Michael Rosen asked a series of questions yesterday in response to the blog I had written explaining why in my opinion the country could afford to pay public sector workers the pay rise they clearly deserve. The questions are big enough and important enough to be worth addressing in some detail. They were:

Thanks for writing this and your other articles, Richard.

Following the big bail-out of the bank, the graphs showed a huge leap in the ‘deficit'. We were given to understand this as the amount the government had borrowed in order to pay for the bail out. This was then used almost universally by the media and the Tories and LibDems to ‘prove' that Labour had ‘crashed the economy' and now it was ‘all hands to the pumps' to correct the ‘deficit'. I can hardly recollect a single voice outside of Paul Krugman to challenge a) what this deficit really was and b) whether it was ok to live with it, and indeed to carry on investing in useful projects in order to increase wealth and value.

However, according to your analysis, even this is skewed. Is that right? Are you saying, in effect, that there was no need to represent this as a ‘deficit' anyway? It could have been represented as an ‘adjustment' or some such? Or was money of some sort ‘borrowed' from non-government funds in order to bail out the banks? If so, why? Why couldn't the govt have just ‘borrowed' from the Bank of England and let it disappear over time? Were the bond-holders (whoever they are) really knocking on Osborne's door warning the Coalition that unless they cut wages/services/benefits they would up the cost of govt borrowing?

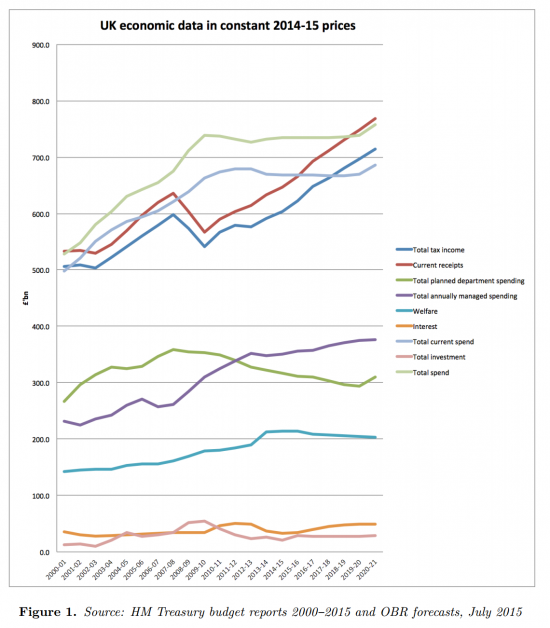

First, some data. This comes from a paper I wrote 18 or so months ago with my City colleague, Professor Ronen Palan:

This data very clearly suggests a number of things. The first is that at the turn of the century, during the dot com boom, Labour raised enough tax to cover all spending.

Then, secondly, Labour chose not to cover costs with revenues because there was a pretty massive stock market crash from 2000 to 2003 and Labour were rightly determined that this should not lead to an unnecessary impact for the vast majority of people who had not partaken in the stock market's absurd bubble.

Third, Labour instead had revenue track spending with about a year's delay. This is, of course, what is normally inevitable. If, as I argue, government spending always comes first out of newly created money then it follows that tax receipts that recover that spend from the economy will lag behind them. And that's precisely what happened until 2007, in what looks in retrospect to be a remarkably controlled fashion.

Fourth, when the crash came it was not because spending went out of control: it very clearly did not. It rose to meet the urgent need of falling incomes, declining employment and the need for investment as a counter-measure, which Labour saw the need for and delivered to beat the crisis. Instead what caused the deficit was the collapse in tax revenues, as the data makes clear. And, as a matter of fact, tax revenues are mainly paid by the private sector. In this case all the revenue that went missing were from that sector. So the crash was not created by the government at all: it was wholly private sector created, with the banks being the prime cause within that part of the economy. To pretend otherwise would be absurd, and just untrue.

Fifth, and largely for the record, this was not Labour's fault. Of course they did not regulate banks well enough. And of course they should not have believed in neoliberalism. That was their fault, but the Tories would have been worse on both counts. This cannot have been Labour's fault because Labour did not cause the crash of US banks or banks across Europe, where many did fail. The fault was systemic and inherent in the madness of a banking system almost universally out of control (Australia and Canada were exceptions, for example, but the exceptions do in this case indicate the generality otherwise) .

