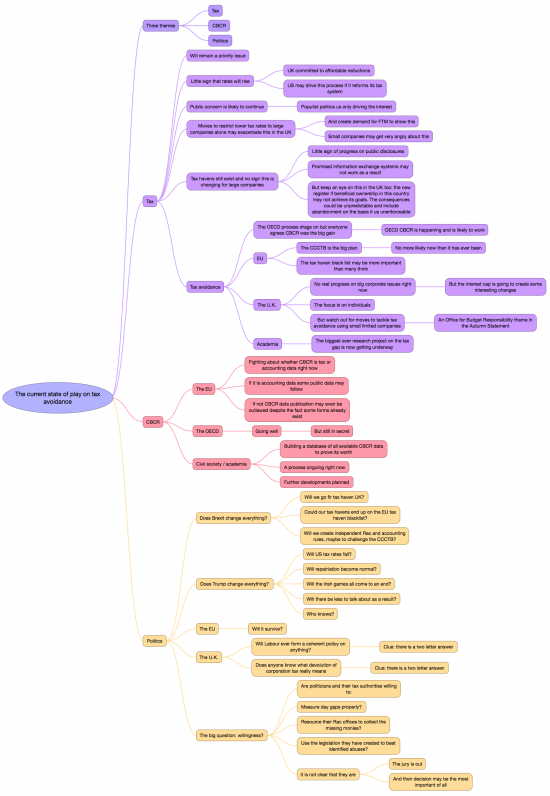

I am giving a talk this afternoon on the current state of play on corporate tax avoidance. It's not meant to be comprehensive or deeply technical. It's an opinion. These are my speaking notes (there's a larger version here):

In bullet points they read like this (with apologies for any typos):

- The current state of play on tax avoidance

- Three themes

- Tax

- CBCR

- Politics

- Tax

- Will remain a priority issue

- Little sign that rates will rise

- UK committed to affordable reductions

- US may drive this process if it reforms its tax system

- Public concern is likely to continue

- Populist politics us only driving the interest

- Moves to restrict lower tax rates to large companies alone may exacerbate this in the UK

- And create demand for FTM to show this

- Small companies may get very angry about this

- Tax havens still exist and no sign this is changing for large companies

- Little sign of progress on public disclosures

- Promised information exchange systems may not work as a result

- But keep an eye on this in the UK too: the new register if beneficial ownership in this country may not achieve its goals. The consequences could be unpredictable and include abandonment on the basis it us unenforceable

- Tax avoidance

- The OECD process drags on but everyone agrees CBCR was the big gain

- OECD CBCR is happening and is likely to work

- EU

- The CCCTB is the big plan

- No more likely now than it has ever been

- The tax haven black list may be more important than many think

- The CCCTB is the big plan

- The U.K.

- No real progress on big corporate issues right now

- But the interest cap is going to create some interesting changes

- The focus is on individuals

- But watch out for moves to tackle tax avoidance using small limited companies

- An Office for Budget Responsibility theme in the Autumn Statement

- No real progress on big corporate issues right now

- Academia

- The biggest ever research project on the tax gap is now getting underway

- The OECD process drags on but everyone agrees CBCR was the big gain

- CBCR

- The EU

- Fighting about whether CBCR is tax or accounting data right now

- If it is accounting data some public data may follow

- If not CBCR data publication may even be outlawed despite the fact some forms already exist

- The OECD

- Going well

- But still in secret

- Going well

- Civil society / academia

- Building a database of all available CBCR data to prove its worth

- A process ongoing right now

- Further developments planned

- The EU

- Politics

- Does Brexit change everything?

- Will we go fir tax haven UK?

- Could our tax havens end up on the EU tax haven blacklist?

- Will we create independent Rac and accounting rules, maybe to challenge the CCCTB?

- Does Trump change everything?

- Will US tax rates fall?

- Will repatriation become normal?

- Will the Irish games all come to an end?

- Will there be less to talk about as a result?

- Who knows?

- The EU

- Will it survive?

- The U.K.

- Will Labour ever form a coherent policy on anything?

- Clue: there is a two letter answer

- Does anyone know what devolution of corporation tax really means

- Clue: there is a two letter answer

- Will Labour ever form a coherent policy on anything?

- The big question: willingness?

- Are politicians and their tax authorities willing to:

- Measure day gaps properly?

- Resource their tax offices to collect the missing monies?

- Use the legislation they have created to beat identified abuses?

- It is not clear that they are

- The jury is out

- And their decision may be the most important of all

- Does Brexit change everything?

- Three themes

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] Source: The current state of play on tax avoidance […]

Excellent post – have just shared with my twitter and wordpress followers.

Thanks