It's commonplace to say that the world has a debt problem. It doesn't. It has a savings problem. Let me explain using the data from Boston Consulting group that I referred to here on Saturday.

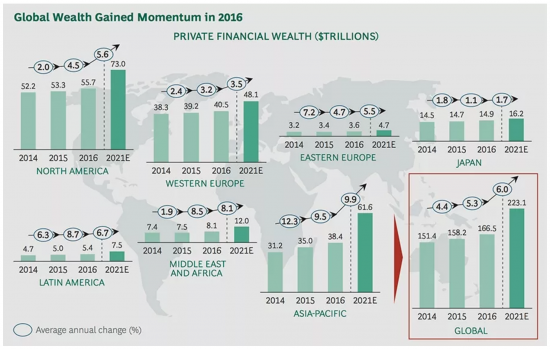

What Boston Consulting Group argue is that the world's most wealthy people (by far) now have assets worth in total about US$166 trillion. This is how they summarise it:

And what they argue is that this sum will grow to US$223 trillion, which is an increase of 34% implying annual growth of at least 6%, which is way faster than the world economy will grow.

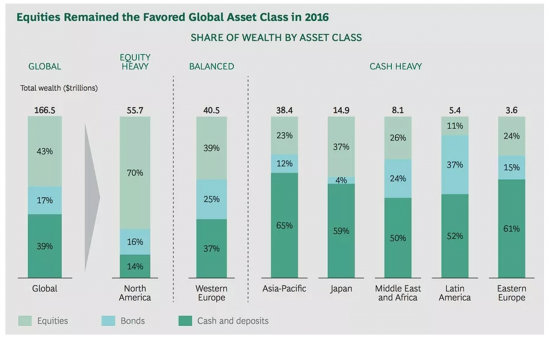

And how are these sums invested? They summarise this as follows:

I am going to work on the global figure. The growth can't all be in equities: if it was then equities would have to increase in value by 79% over the period, implying well over double digit equity growth rates over the next five turbulent years. I think that unlikely. I think it even more unlikely if there is any unwinding of QE, which will push down bond prices. And so cash must also be forecast to grow heavily by Boston Consulting or this wealth increase is dependent upon market change assumptions, as well as wealth ownership share assumptions, that push all boundaries of credibility.

Now let's look at what any of these assumptions imply. First, if bonds are to retain value I think it is assumed QE unwinding will not happen and interest rates will remain very low.

Second, even so, it is assumed that nothing is going to upset the trajectory of stock markets.

And third, it's assumed that the very wealthiest are going to be depositing vastly more cash than ever before.

I buy the second assumption: I think talk of QE unwinding is unreal and that no one is going to risk it because they know no market wants it and no economy can survive the resulting liquidity issues that this may create.

I buy some continuing equity growth, not because it is rational or justified but simply because if the wealthy get wealthier they have to save in something and the supply of equities is being deliberately kept short by a lack of new share issues and by massive share buy-back programmes that mean more money is chasing fewer shares and so the price goes up, whether they're worth the money or not.

But it's the cash that really interests me. These are savings. As I have explained, and as the Bank of England agrees, the economy does not need savings. They are not what funds investment. When a bank makes a loan it does not lend on depositors' money. What it does instead is create new money. And what savings are is the unspent part of that new money that was created out of the loan.

Think of this another way. The borrower has spent the money they secured from a bank and they have to service the debt. But some of the people they paid are not spending what they received; they're saving it. But that does not create new loans or investment, because we know that's not true and we know savings have no role in that process. So what do these savings represent? Quite simply they are money withdrawn from use in the economy.

This is serious, especially if it's going to exceed US$10 trillion a year. What it means is that the borrowers (and I worry most about small business and individuals here) are trying to service debt but the rate of growth in the economy that should permit them to do so is being severely limited because vast sums that they're spending are being withdrawn from the economy each year as savings, which slows the entire economy down by preventing the flow of money within it. The result is simple: we remain in the economic doldrums at best; income growth remains poor, whilst the stock of world savings grows outrageously and governments, as the borrowers of last resort for the savings of the world's wealthy, have to continue to run deficits which they say curtails their opportunity to take action to redress any of the economic issues arising (whether that is true or not, which for the record it is not). And in the meantime those in debt have to borrow more to service debt that already exists. The spiral is very dangerous.