Let me then address the specific questions. I, Ann Pettifor, Paul Krugman and of course some others, were arguing before the crash (in the case of Ann and myself) that what was happening was systemic. To lay the blame at Labour's door when the entire political culture of the UK, which made itself subservient to the supposed wisdom of markets in the way I describe in my book The Courageous State, is just a lie. The UK crash would have been as bad if the Tories had been in office as it was under Labour.

What was different was the reaction. Labour went for growth: it increased investment; it boosted the consumer economy (remember the 'cash for clunkers' scheme, which worked in moderation even if it was not very green, or economically inspired?); and it permitted the continuation of government spending. Why? Because the economy needed jobs. But most of all what it needed was money.

By 2009 banks had simply stopped lending. And people and businesses were saving because they were worried. Both were entirely logical things to do. But in an economy dominated by a single currency as the UK is savings must equal borrowings. And as the creator of cash, if most of the economy insisted on saving in 2009 (as it has also done so since because there is still only limited confidence in where we're going and what the risks are) then the government has no choice but to act as borrower of last resort i.e. it has to borrow what everyone else insists on saving because that cash has nowhere else to go. And so it ran a deficit. It did not even have a choice but do so: the economy demanded it because of the simple equation that in cash terms savings will equal borrowings and there was literally nowhere else for the money to go but to the government, who had to borrow it.

But in the process what the government did with that money (which was otherwise effectively withdrawn from active use in the economy, because that's what saving does) was what no one else would do, which was to spend it. And by spending it they did keep cash in the economy to ensure there was enough to make it go round, as is necessary if any economic well-being is to survive in such a situation.

And when even that spending did not look as though it could compensate for a lack of bank injected cash in the economy then QE had to be used as well.

But did the government have to borrow from bond holders? Could it have instead just borrowed the money from the Bank of England? Technically the answer is the government never needs to borrow from the public or gilt markets. EU law does though prevent a government borrowing from its central bank. That is to artificially support the role of banks in the bond markets, but the reality is that without that law we would not technically need those markets at all in the modern economy (we did in past eras, but what existed 50 plus years ago should be consigned to history now). That same law seemed to technically make us beholden to those bond markets. But the reality was different for three reasons.

First, actually people were begging to government to take their money. They still are, even though as I have shown in the last week, they literally make nothing from saving in government bonds; the corollary of which is that such borrowing costs the government nothing right now. The government did then have all the power in this relationship: they were the party doing the favour to bond holders by giving them a secure place to save, and not the other way round.

Second, as we now know (but did not for sure in 2009), QE works and quite simply cancels debt. Near enough one quarter of UK government debt has been cancelled by QE because the government cannot owe debt to itself, but now owns £435 billion of its own supposed debt.

And third, the bond holders did as a result have no way they could dictate terms to anyone. The pretence that they could demand austerity was a convenient and deliberately constructed myth that supposedly gave power to bankers and their friends in a way that was terribly convenient to a government intent on crashing the size of the state, but it had not an iota of truth in it. Actually bankers are desperate for government debt without which they cannot properly function.

To answer Michael's question then, the idea that we are beholden to bond holders is pure nonsense. I should say I have no problem with nonsense stories in the right circumstances, like when going on a bear hunt. But when used as a mechanism to suppress the well-being of people to the point where the lives of millions are deliberately turned into misery I think the situation very different, and culpability has to be taken in to consideration. If I could I would place Cameron and Osborne in the dock and I now suspect they might be found guilty by a jury of their peers. But, despite that, some are still crazy after all these years and so the pernicious myth goes on.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“EU law does though prevent a government borrowing from its central bank.”

Hang on, Richard, did you not state here just the other day, that, technically in accounting terms, the Government has to borrow from the BoE every pound that it wishes to spend?

If that is indeed so, then in what way does that differ from “a government borrowing from its central bank”?

I would be pleased if you could kindly explain this difference? Thanks.

It does do that – but then the BoE packages the resulting balance up as debt and sells it as the EU requires

So it does borrow on very short term account – but cannot maintain the balance

The two positions are wholly reconciled as a result

I thought that the only debt that is sold (as Gilts, and by the Treasury) is what is *not covered* by the Reserve drain that takes place when taxes are paid (i.e. excess reserves in the overnight interbank market), subsequent to the Reserve add that occurs when the BoE debits the Treasury account, and credits the Reserve Accounts of the commercial banks which holds the accounts of the direct recipients of Gov spending?

