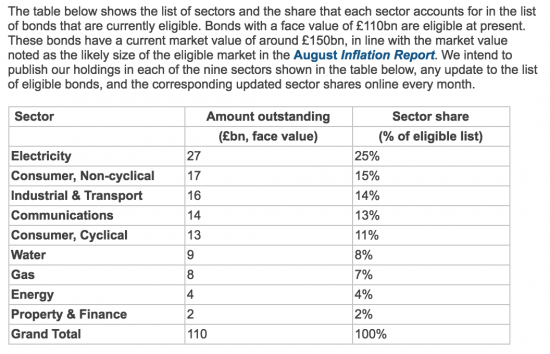

I have already mentioned the press release issued by the Bank of England yesterday on its £10 billion corporate bond buying programme and the need that it highlights for public country-by-country reporting. There is another feature of this announcement that I think worthy of note. In the announcement they say:

To put it another way, if the vast majority of the electricity, communications, water, gas and other energy companies in question were at one time publicly owned utilities (and that is likely to be true) then over half of the bonds available for purchase have been issued by former state owned activities. This shows three things.

First, what a bad deal we got in selling them.

Second, that a great deal of the value in the UK was state created.

And third, that we cannot now rely on these companies in private ownership to deliver what the country needs without state aid.

In that case how much more sense it would make to start reacquiring stakes in these companies with the funds in question? That would also prevent the most common usage of any new bond issues that the BoE programme might stimulate, which is share repurchase.

The BoE policy is yet another exercise in dogma over-ruling economic sense. What we are seeing is market failure in action: the need for investment is being ignored by private investors because they cannot make a gain from it. There is a need for that investment but instead of funding it directly as People's Quantitative Easing would do the Bank is trying to tickle the market into action. That won't work: the incentives are not changed by small changes in interest rates. The need is for direct action. And for courageous politicians willing to take it. Instead we get this farce.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The way things are going maybe the direct action we need will come from the end of a pitchfork or a gun? We’ve already lost an MP to right wing visciousness. When will the centre break and retaliate?

I muse on this because you recenly spoke about life and death pertaining to the ructions in the health service.

But latterly I view life and death as the options that may face a nasty bunch of parliamentarians whose only wish seems to be to make peopel’s lives harder and also enable others to make money out of them (us).

Anger is still growing.

This is more than a ‘tickle’ in European politics: direct investment by the Bank in the most politically powerful entities in European capitals.

The boards of these national utility and infrastructure corporations are very, very well-connected people: past, present and future ministers, trade union leaders, directors of ‘national champions’.

So far, these men are looking forward to a rapid disengagement from the kndergarten politics of Europe’s wayward island – tantrums, fantasies, name-calling and occasional damage – but, once again, the Bank is playing the part of the adult in the room.

Richard,

I don’t see how you can use the evidence presented to stand up any of your claims.

The evidence says nothing to how good or bad a deal the sale was. It says nothing about if said utilities would have been better, worse, or the same as they are now if kept in state hands, and it says nothing about state aid.

If you want to believe that feel free to do so

Why not try entering a discussion? We might both learn something.

I did

You dismissed it out of hand

There’s not much to add

I closed the case

Experience has taught me to spot a waste of time coming from a mile off

Darren

You are a well behind the curve here. More detailed discussions about this topic have occurred here previously and elsewhere on the internet. This particular post is merely offering supporting evidence that privatisation isn’t all of what it is cracked up to be.

It now seems to be accepted that the Royal Mail was sold well under its true value (as have most if not all public utilities). And now the RM is wanting to reduce its pension contributions to its work force. Why? Because it wants to give that money to its shareholders. In other words we see yet another mechanism of moving money away from ordinary working people and to the retired or top 1%.

This is where the North American capitalist model is going wrong and sowing the seeds of its own destruction. Not only is it dangerous but it is also stupid.

I think you are confusing debt and equity here. Holding debt in these companies does not confer any form of ownership – so buying the debt wouldn’t be nationalising them in any way.

Nor from the debt these companies have can you infer anything regarding the value the government got when selling them, or even how much the companies themselves are worth.

I am wholly aware of the difference

And I am aware that debt and equity are substitutes for each other – as any good economist knows

Debt and Equity are definately NOT substitutes for each other. Any economist should know this.

It’s kind of the whole point – a company valuation is based on it’s net assets minus it’s net liabilities. Equity sits on the asset side of the balance sheet and debt/bonds on the liability side. As an economist and accountant I would have expected you to know this.

So you’re not an economist then?

I happen to be bith an accountant and economist

And I know all that

And my comment stands

Yours does not. It is that of an accountant. And a typically pedantic one at that

OK let’s take an example. BT has about 10bn GBP of debt. How much is BT worth?

Given your statement we should be able to work that out from it’s debt holdings alone.

You know that is an absurd argument

Please don’t waste my time

Go and find another straw man to play with