.

On the bigger question of our MPs understanding of economics, probably many simply do not comprehend these issues but they can always obtain expert opinion if they wish. I suspect they simply follow the easy option of acting out the instructions given to them by the major players – the international bankers, Bilderbergers, Tri-lateral commissioners etc and ultimately look forward to an appropriate appointment via the revolving door – or am I being too cynical?

I am still a tad confused, the Conservatives claimed “public debt” and “Labour” [policy] was the cause of the Great Recession. If you look at sectoral balance (debt side) data e.g. between 2004 and 2009 Govt debt (yellow) is many times household debt (blue). They have a point?

So what’s at work here? Is the point that Govt can handle its debt in a number of ways. Household debt can only be worked off with increased income or reduced costs or the poor house. With falling or stressed real incomes household/private debt is the trigger Graeber discusses, even though household debt might be (to start) a smaller component of % GDP than Govt debt. So is Graeber’s hypothesis that austerity inevitably leads to increased household/private debt and that inevitably initiates another, and potentially catastrophic, crash? The proverbial straw that broke the camel’s back.

Am I correct to say – any persistent net household debt is serious compared to it being a norm for well-managed Govt debt?

Thus prudent macro policy, even for Tories should be – do not stress household income [too much] and stoke debt, especially if they want their uber-consumerist society to thrive. Or is it that the wealthy quite fancy cyclical economic chaos as they feel they have the insider knowledge to exploit it, funnelling even more wealth up.

And the elephant in the room must be the balance of trade deficit. I remember when the News only talked about inflation, balance of trade and unemployment figures; now the balance of trade is an inconvenient statistic hardly discussed by the MSN.

In haste…the problem is that the household sector is all households

Some (a minority) have considerable savings

Others (A significant number) have significant debt

The charts do not show the agregation

So there can be net savings and still a debt crisis

The data I use shows that better, I think