Is this correct?

Or is this debt sale (of excess reserves) indeed the “resulting balance” that you are talking about?

Many thanks!

It is the next sum, of course, that is sold

But that does not mean the explanation is wrong: it just means there is a netting off rather quickly in some cases in a rapidly rotating model that is apt to hide the reality of each element

Is all of the money lent by the bondholders, their savings i.e. unspent income? I had sort of, assumed that part of the money came from some banks who had lent money (created by them ).

If money is hoarded and neither its owners or the government spend it, is this what is called a liquidity trap?

All I spent money arises from what I call incomplete transactions – where the promise to any has yet to be completed. This is what savings are

Banks do not create new money to do this. They assist others to buy bonds but actually their own holdings are quite small overall (except as part of their overnight operations): they place money with the BoE on reserve accounts instead in the longer term. Most QE funding has ended up on these reserve accounts, but explaining that is not a Saturday afternoon job

Money hoarding is money taken out of circulation and yes that can create liquidity traps

got the idea. Thanks

Maybe as a TV show “People vs Establishment”, a welcome reversal to TV’s obsession with poverty porn.

🙂 🙂 🙂 🙂

Something has changed…..

I’ve been following these heterodox economic theories for years…, and understand them in principal, as a non-economists…and the implications of them. Realising the illogicality the mainstream thoughts that tax must fund spending and books must be balanced, labour are spend spend spend… you know the drill.

But. now, it looks like these heterodox ideas, MMT, the things you talk about are on the verge of going mainstream.

Michael Rosen is a poet!…and has 100k followers on twitter. He has (on the face of it), nothing to do with political economics!

However, as apparent on Twitter the last few days that I have followed him, he’s shouting about it….because, his eyes have been opened to the possibilities that logically appear when the flawed mainstream thinking is shown to be the bullshit it is..

More celebrities need to follow his path…., Michael If you read this, then please consider using your power of ‘celeb’ to let others in the public eye know. You’re so much more interesting than Boring old Tax economists like Mr Murphy! (sorry!), or geeky system engineers like me.

Its perhaps the only way to get outside this echo chamber we appear to be inside, and show the population of the UK….(and maybe the world), that another way is possible…

My off has never been so ended 🙂

Maybe Richard could send Michael Rosen a review copy of The Joy of Tax?

Maybe….

@ Tony Weston

I think you might want to check Michael Rosen on Wikipedia. Coming originally from a different ‘tradition’ I was very surprised to find out he was a children’s author. Funny that.

What a trick Labour missed by raising taxes and borrowing in order to spend when as we now know they could have just printed all the money they needed.

such poverty of thought. Same with this current lot. Why this and other governments have made themselves so unpopular when all they have to do is turn on the printing presses is a mystery.

It’s like insisting on digging up oil and coal to pollute the planet instead of using a perpetual motion machine!

You very clearly can’t read

I do know you won’t be commenting again

Over lunch today listening to Any Questions I heard Chuka Umunna actually stick up for his Party and deny strongly that Labour had caused the crash.

I nearly fell off my seat but it did make feel really good hearing him say this so forcefully. More of the Labour party need to do the same because ‘It’ is the big lie of our age so far.

Great blog BTW – thank you.

Thanks

Thanks very much, Richard. You’re right, there is nothing wrong with fantasy, so long as we agree it’s fantasy. The problem is that politicians try to lure us into ways of seeing the truth that are fantasies (or ‘guiding myths’, if you like) and these come to dominate. As you suggest, the dominant myth of our time has been the idea that Labour ‘crashed the economy’ or that ‘there was no money left’. This is then built on as a justification to not pay public sector workers. This is based, I would say, on the notion that you can use leeches to cure someone of anaemia and yet the Tories have been very successful in peddling their version of the myth which is that ‘saving’ money by not paying poor people is good for those poor people.

I agree Michael

The “guiding myth” that has endured ever since the days of Thatcher in the late 1970s is that Government finances are like those of a household, and that the country has to “live within its means”.

This, in the case of a nation such as the UK, with its own sovereign, non-convertible, fiat currency, is not only economic nonsense, but a misleading and socially destructive lie.

