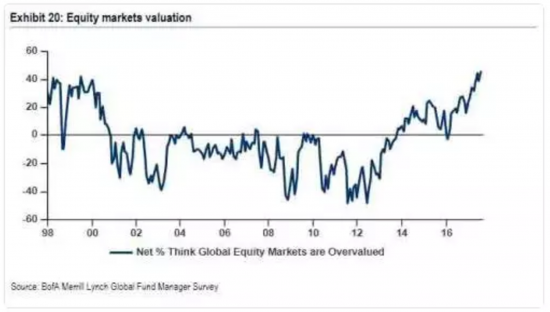

John Auther asks the simple question of whether shares are too expensive at present in the FT this morning. He provides a lot of evidence. The answer is always that they are. In fact he argues that the only times they have ever been as overvalued are 1929 and 1999. It is a sentiment with which I entirely agree. But perhaps the most compelling evidence is that fund managers themselves think that. This chart is based on a survey of their opinion by the Bank of America and Merrill Lynch. A majority of fund managers think shares are overpriced.

The summary of the argument (which is, admittedly made for US stocks but which, I think, applies just as readily to the UK) is:

The summary of the argument (which is, admittedly made for US stocks but which, I think, applies just as readily to the UK) is:

But the critical point is that to buy now, you have to hope that dividends will start growing at a much faster rate (there is no reason to expect this); or alternatively that multiples and profit margins will continue at their current extended levels. Both – particularly margins – tend to be mean-reverting over time. So buying US stocks now requires a belief that “it's different this time” with respect to the valuations that people will put on stocks, and the margins that companies can command.

Such beliefs are irrational. That is why I think a downturn is inevitable. And why I think anything that lures more people into the market than is wise is dangerous for the liquidity crisis to come when people will try to exit markets rapidly.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Truth if ever it was needed that the so-called powerhouse of today’s economy is based on nothing but ‘irrational exuberance’ (bullshit).

God, I wish we could just go back to making stuff. I’m heartily sick of this wishful thinking usurping useful work.

Of course, you’ve been saying that the stock market is overvalued for years. A stopped clock…

Well I said it a lot in 2003

And I did in 2008

And again from 2012

I tale some comfort from that graph and other evidence

C’mon Mr Strauss – there is a litany of over priced stocks going back decades that can be associated with crashes.

And what do you have to say about what generates the high values? What about stock buybacks where quite legally firms can buy their own stock in order to help sustain values and pass on ever increasing dividends to investors?

The money and debt to do this just retards wages and R & D.

What sort of market is that? It’s a get rich quick scheme – that’s all it is.

Yes shares are overvalued and when the dip or crash happens it will be instant. The issue is equities providing dividends have attracted people out of Gilts and Treasuries. The question is will it be different this time when treasuries fall and yields rise? QE has left us with a basket of unknowns. History always repeats but perhaps there might be interesting twists this time.

The FT had an another interesting chart on the10 August of the ratio of market caps to nominal GDPs. https://www.ft.com/content/c4de73e2-17a1-11e7-9c35-0dd2cb31823a

This showed the Swiss stock market by far the most overvalued followed by Japan, Sweden, US and UK. Comparatively Germany and Italy are more cautiously valued. I have been buying both these European markets for several years and some decent yields are to be found offering currency as well as market diversification. Russia is cheap for the adventurous. When the fall comes it will ripple across all markets so have cash to buy after the panic settles.