I am in Brussels (again) today speaking at a conference organised as part of the Enlighten Horizon 2020 programme. The panel I am a part of is discussing various issues relating to fiscal convergence. My own part addresses the tax gap and fiscal convergence and in essence suggests that unless failure to address the tax gap is taken into account fiscal convergence is a fairly meaningless concept as GDP will be incorrectly stated and so too will real levels of government spending, which will be disproportionately overstated. These are my slides:

Fiscal convergence and the tax gap

- Richard Murphy

- Professor of Practice in International Political Economy, City, University of London

- 22 May 2017

Fiscal convergence

- Can be defined as the fiscal prudence intended to achieve the goals for unified economic management specified in the Maastricht Treaty

- The problem with this is that this assumes that available economic data is sufficient to confirm compliance with this objective

- I suggest that this is an inappropriate assumption and new conditions for fiscal convergence need to be established

The failings of existing criteria

- The existing criteria are applied within a framework that:

- Assumes existing macroeconomic data is fit for purposes

- Ignores much of the GDP lost to the shadow economy

- Ignores the tax gap

- Imposes no requirement to address these issues

- Implicitly endorses the current structures that permit their existence as a result

- Does not require convergence as a consequence

The scale of the issue

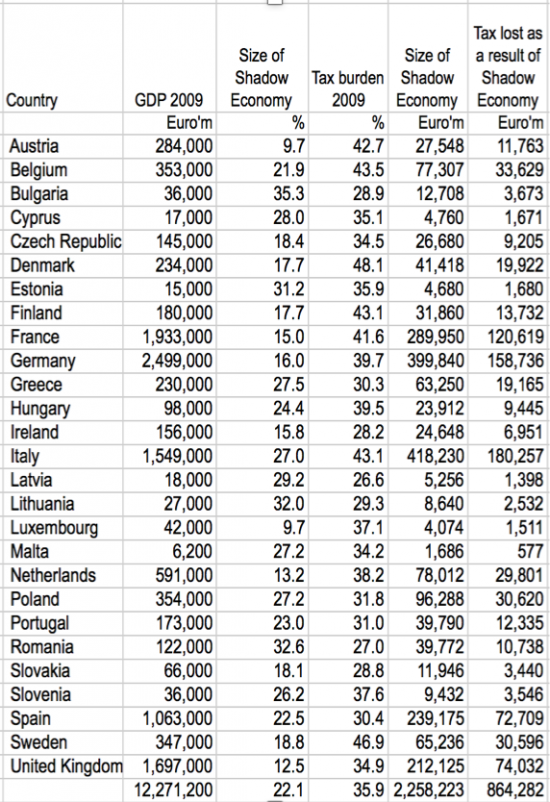

- For convenience I am using data from my 2012 report on the EU tax gap

- http://www.socialistsanddemocrats.eu/sites/default/files/120229_richard_murphy_eu_tax_gap_en.pdf

- There is no doubt that this could be updated

- It's also undoubtedly true that with more work the methodology could be improved

- And I stress nothing in this work suggests that sums noted represent tax recoverable in current tax structures.

The size of the EU's shadow economies

Convergence requires

- Assessment of economic capacity based on GDP inclusive of the shadow economy

- Assessment of deficits on the basis of tax spending including uncollected tax as if it is a budgeted tax spend

- A requirement that this spend be controlled like all others

The pre-condition of accepting this goal

- There has been a reluctance to tackle this issue

- This is based on the widespread belief that if the tax gap is tackled the economic activity brought within the scope to tax will be lost altogether

- This is not true. Microeconomic theory says that markets work best to maximise social well-being when there is a level playing field on which all market participants compete

- The tax gap destroys that level playing field. The result must be that markets deliver sub-optimal results because of misinformation, distorted rates of return, misapplication of capital and reduced productivity

- Closing the tax gap will overcome these market defects. Accepting this market based argument is the pre-condition for change in the convergence criteria

There is a need to deliver change

- Improve measures of the shadow economy

- Improve measurement of the tax gap

- Invest in closing the tax gap

- Develop the tools to help achieve this goal

The necessary tools

- Country-by-country reporting

- Effective company registries

- Including verified beneficial ownership data

- Full accounts on public record or the loss of limited liability

- Domestic automatic information exchange from banks to tax authorities and company registries to identify who is trading within an economy

- Regulatory staff to monitor the supply of data

- Enforcement staff to tackle tax gaps

- Then we might have something like convergence

- Right now we only have a pretence of it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Good luck Richard, safe journey.

I hope they listen.

I would be interesting here what our own MEPs have to say about your work.

This is an academic gig

Some politics tomorrow

It’s a big assumption that the amount of uncollected tax in the shadow economy is in proportion to the amount of tax collected in the non-shadow economy. This is a case where better data is needed, and what better than to follow the links in the Bank of England report on the shadow economy and decriminalise most of it. Especially those activities between consenting adults.

Until then, it’s all guessing, and this is not worthy of an analyst who thinks Scotland needs data with a lower margin of error.

Read my paper

I address the issue

I assume your paper cross-references yourself frequently. It’s good to have consistency.

Mr Fletcher

This is a place that encourages debate, but narcissistic cynicism

It seems you are dedicated to wasting time here

I regret there is a simple solution to that: you will need to play somewhere else.

Richard

The big worry for me is who will choose and monitor:

1) Regulatory staff to monitor the supply of data

2) Enforcement staff to tackle tax gaps.

So many unscrupulous people and entities in government have their hands on the controls at the moment, all over the world. How can we (ordinary people) ensure that regulators and the data they collect and supervise won’t get shamefully manipulated to suit the status quo? Regulators and enforcement staff can be bought, unfortunately. Data can be skewed and stifled by a press that not really interested in Truth. Corporations have no soul and nothing matters to them except profit.

Grrrr….

I hadn’t expected to see that only Luxembourg and Austria have smaller % shadow economies than the UK. Are you sure that’s right?

Based on the sources I used in the EU

Numbers for Italy are disturbing – I wonder what sort of knock-on effect Italy has on other countries. Although it provides little in the way of numeric data Saviano’s Gomorrah & Zero Zero Zero certainly give a good flavour of what goes on. I had to smile at the low % in Luxy – they keep a nice orderly house the Luxembourgers – whilst facilitating the wreaking of havoc elsewhere.

In the case of Greece, I believe they have yet to implement fully electronic collection of VAT/TVA data & yet it would be trivial to do so. Devil, details etc.

One element of the shadow economy is what I would call the 70/30 or 80/20 – where 70% or 80% of work is paid for legitimately (& taxed) and the rest is cash. very difficult to control & perhaps almost impossible to measure. I can think of two countries where this is common place.

Switzerland is even neater……