Mr Rosen

Saying “there was no money left” is bizarrely silly. Money is a measure of value & means of exchanging it. It is like saying “my biggest concern about the obesity crisis is that we’ll run out of kilograms”.

I thought Richard’s summary was largely correct but he doesn’t give sufficient importance to the appallingly toxic effects of house price rises which tend to do far more damage to the UK economy than almost any other.

As a (regrettably) old chap I can honestly say there were 2 truly catastrophic policy blunders in my lifetime. One was Blair’s Iraq war. The other was Thatcher selling off council housing. I quite understand why she did it. There is no easier way to turn a good person into a bad person than to make them a property owner, but the effects were horrific.

The result has been a country that is, euphemistically, “highly leveraged” {i.e borrowed to the hilt}, Almost everyone would say that housing costs need to come down. The only way that can happen is for house prices to come down. But if house prices fall there is a genuine panic across most of the country. In a way that is understandable because, sadly, if house prices fell to an affordable level (say half their current level) most of our banks fall over.

You can’t win, you can’t break even & you can’t quit the game.

LOVE word of mouth BTW

Clearly the crash was coming, clearly it was obvious, clearly it was desired and clearly it has served a political more than an economic purpose. The oligarchic state has used it to continue the reversal of the gains made by workers since the 1870s. It all rather reminds me of the sham crisis of 1976. No wonder the Liarbour establishment is hopping mad at Corbyn and the grass roots for spoiling everything. Luckily they have the benefit of the fake electoral system to subsidise their ideological preferences.

“Labour raised enough tax to cover all spending.”

Should this statement be re-worded to say that tax returns exceeded government spending?

🙂

‘And third, the bond holders did as a result have no way they could dictate terms to anyone. The pretence that they could demand austerity was a convenient and deliberately constructed myth that supposedly gave power to bankers and their friends in a way that was terribly convenient to a government intent on crashing the size of the state, but it had not an iota of truth in it. Actually bankers are desperate for government debt without which they cannot properly function’.

The bond vigilante issue looks to me as though people are assuming that bond holders can behave like shareholders – demanding higher and quicker returns when they feel like it – using the power of their funds as leverage to influence the Government.

Looking at the behaviour of the financial markets concerning mortgage backed securities I’m not surprised this happens. In America – mortgage bonds (which I understand to be long term in nature) were increasingly treated in a very short term way as the market went for volume in order to increase revenue (to grow the market).

As I understand it (as put forward by economist Robert Shiller) , this behaviour around bonds was caused by a lot of those involved in shares after the dot com bubble burst ‘rotating’ into bond trading afterwards which would have brought in a more short term like thinking into the bond markets there.

I know that mortgage bonds and government bonds are different instruments but the markets seem want to treat all bonds (investments) the same – to be able extract as much worth out of them as they can on a whim. They are not interested in the what they are investing in – only the income they can generate as quickly as possible. The fact that bonds are long term seems to mean nothing to them.

What sort of market is it that cannot discriminate between types of investment? An extremely greedy one.

The financial markets also want to portray themselves as having the power to do with bonds that they do with shares even though as you say they cannot because the terms of the bond ownership are actually legally different to the terms of owning shares (I hope!).

This portrayal is indeed a sabre rattling sham because I’ve seen arguments everywhere that the UK Government has never ever failed to deliver on its matured bonds and they have also matured at their promised performance levels on a regular basis.

I read in one of your blogs Richard that UK Government bonds are so stable that some have been left unredeemed for years.

Many bonds remain in the same hands for very long periods

And why not?

Redemption often comes first

The financial system is prone to failure at any time since it cannot ensure that it does not overvalue it’s assets or understate it’s liabilities. In one sense this is to be expected since the system is attempting to monetise the millions of transactions that make up GDP in this country and around the world.

The creation of money precedes the creation of wealth and assets, this must be so since otherwise there would have to be a store of money available at the start of a productive cycle that would exactly match the output value of that cycle.

Given that the creation of money by a society (ie not by individuals) facilitates the creation of wealth then we should all support such a system and, indeed, society underwrites deposits and rescues it’s banks when they are in financial difficulty.

The portrayal of this as Labour “maxing out on the credit card” by the Tories and the Liberals was shameful and this distortion by the simple minded for the simple minded should not be forgotten.