But this debt is not then created freely; it is created because a tiny, but incredibly wealthy, minority in society are choosing not to spend. And this is a trend that is forecast to grow, rapidly. There is then no hope of growth; no hope of governments clearing deficits, and no hope of signs of future wellbeing in the Boston Consulting forecast. It does instead suggest substantial increases in private debt and government borrowing because the wealthy want to claim an ever growing part of a pie they are doing their best to shrink by saving excessively.

What is to be done about it? The answer is that if the world is facing such an enormous glut of savings then they have to be taxed as fast as possible to prevent they imbalances they create. So we need higher corporation taxes. We need withholding taxes on dividends and interest going to tax havens. We need capital gains taxes at rates as high as income taxes. We need an investment income surcharge to increase tax rates on unearned income to match those including national insurance on earnings. And we need effective wealth taxes. Plus a continued crack down on tax havens, of course.

And I mean we may need all of these. The world cannot afford for its wealthy people to become US$57 trillion richer in the next five years. That would be a disaster for us all, including the wealthiest. So action is needed urgently. And now. We can't wait for things to get ugly.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Spot on Professor.

I am still entirely unused to being referred to as such

As far as I am concerned (a working class lad who managed to get into University at 29) you are worthy of the title.

I have been struggling with why the world treats people like it does having seen my father suffer redundancy and having suffered it twice myself by the time I was 25!

It would have been so easy for you to become another blog trumpeting the joys of neo-liberalism. Instead you did not – thank goodness. Many of us know that something is wrong.

Not only did you take on the neo-lib shibboleth you also took a very interesting and difficult route to take it on – the misunderstood and widely reviled issue of tax. I cannot think of anyone in the modern era who has done as much to counter the anti-tax movement as you have done (forgive me but I was not aware of the TJN – I became aware of them because of you).

You are similar to Michael Hudson in my view – his work on the history of debt (I’m sure that there are others) in that you go back to first principles – things that have been forgotten by humanity and should not have been. ‘Sounds like Lord of the Rings I know but it is true.

Hudson talks a lot about how ancient civilisations dealt with debt and that the problems with indebtedness for societies were well known for thousands of years. They also had some very fair ways of dealing with it because they knew the consequences of not doing so. Essentially Hudson seems to be saying that we are being taught to accept debt as currently practiced. TINA be damned.

When I heard that you had become a Professor of Practice I thought (1) they wanted to co-opt you in order to control you or (2) the ‘pure’ academics had at last realised that neo-liberalism has nothing to do with how the real world worked and was finished – which is why the Queen asked her now infamous question.

What also sets you apart from many others is that you have also thought deeply and reflected about the mechanics and the vision of a better world.

What are Professor’s for if not for that?

Mind you, don’t get too used it!

Maybe you should be more prosaic

I had worked with this team

They wanted to work with me

We secured research funding

I am working with them

When the money runs out I get a P45 if I raise no more money

[…] as I have noted, things are forecast to get a lot worse. And this is all despite the fact, as they again note, the economy is about £300bn smaller than […]

[…] have noted concerns on growing wealth inequality this morning, here and here. Over the weekend I also published references to the call I made for a peaceful revolution […]

Where in permanent stagnation,because of the tax system,rough figures just to make the point the wealthiest 10% pay 30% on 90% of all wealth,which means 10% of wealth owners pay 70% of all tax,which is 90% of the people!

So for every £ created (by those that can get credit and than number is falling because of this) they only have to pay back 30% of the money created whilst those(many of which getting credit is priceless or even at 1500% if they can)that still have to pay back 70% of the money created!!!

This is unsustainable unless the value of work increases which will result in inflation Probably hyper.

We have to use the money already created to stabilise the economy and that can only be done by at least paying the share you have taken from the economy to save! even then that will only keep inequality at present levels!

Getting tax out of tax havens but even that will create inflation if not done properly but it can be done!

