The Guardian reported last night that:

Financial markets have coped well with the Brexit vote and other potentially disruptive political developments but asset prices may be running too high and the risks to market stability are growing, a report has warned.

The Bank for International Settlements (BIS) — the central bank for central bankers — said in its quarterly review that valuations are high, especially given that the foundations they are built on may not be so solid. It did not explicitly say that stock and bond markets are waiting to burst.

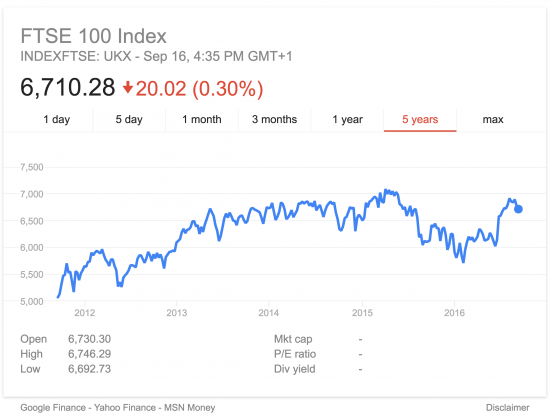

I don't think they needed to say so. But what they are saying is that this makes no sense at all:

I am well aware that some say I am always predicting downturn. That is true. But for good reason. As the BIS is saying, the fundamentals do not equate to current asset pricing and have not for a long time. And at some point this will end in tears, of that I am certain. But I do not know when, precisely, for the record.

And that, by the way, is when Green Infrastructure Quantitative Easing or People's Quantitative Easing as it is now known, will really be needed, very badly.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The fundamentals make a bit more sense if you believe that the balance between paying wages and paying shareholders has shifted, permanently, to a new equilibrium in which starvation wages and the JD Sports and Amazon ‘Gulag’ arrangements are normalised, and universal.

This view, and current stock market valuations, also requires the effective rate of corporate taxation is zero.

For some companies, this may be a reasonable view.

The missing component in this analysis is China: wages are rising, and will continue to rise as the transition from agriculture to industry runs its course: but a genuinely competitive labour market won’t raise wages there to G7 levels for at least another decade. So there will still be a low-wage competitor in every sector except services…

…And countries like Britain, eager to compete in a race to the bottom.

Fair taxation campaigns may be another confounding factor: but the markets don’t believe it – and Apple’s share price doesn’t completely reflect it.

And nothing allows for automation as yet…

That is a massive shock wave that no one has worked out