However we need control systems that work. What the 2007/8 crisis showed was that the occupants of financial boardrooms did not understand what they were doing, indeed there was a collective failure of accountants, internal auditors, external auditors, audit committees, credit reporting agencies and, of course, directors. There was also a failure of financial journalism.

Nothing much has changed.

The crisis also showed that the power to create money that is granted to “private” entities by society was being misused. Loans could be advanced to cover High Street retail chains that could be milked, run down and sold off and to cover mind numbingly complex financial instruments traded in unregulated markets the proceeds of which were transferred to offshore jurisdictions.

Again nothing much has changed.

The affordability of pay rises for public sector workers was raised on Question Time. Not a single member of the panel distinguished between the net cost to the Treasury and the gross, prima facie cost; and Dimbleby essentially allowed a discussion about whether an undefined cost was affordable to meander on. This then allowed the austerity narrative to reinforced by Rees-Mogg who was at pains to tell us that nurses received an annual spinal column uplift along with a payrise but did not allow his mighty intellect to illuminate the distinction between a gross and a net cost.

How is it possible to have a sensible debate about economic issues given the current state of British journalism?

In the sense that money is credit used to facilitate wealth creation you are right

And rte the last, hard to tell

(And apologies: this got lost in the moderation queue)

“Fourth, when the crash came it was not because spending went out of control”

The best visual representation of this can be found on the ONS site under:

The debt and deficit of the UK public sector explained

http://visual.ons.gov.uk/the-debt-and-deficit-of-the-uk-public-sector-explained/

Half way down the page under: UK public sector spending, income, surplus and deficit, 1993 to 2014

– you can clearly see both spending and income rising in unison until income drops in 2008/2009

Agreed

I love this blog, Richard.

One thing I would add that Labour did post-crash was to lower the VAT rate.

I think the time is now ripe for Labour (with it’s renewed voice) to start presenting this stuff to show that they were, and will be again, by far the best economic managers. And that it is the tories who are the wreckers. That is evident now for all to see.

And, with my LVT hat on, I would like to see John Mc taking up the policy, which the Labour Land Campaign promotes, of increasing the LVT rate to reduce the VAT rate, which would be possible after Brexit. That rather than reducing the income tax rate, which is already low for basic rate tax payers.

Great post Richard, thanks for this. I’d also like to thank Michael Rosen for helping to spread the word.

Maybe these heterodox economics ideas are approaching their tipping point more rapidly than we realize?

I hope so

I hope you won’t mind my pointing out that the term “blog” means a collection of posts (articles) on one site, like this one. Blog is to post as account is to item. You post articles to a blog, just like you post debits and credits to an account. It is correct to call individual articles within a blog “blog posts” or “articles”, not “blogs”.

In a new world with new words I think it is possible that this one is still finding its meaning

Sorry, I’d edit, but that seems not to be an available function.

The word “blog” is a contraction of “web log”. It’s like a diary. You write entries in diaries, you write posts in blogs.

I have a team for now: many thanks for the offer

When Osborne spoke ao his desire to reduce the Government;s share of GDP to the lowest level since the 1930s some people (sadly not many of hem Labour MPs) pointed out that in the 1930s we had no NHS & a v rudimentary free education system.

This was put to a Tory MP whose reply was “The economy is much bigger now”.

I can honestly say that was the most vacuous remark I’ve ever heard. Obviously, any price from the 1930s can have (at least) a zero added onto it. The fact remains that when a school would probably have cost £10,000 to build & a capable junior school teacher would have worked for £2 a week we couldn’t afford a free education service on 30% of the economy. Why would we now?

We can’t

It’s as simple as that

It takes a special form of simple mind to think we can

We need a good narrative to counter the tory argument of not leaving our debt to the young.

If I owned my own bank and could borrow from myself at 0.25%, I would build houses for my kids, and in the process create jobs for builders. My kids can then spend their wages into the economy – on cars and eating-out and other frivolous stuff that makes work for others. When I die they will discover they have inherited a 20-odd year debt to be paid off at 0.25%…they will be chuffed to bits because it’s not so much of a burden (and they they might talk to the bank about rolling over the debt). They will be even more chuffed to learn that they now own the bank.

Absolutely

Are not these debts potentially odious, taken on as they were entirely for the benefit of Osborne and Cameron’s class? Borrowing money to give it to rich people and then telling poor people they can’t have schools or hospitals as they have to pay it back seems a little outside any legitimate governmental remit.