This is also the reason for investment falling i) why when you can use your savings just to print more savings,ii the chance of successfully finding anything to invest in becomes less and less(other than to prop up or create new asset bubbles that will create more debt for others to pay back!

Defition of capitalism: money making money.

I agree and would put it like this.

All money is debt, so anyone who thinks we have a debt problem is saving we have a money problem. But the problem is not really debt or money. Money can be created as needed. The problem is how money is distributed and flows – the fact that it does not flow to all parts of society. This has become a limit on what we can achieve.

The rich are the stagnant pools in the money circuit limiting flow and thereby limiting the ability of humanity to flourish.

Agreed

I like it

I like the idea of stagnant pools. There is a youtube video on modern monetary theory which uses a diagram of a bathtub and water flow to explain the theory of how it works. Can’t find it at the moment, sorry.

I have found it

Later

Ultimately it’s not about debt or money or taxes: it’s about power.

Why are the ultra wealthy happy to perpetuate this situation? Because it increases their power. They don’t want more money. They want more power. They want the power to control all the real resources including other people. Growth, overall prosperity even the longevity of our civilisation are all secondary to their maintaining and gaining power.

They resist taxes on their wealth and income and they resist the supply of newly created money to anyone but themselves (unless they are able to collect interest on that money).

Their resistance is rational because paying more tax or giving other people interest free money necessarily reduces their relative power.

They are class conscious and collectively work to protect their class but they are also driven by incredibly intense internal rivalries. If one ultra high net worth individual pays more tax than their peers they risk falling behind and being overpowered by those who avoid the tax.

Basically the very wealthy understand the rules of the game and play to win. They deliberately hide the rules from the rest of us to make it impossible for us to play at all. The game is only played by very wealthy people. We’re just some of the pieces.

History suggests that no-one can win this game for long because the resulting instability causes systemic collapse. The only way out is for everyone to understand the rules of the game and for everyone to accept that it’s a game we can’t afford to play anymore. Nuclear weapons, climate change and peak-everything means there’s potentially no coming back if our current civilisation collapses.

The fundamental origin of all resources is the planet. Human exploitation of those resources is the basis of all wealth and an economy is the making and distribution of everything that entails. Money is the means to facilitate that movement. It also determines the degree of rationing within the system. It is the enforcement of discriminatory rationing of access to the fundamental resource by a privatising, self-empowering minority, firstly by means of physical violence then post legitimated by judicial force, extracting rents for access that underpins the division of the haves from the have-nots. If any polity or society were to organise itself on the principle that all resources are a common inheritance and decide that all of the fundamental resources were to be held in common and jointly by all citizens by means of a Common Good agency, owned by the people directly and not as an arm of ‘The State’ which would set the rents for access levels and distribute that revenue stream equitably as rights of dividend and allowances to all for a basic level of access to wealth for the common needs for food, clothing, and shelter then those revenues being ‘banked’ at present would be redirected to the roots of the economy for the free choice of the shareholders to spend as they chose, and eliminate the situation whereby a tiny minority dwell in a ‘garden of eden’ and a vast majority subsist in a desert. Discuss.

Robin Clunie:

I agree with you to an extent.

Humans are inseparable from the planet and its ecosystems. We don’t notice this as clearly as our ancestors because of our complex distributed production system. Nevertheless we each require some area of land to actually have our physical home and some minimum share of total production to live a dignified existence (i.e a life that is acceptable and respectable in the eyes of the rest of society).

Our laws, taxes, political system, private sector economy and state should all be set up to provide that minimum of a dignified existence for all. The reason it is not so setup is the very real power of the wealthy minority called the ruling elite.

You are correct that this power is ultimately based upon the use of physical force: violence.

While it would be nice to legislate away such power and the violence that lurks behind it that isn’t really possible. Power abhors a vacuum. If the powerful all laid down their power today it would only be a matter of time before someone else picked it up.

This also answers David Morey’s question below:

If you have power, real power, you recognise this reality of the nature of power. You know it can be seized or given away, it can accumulate in one place or ebb away somewhere else but it can never be destroyed permanently. If you give up your power someone else will take it. Maybe they’ll wield it wisely and fairly but then again, maybe they won’t.

The only way to be sure you and your family don’t suffer at the wrong end of someone else’s power is to have sufficient power to protect yourself.

The powerful don’t trust anyone else so they cling to and accumulate power for fear that if they don’t someone will use it against them. The only way to avoid destructive violent revolution or permanent intolerable inequality is to get everyone on board with a fair way to manage power so that no-one or no organisation can misuse it to hurt others.

That’s essentially what all of politics and economics is: a (largely) nonviolent means of negotiating power relations.

Somehow we’ve got to negotiate a peaceful relinquishing of power by those who currently wield it. Paradoxically the more angry the majority get with the elite for abusing their power the more tightly and fearfully the elite hold on to that power.

We almost need an economic “truth and reconciliation” commission to mediate and manage the transition to a more equitable and sustainable society and economy.

Those who have been hurt by the regime of the past 40 years deserve and require apologies, compensation and a permanent change so they and their heirs are not similarly hurt in future. Those in power need understanding and forgiveness for their bad deeds or they won’t give up their power for fear of retribution. But also the powerful deserve thanks for the good they have achieved. Let us not forget that, though imperfect, our elite are far from the worst that elites’ can be. A very cursory look at history shows this to obviously be the case.

If we were all comfortable speaking the truth and all confident a better world would emerge from the process I’m sure we’d all engage constructively in that process: rich and poor alike.

While ever it is us-vs-them or while the masses are ignorant of reality and therefore easily led by demagogues seeking power for themselves then there’ll be lies, power games and the ever present danger of violent escalation.

We have to start by gathering the evidence that the politics and economics of the elite are suboptimal for the population and the planet. We’re well advanced in that endeavour. Then we need to communicate that evidence to the general population. That’s much more difficult because the elite’s power over both the media and the working lives of the general public drastically hinder our communications.

I think we can work more quickly and efficiently by mapping out the exact strategy the elite uses to control the thinking of the population and thus find weaknesses in their propaganda and strengths in our own message.

Once enough people are aware of the truth we maybe reach a point where an “economic truth and reconciliation comission” is necessary to aid a smooth, peaceful transition and avoid either:

– panicked defensive violence from the elite, or

– angry vengeful violence from the population.

A party or coalition of parties could stand for election on a manifesto of economic truth and reconciliation. If elected their government would effectively be that truth and reconciliation comission.

Why are the elite and the wealthy being so fearful and unimaginative, refusing to give way to change? How do you see their thinking process?

Fear of loss motivates these people

It is a horribly powerful emotion

I find that money changes people and not for the better.

Watch the film ‘Margin Call’ (highly recommended) where the characters in it are bought handsomely in order to shut them up about the incompetence of the commercial bank they work for and whom is about to sell valueless assets into the market.

I often think that the Ring in Tolkien’s Lord of the Rings opus was actually a metaphor about the power of money.

Thanks everyone for the very interesting comments. Fear, lack of imagination, hurt I guess are key, these people don’t think love or cooperation will give them what they want, they have to be able to order it or buy it. I’ve always been keen to buy myself free time to do what I want, but not needed too much money to achieve it, but rent costs are making it very hard to avoid the rat race these days for the young. But maybe we need to focus on the obvious desperation and inadequacy of our elites, removing status from them, and the help they need to be relieved of their problems so society as a whole can be rebalanced. These sad people need help, they need to throw off their excess wealth and safety crutches, their risk aversion and excess defensiveness.

Do I understand you correctly? We need higher taxes – not to fund government spending (this is a misconception) – but to destroy the hoards of savings that are not going back into the economy. This reminds me of Beowulf. He was the hero of a world like ours beset by the fear of terrorism: the gold-hoarders sheltering in their clan-huts, frightened of the dark world beyond their hearth-fires. At the end of his life Beowulf undertakes a second heroic adventure, as the tables have turned in his world – and he descends to the bottom of a lake to recover the hoard of gold kept out of circulation by a dragon.

Three of the reasons for tax are to tackle inequality, reprice market failure and reorganise the economy. That’s what motivates a wealth tax. All three are essential now